TIDMMPL

RNS Number : 3526Q

Mercantile Ports & Logistics Ltd

27 October 2021

27 October 2021

Mercantile Ports & Logistics Limited

("MPL", the "Group" or the "Company")

Interim Results

Mercantile Ports & Logistics (AIM: MPL), which is operating

and continuing to develop a modern port and logistics facility in

Navi Mumbai, Maharashtra, India, announces its interim results for

the period ended 30 June 2021.

Summary of key points during and post period :

-- The Group successfully restructured the term loan with following key highlights.

Rate of interest reduced from 13.45% to 9.5%

Principal repayment start date shifted from October 2020 to

October 2022.

Moratorium on interest payments until February 2022

-- Strong balance sheet with total assets of GBP148 million

(June 2020: GBP168 million), a debt to equity ratio of 0.47 (June

2020: 0.38) and cash of GBP1.68 million at 30 June 2021 (June 2020:

GBP 7.80 million).

-- Group revenue of GBP0.85 million (June 2020: GBP0.16 million) .

-- Loss for the 30 June 2021 GBP 3.40 million (June 2020: GBP2.6 million)

-- Net asset value as at 30 June 2021 GBP 91.25 million (June 2020: GBP108.63 million)

-- New contract signed with Saurashtra Cements limited and with

Esquire Shipping & Trading Private Limited.

Jeremy Warner Allen, Executive Chairman of MPL , stated 2020 saw

the coronavirus COVID-19 pandemic as a defining global health

crisis and perhaps the greatest challenge the world has faced since

World War II. Despite this, progress at our Karanja facility

continued as the management team strived to support the existing

clients, including the Tata Projects and Daewoo Engineering Joint

Venture (the "JV"). In the first half of 2021, the Company has

signed new contracts with Saurashtra Cements Limited and with

Esquire shipping & Trading Private Limited. We are also busy

with negotiations with other prospective customers which are

expected to boost the top line of the Group.

Jay Mehta, CEO of MPL stated, "These financial results show an

all-round performance aligned to a clearer business strategy. The

Group is expecting further strong operational and financial

performance in H2 2021, which is extremely pleasing and does, I

believe, show that our strategy is working.

Enquiries:

Mercantile Ports & Logistics Jay Mehta

Limited

C/O Newgate Communications

+44 (0)203 757 6880

Cenkos Securities plc Stephen Keys

(Nomad and Broker) +44 (0)207 397 8900

Newgate Communications Isabelle Smurfit

(Financial PR) +44 (0)203 757 6880

mpl@newgatecomms.com

Chairman's Statement

Against the backdrop of a serious wave of Covid-19 in India, and

in particular Maharashtra earlier this year, MPL has continued to

navigate difficult issues well in these challenging times. In the

First Half of 2021, the Company managed to restructure its

corporate debt amongst the consortium of Indian Banks. The fact

that the Company successfully negotiated down its interest payments

by approximately 400 bps is a significant development and shows the

growing confidence that our banking partners have with regards to

the development and operation of our business on the ground. In

addition to the interest rate reduction, the Company took advantage

of Covid-19 related mitigation relief packages sanctioned by the

Government of India to defer interest payments and defer principal

payment of the loan till October 2022. The goal of the Company

continues to be to further strengthen its capital structure by

refinancing its entire debt at a lower interest rate.

Despite there being a mandatory lockdown in the first half of

the year, MPL managed to build a strong pipeline with end users of

its facility and signed two long term contracts to handle 6-7

million tons of bulk cargo over the next three years. Our contract

with Daewoo Tata Joint Venture, which was signed in 2019, continues

to progress well and we have also increased the personnel in the

business development team with representatives from Hunch Venture

playing an integral role in helping us attract new customers.

While there is always a threat of another potential Covid-19

wave to hit India, the fact that over a billion doses of vaccine

have been administered, gives a hopeful sense that the worst may be

behind us now. The current economic backdrop is of the economy

growing strongly across all sectors especially in solving the

logistics log jam across the country. We believe that our business

on the ground will continue to play a role in decongesting and

improving the logistical outcomes in the most important and vibrant

trading center in the country. I, along with the rest of the board,

am excited about the future opportunities for MPL India.

