TIDMHUM

RNS Number : 5959X

Hummingbird Resources PLC

21 December 2023

Hummingbird Resources plc / Ticker: HUM / Index: AIM / Sector:

Mining

21 December 2023

Hummingbird Resources pl c

("Hummingbird" the "Group" or the "Company")

Operational and exploration update

Hummingbird (AIM: HUM) is pleased to provide an operational and

exploration update, including recent drilling results.

Operational Update

Yanfolila Gold Mine, Mali

-- 78,220 ounces of gold ("oz") were produced at Yanfolila to 30

November 2023 at an average AISC of c.US$1,340 per oz and the

Company is on target to meet FY-2023 production guidance of 80,000

- 90,000 oz and AISC under US$1,500 per oz.

-- Key areas of focus remain the development of the Komana East

Underground ("KEUG") operation and the continuation of mining

performance across the mine.

Kouroussa Gold Mine, Guinea

-- 3,094 oz have been produced at Kouroussa to 30 November 2023.

The processing plant is operating at nameplate capacity on a

consistent 24 hour a day basis with ramp up of the mining fleet

productivity rates improving.

-- The Company anticipates gold production from Kouroussa in

H2-2023 of c.5,000 oz of gold, with lower production driven largely

by the delays in accessing higher grade ore due to initial lower

than contracted mining volumes.

-- Mining is progressing towards the higher-grade regions of the

Koekoe deposit, with Kouroussa expected to reach full commercial

production in Q1-2024.

Dugbe Gold Project, Liberia

-- The Company recently completed the conversion of the

Company's 51% interest in the Dugbe Gold Project (the "Project")

into a 51% interest in Pasofino Gold Limited ("Pasofino"), which

simplifies the ownership structure, providing clear visibility and

control to facilitate more efficient decision-making and project

advancement to drive the material value the Project represents to

all stakeholders.

-- Pasofino plans to optimise the 2022 Definitive Feasibility

Study ("DFS") and evaluate a new drilling programme to extend the

key Project deposit Tuzon, along with possible additional

exploration targets previously evaluated.

Circular, Revenue Protection and Outlook Update

-- A further update on the Company's fundraise as announced on 7

December 2023 will be provided in due course. As noted previously,

proceeds will be used to accelerate its growth strategy, increase

exploration, and strengthen the balance sheet.

-- The Company is implementing a near term revenue protection

strategy over a portion of the Company's production for the first

three quarters of FY-2024 in the order of 60,000 oz, as the Company

materially deleverages its balance sheet in FY-2024, with c.44,500

oz of gold now protected through forward pricing and cost collars,

averaging above US$2,000 per oz.

-- As previously noted, the Company continues to focus on

material balance sheet deleveraging which is set to commence in

Q1-2024 with scheduled debt repayments of c.US$77 million in

FY-2024, c.US$61 million in FY-2025, and the remainder c.US$15

million payable by the end of FY-2028.

-- Formal FY-2024 Group guidance will be provided in the Q4-2023

operational and trading update, expected in January 2024.

Drilling results and exploration update

-- Between May and November 2023, the Company completed c.5,900

metres ("m") of drilling at Yanfolila to identify increased mining

opportunities and extend life of mine ("LOM") at the asset.

-- Drilling focussed on the Gonka and Sanioumale West deposits

with notable drill results including:

o 2m @ 37.30 grams per tonne ("g/t") from 45 m (GKRC0456)

o 16m @ 8.38 g/t from 17 m (GKRC0459)

o 4m @ 10.00 g/t from 22 m (SWGCM006096)

o 4m @ 7.21 g/t from 22 m (SWGCM006960)

-- The Company believes it is essential that its exploration

plans are increasingly executed to deliver results that lead to

increased Resources and Reserves for the Group to extend LOM at

both operating assets. A comprehensive Group exploration plan is in

place for FY-2024 onwards, with further updates to be provide

during FY-2024 once programmes begin.

Investor Presentation

The Company's senior management team will be holding an investor

presentation this Friday 22 December at 11:00 GMT via the Investor

Meet Company platform.

The event will cover the recent fundraise and this release, and

provide an opportunity for Q&A. The Company

invites attendees to pre-send questions to the Company via IR@hummingbirdresources.co.uk .

