TIDMORM

RNS Number : 5559P

Ormonde Mining PLC

21 June 2022

21 June 2022

Ormonde Mining plc

("Ormonde" or the "Company")

Final Results for the Year Ended 31 December 2021

Ormonde announces its final results for the year ended 31

December 2021.

Key points:

-- Newly constructed Board appointed, including Brian Timmons

(previously Non-Executive Director) becoming Non-Executive Chairman

in October 2021 and Brendan McMorrow becoming Chief Executive

Officer in November 2021 - significant ongoing cost savings

-- The Board is reviewing a range of acquisition opportunities

in appropriate jurisdictions including precious metals, precious

stones, battery metals and base metals projects

-- Process supported by newly appointed senior technical and geological consultants

-- The Board continues to evaluate its strategy to unlock value

for shareholders from the Company's existing assets in Spain,

including a potential transaction relating to the Company's

interests at La Zarza

-- Total comprehensive loss of EUR1.6 million including EUR0.4 million asset impairment

-- Net assets of EUR5.96 million, including a cash balance of

EUR3.75 million, placing the Company in a position of strength to

undertake a transaction

Brian Timmons, Chairman, commented:

"2021 was a year of transition for the Company as we

restructured the Board, reviewed the Company's assets , reorganised

the Company to operate on a reduced cost basis , and positioned

Ormonde to execute an opportunity to enable the Company to leverage

its listing and balance sheet and generate value for

shareholders.

I would like to thank our shareholders for their continued

support and patience. I am conscious that shareholders are keen to

see the value of their holding grow. Our job is to ensure that we

deliver the best opportunity to achieve this; one which offers the

maximum upside from the Company's current balance sheet. I am

confident that we have the team in place to execute on that goal

and deliver shareholder value."

Enquiries:

Ormonde Mining plc

Brian Timmons, Non-Executive Chairman

Tel: +353 (0)1 801 4184

Vigo Consulting (Investor Relations)

Ben Simons / Charlie Neish

Tel: 44 (0)20 7390 0230

Davy (Nomad, Euronext Growth Advisor and Joint Broker)

Barry Murphy

Tel: +353 (0)1 679 6363

CHAIRMAN'S REVIEW

Introduction

I am pleased to provide my first report to shareholders as

Ormonde's Chairman, having been appointed as a Non-Executive

Director in June 2020, and subsequently as Non-Executive Chairman

in October 2021.

2021 was a year of transition for the Company as we restructured

the Board, reviewed the Company's assets, reorganised the Company

to operate on a reduced cost basis, while building its capability

to e xecute an opportunity that will enable the Company to leverage

its listing and balance sheet to generate value for

shareholders.

Leadership Restructuring

Following the Company's Annual General Meeting in September

2021, Jonathan Henry, and his board and management team left the

Company.

Brendan McMorrow and Keith O'Donnell joined me on the Board, and

Brendan was subsequently appointed in November 2021 to discharge

the role of Chief Executive Officer. Brendan, Keith and I each have

over 30 years' experience in company management, capital markets,

and publicly listed natural resources companies.

The Board is now supported in its endeavours by experienced

industry consultants. These include Steve Nicol and Professor Garth

Earls, who bring with them over 70 years of combined relevant

experience. Drawing on his background in mine evaluation and

operations, Steve, as Senior Technical and Mining Advisor, is

assisting in the evaluation of potential new mining assets. He

previously worked with Ormonde to identify and commercialise the

Barruecopardo Tungsten mine in Spain, whose 30% interest was sold

by the Company in 2020 for EUR6 million. Garth is assisting the

Company as a Senior Geologist, focused on project exploration and

development appraisal. Garth has over 40 years of professional

experience in mineral exploration, was part of the team that

discovered the six-million-ounce Curraghinalt gold deposit in

Northern Ireland, and currently serves as Executive Chairman of

International Geoscience Services. He is a former Director of the

Geological Survey of Northern Ireland and a past Chairman of the

Geosciences Committee of the Royal Irish Academy.

Steve and Garth provide the complementary skill sets required to

evaluate the geological, technical, mining operational and

commercial elements of the projects under review and to identify

worthwhile opportunities to generate value for the Company and its

shareholders.

We are now pursuing investment opportunities at a more

appropriate and efficient cost to the Company. Until the Company

has made material strategic progress in this regard, the directors

have waived their entitlement to non-executive directors' fees.

