TIDMOHGR

RNS Number : 4710V

One Health Group PLC

04 December 2023

4 December 2023

One Health Group plc

("One Health" or "OHG" or the "Group")

Half Year results for the Six Months to 30 September 2023

(unaudited)

& Declaration of Interim Dividend

Underlying EBITDA 48% ahead of prior year

New surgical capacity coming on stream to meet massive demand

for NHS-funded surgery

One Health (AQSE: OHGR), a provider of NHS-funded medical

procedures, is pleased to announce its unaudited interim results

for the six months ended 30 September 2023.

Financial Highlights

The Group has performed well in the first half with excellent

increases in revenues, profitability and cash. The interim dividend

has been increased by 22% to 2.03p per share.

Financial Summary Current period Prior Year Increase %

Turnover GBP11.06m GBP9.83m +13%

---------------- ------------ -----------

Underlying EBITDA GBP0.787 m GBP0.532 m + 48 %

---------------- ------------ -----------

Underlying EPS 5.15 pence 3.91 pence + 32%

---------------- ------------ -----------

Cash balance GBP3.64 m GBP2.68 m + 36 %

---------------- ------------ -----------

Interim dividend 2.03 pence 1.66 pence + 22 %

---------------- ------------ -----------

Declaration of Interim Dividend

One Health Group plc is pleased to announce that the Board of

Directors has declared an interim dividend at the rate of 2.03

pence per share, to be paid on on 12 January 2024 to shareholders

on the register as at close of business on 22 December 2023. The

ex-dividend date will be 21 December 2023.

Operational Highlights

-- New patient referrals increased by 12%

-- Surgical procedures carried out on some 3,000 NHS patients, a 7% increase

-- Surgical activity started at a new independent hospital in a new geographical area

-- Additional capacity sourced within two current independent hospital partners

-- Attracted 15 new clinicians to the business to support growth.,

-- Increased demand for Waiting List transfers with two new NHS Trust contracts

-- National media campaign launched by the NHS to promote

knowledge of 'Patient Choice' will increase GP referrals.

Planned developments & Potential Profit Impact

-- Another 30 clinicians in the application process.

-- Surgical hubs are being actively pursued to increase the

Group's surgical capacity to help to satisfy the demand from the

NHS.

Review of the period

Operationally, 2023 has seen a further increase in the national

NHS waiting list and industrial action causing disruption to NHS

patients care caused by cancelations. As a result demand for

support by the independent sector remained high during the first

half of the year. During the period we saw an increased demand for

waiting list transfers and direct referrals from NHS Trusts. The

Group has attracted 15 new clinicians to the Group into new

geographical areas and continues to expand surgical capacity in

existing areas, meaning One Health is well placed to support the

NHS in the second half of the year, traditionally our busiest

period. The Group continues to work closely with NHS trusts to

support the reduction of waiting lists for elective care.

From a financial perspective One Health has performed well in

the first half of the year. Financial performance is in line with

management and market expectations and as we enter our busiest

period of the year, we are confident we will achieve full year

revenue and profit expectations.

Cash reserves at the end of September 2023 of GBP3.64m support

ongoing investment in growth and our progressive dividend policy.

The Board is therefore declaring an increased interim dividend of

2.03p per Ordinary Share (H1 22/23: 1.66p per share) to be paid on

12 January 2024 to shareholders on the register as at close of

business on 22 December 2023. Last year's interim dividend was

agreed by the Board before the business was listed and was paid in

January 2023. Following the IPO in November 2022, the Group is

adjusting the profile of dividend payments and expects the interim

dividend to represent 1/3 of the full year dividend going

forward.

Adam Binns, Chief Executive Officer, said:

"One Health has performed well in the first six months of the

financial year, with turnover up 13% to GBP11.06m, underlying

EBITDA up 48% to nearly GBP0.8m and new patient referrals up 12% at

6,094.

"Notably these referrals include an increasing number of NHS

patients transferring to One Health from local Trust waiting lists

to help them reduce their internal waiting lists, with two new

contracts secured in H1. The Trust transfer activity is in addition

to patients received through the traditional route by choosing to

be referred to One Health through 'Patient Choice' after visiting

their GP.

"We are pleased with performance in the first half of the year

and expect to achieve our year end forecasts."

