TIDMLFT

RNS Number : 4448T

Lift Global Ventures PLC

20 March 2023

20 March 2023

Lift Global Ventures Plc

("Lift" or the "Company")

Half Year Results

The Directors of Lift Global Ventures Plc (AQSE:LFT) are pleased

to announce its half year results for the six-month period ended 31

December 2022.

Chairman's Statement

It is with pleasure that I take this opportunity to update

shareholders of Lift Global Ventures Plc (the "Company" or "Group")

on the Group's performance during the final six months of 2022.

Update on Investment Strategy

Investment in Miriad Limited ("Miriad")

On 5 September 2022, we were pleased to announce the acquisition

of the entire issued share capital of Miriad Limited ("Miriad"), a

financial PR and IR consulting company run by well-known stock

market commentator and current Director, Zak Mir. Miriad provides a

bespoke, personalised PR and IR service to small- and mid-cap

entities in the UK and access to Zak's deep market insights, vast

industry connections and significant social media following.

Miriad is the home of Zak's Traders Café, which is arguably the

one stop shop for technical, fundamental and sentiment analysis

from the moment the markets open. Zak's Traders Café has over

23,000 twitter followers.

Zak has worked in the financial markets for over 30 years,

initially as a derivatives broker in the 90s, and later as one of

the UK's leading stock market commentators. He was a pioneer of

technical analysis in the UK, covering major markets down to small

caps. In recent years, Zak has specialised in providing detailed

insights to retail and institutional investors on small cap

companies, while assisting quoted companies in getting their

message out to these investors.

Zak has written for numerous investment publications including

Shares Magazine, Investors' Chronicle, Yahoo! Finance, and

Spectator Money, while appearing as a guest stock market

commentator on CNBC and Bloomberg. He is a member of the National

Union of Journalists.

The Company continues to invest in Miriad which has recently won

new clients as it looks to ramp up this side of the business

supporting junior listed, and private companies, especially in

difficult financial markets.

Investment in IAMFIRE

In July 2022 the Company also made a small investment in IAMFIRE

Plc, an investment issuer listed on the AQSE Market Growth Exchange

with an investment strategy focused on the identification of

opportunities in social commerce, life sciences & natural

resources, at a cost of GBP49,052.

Investment in Trans-Africa Energy Limited ("TAE")

As announced on 9 December 2022, the Board proposed to broaden

the investment acquisition strategy of the Company to include

energy infrastructure and strengthen the Board with the requisite

skills to pursue this. The Board was pleased to announce, on 31

January 2023, that the Company had subscribed for GBP750,000 of

unsecured convertible loan notes ("Loan Notes") in TAE, a UK

private company focussing on the development, financing,

construction and operation of energy infrastructure projects

located primarily in Sub-Saharan Africa. The subscription was the

Company's first investment in furtherance of its expanded

Investment Strategy - investment in the robust energy

infrastructure sector and enabling a lower carbon economy.

TAE has entered into a Joint Development Agreement ("JDA") with

Ghana National Gas Company Ltd. which grants it a majority and

managing stake in the design, construction, management and

operation of four onshore Ghana related infrastructure projects for

the processing and transporting of natural gas.

The projects are:

1. The Takoradi to Tema Pipeline ("TTP");

2. The Ghana to Côte d'Ivoire Pipeline;

3. The addition of new infrastructure (e.g., gas processing

facilities) associated with the pipelines; and

4. The Prestea to Kumasi Pipeline.

The TTP is the first of the projects and the most advanced with

TAE expecting that financial close to be in H2 2023. The TTP will

be a buried onshore natural gas pipeline running from Takoradi

(Aboadze) to Tema (on the eastern side of Accra).

The proceeds received by TAE pursuant to the Loan Notes will be

used for the first project including Front End Engineering Design,

route surveys, environmental and social impact studies, and general

working capital requirements.

TAE has the ability to issue Loan Notes up to an aggregate

amount of GBP8,000,000 and can redeem the Loan Notes within a

period of 18 months from the date on which they have been issued.

Further details on the terms of the Loan Notes have been detailed

in the Company's announcement of 31 January 2023.

Changes to the Board of Directors

In December 2022, the Company welcomed two new Non-Executive

Directors, Mr. Roy Kelly as Chairman and Mr. Sandy Barblett to its

Board of Directors.

