TIDMHUM

RNS Number : 1708P

Hummingbird Resources PLC

07 February 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

7 February 2023

Hummingbird Resources plc

("Hummingbird" or the "Company")

Strategic Investor, Issuance of Deferred Consideration Shares

& TVR announcement

Strategic Investor:

The Company is pleased to announce a strategic investment of

US$15 million by CIG SA ("CIG")(1) into Hummingbird. CIG is a

leading African investment company, with a ten-year track record

and over US$100 million of active investments across a number of

sectors including mining and construction.

This investment strengthens the Company's balance sheet and

provides improved liquidity to help ensure we bring our second gold

mine, Kouroussa in Guinea, into production as scheduled for first

pour by the end of Q2 2023 and to help fast track exploration at

the asset. Additionally, it endorses the Company's strategy for

growth with a strategic partner to underpin that ambition - both in

the West African region and beyond.

Deferred Consideration:

Further, the Company announces the settlement of the deferred

consideration payable to Cassidy Gold Corp ("Cassidy"), as

announced on 26 June 2020, for the acquisition of Kouroussa,

Guinea. This deferred consideration is payable under the terms of

the acquisition agreement owing to the increased size of the

Company's reserve base at Kouroussa as published last year.

Dan Betts, CEO of Hummingbird, commented:

"We are delighted to welcome CIG as a key strategic investor

into the Company. As we bring the development of our second mine at

Kouroussa into production by the end of Q2 this year; we see this

investment as the first step of a partnership with the ambition of

building a multi asset international gold producer built on strong

foundations in West Africa."

CIG Strategic Investment - Further Details:

The Company has entered a conditional subscription agreement for

the investment of US$15 million into the Company by CIG (the

"Subscription"), which is split into two tranches:

o A firm first tranche of US$3.8 million, which involves the

issue of 39,360,800 new ordinary shares of GBP0.01 of the Company

("Ordinary Shares") (the "First Tranche Shares"), and;

o A conditional second tranche, subject to Shareholder approval,

of US$11.2 million, which involves the issue of 117,724,008 new

Ordinary Shares (the "Second Tranche Shares").

Both tranches are being issued at a subscription price of 7.79

pence, which represents a c.2% premium to the 30 day VWAP (the

"Subscription Price").

In aggregate, the First Tranche Shares and Second Tranche Shares

amount to 157,084,808 Ordinary Shares (the "Subscription Shares")

to be issued to CIG. Following the issue of the Subscription

Shares, and the Cassidy Deferred Consideration Shares (as per the

details below), CIG would have a holding of 27 percent in the

Company's share capital as enlarged by the issue of the

Subscription Shares and the Cassidy Deferred Consideration

Shares

The First Tranche Shares are expected to be admitted to trading

on AIM on 10 February 2023, resulting in CIG having a holding of

8.6% in the Company. Conditional upon, inter alia, Shareholder

approval being granted at the General Meeting for the issue of the

Second Tranche Shares, the Second Tranche Shares will be admitted

to trading on AIM as soon as practicalble following the General

Meeting. The full consideration of US$15 million has been received

by the Company and is being held on deposit pending the relevant

share issues and/or return to CIG to the extent the necessary

approvals are not granted at the General Meeting. The Company

intends on publishing the required shareholder circular and notice

of General Meeting shortly and a further announcement will be made

as and when appropriate.

As noted above, the US$15 million proceeds of the Subscription

will be used to strenghten the Company's balance sheet and provide

improved liquidity to help ensure we bring our second gold mine,

Kouroussa in Guinea into production as scheduled for first gold

pour by the end of Q2 2023 and to help fund additional exploration.

Additionally, it endorses the Company's strategy for growth with a

strategic partner to underpin that ambition - both in the African

region and beyond.