MPL's management team continues to work with existing and

potential customers in order to fully utilize our available

capacity at Karanja Port.

Since the period end, MPL was pleased to secure GBP10.1 million

by way of a placing with new and existing shareholders which will

aid the development of MPL's business.

On behalf of the Board, I should like to thank our employees and

management for their continued support and commitment to the

Company in very difficult circumstances caused by the pandemic.

Jeremy Warner Allan, Chairman

Mercantile Ports & Logistics Limited __ October 2021

Note

6 months 6 months Year to

to to 31 Dec

30 June 30 June 2020

2021 2020

GBP000 GBP000 GBP000

CONTINUING OPERATIONS

Revenue 850 155 745

Operating costs (84) (58) (48)

Administrative expenses (2,171) (2,046) (4,944)

-------------- ------------------- --------------

OPERATING LOSS (1,405) (1,949) (4,247)

Finance income 29 44 104

( 1,976

Finance cost (2,031) (695) )

-------------- ------------------- --------------

NET FINANCING COST (2,002) (651) (1,872)

LOSS BEFORE TAX (3,407) (2,600) (6,119)

Tax expense for the period - - (456)

-------------- ------------------- --------------

LOSS FOR THE PERIOD (3,407) (2,600) (6,575)

Loss for the period attributable

to:

Non-controlling interest (7) (5) (11)

Owners of the parent (3,400) (2,595) (6,564)

-------------- ------------------- --------------

Loss for the period / year (3,407) (2,600) (6,575)

============== =================== ==============

Other comprehensive income/(expense)

Items that will not be reclassified

to profit or loss

Re-measurement of net defined

benefit liability - - (4)

Items that may be reclassified

to profit or loss

Exchange differences on translating

foreign operations 5 (3,018) 774 (6,161)

-------------- ------------------- --------------

Other comprehensive loss for the

period / year (3,018) 774 (6,165)

-------------- ------------------- --------------

Total comprehensive loss for the

period / year (6,425) (1,826) (12,740)

============== =================== ==============

Total comprehensive loss for the

period / year attributable to:

Non-controlling interest (7) (5) (11)

Owners of the parent (6,418) (1,821) (12,729)

-------------- ------------------- --------------

(6,425) (1,826) (12,740)

============== =================== ==============

Loss per share (consolidated):

Basic & Diluted, for the period

attributable to ordinary equity

holders ( GBP 0.002p) ( GBP 0.001p) ( GBP 0.003p)

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2021

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

Note Period Period Year ended

ended ended 31 Dec

30 June 30 June 2020

2021 2020 (restated*)

GBP000 GBP000 GBP000

Assets

Property, plant and equipment 8 129,145 139,022 131,343

Intangible asset 4 4 4

--------- ------------------ -----------

Total non-current assets 129,149 139,026 131,347

--------- ------------------ -----------

Trade and other receivables 17,605 20,694 18,771

Cash and cash equivalents 1,679 7,796 3,895

--------- ------------------ -----------

Total current assets 19,284 28,490 22,666

Total assets 148,433 167,516 154,013

========= ================== ===========

Liabilities

Non-current

Employee benefit obligations 7 4 7

Borrowings 7 42,306 37,943 34,729

Lease liabilities payables 1,580 2,691 1,716

Non-current liabilities 43,893 40,638 36,452

--------- ------------------ -----------

Current

Employee benefit obligations 330 159 224

Borrowings 7 447 3,753 4,074

Current tax liabilities 403 202 384

Leases Liabilities payable 767 739 694

Trade and other payables 11,345 13,397 14,512

--------- ------------------ -----------

Current liabilities 13,292 18,250 19,888

--------- ------------------ -----------

Total liabilities 57,185 58,888 56,340

--------- ------------------ -----------

Net assets 91,248 108,628 97,673

========= ================== ===========

Equity

Share capital and share

premium 134,627 134,627 134,627

Retained earnings (13,794) (6,421) (10,394)

Translation reserve (29,582) (19,588) (26,564)