About One Health Group

One Health engages over 100 NHS Consultants who sub-specialise

in the various surgeries offered by the Group, through a growing

network of community-based outreach clinics and surgical operating

locations. In the year to March 2023 One Health serviced almost

12,000 new patients, through over 29,000 consultations and

performed 5,790 surgical procedures. One Health uses surgeons and

anaesthetists that are mostly employed by the NHS, on a consultancy

basis. It currently works with over 100 professionals across seven

hospitals and over 30 CQC registered clinics.

One Health's activities are focused on areas where the patient

needs are under-supplied by the local NHS service as well as

locations where population density is relatively high, and the

level of private medical insurance is relatively low. One Health

has also sought to expand geographically from its head office in

Sheffield, South Yorkshire into neighbouring counties, which meet

the required criteria. Currently, the Group's activities are

focused in Yorkshire, Lincolnshire, Derbyshire, Nottinghamshire and

Leicestershire. Revenue in the year to 31 March 2023 was derived

from 60 Clinical Commissioning Groups in addition to contracts

directly with NHS hospitals to manage their internal waiting

lists.

One Health's business model has focused to date on four main

areas: being Spine, Orthopaedics, General Surgery and Gynaecology.

The split of inpatient procedures in the year to 31 March 2023 was

as follows: Orthopaedics 44% Spine 27% General Surgery 22%

Gynaecology 7%.

Orthopaedics and Spine are particularly attractive areas for One

Health as the Directors believe that they benefit from powerful

growth drivers in terms of an ageing demographic, physical

inactivity and an increasing proportion of the population being

categorised as obese. Within orthopedics, the most common surgeries

performed by One Health are knee and hip replacements.

* ( https://www.onehealth.co.uk/investors )

The Directors of One Health Group plc accept responsibility for

the contents of this announcement.

For more information, please contact:

One Health Group plc via Square1 Consulting

Oberon Capital - AQSE Corporate Adviser and Broker +44 203 179 5300

Nick Lovering

Mike Seabrook

Adam Pollock

Square1 Consulting +44 207 929 5599

David Bick +44 7831 381201

Consolidated Statement of Income and Retained Earnings

For the six months to 30 September 2023

6 months to 6 months to Year to

30 September 30 September

2023 2022 31 March 2023

GBP GBP GBP GBP GBP GBP

TURNOVER 11,062,281 9,831,204 20,501,807

Cost of Sales (9,104,582) (8,184,746) (16,865,547)

------------ ------------ -------------

GROSS PROFIT 1,957,699 1,646,458 3,636,260

Administrative

Expenses (1,278,873) (1,298,153) (3,051,263)

Share option

charge 0 (119,487) (360,443)

------------ ------------ ------------

Adjusted

Administrative

Expenses (1,278,873) (1,417,640) (3,411,706)

Other Operating

Income 54,600 47,571 104,209

------------ ------------ -------------

OPERATING PROFIT 733,426 276,389 328,763

Loss on

revaluation

of investment

property (170,620)

Interest

receivable

and similar

income 35,775 3,317 18,909

------------ ------------ ------------

35,775 3,317 (151,711)

Interest payable

and similar

expenses (62,483) (23,848) (96,907)

------------ ------------ -------------

PROFIT BEFORE

TAXATION 706,718 255,858 80,145

Tax on profit (165,709) (46,616) (19,842)

PROFIT FOR THE

FINANCIAL

PERIOD 541,009 209,242 60,303

============ ============ =============

Other

comprehensive

income 0 0 195,339

TOTAL

COMPREHENSIVE

INCOME FOR THE

PERIOD 541,009 209,242 255,642

============ ============ =============

Profit

attributable

to owners of the

parent 541,009 209,242 255,642

Underlying EBITDA* 786,550 532,128 1,532,386

Retained earnings

at beginning of

period 4,916,111 5,012,465 5,012,465

Profit

attributable

to owners of the

parent 541,009 209,242 60,303

Transfers to

reserves 0 0 553,698

Dividends (413,733) (560,280) (710,355)