Webcast link:

https://www.investormeetcompany.com/hummingbird-resources-plc/register-investor

Dan Betts, CEO and Interim Executive Chairman of Hummingbird,

commented:

"In late November it became increasingly evident that the slower

than expected ramp-up at Kouroussa was placing increasing strain on

the Company's balance sheet. As such, the difficult decision was

made to inject additional funds into the business through an equity

offering. This was aimed not only to fortify our balance sheet, but

also to provide capital support for the Group's operations.

Moreover, it positions us to accelerate our growth strategy and

exploration efforts.

The Company has faced challenges ramping-up operations at

Kouroussa, mainly through lower mining productivity rates than

planned. However, through working constructively with our key

contractors and bringing in additional mining fleet, we continue to

expect Kouroussa to reach commercial production for a full year of

production in 2024. Further, as noted above, Yanfolila remains on

track to deliver on our FY-2023 guidance of 80,000 - 90,000 oz at

an AISC under US$1,500 per oz and we are seeing progress in the

development of the KEUG operation, which is a central focus of our

long-term operations at Yanfolila.

Extending the LOM at our assets is a key corporate focus area

for Hummingbird, especially now that we have two operating mines in

place. We plan to continue delivering targeted, cost effective

drilling campaigns at known and future deposits with existing

positive exploration results targeted at Yanfolila, and

increasingly at Kouroussa. As we look forward, our team has

developed detailed exploration plans which we will look to

increasingly execute and remain confident of maintaining and

extending Yanfolila's LOM and in particular extending Kouroussa's

LOM to reach our target of a +1 million ounce Reserve base at that

asset.

For FY-2024, the Company's key areas of focus are achieving

material deleveraging of the balance sheet, a Group production

profile of c.200,000 oz of gold, accelerated exploration plans,

maintaining and enhancing our ESG programmes and the advancement of

Dugbe."

Operational Update

Yanfolila Gold Mine, Mali

-- At the end of November 2023, a total of 78,220 oz was

produced at Yanfolila at an average AISC of approximately US$1,340

per oz.

-- The production during Q4-2023 saw reduced throughput in late

November due to increased maintenance on the mill, impacting

processing volumes, resulting in lower recovery grades at that

time.

-- KEUG development has continued with approximately 122 metres

("m") mined to date, with upgrades to the power reticulation,

establishment of mine dewatering and ventilation taking place

during Q4-2023. The project remains a crucial element in the

Company's long-term mine plan at Yanfolila, with the expectation of

producing initial developmental ore in H1-2024 and ramping up

production throughout the remainder of the year.

Kouroussa Gold Mine, Guinea

-- As noted in the Q3-2023 operational and trading update,

Kouroussa has faced ramp up challenges, in particular from lower

mining productivity rates than planned, leading to reduced volumes

and a delay mining the high-grade material at the initial key

deposit, Koekoe.

-- As of 30 November 2023, Kouroussa produced 3,094 oz, which is

below the Company's anticipated productivity levels as planned at

this stage of the ramp up phase.

-- However, throughout November, into December, with all the

mining fleet onsite and an additional support fleet in operation ,

mining productivity continued to rise towards target BCM movement

rates and is progressing towards the higher-grade regions of the

Koekoe deposit.

-- Through December, the processing plant performance has

continued to improve with the plant operating at nameplate capacity

on a consistent 24 hour a day basis .

-- Mining is progressing towards the higher-grade regions of the

Koekoe deposit, with Kouroussa expected to reach full commercial

production in Q1-2024.

-- The Company notes that on 18 December 2023, the country's

main fuel depot in Guinea's capital Conakry had a fire impacting

oil supply in country. The Company is working with its fuel

supplier contractor to minimise any adverse supply impacts at the

mine. As a precautionary measure, the Company has temporarily

suspended mining operations, while the processing plant continues

to operate, until regular fuel supply is restored, which is

expected in the near term.

-- With the ramp-up of Kouroussa progressing towards the

higher-grade parts of the orebody at the Koekoe deposit, the

Company continues to expect Kouroussa to reach full commercial

production in Q1-2024.

Dugbe Gold Project, Liberia

-- As noted above, the Company recently completed the conversion

of the Company's 51% interest in the Dugbe Gold Project into a 51%

interest in Pasofino, which simplifies the ownership structure,

providing clear visibility and control to facilitate more efficient

decision-making and project advancement to drive the material value

the Project represents to all stakeholders.