Roy and Sandy bring extensive knowledge and expertise in

completing transactions in the energy sector, as well as

considerable experience working with public companies, and will

help the Company to identify opportunities within its investment

acquisition strategy.

In December 2022, the Company also announced the resignation of

Mr. Paul Gazzard and Mr. Tim Daniel.

Financial Overview

As at 31 December 2022, the Group had cash reserves of

GBP1,199,316, compared to GBP1,322,305 as at 30 June 2022. The cash

balance arose from the Company raising GBP1,726,300 (before

expenses) in April 2022 upon admission to the AQSE Growth Market

("Admission"). The Group remains debt free.

The Group reports revenue of GBP149,875 for the 6-month period

to 31 December 2022 derived from the activities of Miriad.

Administration expenses for the 6-months to 31 December 2022

totalled GBP356,309 (30 June 2022: GBP286,280). Included in this

was administration expenses of Directors' fees of GBP146,392 and a

settlement payment to the departing board members of GBP62,800. The

Group also incurred costs of GBP188,298 for the year to 30 June

2022 in connection with Admission.

Future

On behalf of the Board, I thank you for your continued support

and look forward to continuing to build on the Company's portfolio

in the energy sector and working with TAE as it rolls out its

proposed projects. We are also committed to continuing to build

Miriad. We shall continue to update shareholders on our

investments.

Roy Kelly

Chairman

Condensed Consolidated Statement of Financial

Position As At 31 December 2022

---------- ----------------

Note Unaudited Unaudited

31 December 30 June 2022

2022 GBP

GBP

---------------------------------- ------------------- ---------------

Non-Current Assets

Intangible assets 6 298,696 -

Fair value through profit and loss

equity investments 7 36,567 -

Total non-current assets 335,263 -

Current Assets

Trade and other receivables 171,140 338,366

Cash and cash equivalents 1,199,316 1,322,305

Total current assets 1,370,456 1,660,671

--------------------------------------------------- --------------- ----------------

Total Assets 1,705,719 1,660,671

--------------------------------------------------- --------------- ----------------

Current Liabilities

Trade and other payables 159,387 64,235

--------------------------------------------------- --------------- ----------------

Total Liabilities 159,387 64,235

--------------------------------------------------- --------------- ----------------

Net Assets 1,546,332 1,596,436

--------------------------------------------------- --------------- ----------------

Equity attributable to owners of

the Parent

Share capital 8 957,100 915,433

Share premium 8 1,225,507 1,097,757

Other reserves 57,824 57,824

Retained earnings (694,099) (474,578)

--------------------------------------------------- --------------- ----------------

Total Equity 1,546,332 1,596,436

--------------------------------------------------- --------------- ----------------

The condensed consolidated financial statements were approved

and authorised for issue by the Board of Directors on 17 March 2023

and were signed on its behalf by:

Zak Mir

Chief Executive

Officer

Condensed Consolidated Income Statement

For The Six Months Ended 31 December 2022

Note Unaudited

For the

6 month period Audited

ended 31 For the

December period ended

2022 30 June 2022

GBP GBP

-------------------------------------------- ----- ---------------- --------------

Revenue 149,875 -

Gross Profit 149,875 -

Administration expenses 4 (356,909) (286,280)

Listing fees - legal and professional

services - (188,298)

Operating Loss (356,909) (474,578)

-------------------------------------------- ----- ---------------- --------------

Valuation losses on fair value through

profit and loss equity investments 7 (12,486) -

-------------------------------------------- ----- ---------------- --------------

Loss before Taxation (219,520) (474,578)

-------------------------------------------- ----- ---------------- --------------

Corporation tax charge - -

-------------------------------------------- ----- ---------------- --------------

Loss for the period (219,520) (474,578)

-------------------------------------------- ----- ---------------- --------------

Earnings per share (pence) - Basic &

Diluted 5 (0.23) (1.48)

-------------------------------------------- ----- ---------------- --------------

The Company has no Other Comprehensive Income as at 30 June

2022.

All operations are continuing.