------------ ------------ -------------

RETAINED EARNINGS

OF THE GROUP 5,043,387 4,661,427 4,916,111

------------ ------------ -------------

Earnings per

share

Underlying* 5.15 p 3.91 p 11.29 p

Basic 5.15 p 2.09 p 0.60 p

Diluted 5.06 p 2.09 p 0.58 p

*Excludes costs relating to exceptional items as detailed in

Note 3

Consolidated Statement of Financial Position

As at 30 September 2023

As at As at As at

30 September 2023 30 September 2022 31 March 2023

GBP GBP GBP GBP GBP GBP

FIXED ASSETS

Tangible Assets 1,646,788 1,109,100 1,346,897

Investment Property 1,691,285 1,861,905 1,691,285

------------ ------------ ------------

3,338,073 2,971,005 3,038,182

CURRENT ASSETS

Debtors 4,582,583 5,842,346 4,326,079

Cash at bank and at hand 3,642,649 2,683,143 3,284,548

---------- ---------- ----------

8,225,232 8,525,489 7,610,627

Amounts falling due within one year 4,627,816 5,260,976 3,833,191

---------- ---------- ----------

NET CURRENT ASSETS 3,597,416 3,264,513 3,777,436

TOTAL ASSETS LESS CURRENT

LIABILITIES 6,935,489 6,235,518 6,815,618

Amounts due after more than one

year (1,063,717) (1,059,031) (1,071,122)

Provisions for liabilities (59,794) 2,935 (59,794)

------------ ------------ ------------

NET ASSETS 5,811,978 5,179,422 5,684,702

============ ============ ============

CAPITAL AND RESERVES

Called up share capital 52,551 10,000 52,551

Share premium 365,448 0 365,448

Revaluation reserve 107,934 83,215 107,934

Share option reserve 242,658 424,780 242,658

Retained earnings 5,043,387 4,661,427 4,916,111

------------ ------------ ------------

SHAREHOLDERS' FUNDS 5,811,978 5,179,422 5,684,702

============ ============ ============

Consolidated Cashflow Statement

For the six months to 30 September 2023

6 months to 6 months to Year to

30 September 2023 30 September 2022 31 March 2023

GBP GBP GBP

Cash flows from operating activities

Cash generated from operations 1,159,301 (375,482) 209,363

Interest paid (62,483) (23,848) (96,907)

Tax paid 0 0 (152,353)

------------------- ------------------- ---------------

Net cash from operating activities 1,096,918 (399,330) (39,897)

Cash flows from investing activities

Purchase of tangible fixed assets (353,354) (19,144) (23,840)

Sale of tangible fixed assets 0 0 1,061

Interest received 35,775 3,317 18,909

Net cash from investing activities (317,579) (15,827) (3,870)

Cash flows from financing activities

Loan repayments in year (26,400) (26,400) (52,800)

Accrued loan interest 18,995 0 38,491

Share issue 0 0 367,999

Equity dividends paid (413,733) (560,280) (710,355)

------------------- ------------------- ---------------

Net cash from financing activities (421,138) (586,680) (356,665)

=================== =================== ===============

(Decrease)/increase in cash and cash equivalents during

the period 358,101 (1,001,837) (400,432)

Cash and cash equivalents at beginning of period 3,284,548 3,684,980 3,684,980

Cash and cash equivalents at end of period 3,642,649 2,683,143 3,284,548

One Health Group plc

Notes to the Interim Results

for the Period 1 April 2023 to 30 September 2023

1. STATUTORY INFORMATION

One Health is a public Group, limited by shares, registered in

England and Wales. The Group's registered number is 04201068 and

registered office address is 131 Psalter Lane, Sheffield, South

Yorks, S11 8UX.

The Interim Results have been reviewed, not audited, and were

approved by the Board of Directors on 1(st) of December 2023.

2. ACCOUNTING POLICIES

Basis of preparing the Interim Results

These Interim Results have been prepared in accordance with

Financial Reporting Standard 102 "The Financial Reporting Standard

applicable in the UK and Republic of Ireland" and the Companies Act

2006. The Interim Results have been prepared under the historical

cost convention as modified by the revaluation of certain

assets.

The Interim Results have been prepared on a going concern basis.

The Directors have reviewed and considered relevant information,

including the annual budget and future cash flows in making their

assessment. The Directors have tested their cash flow analysis to

account for the impact on their business of possible scenarios,

alongside the measures that they can take to mitigate the impact of

possible scenarios. Based on these assessments, given the measures

that could be undertaken to mitigate the current adverse

conditions, and the current resources available, the Directors have

concluded that they can continue to adopt the going concern basis

in preparing the annual report and accounts.