The Dugbe Gold Project represents material valuation upside for

the Company as represented by the pre- and post-tax NPV's of the

Project in the sensitivity table below based on gold prices between

US$1,700 - US$2,300 per oz.

Gold price sensitivity on NPV

---------------------------------------------------------------------------

Gold Price (US$/oz) $ 1,700 $ 1,800 $ 1,900 $ 2,000 $ 2,100 $ 2,200 $ 2,300

-------------------------------- --------- --------- --------- --------- --------- --------- ---------

Pre-tax NPV(5%) (US$ million) $691 $843 $996 $1,149 $1,301 $1,454 $1,607

-------------------------------- --------- --------- --------- --------- --------- --------- ---------

Post-tax NPV(5%) (US$ million) $530 $645 $760 $875 $990 $1,104 $1,219

-------------------------------- --------- --------- --------- --------- --------- --------- ---------

Notes: the above calculations are internal forecasts based upon

the June 2022 DFS economic model and are based on a 100% basis.

Further, the current Project highlights from the June 2022 DFS

(at US$1,700 oz gold price) are detailed below, with plans as noted

in the highlights above to optimise and improve the current

DFS.

Description Units Value

Production Statistics

Production LOM years 14

--------------------- -------

Production LOM months 159

--------------------- -------

Total Ore Tonnes million tonnes ("Mt") 66.27

--------------------- -------

Total Au Ounces Recovered million oz 2.27

--------------------- -------

LOM Average

Throughput Mt per annum 5.00

--------------------- -------

Au Grade g/t 1.30

--------------------- -------

Au Recovery % 83.01

--------------------- -------

Au Ounces Recovered oz/a 171,594

--------------------- -------

Initial Capital Cost US$ million 435

--------------------- -------

SIB Capital Cost US$ million 98

--------------------- -------

Operating Cost

LOM Average US$ million /a 147

--------------------- -------

LOM Unit Cost US$/t 29

--------------------- -------

Financial Outcomes (Pre-Tax)

NPV US$ million 690

--------------------- -------

IRR % 26.35

--------------------- -------

Payback Period (undiscounted) years 3.3

--------------------- -------

AISC US$/oz 1,005

--------------------- -------

US$/t 34

--------------------- -------

Financial Outcomes (Post-Tax)

NPV US$ million 530

--------------------- -------

IRR % 23.6

--------------------- -------

Payback Period (undiscounted) years 3.3

--------------------- -------

AISC US$/oz 1,005

--------------------- -------

US$/t 34

--------------------- -------

Exploration Plans for FY-2024 and beyond

As part of the proposed equity placement, the Company plans to

use c.US$5 million of monies raised, subject to inter alia,

shareholder approval, to accelerate its exploration plans.

Following exploration conducted during FY-2023, the Company has

developed comprehensive exploration plans for FY-2024 onwards.

These plans are designed to systematically expand the Resource

bases at both the Yanfolila and Kouroussa operations, with the goal

to increase the Reserve bases and extend LOM at both operating

assets.

Central to Hummingbird's exploration strategy is the

implementation of a structured exploration-to-mine pipeline at both

Yanfolila and Kouroussa. This pipeline prioritises key workstreams

that encompass initial target definition, Resource and Reserve

definition, and mine plan development. By streamlining the

exploration process, the Company is looking to ensure that its

efforts are focused on targets with the highest potential for

success, maximising the likelihood of identifying and developing

new mining opportunities.

The exploration-to-mine pipeline encompasses the following

stages:

-- Initial target definition:

o Employing a range of exploration techniques, including

geological mapping, geophysics, geochemical surveys and artificial

intelligence and machine learning, to identify promising

exploration targets.

-- Resource and Reserve definition:

o Conducting systematic drilling programs to delineate the

extent and grade of mineralisation at identified targets.

-- Mine plan development:

o Utilising the defined Resources and Reserves to develop

feasible and profitable mine plans for potential new mining

operations.

The following table provides an overview of the key areas of

focus for the Company's exploration team based upon a

priority-based system of high probability of results leading to

increased Resources to Reserves for the Group to extend LOM at both

operating assets.