Condensed Consolidated Statement of Cash Flows

For The Six Months Ended 31 December 2022

------------------------------------------------------------- ------------ ------------

Note Unaudited Audited

31 December 30 June

2022 2022

GBP GBP

------------------------------------------------------ ----- ------------- -----------

Cash flows from operating activities

Loss before taxation (219,520) (474,578)

Adjustments for:

Expected credit loss provision 13,667 -

Fair value loss on equity investments 12,486 -

Share based payments - 43,664

Changes in working capital:

Increase in trade and other receivables 204,226 (338,366)

Increase in trade and other payables 43,969 64,235

Net cash used in operating activities 54,828 (705,045)

------------------------------------------------------ ----- ------------- -----------

Cash flows from investing activity

Cash paid for acquisitions, inclusive of acquisition

costs 6 (201,840) -

Cash paid for investments 7 (49,052) -

Cash acquired on acquisitions 6 70,325 -

Net cash used in investing activity (180,567) -

Cash flows from financing activity

Net proceeds from issue of shares - 2,027,350

Cost of share issues 2,750 -

Net cash generated from financing activity 2,750 2,027,350

------------------------------------------------------ ----- ------------- -----------

Net increase in cash and cash equivalents (122,989) 1,322,305

Cash and cash equivalents at start of the 1,322,305 -

period

Cash and cash equivalents at end of period 1,199,316 1,322,305

------------------------------------------------------ ----- ------------- -----------

Non- Cash Investing and Financing Activities

Unaudited 6 months ended 31 December 2022 - 4,166,666 new

Ordinary Shares were issued at a price of GBP0.04 per share as

partial consideration for the acquisition of Miriad Limited,

totalling GBP166,667.

Condensed Consolidated Statement of Changes In Equity

For The Six Months Ended 31 December 2022

Attributable to Equity Shareholders

------------------------------------------------------------

Notes Share Share Other Retained Total

Audited - Period ended capital premium reserves earnings equity

30 June 2022 GBP GBP GBP GBP GBP

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

On incorporation 50,000 - - - 50,000

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

Loss for the period - - - (474,578) (474,578)

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

Total Loss for the period - - - (474,578) (474,578)

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

Transactions with owners

Issue of ordinary shares 8 865,433 1,150,867 - - 2,016,300

Cost of capital 8 - (53,110) - - (53,110)

Options and warrants granted - - 57,824 - 57,824

Total transactions with

owners 865,433 1,097,757 57,824 - 2,021,014

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

As at 30 June 2022 915,433 1,097,757 57,824 (474,578) 1,596,436

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

Unaudited - Period ended

31 December 2022

At 1 July 2022 915,433 1,097,757 57,824 (474,578) 1,596,436

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

Loss for the period - - - (219,520) (219,520)

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

Total Loss for the period - - - (219,520) (219,520)

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

Transactions with owners

Issue of ordinary shares 8 41,667 125,000 - - 166,667

Cost of capital 8 - 2,750 - - 2,750

Total transactions with

owners 41,667 127,750 - - 169,417

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

As at 31 December 2022 957,100 1,225,507 57,824 (694,099) 1,546,332

------------------------------ ------ ----------- ---------- ---------- ---------- -----------

1. Reporting Entity

Lift Global Ventures Plc (the "Company" or the "Group") is a

company domiciled in the United Kingdom. The consolidated interim

financial information as at and for the six months ended 31

December 2022 comprise the results of the Company and its

subsidiary (together referred to as the "Group").

The consolidated financial statements of the Group as at and for

the period ended 30 June 2022 are available upon request from the

Company's registered office at Suite 1, 15 Ingestre Place, London,

England, W1F 0DU or at liftgv.com.

2. BASIS OF PREPARATION

The financial information set out in this report is based on the

consolidated financial information of Lift Global Ventures Plc and

its subsidiary company. The financial information of the Group for

the 6 months ended 31 December 2022 was approved and authorised for

issue by the Board on 17 March 2023. The interim results have not

been audited. The financial information for the period ended 31

December 2022 set out in this interim report does not comprise the

Group's statutory accounts as defined in section 434 of the

Companies Act 2006. The Directors have elected not to apply IAS 34

Interim Financial Reporting. This financial information is

consistent with the recognition and measurement requirements of

UK-adopted international standards. The comparative information for

the year ended 30 June 2022 is not the Group's full annual accounts

for that period but has been derived from the annual financial

statements for that period.

The consolidated financial information incorporates the results

of Lift Global Ventures Plc and its subsidiary undertaking as at 31

December 2022. The Group was formed on 5 September 2022 upon the

Company's acquisition of Miriad Limited, as such the corresponding

amounts are for the Company only for period ended 30 June 2022.