--------- ------------------ -----------

Equity attributable to

owners of parent 91,251 108,618 97,669

--------- ------------------ -----------

Non-controlling interest (3) 10 4

--------- ------------------ -----------

Total equity and liabilities 91,248 108,628 97,673

================ ================== =============

(*) Refer to note 9 for full details of the restatement of

position at 30 June 2020

CONDENSED STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 JUNE 2021

Note 6 months 6 months Year to

to to 31 Dec 2020

30 June 30 June

2021 2020

GBP000 GBP000 GBP000

CASH FLOWS FROM OPERATING ACTIVITIES

Loss before tax for the period / year (3,407) (2,600) (6,119)

Non cash flow adjustments 6 3,020 1,466 2,020

--------- --------- -------------

Net cash generated/used from operating

activities (387) (1,134) (4,099)

--------- --------- -------------

Net changes in working capital 6 (489) 445 1,661

--------- --------- -------------

Net cash from operating activities (876) (689) (2,438)

--------- --------- -------------

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and equipment (1,082) (7,717) (8,390)

Finance income 11 39 73

--------- --------- -------------

Net cash used in investing activities (1,071) (7,678) (8,317)

--------- --------- -------------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from borrowing (net) 992 1,464 2,678

Repayment of bank borrowing principal (640) - -

Interest paid on borrowing (522) - (1,520)

Repayment of leasing liabilities principal

(net) (53) (3) (845)

Interest payment on leasing liabilities (24) (107) (188)

--------- --------- -------------

Net cash (used in) / generated from

financing activities (247) 1,354 125

--------- --------- -------------

Net change in cash and cash equivalents (2,194) (7,013) (10,630)

Cash and cash equivalents, beginning

of the period 3,895 14,823 14,823

Exchange differences on cash and cash

equivalents (22) (14) (298)

--------- --------- -------------

Cash and cash equivalents, end of

the period 1,679 7,796 3,895

========= ========= =============

Note :

1) The adjustments and working capital movements have been

combined in the above Statement of Cash Flows.

Consolid ated St atement of Changes in Equity

for the PERIOD ended 30 JUNE 2021

Stated Translation Retained Other Non- controlling Total

Capital Reserve Earnings Components Interest Equity

of equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------- ------------ ---------- ------------ -----------------

Balance at

1 January 2020 (restated) 134,627 (20,403) (3,826) -- 15 110,413

Issue of share capital -- -- -- -- -- --

Transactions with

owners 134,627 (20,403) (3,826) -- 15 110,413

--------- ------------ ---------- ------------ ----------------- ---------

Loss for the period/year -- -- (6,564) -- (11) (6,575)

Foreign currency translation

differences for foreign

operations -- (6,161) -- -- -- (6,161)

Re-measurement of

net defined benefit

pension liability -- -- -- (4) -- (4)

Re-measurement of

net defined benefit

pension liability

transfer to retained

earning -- -- (4) 4 -- --

Total comprehensive

income for the year -- (6,161) (6,568) -- (11) (12,740)

--------- ------------ ---------- ------------ ----------------- ---------

Balance at

31 December 2020 134,627 (26,564) (10,394) -- 4 97,673

========= ============ ========== ============ ================= =========

Balance at

1 January 2021 134,627 (26,564) (10,394) -- 4 97,673

Issue of share capital -- -- -- -- -- --

--------- ------------ ---------- ------------ ----------------- ---------

Transactions with

owners 134,627 (26,564) (10,394) -- 4 97,673

--------- ------------ ---------- ------------ ----------------- ---------

Loss for the period -- -- (3,400) -- (7) (3,407)

Foreign currency translation

differences for foreign

operations -- (3,018) -- -- -- (3,018)

--------- ------------ ---------- ------------ ----------------- ---------

Total comprehensive

income for the period -- (3,018) (3,400) -- (7) (6,425)

--------- ------------ ---------- ------------ ----------------- ---------

Balance at

30 June 2021 134,627 (29,582) (13,794) -- (3) 91,248

========= ============ ========== ============ ================= =========

NOTES TO THE CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS

1. Reporting entity

Mercantile Ports & Logistics Limited (the "Company") was

incorporated in Guernsey under the Companies (Guernsey) Law 2008 on

24 August 2010. The condensed interim consolidated financial

statements of the Company for the period ended 30 June 2021

comprise the Company and its subsidiaries (together referred to as

the "Group"). The Company had been established to develop, own and

operate port and logistics facilities.