Exploration Overview

Yanfolila Gold Mine, Mali:

The Company is focused on maintaining and extending Yanfolila's

LOM, through exploration of primarily brownfield and near-mine

opportunities, including both open pit and underground

opportunities. Hummingbird believes that there is significant

potential for the Company to operate beyond the current Reserve

base LOM primarily through upgrading of the current 1,705 thousand

oz ("Koz") Resource and the further development of underground

potential at several deposits including Komana East (where

development has already begun), Komana West, Sanioumale West,

Sanioumale East and Gonka, which already have identified

underground Resources.

Additionally, through our collaboration with Mira Geoscience

Ltd, the Company has identified several greenfield areas for

initial exploratory drilling, including Diaban Nord, and Gonka

South where multiple targets have been delineated. The tables below

highlight the Company's exploration priorities.

Target Priority Category

Yanfolila Gold Mine, Mali

Sanioumale West 1 Resource upgrade & extension

--------- -----------------------------

Gonka 1 Resource extension

--------- -----------------------------

Kama Oxide 1 Maiden MRE

--------- -----------------------------

Guirin West 2 Resource upgrade

--------- -----------------------------

Kabaya South 2 Resource upgrade

--------- -----------------------------

Gonka Underground 3 Resource definition

--------- -----------------------------

Komana East / Gonka Link 3 Greenfields

--------- -----------------------------

Mira Targets 3 Greenfields

--------- -----------------------------

Komana West 3 Resource extension

--------- -----------------------------

Kouroussa Gold Mine Guinea,

The Kouroussa Mine located within Guinea's gold prolific Siguiri

Basin and a core focus of the Company is to extend both the Reserve

profile and the LOM of the asset. The Company is confident that

there remains a material upside opportunity at Kouroussa and is

targeting an increase of Reserves to 1.0 Moz and a 10-plus year

LOM.

The current focus for the Company is on near mine opportunities

and the exploration and expansion of the Bag Farm-Junction and the

high-grade X-Vein Resource base deposits.

Currently the Company is considering a programme of deep ground

penetrating radar to detect and define vein and structure targets

for further exploration.

Target Priority Category

Kouroussa Gold Mine, Guinea

Koekoe 1 & 2 Resource extension

--------- -----------------------------------------------

X-Vein 1, 2 & 3 Greenfields (West) and Resource upgrade (Main)

--------- -----------------------------------------------

Kinkine 2 Resource extension

--------- -----------------------------------------------

Bag Farm Junction 3 Resource upgrade

--------- -----------------------------------------------

Koekoe Underground 3 Resource upgrade & extension

--------- -----------------------------------------------

Drilling Results Detail

Drilling conducted at the Yanfolila mine was concentrated on

near-mine prospects, focusing on two deposits, Gonka ("GO") and

Sanioumale West ("SW"), with the drilling campaign goals being to

extend and upgrade potential Mineral Resources at both targets

through reverse circulation ("RC") drilling, employing both

exploration holes and limited de-risking grade control

drilling.

Gonka

At GO, drilling focused on increasing the geological confidence

of the potential extension of the deposit, primarily targeting a

southerly extension to the GO main pit that had previously been

drilled on wider spacing parameters. Received assays have revealed

that the mineralisation was intersected at shallower depths than

originally modelled and indicates that it remains open to the east

of the deposit. The Company is currently updating its geological

model and preparing an updated Mineral Resource Estimate, which

will be included in the Company's FY-2024 Reserve and Resource

update.

Sanioumale West

Drilling at SW involved a combination of exploration drilling to

identify Mineral Resource expansion opportunities, and grade

control drilling to de-risk an extension to a pushback of the

current pit to incorporate additional Ore Reserves to the southwest

of the deposit.

Exploration drilling, completed in November 2023, targeted both

an extension at depth of the southwestern pushback and a step-out

program to the northeast.

