TIDMHUM

RNS Number : 2171T

Hummingbird Resources PLC

21 July 2022

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

21 July 2022

Hummingbird Resources plc

( "Hummingbird" or the "Company")

Q2 2022 Operational and Trading Update

"Operational trends improving"

Hummingbird Resources plc (AIM: HUM) provides an operational

update for the second quarter of 2022 ("Q2 2022").

An interview with senior management discussing the operational

and trading update can be viewed here.

Further, an updated drone and timelapse camera video detailing

the construction progress at the Kouroussa gold mine in Guinea can

be viewed here.

Q2 2022 updates:

-- Quarter production: Q2 2022 production increased 29% from Q1

2022 to 20,013 ounces ("oz") of gold (Q1 2022: 15,548oz), with

improved mining rates (+26%), processing plant throughput (+20%)

and mill feed grade (+9%) achieved during the quarter

-- All-in Sustaining Cost ("AISC"): AISC reduced by 17% from Q1

2022 to US$1,859 per oz (Q1 2022: US$2,235 per oz) primarily due to

improved quarterly production. Inflationary pressures are being

felt, especially from fuel and consumables, in common with the

global mining industry. However, the Company expects a continual

improvement in the AISC profile from current levels for the

remainder of the year

-- Gold sold: 20,490 oz of gold ("Au") sold in Q2 2022 at an

average realised price of US$1,851 per oz (Q1 2022: 15,179 oz at an

average realised price of US$1,871). The Company held 2,418 oz of

gold inventory on 30 June 2022, valued at c.US$4.3 million

-- Kouroussa, Guinea: During the quarter, construction at

Kouroussa advanced into the important civil works phase of the

build process. The build remains on time and on budget to meet the

scheduled first gold pour by the end of Q2 2023 (see video link

above for more detailed visuals on the construction progress)

-- Dugbe, Liberia : The Dugbe final feasibility study results

were released on 13 June 2022 by our joint venture partners

Pasofino Gold Ltd ("Pasofino") showcasing a sizeable gold mining

project of 2.76 million of ounces ("Moz") of gold in Reserves

(4.01Moz Resources) and strong project economics including a

pre-tax NPV(5%) of US$690 million (US$530 million post-tax), 26.35%

IRR (23.6% post-tax), and a life of mine ("LOM") of 14 years,

producing 200,000 oz per annum in the first five years . As noted

in the June release, the Company is currently conducting a

strategic review of its options to best realise the maximum value

of Dugbe for all stakeholders

-- Updated Company Reserves and Resources(1) : Updated Company

Reserves and Resources Estimate statements for each of the

Company's three gold assets were released during the quarter.

Company Reserves increased materially to 4.13Moz of Au from 1.12Moz

as reported in November 2021 and Resources increasing 8% to 7.28Moz

of Au from the previous statement

Outlook:

-- Guidance: The Company maintains its 2022 guidance of 87,000 -

97,000 oz of gold, forecasting improved H2 production versus H1

2022 levels, in line with our start of year guidance expectations

and our current mine plan. Due to ongoing inflationary cost

pressures, especially from fuel and consumables, the full year AISC

guidance of US$1,300 - US$1,450 per oz will be re-assessed at the

end of Q3 and a further update provided at that time

Dan Betts, CEO of Hummingbird, commented:

"For the second quarter we saw production improvements at

Yanfolila; ongoing construction progress at Kouroussa with major

civil works taking shape towards first gold pour the end of Q2

2023; release of our updated Company Reserves and Resources

statements showcasing LOM extensions providing real long-term value

for the Company, coupled with a major milestone being achieved with

the release of the feasibility study on Dugbe by our joint venture

partners Pasofino.

Despite macro conditions from inflationary pressures being seen

across the board, we remain focussed on maintaining an improving

production profile through H2 2022 at Yanfolila, which should

compensate for most of these pressures, coupled with ongoing

optimisation and cost reduction strategies being implemented at

Yanfolila.