The accounts are presented in Sterling currency and rounded to

the nearest pound.

Financial Reporting Standard 102 - reduced disclosure

exemptions

The Group has taken advantage of the exemption from disclosing

the Group key management personnel compensation, as required by FRS

102 paragraph 33.7.

Basis of consolidation

The Interim Results include the interim financial information of

the Group and all of its subsidiary undertakings, together with the

Group's share of the results of associates made up to 30

September.

A subsidiary is an entity controlled by the Group. Control is

the power to govern the financial and operating policies of an

entity so as to obtain benefits from its activities. Where the

Group owns less than 50% of the voting powers of an entity but

controls the entity by virtue of an agreement with other investors

which give it control of the financial and operating policies of

the entity, it accounts for that entity as a subsidiary.

Where a subsidiary has different accounting policies to the

Group, adjustments are made to those subsidiary financial

statements to apply the Group's accounting policies when preparing

the consolidated Interim Results.

Any subsidiary undertakings or associates sold or acquired

during the year are included up to, or from, the dates of change of

control or change of significant influence respectively.

All intra-Group transactions, balances, income, and expenses are

eliminated on consolidation. Adjustments are made to eliminate the

profit or loss arising on transactions with associates to the

extent of the Group's interest in the entity.

2. ACCOUNTING POLICIES - continued

Significant judgements and estimates

In preparing the Interim Results it is necessary to make certain

judgements, estimates and assumptions that affect the amounts

recognised in the financial information presented in the Interim

Results. These assumptions are reassessed annually as part of the

interim and year end accounts preparation process.

The critical judgments that the directors have made in the

process of applying the Group's accounting policies that have the

most significant effect on the Interim Results are discussed

below.

i) Assessing indicators of impairment

In assessing whether there have been any indicators of

impairment assets, the directors have considered both external and

internal sources of information such as market conditions,

counterparty credit ratings and experience of recoverability. There

have been no indicators of impairments identified during the

current financial year.

Key sources of estimation uncertainty

i) Determining useful economic lives of tangible fixed assets

The Group depreciates tangible fixed assets over their estimated

useful lives. The estimation of the useful lives of assets is based

on historic performance as well as expectations about future use

and therefore requires estimates and assumptions to be applied by

management. The actual lives of these assets can vary depending on

variety of factors, including technological innovation, product

life cycles and maintenance programmes.

The judgment is applied by management when determining the

residual values for tangible fixed assets. When determining the

residual value management aim to assess the amount that the Group

would currently obtain for the disposal of the asset, if it were

already of the condition expected at the end of its useful life.

Where possible this is done with reference to external market

prices.

(ii) Recoverability of debtors

The Group establishes a provision for debtors that are estimated

not to be recoverable. When assessing recoverability, the directors

have considered factors such as the ageing of debtors, past

experience of recoverability and the credit profile of individual

or Groups of customers.

Turnover

Turnover is measured at the fair value of the consideration

received or receivable, excluding discounts, rebates, value added

tax and other sales taxes.

Turnover consists of the provision of medical and clinical

services, sale of medical implants, and recharge of direct costs

incurred. All turnover is generated in the United Kingdom.

Dividend income is recognised when the right to receive payment

is established.

Tangible fixed assets

Tangible assets are started at cost less accumulated

depreciation and accumulated impairment losses. Depreciation on

other assets is provided at the following annual rates in order to

write off the cost, less estimated residual value of each asset

over its estimated useful life.

Freehold property 2% straight line

Long leasehold 10% straight line

Plant and machinery 15% straight line

Fixtures and fittings 20% straight line

Computer equipment 25% straight line

2. ACCOUNTING POLICIES - continued

The assets' residual values. useful lives and depreciation

methods are reviewed, if appropriate at the end of each reporting

period. The effect of any change is accounted for

prospectively.

Investment property

Investment property is shown at most recent valuation. Any

aggregate surplus or deficit arising from changes in fair value is

recognised in the Statement of Income and Retained Earnings.

Investment in a subsidiary company

Investment in subsidiary company is held at cost less

accumulated impairment losses.

Financial instruments

The Group has elected to apply the provisions of Section 11

'Basic Financial Instruments' and Section 12 'Other Financial

Instruments Issues' of FRS 102 to all of its financial

instruments.

