Microsaic Systems plc Funding Update (2380T)

13 November 2023 - 7:42PM

UK Regulatory

TIDMMSYS

RNS Number : 2380T

Microsaic Systems plc

13 November 2023

13 November 2023

Microsaic Systems plc

("Microsaic" or the "Company")

Funding update

The Company announced on 3 November that it had begun a very

significant cost reduction exercise which would include a

substantially reduced operation cost base and the intention to

reduce overheads by cancelling admission to trading of its shares

on AIM ("Delisting") and conversion to a private company.

The Company has since been engaged in further funding

discussions which involve raising funds subject to reinstatement of

the Company's shares to trading on AIM. The Company is reviewing

the proposals and will provide a further update on the resolutions

to be put to shareholders to give effect to such proposals as soon

as is reasonably practicable, along with an updated timetable for

key events. This will include the revised timing for publication

and posting of a circular to shareholders giving notice of a

general meeting. The Directors believe that concluding a modest

fundraise to support the retention of the AIM listing would be in

the best interests of the Company in the medium term. Completion of

such a fundraising remains conditional upon, inter alia, the

publication of both the FY22 audited annual accounts on a going

concern basis and the interim results for the six months ended 30

June 2023.

It is likely that, if proceeding with a fundraising subject to

obtaining fresh shareholder authorities to allot new shares on a

non-pre-emptive basis, the Company would still need to table an

alternate resolution to approve Delisting in the event that the

resolutions required to implement a fundraising were not passed. If

the fundraising resolutions were to be approved, with firm

commitments obtained from investors prior to the GM then being

subject only to admission of the new shares (i.e. assuming

reinstatement will occur), the Delisting resolution would be

withdrawn from the business of the General Meeting.

Enquiries:

Microsaic Systems plc

Bob Moore

Executive Chairman +44 (0)1483 751 577

Singer Capital Markets

(Nominated Adviser & Joint Broker) +44 (0)20 7496 3000

Aubrey Powell / Angus Campbell

Turner Pope Investments (TPI) Limited

(Broker)

Andy Thacker / James Pope +44 (0) 20 3657 0050

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information as stipulated

under the UK version of the market abuse regulation no 596/2014

which is part of English law by virtue of the European Union

(Withdrawal) Act 2018, as amended. On publication of this

announcement via a regulatory information service, this information

is considered to be in the public domain. The above named director

takes responsibility for the release of this announcement.

About Microsaic (www.microsaic.com)

Microsaic listed on AIM in 2011 to develop and commercialise

micro-engineering chip-based mass spectrometry equipment. Having

invested GBP30m over the last 20 years before and after the IPO,

Microsaic has a robust patent portfolio in cutting-edge technology

which enables analytical detection and characterisation at the

point-of-need, whether within a human health environment,

conventional laboratory setting, or within a bioprocessing facility

for continuous mass spectrometer detection and monitoring of data

at any step in the process workflow.

Microsaic's products and systems are commercially available

through global markets via a network of regional and local

partners, targeting its core laboratory, manufacturing, and

point-of-need applications. Microsaic is an innovative company.

Most recently the Company has developed an Acrylamide detector for

use in the food industry and a ProteinID detector for the biopharma

industry that will greatly reduce the manufacturing wastage costs

by early detection of expensive product failure throughout the

biopharmaceutical manufacturing process. For environmental

monitoring, Microsaic has developed a method to analyse

perfluoroalkyl-and polyfluoroalkyl (PFAS) substances, otherwise

known as 'forever chemicals' using its mass spectrometer. This

equipment can analyse water samples and determine whether PFAS

concentrations are above legal thresholds with novel mobile testing

capability. All of these new products are at the final stage of

development and are expected to be released to the market in

2024.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUOOWROKUAARA

(END) Dow Jones Newswires

November 13, 2023 03:42 ET (08:42 GMT)

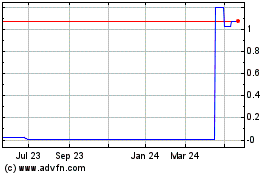

Microsaic Systems (AQSE:MSYS.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

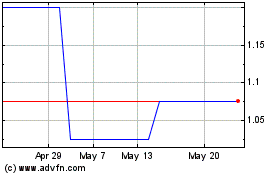

Microsaic Systems (AQSE:MSYS.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025