Table of the June 2023 - November 2023 Yanfolila drilling

results

Hole ID Depth From (m) Depth To (m) Intercept Description (g/t Au)

GKRC0456 45 47 2m @ 37.30 g/t

--------------- ------------- -------------------------------

GKRC0463 74 75 1m @ 16.99 g/t

--------------- ------------- -------------------------------

GKRC0459 17 33 16m @ 8.38 g/t

--------------- ------------- -------------------------------

GKRC0472 126 127 1m @ 6.94 g/t

--------------- ------------- -------------------------------

GKRC0474 87 97 10m @ 5.21 g/t

--------------- ------------- -------------------------------

GKRC0461 59 66 7m @ 3.26 g/t

--------------- ------------- -------------------------------

GKRC0472 114 116 2m @ 3.26 g/t

--------------- ------------- -------------------------------

GKRC0461 93 95 2m @ 3.13 g/t

--------------- ------------- -------------------------------

GKRC0463 118 119 1m @ 3.00 g/t

--------------- ------------- -------------------------------

GKRC0466 49 51 2m @ 2.83 g/t

--------------- ------------- -------------------------------

GKRC0454 7 8 1m @ 2.39 g/t

--------------- ------------- -------------------------------

GKRC0471 77 84 7m @ 2.29 g/t

--------------- ------------- -------------------------------

GKRC0467 112 113 1m @ 1.96 g/t

--------------- ------------- -------------------------------

GKRC0453 36 40 4m @ 1.93 g/t

--------------- ------------- -------------------------------

GKRC0464 38 39 1m @ 1.92 g/t

--------------- ------------- -------------------------------

GKRC0463 122 129 7m @ 1.90 g/t

--------------- ------------- -------------------------------

GKRC0461 101 110 9m @ 1.85 g/t

--------------- ------------- -------------------------------

GKRC0453 2 3 1m @ 1.85 g/t

--------------- ------------- -------------------------------

GKRC0467 106 107 1m @ 1.72 g/t

--------------- ------------- -------------------------------

GKRC0459 7 11 4m @ 1.62 g/t

--------------- ------------- -------------------------------

GKRC0453 32 33 1m @ 1.56 g/t

--------------- ------------- -------------------------------

GKRC0468 22 23 1m @ 1.50 g/t

--------------- ------------- -------------------------------

GKRC0465 118 122 4m @ 1.50 g/t

--------------- ------------- -------------------------------

GKRC0468 128 130 2m @ 1.48 g/t

--------------- ------------- -------------------------------

GKRC0467 101 102 1m @ 1.45 g/t

--------------- ------------- -------------------------------

GKRC0457 47 48 1m @ 1.44 g/t

--------------- ------------- -------------------------------

GKRC0471 92 96 4m @ 1.43 g/t

--------------- ------------- -------------------------------

GKRC0464 19 25 6m @ 1.40 g/t

--------------- ------------- -------------------------------

GKRC0462 19 21 2m @ 1.34 g/t

--------------- ------------- -------------------------------

GKRC0461 80 84 4m @ 1.29 g/t

--------------- ------------- -------------------------------

GKRC0467 89 93 4m @ 1.23 g/t

--------------- ------------- -------------------------------

GKRC0471 124 134 10m @ 1.22 g/t

--------------- ------------- -------------------------------

GKRC0464 49 64 15m @ 1.18 g/t

--------------- ------------- -------------------------------

GKRC0456 16 17 1m @ 1.16 g/t

--------------- ------------- -------------------------------

GKRC0461 69 72 3m @ 1.14 g/t

--------------- ------------- -------------------------------

GKRC0468 134 136 2m @ 1.12 g/t

--------------- ------------- -------------------------------

GKRC0465 136 138 2m @ 1.06 g/t

--------------- ------------- -------------------------------

GKRC0466 54 66 12m @ 1.05 g/t

--------------- ------------- -------------------------------

GKRC0462 27 28 1m @ 1.05 g/t

--------------- ------------- -------------------------------

GKRC0463 91 101 10m @ 1.00 g/t

--------------- ------------- -------------------------------

GKRC0457 129 130 1m @ 0.93 g/t

--------------- ------------- -------------------------------

GKRC0457 62 63 1m @ 0.92 g/t

--------------- ------------- -------------------------------

GKRC0465 128 129 1m @ 0.91 g/t

--------------- ------------- -------------------------------

GKRC0457 53 54 1m @ 0.88 g/t

--------------- ------------- -------------------------------

GKRC0458 90 91 1m @ 0.84 g/t

--------------- ------------- -------------------------------