The Group financial information is presented in Pound Sterling

and values are rounded to the nearest pound.

The same accounting policies, presentation and methods of

computation are followed in the interim consolidated financial

information as were applied in the Company's latest annual audited

financial statements except for those stated at 2.1 below or those

that relate to new standards and interpretations effective for the

first time for periods beginning on (or after) 1 July 2022 and will

be adopted in the 2023 annual financial statements.

A number of new standards, amendments and became effective on 1

July 2022 and have been adopted by the Group. None of these

standards have materially affected the Group.

Accounting policies applied for the 6-month period ended 31

December 2022

2.1 Basis of Consolidation

The Group Financial Statements consolidate the Financial

Statements of Lift Global Ventures Plc and the Financial Statements

of its subsidiary undertaking, Miriad Limited, made up to 31

December 2022.

Subsidiaries are entities over which the Group has control. The

Group controls an entity when the Group is exposed to, or has

rights to, variable returns from its involvement with the entity

and has the ability to affect those returns through its power over

the entity. Where an entity does not have returns, the Group's

power over the investee is assessed as to whether control is held.

Subsidiaries are fully consolidated from the date on which control

is transferred to the Group. They are deconsolidated from the date

that control ceases.

Inter-company transactions, balances, income and expenses on

transactions between group companies are eliminated. Profits and

losses resulting from intercompany transactions that are recognised

in assets are also eliminated. Accounting policies of subsidiaries

have been changed where necessary to ensure consistency with the

policies adopted by the Group.

2.2 Intangible Assets

Goodwill arises on the acquisition of subsidiaries and

represents the excess of the consideration transferred and the

acquisition date fair value of any previous equity interest in the

acquire over the fair value of the net identifiable assets,

liabilities and contingent liabilities of the acquire.

Goodwill is not amortised however impairment reviews are

undertaken annually, or more frequently if events or changes in

circumstances indicate a potential impairment. The carrying value

of goodwill is compared to the recoverable amount, which is the

higher of value in use, discounted to present value using a

discount rate reflective of the time value of money and risks

specific to the business unit. Any impairment is recognised

immediately as an expense and is not subsequently reversed.

For the purpose of impairment testing, goodwill acquired in a

business combination is allocated to each of the cash-generating

units, or groups of cash-generating units. Each unit or group of

units to which the goodwill is allocated represents the lowest

level within the entity at which the goodwill is monitored for

internal management purposes. Goodwill is monitored at the

operating segment level.

2.3 Business Combinations

Acquisitions of business are accounted for using the acquisition

method. The consideration transferred in a business combination is

measured at fair value, which is calculated as the sum of the

acquisition -- date fair values of assets transferred by the Group,

liabilities incurred by the Group to the former owners of the

acquiree and the equity interest issued by the Group in exchange

for control of the acquiree. Acquisition -- related costs are

recognised in profit or loss as incurred.

At the acquisition date, the identifiable assets acquired, and

the liabilities assumed are recognised at their fair value at the

acquisition date.

Goodwill is measured as the excess of the sum of the

consideration transferred, the amount of any non -- controlling

interests in the acquiree, and the fair value of the acquirers

previously held equity interest in the acquiree (if any) over the

net of the acquisition -- date amounts of the identifiable assets

acquired, and the liabilities assumed. If, after reassessment, the

net of the acquisition -- date amounts of the identifiable assets

acquired and liabilities assumed exceeds the sum of the

consideration transferred, the amount of any non -- controlling

interests in the acquiree and the fair value of the acquirers

previously held interest in the acquiree (if any), the excess is

recognised immediately in profit or loss as a bargain purchase

gain.

2.4 Fair value through profit and loss equity investments

(i) Classification

Fair value through profit and loss equity investments are

classified in this category if acquired principally for the purpose

of trading or selling in the short term. Investments in this

category are classified as current assets if expected to be settled

within 12 months; otherwise, they are classified as

non-current.

(ii) Recognition and Measurement

Regular purchases and sales of fair value through profit and

loss equity investments are recognised on the trade date - the date

on which the Group commits to purchasing or selling the asset. They

carried at fair value through profit or loss is initially

recognised at fair value, and transaction costs are expensed in the

Income Statement. They are measured at fair value using the fair

value hierarchy, as disclosed at note 7.