2. General information and basis of preparation

The condensed interim consolidated financial statements are for

the 6 months' period ended 30 June 2021 and are not for full year

accounts. The condensed interim consolidated financial statements

are prepared under AIM 18 guidelines. They have been prepared on

the historical cost basis. They do not include all of the

information required in annual financial statements in accordance

with International Financial Reporting Standards ("IFRS") as issued

by EU. The condensed interim consolidated financial statements are

un-audited.

The condensed interim consolidated financial statements are

presented in Great British Pounds Sterling (GBP), which is the

functional currency of the parent company. The preparation of the

condensed interim consolidated financial statements requires

management to make judgments, estimates and assumptions that affect

the application of accounting policies and the reported amounts of

assets, liabilities, income and expenses. Actual results may differ

from these estimates.

In preparing these, condensed interim consolidated financial

statements, the significant judgments made by management applying

the Group's accounting policies and the key sources of estimation

uncertainty are the same as those applied in the annual IFRS

financial statements. "The Company is confident of its ability to

raise further funds to meet cost overruns, project enhancements or

working capital requirements. The Company's financing effort to

date is considered sufficient to enable the Company to fund all

aspects of its operations. As a result, the condensed interim

consolidated financial statements have been prepared on a going

concern basis."

The condensed interim consolidated financial statements have

been approved for issue by the Board of Directors on 26(th)

October, 2021.

3. Significant accounting policies

The interim financial statements have been prepared in

accordance with the accounting policies adopted in the Group's last

annual financial statements for the year ended 31 December 2020.

The accounting policies have been applied consistently throughout

the Group for the purposes of preparation of these interim

financial statements.

New standards, amendments and interpretations to existing

standards effective from January 1, 2021

There are no accounting pronouncements, which have become

effective from 1 January 2021 that have a significant impact on the

Group's interim condensed consolidated financial statements.

4. Going Concern

The Board assessed the Group's ability to operate as a going

concern for the next 12 months from the date of signing the

financial statements, based on a financial model which was prepared

as part of approving the 2021 budget.

The Directors considered the cash forecasts prepared for the 18

month period ending 31 December 2022 (which includes the potential

impact of COVID-19), together with certain assumptions for revenue

and costs, to satisfy themselves of the appropriateness of the

going concern basis used in preparing the financial statements.

Regarding financing, the Group had capital GBP3.89 million made

up of a cash balance of GBP3.89m as at 30 June 2021 and fundraise

proceed of GBP9.00 million (net of fundraise cost) in 1(st) week of

September 2021. During the period the Company has successfully done

One Time Restructuring (OTR) and as per revised OTR terms Company

was to start repayment of the principal amount of term loan from

October 2022 onwards. The directors believe that the debt providers

will continue to support the Group thereafter which is evident from

interim support received in first half of 2021 by way of INR 10

crores (GBP0.63 million) GECL facility.

The Directors also took account of the principal risks and

uncertainties facing the business referred to above, a sensitivity

analysis on the key revenue growth assumption and the effectiveness

of available mitigating actions.

The uncertainty as to the future impact on the Group of the

recent Covid-19 outbreak has subsequently been considered as part

of the Group's adoption of the going concern basis. In the downside

scenario analysis performed, the Directors have considered the

impact of the Covid-19 outbreak on the Group's trading and cash

flow forecasts. In preparing this analysis, the Directors assumed

that the lockdown effects of the Covid-19 virus would peak in India

around the end of June 2021 and trading will normalize over the

subsequent few months, albeit attaining substantially lower levels

of revenue than budgeted, for at least the rest of the current

financial year.

A range of mitigating actions within the control of management

were assumed, including reductions in the Directors and all staff

salary by 35% until the end of the year, a reduction in all

non-essential services.

5 . Comprehensive income

The comprehensive loss for the period is calculated after

debiting a loss of GBP 3.02 million, which arises on the

retranslation of foreign operations to Great British Pounds

Sterling (GBP), which is the functional currency of the Company.