GKRC0472 120 121 1m @ 0.81 g/t

--------------- ------------- -------------------------------

GKRC0463 86 88 2m @ 0.75 g/t

--------------- ------------- -------------------------------

GKRC0471 112 113 1m @ 0.68 g/t

--------------- ------------- -------------------------------

GKRC0458 95 96 1m @ 0.66 g/t

--------------- ------------- -------------------------------

GKRC0459 91 93 2m @ 0.60 g/t

--------------- ------------- -------------------------------

GKRC0461 87 88 1m @ 0.58 g/t

--------------- ------------- -------------------------------

GKRC0461 132 133 1m @ 0.57 g/t

--------------- ------------- -------------------------------

GKRC0467 95 96 1m @ 0.55 g/t

--------------- ------------- -------------------------------

GKRC0456 19 20 1m @ 0.53 g/t

--------------- ------------- -------------------------------

GKRC0456 59 60 1m @ 0.53 g/t

--------------- ------------- -------------------------------

GKRC0461 40 41 1m @ 0.50 g/t

--------------- ------------- -------------------------------

SNWRC0520 99 109 10m @ 1.52 g/t

--------------- ------------- -------------------------------

SNWRC0526 119 120 1m @ 0.86 g/t

--------------- ------------- -------------------------------

SNWRC0526 141 142 1m @ 0.61 g/t

--------------- ------------- -------------------------------

SNWRC0526 158 160 2m @ 0.82 g/t

--------------- ------------- -------------------------------

SNWRC0527 52 56 4m @ 1.11 g/t

--------------- ------------- -------------------------------

SNWRC0529 47 48 1m @ 0.68 g/t

--------------- ------------- -------------------------------

SNWRC0529 52 53 1m @ 0.64 g/t

--------------- ------------- -------------------------------

SNWRC0530 18 19 1m @ 0.59 g/t

--------------- ------------- -------------------------------

SNWRC0530 49 50 1m @ 1.78 g/t

--------------- ------------- -------------------------------

SNWRC0533 85 86 1m @ 3.09 g/t

--------------- ------------- -------------------------------

SWGCM006951 10 17 7m @ 5.80 g/t

--------------- ------------- -------------------------------

SWGCM006096 22 26 4m @ 10.00 g/t

--------------- ------------- -------------------------------

SWGCM006093 10 22 12m @ 3.30 g/t

--------------- ------------- -------------------------------

SWGCM006060 8 18 10m @ 3.81 g/t

--------------- ------------- -------------------------------

SWGCM006098 15 20 5m @ 7.09 g/t

--------------- ------------- -------------------------------

SWGCM006959 17 26 9m @ 3.50 g/t

--------------- ------------- -------------------------------

SWGCM006960 22 26 4m @ 7.21 g/t

--------------- ------------- -------------------------------

SWGCM006055 13 18 5m @ 5.39 g/t

--------------- ------------- -------------------------------

SWGCM006088 15 21 6m @ 3.78 g/t

--------------- ------------- -------------------------------

SWGCM006091 21 26 5m @ 4.06 g/t

--------------- ------------- -------------------------------

SWGCM006958 9 16 7m @ 2.86 g/t

--------------- ------------- -------------------------------

SWGCM006974 6 11 5m @ 3.33 g/t

--------------- ------------- -------------------------------

SWGCM006095 5 14 9m @ 1.78 g/t

--------------- ------------- -------------------------------

SWGCM006094 1 8 7m @ 2.03 g/t

--------------- ------------- -------------------------------

SWGCM006965 5 13 8m @ 1.67 g/t

--------------- ------------- -------------------------------

SWGCM006967 20 26 6m @ 2.08 g/t

--------------- ------------- -------------------------------

SWGCM006061 4 7 3m @ 3.86 g/t

--------------- ------------- -------------------------------

SWGCM006952 22 26 4m @ 2.87 g/t

--------------- ------------- -------------------------------

SWGCM006059 20 24 4m @ 2.77 g/t

--------------- ------------- -------------------------------

SWGCM006054 18 23 5m @ 2.21 g/t

--------------- ------------- -------------------------------

SWGCM006950 7 14 7m @ 1.49 g/t

--------------- ------------- -------------------------------

SWGCM006099 6 12 6m @ 1.47 g/t

--------------- ------------- -------------------------------

SWGCM006957 4 9 5m @ 1.73 g/t

--------------- ------------- -------------------------------

SWGCM006102 20 26 6m @ 1.36 g/t

--------------- ------------- -------------------------------

SWGCM006100 11 19 8m @ 1.00 g/t

--------------- ------------- -------------------------------