Fair value through profit and loss equity investments are

derecognised when the rights to receive cash flows from the assets

have expired or have been transferred, and the Group has

transferred substantially all of the risks and rewards of

ownership.

Gains or losses arising from changes in the fair value of fair

value through profit and loss equity investments at fair value

through profit or loss are presented in the Income Statement within

"Other (Losses)/Gains" in the period in which they arise.

2.5 Segment Reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors that makes

strategic decisions.

Segment results, include items directly attributable to a

segment as well as those that can be allocated on a reasonable

basis.

2.6 Revenue

Revenue is measured at the fair value of the consideration

received or receivable, and represent amounts receivable for goods

supplied, stated net of discounts, returns and value added taxes.

Under IFRS 15 there is a five-step approach to revenue recognition

which is adopted across all revenue streams. The process is:

Step 1: Identify the contract(s) with a customer;

Step 2: Identify the performance obligations in the

contract;

Step 3: Determine the transaction price;

Step 4: Allocate the transaction price to the performance

obligations in the contract; and

Step 5: Recognise revenue as and when the entity satisfies the

performance obligation.

Revenue comprises of public relations services provided by Zak

Mir. Public relations services are billed on a monthly or quarterly

retainer basis and comprise of web interviews, posts on social

media, articles, podcast interviews and introduction to contacts.

Revenue is recognized evenly over time on a monthly basis.

3. GOING CONCERN

Management has prepared a forecast and believe that current cash

reserves will adequately cover the working capital requirements of

the Company. In addition, the Company acquired the entire share

capital of Miriad Limited on 5 September 2022 which is a revenue

generating and profitable entity. The Group has sufficient cash to

cover the working capital requirements of the Group, for a period

of at least 18 months from the period end.

As such, the Directors have a reasonable expectation that the

Company has, and will have access to, adequate resources to

continue in operational existence for the foreseeable future and,

therefore, continue to adopt the going concern basis in preparing

the financial statements.

4. EXPENSES BY NATURE

Unaudited

31 December Audited

2022 30 June 2022

GBP GBP

------------------------------------------------ ------------- --------------

Directors' fees 146,392 112,000

Employers tax contributions and other

employment expenses 15,351 4,278

Fees paid to the company's auditor for

the audit of the Company financial statements 50 20,000

Professional, legal and consulting fees 145,613 65,247

PR and marketing 5,825 1,750

Insurance 11,163 4,025

Exchange listing fees 4,928 9,137

IT and software services 1,352 8,754

Rent 245 13,503

Share option expense - 43,664

Expected credit loss provisions 13,667 -

Other expenses 12,323 3,922

------------------------------------------------ ------------- --------------

Total administrative expenses 356,909 286,280

------------------------------------------------ ------------- --------------

5. LOSS PER SHARE

Unaudited

31 December Audited

2022 30 June 2022

GBP GBP

------------------------------------------------- ------------- --------------

Net loss for the year from continued

operations attributable to equity shareholders (219,520) (474,578)

Weighted average number of shares for

the period/year 94,215,435 32,126,311

------------- --------------

Basic loss per share for continued operations

(expressed in pence) (0.23) (1.48)

------------- --------------

The number of share options and warrants that could potentially

dilute the loss per share in future periods is 32,814,510 as at 31

December 2022. A calculation for the diluted loss per share has not

been performed as this would be anti-dilutive.

6. ACQUISITION OF MIRIAD LIMITED

On 5 September 2022, the Company acquired 100% of the issued

share capital of Miriad Limited ("Miriad"). The total consideration

payable for the acquisition consisted of GBP200,000 in cash and the

issue and allotment of 4,166,666 Ordinary Shares at GBP0.04 per

share, for total proceeds of GBP166,667. Acquisition costs totaled

GBP1,840 and have been included within the cost of the

investment.

Prior to the acquisition, Mirad was owned and controlled by Zak

Mir, a Director of Company, and his wife.

The following table summarises the consideration paid for Miriad

Limited and the fair values of the assets and equity assumed at the

acquisition date.