The second half of 2022 is also a critical stage in the

development of our second gold mine at Kouroussa in Guinea, which

remains on track and budget for first gold pour by the end of Q2

2023. The release of the updated Reserves and Resources in Q2

demonstrates the significant open pit grades at this project, which

is a cornerstone of our growth strategy through bringing into

production, diversifying our asset base and generating strong

future cashflows for the Company.

Finally, in H2 2022, we will work with our partners at Pasofino

to conduct a strategic review of Dugbe, Liberia to better

understand our options to maximise shareholder value from this rare

and valuable asset."

Operational Summary

Unit Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022

Gold poured oz 24,494 22,102 18,181 15,548 20,013

------ ---------- ---------- ---------- ---------- ----------

Mined BCMs bcms 2,672,788 2,095,935 1,920,311 2,164,253 2,726,205

------ ---------- ---------- ---------- ---------- ----------

Ore mined t 443,490 392,005 445,808 502,800 511,449

------ ---------- ---------- ---------- ---------- ----------

Ore processed t 391,652 326,020 341,936 298,925 357,837

------ ---------- ---------- ---------- ---------- ----------

Avg. mill

grade feed g/t 2.14 2.27 1.79 1.71 1.87

------ ---------- ---------- ---------- ---------- ----------

Recovery % 91.88% 91.95% 92.38% 95.39% 94.82%

------ ---------- ---------- ---------- ---------- ----------

Gold inventory

- incl SMO oz 1,972 2,769 2,246 2,557 2,418

------ ---------- ---------- ---------- ---------- ----------

Note: Ore mined includes high grade, low grade, and marginal

material. Ore processed is a blend based on preferential feed of

high-grade and low grade , with marginal ore added as an

incremental feed source

Yanfolila, Mali - Operational charts detailing improving trends:

quarterly production; mined BCMs; and average mill grade feed

(g/t)

-- Q2 2022 production of 20,013 oz was a 29% improvement from

the 15,548 oz recorded in Q1 2022. Additional excavator fleet

became operational during the quarter which led to improved mining

volumes and the ability to deliver on the mine plan, leading to

improved gold poured ounces

-- As noted in our Q1 2022 release, the Company was looking to

increase throughput at the mill in Q2, in particular by utilising

increasing oxide stockpiles from mining at the Sanioumale West

("SW") deposit. This took place, with ore processed at the mill

increasing c.20% quarter on quarter to 357,837 oz

-- Mill feed grade for Q2 2022 averaged 1.87 g/t, up +9% (Q1

2022: 1.71 g/t)

-- With improved mining rates and practices starting to take

place, the quantity and quality of ore on our run of mill ("ROM")

pad improved during the quarter, leading to improvements in mill

feed grade

-- Mined bank cubic meters ("BCM") totalled 2,726,205 in Q2 2022

versus 2,164,253 in Q1 2022, a c.26% improvement. This was driven

primarily by the additional excavator fleet that became operational

in the quarter

-- With BCM movements now more in line with our mine plan

forecasts, a key focus for H2 2022 is to better deliver on the mine

plan on a daily, weekly, and monthly basis running into

year-end

-- Processing plant recovery rates for Q2 2022 remained at very

good levels of 94.82% versus 95.39% in Q1 2022

-- The Company is forecasting improved H2 production versus H1

2022 levels, in line with our start of year guidance expectations

and our current mine plan primarily driven by more consistent

mining volume rates leading to better access to higher quality ore

at the right sequence to the mine plan; improved ROM pad

performance of quality and quantity of ore feed to the mill; and

ongoing consistent processing plant performance

-- As noted in our updated Company Reserves and Resources

statements, with Yanfolila Komana East underground ("KEUG")

Reserves increasing 75koz (+37% from the previous statement), to

total 278koz at 3.94 g/t, KEUG is expected be a key source of

high-grade ore, providing a c.40,000- 50,000 oz per annum

production profile for a minimum of +5-6 years once in production

(with KEUG LOM upside potential with further exploration drilling

given mineralisation remains open at depth)