SWGCM006089 1 8 7m @ 1.03 g/t

--------------- ------------- -------------------------------

SWGCM006090 7 12 5m @ 1.32 g/t

--------------- ------------- -------------------------------

SWGCM006982 8 13 5m @ 1.23 g/t

--------------- ------------- -------------------------------

SWGCM006101 23 26 3m @ 1.54 g/t

--------------- ------------- -------------------------------

SWGCM006056 3 7 4m @ 1.09 g/t

--------------- ------------- -------------------------------

SWGCM006057 22 24 2m @ 2.12 g/t

--------------- ------------- -------------------------------

SNWRC0534 51 52 1m @ 2.62 g/t

--------------- ------------- -------------------------------

SNWRC0535 50 54 4m @ 2.71 g/t

--------------- ------------- -------------------------------

SNWRC0536 62 65 3m @ 1.93 g/t

--------------- ------------- -------------------------------

SNWRC0537 44 53 9m @ 1.10 g/t

--------------- ------------- -------------------------------

SNWRC0538 51 57 6m @ 7.50 g/t

--------------- ------------- -------------------------------

SNWRC0538 78 79 1m @ 0.80 g/t

--------------- ------------- -------------------------------

SNWRC0544 58 60 2m @ 0.77 g/t

--------------- ------------- -------------------------------

SNWRC0545 31 32 1m @ 0.92 g/t

--------------- ------------- -------------------------------

SNWRC0546 21 22 1m @ 1.86 g/t

--------------- ------------- -------------------------------

SNWRC0546 43 44 1m @ 0.50 g/t

--------------- ------------- -------------------------------

SNWRC0547 0 1 1m @ 2.27 g/t

--------------- ------------- -------------------------------

SNWRC0554 8 9 1m @ 0.84 g/t

--------------- ------------- -------------------------------

Minimum Interval 1 m Trigger 0.5 g/t (Max 2 m Internal

Waste)

GKRC Gonka RC exploration drilling, SNWRC = Sanioumale West RC

exploration drilling, SWGCM = Sanioumale West Grade Control

Drilling

Competent Person Review:

David Muir, has reviewed and approved the technical information

contained within this announcement in his capacity as a Competent

Person, as required under the AIM Rules for Companies. David is the

Group Database and Exploration Manager for Hummingbird, and is a

"Competent Person", according to the Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves ("JORC Code, 2012 Edition") and is a member of good

standing with the Australian Institute of Geoscientists (AIG).

**S**

Notes to Editors:

Hummingbird Resources plc (AIM: HUM) is a leading multi-asset,

multi-jurisdiction gold producing Company, member of the World Gold

Council and founding member of Single Mine Origin

(www.singlemineorigin.com). The Company currently has two core gold

projects, the operational Yanfolila Gold Mine in Mali, and the

Kouroussa Gold Mine in Guinea, which will more than double current

gold production once at commercial production. Further, the Company

has a controlling interest in the Dugbe Gold Project in Liberia

that is being developed by joint venture partners, Pasofino Gold

Limited. The final feasibility results on Dugbe showcase 2.76Moz in

Reserves and strong economics such as a 3.5-year capex payback

period once in production, and a 14-year life of mine at a low AISC

profile. Our vision is to continue to grow our asset base,

producing profitable ounces, while central to all we do being our

Environmental, Social & Governance ("ESG") policies and

practices.

For further information, please visit hummingbirdresources.co.uk or contact:

Daniel Betts, Hummingbird Resources Tel: +44 (0) 20 7409

CEO plc 6660

Thomas Hill,

FD

Edward Montgomery,

CD

James Spinney Strand Hanson Limited Tel: +44 (0) 20 7409

Ritchie Balmer Nominated Adviser 3494

-------------------------- ----------------------------

James Asensio Canaccord Genuity Limited Tel: +44 (0) 20 7523

Broker 8000

-------------------------- ----------------------------

Bobby Morse Buchanan Tel: +44 (0) 20 7466

Oonagh Reidy Financial PR/IR 5000

George Pope Email: HUM@buchanan.uk.com

-------------------------- ----------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDTBBFTMTITMLJ

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

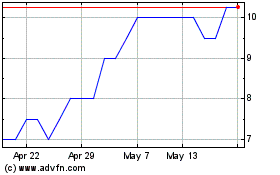

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hummingbird Resources (AQSE:HUM.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025