Basic financial assets, including trade and other receivables,

cash and bank balances and investments in commercial paper, are

initially recognised at transaction price, unless the arrangement

constitutes a financing transaction, where the transaction is

measured at the present value of the future receipts discounted at

a market rate of interest. Such assets are subsequently carried at

amortised cost using the effective interest method.

At the end of each reporting period financial assets measured at

amortised cost are assessed for objective evidence of impairment.

If an asset is impaired the impairment loss is the difference

between the carrying amount and the present value of the estimated

cash flows discounted at the asset's original effective interest

rate. The impairment loss is recognised in profit or loss.

If there is a decrease in the impairment loss arising from an

event occurring after the impairment was recognised, the impairment

is reversed. The reversal is such that the current carrying amount

does not exceed what the carrying amount would have been had the

impairment not previously been recognised. The impairment reversal

is recognised in profit or loss.

Financial assets are derecognised when (a) the contractual

rights to the cash flows from the asset expire or are settled or

(b) substantially all the risks and rewards of the ownership of the

asset are transferred to another party or (c) control of the asset

has been transferred to another party who has the practical ability

to unilaterally sell the asset to an unrelated third party without

imposing additional restrictions.

Basic financial liabilities, including trade and other payables,

bank loans, loans from fellow Group companies and preference shares

that are classified as debt, are initially recognised at

transaction price, unless the arrangement constitutes a financing

transaction, where the debt instrument is measured at the present

value of the future receipts discounted at a market rate of

interest. Debt instruments are subsequently carried at amortised

cost, using the effective interest rate method.

Fees paid on the establishment of loan facilities are recognised

as transaction costs of the loan to the extent that it is probable

that some or all of the facility will be drawn down. In this case,

the fee is deferred until the draw-down occurs. To the extent there

is no evidence that it is probable that some or all of the facility

will be drawn down, the fee is capitalised as a pre-payment for

liquidity services and amortised over the period of the facility to

which it relates.

Trade payables are obligations to pay for goods or services that

have been acquired in the ordinary course of business from

suppliers. Accounts payable are classified as current liabilities

if payment is due within one year or less. If not, they are

presented as non-current liabilities. Trade payables are recognised

initially at transaction price and subsequently measured at

amortised cost using the effective interest method.

Financial liabilities are derecognised when the liability is

extinguished, that is when the contractual obligation is

discharged, cancelled or expires.

2. ACCOUNTING POLICIES - continued

Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held at

call with banks, other short-term highly liquid investments with

original maturities of three months or less and bank overdrafts.

Bank overdrafts are shown within borrowings in current

liabilities.

Distributions to equity holders

Dividends and other distributions to the company's shareholders

are recognised as a liability in the Interim Results in the period

in which the dividends and other distributions are approved by the

company's shareholders. These amounts are recognised in the

statement of changes in equity.

Related party transactions

The Group discloses transactions with related parties which are

not wholly owned with the same Group. It does not disclose

transactions with its parent or with members of the same Group that

are wholly owned.

Taxation

Taxation for the period comprises current and deferred tax. Tax

is recognised in the Consolidated Income Statement, except to the

extent that it relates to items recognised in other comprehensive

income or directly in equity.

Current or deferred taxation assets and liabilities are not

discounted.

Current tax is recognised at the amount of tax payable using the

tax rates and laws that have been enacted or substantively enacted

by the statement of financial position date.

Deferred tax

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed at the statement of financial

position date.

Timing differences arise from the inclusion of income and

expenses in tax assessments in periods different from those in

which they are recognised in the Interim Results. Deferred tax is

measured using tax rates and laws that have been enacted or

substantively enacted by the period end and that are expected to

apply to the reversal of the timing difference.

Unrelieved tax losses and other deferred tax assets are

recognised only to the extent that it is probable that they will be

recovered against the reversal of deferred tax liabilities or other

future taxable profits.

Hire purchase and leasing commitments

Rentals paid under operating leases are charged to the Statement

of Income and Retained Earnings on a straight-line basis over the

period of the lease.

Pension costs and other post-retirement benefits

The Group operates a defined contribution pension scheme.

Contributions payable to the Group's pension scheme are charged to

the Statement of Income and Retained Earnings in the period to

which they relate.

Employee benefits

The Group provides a range of benefits to employees, including

annual bonus arrangements, paid holiday arrangements and defined

benefit and defined contribution pension plans.