-- With the 2022 KEUG Reserves now complete, the Company is

finalising its detailed analysis of the KEUG deposit in terms of

economics, mining and when to incorporate it into the future mine

plans at Yanfolila, with more details of these plans to be

highlighted once finalised

-- Further, in early July, the Economic Community of West

African States ("ECOWAS") lifted economic and financial sanctions

imposed on Mali, after its military rulers proposed a 24-month

transition to democracy and published a new electoral law

-- This is a positive for our Yanfolila operations as it allows

for the removal of restrictions that have been imposed on the

movement of goods and people across borders and international

banking capabilities in particular. Importantly, with the lifting

of sanctions, offsetting of VAT recoverable against taxes payable

has recommenced, expecting to be a net cash benefit

Kouroussa, Guinea

During the quarter, considerable progress was made on

constructing Kouroussa, with the scheduled timeline and budget

remaining on track to achieve the first gold pour by the end of Q2

2023. Key updates included:

-- Major civil works are well underway including: processing

plant CIL tanks construction advancing to plan; the permanent mine

camp cement foundations and related infrastructure underway; and a

ccess roads and related infrastructure such as river crossing

culverts being completed

-- Power (including important solar plant and heat recovery

system initiatives) and mining contractor contracts are expected to

be awarded during Q3 2022

-- The concrete batch plant, rebar bending store and laboratory

facilities became operational in Q1 2022, with cement manufacturing

output increasing for general, processing plant, and mine camp

foundation works that are occurring

-- With the updated Company's Reserves and Resources statements

now completed, our geology team are doing a more detailed review of

future exploration drilling campaigns to be initiated with the

focus to increase Kouroussa's overall Resources and Reserves and

ultimately LOM

-- Community engagement remains a key feature of all

workstreams, with the community projects and livelihood initiatives

to start H2 2022 including: water supply infrastructure; local

community hospital infrastructure improvements and medical

supplies; market gardens; and Shea butter manufacturing

training

Dugbe, Liberia

-- The results of the Dugbe Gold Project FS, prepared by the

Company's earn-in partner Pasofino, were released on 13 June 2022.

This was a key milestone for the Company, taking Dugbe from an

exploration asset to an economically viable and sizeable gold

mining project

-- The FS results showcased 2.76Moz in Reserves (4.01Moz

Resources) and strong project economics including: Pre-tax NPV(5%)

of US$690 million (US$530 million post-tax), 26.35% IRR (23.6%

post-tax); a 3.5-year capex payback period once in production; and

a 14-year LOM, producing 200,000 oz per annum in the first five

years at a low AISC profile of US$1,005/oz

-- The Company is currently conducting a strategic review of its

options to best realise the maximum value of Dugbe for all

stakeholders

Financial Summary:

Unit Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022

Gold sales oz 24,790 22,255 18,489 15,179 20,490

------- -------- -------- -------- -------- --------

Avg. gold sale

price $/oz $1,802 $1,782 $1,782 $1,871 $1,851

------- -------- -------- -------- -------- --------

Operating cash

costs $'000 $33,986 $33,472 $32,486 $32,177 $38,253

------- -------- -------- -------- -------- --------

AISC on gold

sold $/oz $1,386 $1,520 $1,803 $2,235 $1,859

------- -------- -------- -------- -------- --------

Net (debt)

/ cash $'m $9.0 ($5.9) ($25.0) ($47.4) ($64.4)

------- -------- -------- -------- -------- --------

Net (debt)

/ cash inc

gold inventory

value $'m $12.4 ($1.0) ($21.0) ($42.4) ($60.1)