(INR/GBP exchange rate at 30 June 2021 of 102.95, 31 December 2020:

99.60 and 30 June 2020: 92.69 were used).

6. Cash flow adjustments and changes in working capital

The following non-cash flow adjustments and adjustments for

changes in working capital have been made to profit before tax to

arrive at operating cash flow:

Period ended Period ended Year ended

30 Jun 2021 30 Jun 2020 31 Dec 2020

GBP000 GBP000 GBP000

Adjustments and changes in working

capital

Depreciation 1,081 801 1,777

Finance income (12) (39) (74)

Unrealized exchange (loss)/gain (8) 13 13

Finance cost 1,956 691 321

Gain on cancellation of lease - - (34)

Re-measurement of net defined

benefit liability - - (4)

Provision for Gratuity 3 - 16

Loss on sale of Car - - 5

3,020 1,466 2,020

------------- ------------- ------------

Change in trade and other payables (23) 22 994

Change in trade and other receivables (466) 423 667

(489) 445 1,661

------------- ------------- ------------

7. Loan facility

Karanja Terminal & Logistics Private Limited (KTLPL), the

Indian subsidiary was sanctioned a term loan of INR.480 crores

(GBP46 .63 million ) by 4 Indian public sector banks and the loan

agreement was executed on 28(th) February, 2014.

There h as been a One Time Restructuring (OTR) Proposal, which

was initiated by the Group seeking relief under the Covid-19

Pandemic stress on the financial position of the company. The

lenders sanctioned the proposal on 10 June 2021. The revision

consists of the following:

Particular Amount in Amount in

INR Crore GBP Million

-----------

Principal term loan 386.49 37.54

----------- -------------

Addition to term loan (Interest

Mar - 2020 to Aug - 2020) 26.51 2.58

----------- -------------

Revised term loan as per OTR sanction. 413.00 40.12

----------- -------------

Less: principal repayment for Dec

- 2020 quarter 6.52 0.63

----------- -------------

Term loan as at 30 June, 2021 406.48 39.49

----------- -------------

Add:

----------- -------------

Funded interest term loan as at

30 June, 2021 23.65 2.30

----------- -------------

GECL - working capital loan 10.00 0.96

----------- -------------

Total borrowing 440.13 42.75

----------- -------------

Current 4.6 0.45

----------- -------------

Non-current 435.53 42.30

----------- -------------

Balance as at 30 June, 2021 440.13 42.75

----------- -------------

In addition, the interest on principal term loan for the period

from January 2021 to February, 2022 (14 months) has been converted

to Funded Interest Term Loan (FITL) which sums up to INR.52.57

crore ( GBP5 .11 million).

During the year company has availed a GECL loan of INR 10 crore

( GBP0 .63 million) from a public sector bank which carries

interest @7.95% p.a.

The OTR sanctioned by the term lenders extends principal

repayment by 2 years (repayment to commence from December 2022) and

interest payment to start from March 2022. The rate of interest on

term loan is reduced from 13.45% to 9.5% and FITL carries interest

@ 10.50%.

Due to above development term loan repayment is calculated

accordingly as follow:

Repayment amount

Payment falling GBP in Million

due INR in Crore

Within 1 year 4.6 0.45

1 to 5 year's 169.72 16.49

After 5 year's 292.65 28.43

Total 466.97 45.37

============= ===============

The rate of interest will be a floating rate linked to the

Canara bank base rate (7.35%) with an additional spread of 215

basis points. The present composite rate of interest is 9.50%. The

borrowings are secured by the hypothecation of the port facility

and pledge of its shares as well as a personal guarantee by the

chairman, Nikhil Gandhi. The carrying amount of the bank borrowing

is considered a reasonable approximation of the fair value.

8. Property, plant and equipment

As at 30 June 2021, the carrying amount of facility yet to be

capitalized was GBP 81.14 million (30 June 2020: GBP 97.13 million)

and part port facility was capitalised on 01 October 2020 was GBP

13.26 million. The amount of borrowing costs capitalised during the

six months ended 30 June 2021 was GBP 0.85 million (31 December

2020: GBP3.89 million). The weighted average rate used to determine

the amount of borrowing costs during the period eligible for

capitalisation was 13.39 %, which is the effective interest rate of

the specific borrowing.