The terms of the Subscription are set out in an investment

agreement entered into between CIG and the Company and include:

o An undertaking by CIG that it will not (save in limited

circumstances) dispose of the Subscription Shares for a period of

12 months from the date of admission of the First Tranche Shares

(in the case of the First Tranche Shares) or 12 months from the

date of admission of the Second Tranche Shares (in the case of the

Second Tranche Shares)

o In addition the Company has granted CIG a pre-emption right in

relation to further equity issues by the Company while it holds 20%

or more of the Ordinary Shares

o The agreement also contains customary warranties from each

party

Further, CIG has also entered into a relationship agreement with

the Company and the Company's nominated adviser, Strand Hanson

Limited, which imposes certain obligations on CIG in its position

as a substantial shareholder (as defined under the AIM Rules) in

the Company to ensure that the Company will at all times be capable

of carrying on its business independently of CIG and the members of

its group. The relationship agreement remains in force for so long

as CIG's holding does not drop to below 10%.

Issuance of Deferred Consideration Shares to Cassidy - Further

Details:

As noted in the Company's 26 June 2020 announcement regarding

the signing of the share purchase agreement ("SPA") for the

acquisition of Kouroussa, deferred consideration of GBP10 for every

ounce of gold reserve published by (or on behalf of the Company) in

excess of 400,000 gold ounces (subject to a maximum of 1,000,000

ounces, and 100,000 ounce thresholds) (the "excess ounces") becomes

payable to Cassidy Gold Corp ("Cassidy"), in cash or new Ordinary

Shares, at the Company's discretion following the end of the

relevant financial year.

Accordingly, following the publication of the reserve of 647,000

ounces (at 4.15g/t) at Kouroussa on 30 June 2022, deferred

consideration in respect of 200,000 excess ounces is now payable to

Cassidy.

The initial deferred consideration due of GBP2,000,000 is

reduced by GBP532,032 due to the settlement of liabilities by the

Company on behalf of Cassidy, and therefore results in the issue of

22,688,844 new Ordinary Shares to the underlying shareholders of

Cassidy (the "Cassidy Deferred Consideration Shares"), when a VWAP

of 6.47 pence is applied (being the 5 business day trailing VWAP to

31 December 2022).

Admission and Total Voting Rights

Application has been made to the LSE for the admission of the

39,360,800 First Tranche Shares and the 22,688,844 Cassidy Deferred

Consideration Shares to trading on AIM, which is expected to take

effect on or around 10 February 2023 ("Admission").

Following Admission, the Company's issued share capital will

consist of 455,773,694 Ordinary Shares, all with voting rights. The

Company currently does not hold shares in treasury. The total

number of voting rights in the Company following Admission is

therefore 455,773,694 , which may be used which may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in the Company under the FCA's

Disclosure Guidance and Transparency Rules.

(1) CIG is controlled by the same principal as the Company's

primary lending bank.

**S**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold production, development and exploration

Company, member of the World Gold Council and founding member of

Single Mine Origin (www.singlemineorigin.com). The Company

currently has two core gold projects, the operational Yanfolila

Gold Mine in Mali, and the Kouroussa Gold Mine in Guinea, which

will more than double current gold production when production,

scheduled for first gold pour end of Q2 2023. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by Pasofino Gold Limited through an earn-in

agreement. The final feasibility results on Dugbe showcase 2.76Moz

in Reserves and strong economics such as a 3.5-year capex payback

period once in production, and a 14-year life of mine at a low AISC

profile. Our vision is to continue to grow our asset base,

producing profitable ounces, while central to all we do being our

Environmental, Social & Governance ("ESG") policies and

practices.

For further information, please visit hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20

CEO plc 7409 6660

Thomas Hill,

FD

Edward Montgomery,

CSO & ESG

James Spinney Strand Hanson Limited Tel: +44 (0) 20

Ritchie Balmer Nominated Adviser 7409 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20

Thomas Diehl Broker 7523 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20

O onagh Reidy Financial PR/IR 7466 5000

George Cleary Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEANAXELXDEEA

(END) Dow Jones Newswires

February 07, 2023 04:49 ET (09:49 GMT)

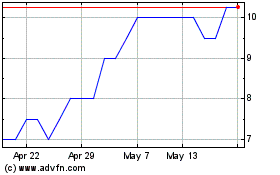

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024