GBP

-------------------------------------------- --------

Cash paid for acquisition 200,000

Total proceeds from share issue 166,667

--------

Total consideration 366,667

--------

Acquisition related costs 1,840

--------

Total consideration and acquisition costs 368,507

--------

Recognised assets and liabilities acquired:

Cash and cash equivalents 70,325

Trade and other receivables 58,600

Trade and other payables (59,115)

--------

Total identifiable net assets 69,810

--------

Goodwill 298,696

--------

7. FAIR VALUE THROUGH PROFIT AND LOSS EQUITY INVESTMENTS

GBP

---------------------------------------------- --------

1 July 2021 -

--------

30 June 2022 -

--------

Additions at cost 49,052

Change in fair value recognised in profit and

loss (12,486)

--------

31 December 2022 36,567

--------

Fair value through profit and loss equity investments include

the following;

GBP

------------------------------------ --------

Quoted:

Equity securities - United Kingdom 36,567

--------

36,567

--------

The fair value of quoted securities is based on published market

prices.

All assets and liabilities for which fair value is measured are

categorised within the fair value hierarchy. The fair value

hierarchy prioritises the inputs to valuation techniques used to

measure fair value. The Group uses the following hierarchy for

determining and disclosing the fair value of financial instruments

and other assets and liabilities for which the fair value was

used:

- level 1: quoted prices in active markets for identical assets or liabilities;

- level 2: inputs other than quoted prices included in level 1

that are observable for the asset or liability, either directly (as

prices) or indirectly (derived from prices); and

- level 3: inputs for the asset or liability that are not based

on observable market data (unobservable inputs).

The following tables set forth, by level, equity investments

measured at fair value on a recurring basis as at 31 December

2022:

Quoted Prices Significant Significant

in Active Markets Other Observable Unobservable

for Identical Inputs Inputs

Assets and Liabilities

(Level 3)

(Level 1) (Level 2) GBP

GBP GBP

------------------ ----------------------- ----------------- -------------

Description

Equity securities 36,567 - -

----------------------- ----------------- -------------

36,567 - -

----------------------- ----------------- -------------

8. Share capital

Ordinary Share

Number of shares premium Total

shares GBP GBP GBP

----------------------------------- ----------- --------- ---------- ----------

Issued and fully paid

----------------------------------- ----------- --------- ---------- ------------

Issued on incorporation - 13

May 2021 5,000,000 50,000 - 50,000

Issue of new shares - 9 September

2021 29,000,000 290,000 - 290,000

Issue of new shares - 29 April

2022 57,543,334 575,433 1,150,867 1,726,300

----------------------------------- ----------- --------- ---------- ------------

Cost of Capital - - (53,110) (53,110)

----------------------------------- ----------- --------- ---------- ------------

At 30 June 2022 91,543,334 915,433 1,097,757 2,013,190

----------------------------------- ----------- --------- ---------- ----------

Issue of new shares - 5 September

2022 4,166,666 41,667 125,000 166,667

Cost of Capital - - 2,750 2,750

----------------------------------- ----------- --------- ---------- ----------

At 31 December 2022 95,710,000 957,100 1,225,507 2,182,607

----------------------------------- ----------- --------- ---------- ----------

On 9 September 2021, the Company issued and allotted 29,000,000

new Ordinary Shares at a price of GBP0.01 per share for gross

proceeds of GBP290,000.

On 29 April 2022, the Company issued and allotted 57,543,334 new

Ordinary Shares at a price of GBP0.03 per share for gross proceeds

of GBP1,726,300.

On 5 September 2022, the Company issued and allotted 4,166,666

new Ordinary Shares at a price of GBP0.04 per share as partial

consideration for the acquisition of Miriad Limited.

9. EVENTS AFTER THE REPORTING DATE

On 31 January 2023, the Company subscribed for GBP750,000 of

unsecured convertible loan notes in Trans-Africa Energy

Limited.

The Directors of the Company accept responsibility for the

contents of this announcement.

Enquiries:

Lift Global Ventures Plc

Zak Mir, CEO +44 (0)203 745 1865

Optiva Securities (AQSE Corporate

Adviser and Broker)

Christian Dennis

Daniel Ingram +44 (0)203 411 1881

For more information please visit: www.liftgv.com

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXGPUCAWUPWPUB

(END) Dow Jones Newswires

March 20, 2023 03:00 ET (07:00 GMT)

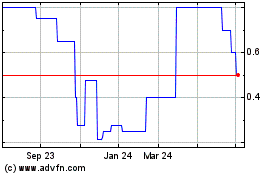

Lift Global Ventures (AQSE:LFT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lift Global Ventures (AQSE:LFT)

Historical Stock Chart

From Dec 2023 to Dec 2024