The group intends to optimize its operations on land parcel of

48 acres, proportionate cost for which has been capitalized till

date. The balance additional reclaimed land of c. 50 acres is ready

for being made available for use by future customers subject to

customized modifications including ground strength requirement,

surfacing etc.

The Group currently has excess surcharge material to the tune of

c.13 acres in possession, in case further reclamation is required

to be carried out to serve additional demand for space requirement

by customers.

9. Prior year adjustment

In prior years, the Group had provided for an income tax

liability on interest income accrued for the assessment years

2013-14 to 2017-18, which was treated as a non-taxable capital

receipt in the Income Tax Return of the respective year that was

filed with the Indian tax authorities. However, the tax department

rejected the treatment applied by the company. The Group filed an

appeal with the Income Tax Appellate Tribunal (ITAT), which

pronounced the decision in favor of the Group by its order during

2019. The ruling becoming effective in June 2020 when the taxing

authority recorded this in their systems followed this

When considering the effect of the ruling becoming effective in

2020, management has reassessed whether it was appropriate to

recognize the uncertain tax liability at 31 December 2019. In doing

so, management have concluded that the recording of the ITAT

decision by the tax authorities in June 2020 provided evidence that

confirmed that it was not probable that the income tax liability

would become payable. In making this judgement, management

concluded that until the tax authorities had updated the tax

records, which occurred in June 2020, it remained probable that an

income tax liability may have become payable. This was not

previously been taken into account prior to approving the 2019

annual report and accounts. As such, the Directors have restated

the statement of Financial Position, Statement of Comprehensive

Income and all other elements of the financial statements so

affected, to give effect to the reversal of the tax provision. This

constitutes an error in accounting treatment adopted in the prior

period financial statement and has accordingly been treated as

prior year adjustment. In doing so, the impact to the financial

statements for the prior period back to 30 December 2019 and

consequently on half-yearly reporting done as 30 June 2020,

summarized as below:

The effect on the Consolidated Statement of Financial Position

as at 31 June 2020 was as follows

Particulars Previously Restated Impact of

reported 30 June Restatement

30 June 20 30 June 20

20 GBP000 GBP000

GBP000

---------------------------------- ----------- ---------- -------------

Trade and other receivables 22,787 20,694 (2,093)

----------- ---------- -------------

Retained earnings (11,336) (6,421) 4,951

----------- ---------- -------------

Translation Reserve (19,440) (19,588) (148)

----------- ---------- -------------

Equity attributable to owners of

parent 103,851 108,618 4,767

---------------------------------- ----------- ---------- -------------

Non-controlling Interest (2) 10 12

---------------------------------- ----------- ---------- -------------

Total equity 103,849 108,628 4,779

---------------------------------- ----------- ---------- -------------

Current tax liabilities 7,074 202 (6,872)

----------- ---------- -------------

10. Event Subsequent to the reporting period.

a. The company further raised GBP10.1 million (GBP9 million

after costs) in August 2021 via subscription, share placing and

Primary Bid. Proceeds of the fund raise are expected to be utilized

for business development, servicing new and existing contracts, and

debt servicing and general working capital requirements.

b. On 13 September 2021 group has consolidated its share capital

by way of issuing 1 share for every 100 shares held.

c. Hunch Ventures has provided additional line of credit of

GBP4.5 million through KJS Concrete Private Limited, to provide

additional headroom for the Company's operations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KQLFLFBLXFBV

(END) Dow Jones Newswires

October 27, 2021 02:00 ET (06:00 GMT)

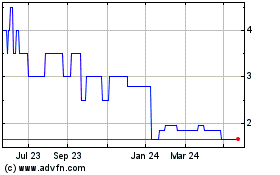

Mercantile Ports and Log... (AQSE:MPL.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

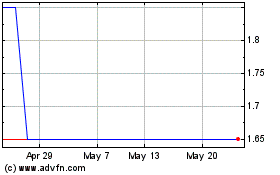

Mercantile Ports and Log... (AQSE:MPL.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025