Short term benefits, including holiday pay and other similar

non-monetary benefits, are recognised as an expense in the period

in which the service is received.

2. ACCOUNTING POLICIES - continued

The Group operates a number of country-specific defined

contribution plans for its employees. A defined contribution plan

is a pension plan under which the Group pays fixed contributions

into a separate entity. Once the contributions have been paid the

Group has no further payment obligations. The contributions are

recognised as an expense when they are due. Amounts not paid are

shown in accruals in the balance sheet. The assets of the plan are

held separately from the Group in independently administered

funds.

The Group operates a number of annual bonus plans for employees.

An expense is recognised in the profit and loss account when the

Group has a legal or constructive obligation to make payments under

the plans as a result of past events and a reliable estimate of the

obligation can be made.

The Group provides share-based payment arrangements to certain

employees. Equity-settled arrangements are measured at fair value

(excluding the effect of non-market based vesting conditions) at

the date of the grant. The fair value is expensed on a

straight-line basis over the vesting period. The amount recognised

as an expense is adjusted to reflect the actual number of shares or

options that will vest.

Where equity-settled arrangements are modified, and are of

benefit to the employee, the incremental fair value is recognised

over the period from the date of modification to date of vesting.

Where a modification is not beneficial to the employee there is no

change to the charge for share-based payment. Settlements and

cancellations are treated as an acceleration of vesting and the

unvested amount is recognised immediately in the income

statement.

3. ADJUSTED EARNINGS PER SHARE

The Directors believe adjusted earnings per share is a better

representation of underlying business performance after allowing

for significant, non-recurring costs, not related to core

activities.

The full year to March 2023 was primarily impacted by costs

associated with the IPO in November 2022 and a share option charge

associated with the employee share option scheme under FRS 102,

section 26.

This creates an alternative performance measure which better

reflects a fair estimate of ongoing profitability and performance.

The calculated Adjusted EBITDA for the accounting periods shown is

as follows:

30 Sep 30 Sep 31 Mar

2023 2022 2023

Reported Profit 541,009 209,242 60,303

Depreciation 53,124 28,563 52,624

Interest 26,708 20,531 77,998

Tax 165,709 46,616 19,842

Statutory EBITDA 786,550 304,952 210,767

--------------------------- -------- -------- ----------

Adjust for non-operating

items

IPO related and other

one off costs 0 107,689 790,556

Costs related to share

options 0 119,487 360,443

Loss on revaluation of

investment property 0 0 170,620

Adjusted EBITDA 786,550 532,128 1,532,386

--------------------------- -------- -------- ----------

4. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted earnings per share is calculated using the weighted

average number of shares adjusted to assume the conversion of all

dilutive potential ordinary shares.

Underlying EPS is calculated using underling EBITDA, which

excludes costs relating to the IPO and share adjustments.

30 Sep 30 Sep 31 Mar

2023 2022 2023

Basic EPS

Profit per interims 541,009 209,242 60,303

Weighted average number

of shares 10,510,093 10,000,000 10,053,619

Earnings per share (Pence) 5.15 2.09 0.60

----------- ----------- -----------

Fully Diluted EPS

Profit per interims 541,009 209,242 60,303

Weighted average number

of shares 10,701,978 10,000,000 10,417,424

Fully Diluted Earnings

per share (Pence) 5.06 2.09 0.58

----------- ----------- -----------

Underlying EPS

Adjusted EBITDA 786,550 532,128 1,532,386

Depreciation -53,124 -28,563 -52,624

Interest -26,708 -20,531 -77,998

Underlying profit before

taxation 706,718 483,034 1,401,764

Taxation -165,709 -91,776 -266,335

Underlying earnings 541,009 391,258 1,135,429

Weighted average number

of shares 10,510,093 10,000,000 10,053,619

Underlying Earnings

per share (Pence) 5.15 3.91 11.29

----------- ----------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXKZMGZNMZGFZM

(END) Dow Jones Newswires

December 04, 2023 02:00 ET (07:00 GMT)

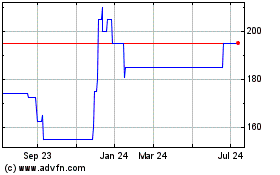

One Health (AQSE:OHGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

One Health (AQSE:OHGR)

Historical Stock Chart

From Nov 2023 to Nov 2024