------- -------- -------- -------- -------- --------

-- Q2 2022 AISC improved 17% from Q1 2022 levels at US$1,859 per

oz, versus US$2,235 per oz in Q1 2022 primarily due to the improved

quarterly production

-- As seen with the Q2 AISC profile, with production

improvements forecast for the H2 2022, the AISC profile is also

scheduled to improve. As noted in our highlights above, due to

ongoing inflationary cost pressures, especially from fuel and

consumables, the full year AISC guidance of US$1,300 - US$1,450 per

oz will be re-assessed at the end of Q3 and a further update

provided at that time

-- As noted above, with sanctions lifted on Mali in early July,

offsetting of VAT recoverable against taxes payable has

recommenced, expected to be a net cash benefit

-- Net debt position c.US$64.4 million end of Q2 2022 (c.US$60.1

million including gold inventory value), with c.US$23 million debt

remaining available from Coris Bank International ("Coris Bank")

expected to be drawn during Q3/Q4 2022 for the Kouroussa

construction purposes. Further, the Company retains an overdraft

facility with Coris Bank of c.US$20 million

-- With improved H2 2022 production and AISC profile forecast at

Yanfolila, the Company's cash flow generation is expected to also

improve

ESG Q2 2022 updates include:

-- The external assurance audit begun in Q2 for the year 3 World

Gold Council ("WGC") responsible gold mining principles ("RGMPs")

requirements. A dedicated Hummingbird ESG team and external

consultants are in place to achieve a positive assurance audit

report outcome, expected in Q4 this year

-- As noted above, at Kouroussa, community engagement remains a

key feature of all workstreams, with the rolling out of initial

community projects and livelihood initiatives to start H2 2022:

including: water supply infrastructure; local community hospital

infrastructure improvements and medical supplies; market gardens;

and Shea butter manufacturing training

-- Further at Kouroussa we expect to be awarding the power

contract soon, which will include carbon emission reduction

technologies that will lower the overall carbon footprint of the

mine including: A +7Mwh solar plant and heat recover generator

units at the processing plant

-- At Dugbe, Liberia the Environmental and Social Impact

Assessment ("ESIA") study is expected to be finalised by our joint

venture partners, Pasofino in Q3 2022

Footnote 1 - All Company Reserves and Resources are shown on a

100% basis. Hummingbird will retain a controlling interest in Dugbe

of 51%

**ENDS**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold production, development and exploration

Company, member of the World Gold Council and founding member of

Single Mine Origin (www.singlemineorigin.com). The Company

currently has two core gold projects, the operational Yanfolila

Gold Mine in Mali, and the Kouroussa Gold Mine in Guinea, which

will more than double current gold production when production,

scheduled for first gold pour end of Q2 2023. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by Pasofino Gold Limited through an earn-in

agreement. The final feasibility results on Dugbe showcase 2.76Moz

in Reserves and strong economics such as a 3.5-year capex payback

period once in production, 14-year life of mine at a low AISC

profile of US$1,005/oz. Our vision is to continue to grow our asset

base, producing profitable ounces, while central to all we do being

our Environmental, Social & Governance ("ESG") policies and

practices.

For further information please visit www.hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20

CEO plc 7409 6660

Thomas Hill,

FD

Anthony Köcken,

COO

Edward Montgomery,

CSO & ESG

James Spinney Strand Hanson Limited Tel: +44 (0) 20

Ritchie Balmer Nominated Adviser 7409 3494

---------------------- ----------------------------

James Asensio Canaccord Genuity Tel: +44 (0) 20

Gordon Hamilton Limited 7523 8000

Broker

---------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20

Ariadna Peretz Financial PR/IR 7466 5000

George Cleary Email: HUM@buchanan.uk.com

---------------------- ----------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKKBNKBKBDOB

(END) Dow Jones Newswires

July 21, 2022 02:00 ET (06:00 GMT)

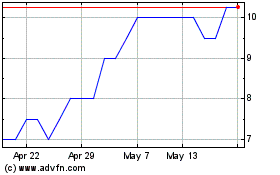

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025