Keras Resources PLC Annual Results Update & Suspension (6523E)

03 July 2023 - 4:00PM

UK Regulatory

TIDMKRS

RNS Number : 6523E

Keras Resources PLC

03 July 2023

Keras Resources plc / Index: AIM / Epic: KRS / Sector:

Mining

3 July 2023

Keras Resources plc ('Keras' or the 'Company')

Annual Results Update & Suspension

Keras Resources plc (AIM: KRS) announces that the audit process

is complete but due to a matching day delay in funds receivable and

funds payable explained below, the publishing of its audited Annual

Report and Accounts for the year ended 31 December 2022 (the

"Annual Report") will be delayed.

As announced on 30 March 2022, the Company entered into an

agreement whereby Keras purchased the outstanding 49% equity

interest in F alcon Isle Resources LLC and Falcon Isle Holdings LLC

(collectively "Falcon Isle"'), the owner of the Diamond Creek Mine,

for a total consideration of US$3.2m. Keras was due to make a cash

payment of US$800,000, being part of the consideration for the

acquisition of Falcon Isle, and a US$240,000 severance payment

("Total Payment") to the former CEO of Falcon Isle ("Helda"), on 1

July 2023 . As announced on 18 May 2023, the Republic of Togo (the

"State") committed to pay a cash consideration of US$1.7 million to

Keras on 17 July 2023 . It has always been the Company's intention

to make the Falcon Isle payments from the amount receivable from

the State and in May 2023 the Company requested Helda for a delay

in making the Total payment until 18(th) July - this was

declined.

Despite the deadline of July 17 for payment of the US$1.7m, the

State with whom we have developed a positive rapport displayed

their goodwill by issuing instructions to make the payment of 1.7

million on June 27, 2023, well ahead of schedule. Unfortunately,

the Company had not received these funds in its own bank account at

the close of business on 30 June 2023, and this has resulted in a

technical default. Keras has received reassurances that the funds

will be available in our account within the next 7 days and the

default will be remedied immediately following the receipt of

US$1.7 million from the State, within the 30 day period permitted

in the agreement with the vendor of Falcon Isle.

As the Annual Report had not been released by 30 June 2023,

being the deadline provided by Rule 19 of the AIM Rules for

Companies (the "AIM Rules"), trading in the Company's ordinary

shares on AIM will be suspended with effect from 7.30am on Monday 3

July 2023. The Annual Report is expected to be released as soon as

the matters set out above are resolved, which is expected to be

within seven days. Release of the Annual Report will permit the

Company to request that the suspension is lifted.

In accordance with Rule 41 of the AIM Rules, the admission of

the Company's shares to trading on AIM would be cancelled if the

Company's shares are suspended from trading for six months.

Graham Stacey, CEO of Keras, commented , "It is very frustrating

to have to delay the publishing of our accounts but it has

highlighted the reason for taking 100% control of Diamond Creek and

the proactive approach by the State, in fulfilling the US$1.7m

payment in advance, underpins their commitment and augurs well for

a productive collaboration on the Nayéga project, benefiting all

parties involved.

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

Article 7 of the Market Abuse Regulation (EU) No. 596/2014 (as

amended) as it forms part of the domestic law of the United Kingdom

by virtue of the European Union (Withdrawal) Act 2018 (as amended).

Upon the publication of this Announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

**ENDS**

For further information please visit www.kerasplc.com , follow

us on Twitter @kerasplc or contact the following:

Graham Stacey Keras Resources plc info@kerasplc.com

Nominated Adviser & Joint SP Angel Corporate Finance

Broker LLP

Ewan Leggat / Charlie Bouverat +44 (0) 20 3470 0470

Joint Broker Shard Capital Partners

Damon Heath / Erik Woolgar LLP +44 (0) 207 186 9900

Notes:

Keras Resources (AIM: KRS) wholly owns the Diamond Creek organic

phosphate mine in Utah, US. Diamond Creek is one of the

highest-grade organic phosphate deposits in the US and is a fully

integrated mine to market operation with in-house mining and

processing facilities. The operation produces a variety of organic

phosphate products that can be tailored to customer organic

fertiliser requirements.

The Company is focused on continuing to build market share in

the fast-growing US organic fertiliser market and build Diamond

Creek into the premier organic phosphate producer in the US.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSSAFAEEDSESW

(END) Dow Jones Newswires

July 03, 2023 02:00 ET (06:00 GMT)

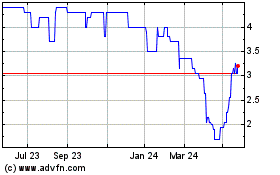

Keras Resources (AQSE:KRS.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

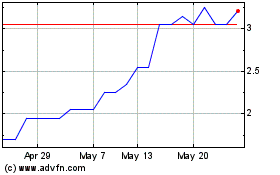

Keras Resources (AQSE:KRS.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025