New Project Evaluation

The range of opportunities being reviewed include precious

metals, precious stones, battery metals and some base metals in a

number of jurisdictions including Africa and Europe.

Our objective is to invest in a project which will generate

meaningful value for shareholders on a sustainable basis. We are

reviewing a number of opportunities that appear promising, without

presenting excessive risk to shareholders.

Existing Projects

Ormonde retains its assets in Spain, namely the Salamanca and

Zamora gold projects and the Board continues to evaluate its

strategy to unlock value for shareholders from these assets. In

addition, the prospect of a transaction relating to the land and

data assets of the Company's La Zarza interest continues with

discussions with interested parties ongoing.

Financials

Ormonde recorded a total comprehensive loss for the period of

EUR1.6 million for 2021, including an asset impairment, noted

below, of EUR0.4 million, compared with a loss of EUR1.1 million in

2020.

Following an internal review of its assets at La Zarza, Ormonde

now values its La Zarza interests at EUR2.0 million, a EUR0.4

million reduction from previous guidance. The Board considers this

to be a fair value and is in discussions regarding a

transaction.

While reviewing new opportunities, the Board has, since its

reconstruction in late 2021, endeavoured to reduce the Company's

overheads with Board and management costs lower on a full year

basis by approximately 60 percent. The impact of these reductions

will be realised in the current year with projected savings related

to payroll of c. EUR0.3 million for 2022 as compared to 2021.

As of 31 December 2021, the Company had net assets of EUR5.96

million, including a cash balance of EUR3.75 million, placing the

Company in a position of considerable strength to undertake a

transaction within the natural resources sector.

Outlook

On behalf of the Board, I would like to thank our shareholders

for their continued support and patience. I am of course conscious

that our shareholders are keen to see the value of their holding

grow. Our job is to ensure we deliver the best opportunity to

achieve this; one which offers the maximum upside from the

Company's balance sheet and resources. I am confident that we have

the team in place to execute on that goal and deliver value to

shareholders. While we are undertaking that process, we will

continue to manage costs prudently. I look forward to updating you

on the Company's progress in due course.

Brian Timmons

Chairman

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2021

Year ended Year ended

31-Dec-21 31-Dec-20

EUR000s EUR000s

Turnover 0 0

Administration expenses (1,194) (1,119)

Impairment of intangibles (400) 0

______ ______

Loss on ordinary activities (1,594) (1,119)

Finance costs (24) (17)

______ ______

Loss for the year from continuing

activities (1,618) (1,136)

Profit from discontinued operations 0 1,600

______ ______

Loss (profit) for the year (1,618) 464

Taxation 0 0

______ ______

Loss (profit) for the Period

after tax (1,618) 464

Other comprehensive income

less: Reclassification of foreign

currency gain on disposal of

foreign operation 0 (1,600)

______ ______

Total comprehensive (loss) for

the period (1,618) (1,136)

______ ______

Earnings per share

from continuing operations

Basic & diluted (loss) per share

(in cent) (0.34) (0.24)

Total earnings per share

Basic & diluted (loss) per share

(in cent) (0.34) 0.10

Consolidated Statement of Financial Position

as at 31 December 2021

31-Dec-21 31-Dec-20

EUR000s EUR000s

Assets

Non-current assets

Intangible assets 309 295

_______ _______

Total Non-Current Assets 309 295

Current assets

Trade and other receivables 93 58

Asset classified as held for

sale 2,000 2,400

Cash & cash equivalents 3,746 4,965

_______ _______

Total Current Assets 5,839 7,423

_______ _______

Total Assets 6,148 7,718

_______ _______

Equity & liabilities

Capital and Reserves

Issued capital 4,725 4,725

Share premium account 29,932 29,932

Share based payment reserve 281 283

Capital conversion reserve

fund 29 29

Capital redemption reserve

fund 7 7

Retained losses (29,013) (27,469)

_______ _______

Equity attributable to the

Owners of the Company 5,961 7,507

Current Liabilities

Trade & other payables 187 211

_______ _______

Total Liabilities 187 211

_______ _______

Total Equity & Liabilities 6,148 7,718

_______ _______

Consolidated Statement of Cashflows

for the year ended 31 December 2021

Year ended Year ended

31-Dec-21 31-Dec-20

EUR000s EUR000s

Cashflows from operating activities

Loss for the year before taxation

Continuing operations (1,618) (1,136)

Discontinued operations 0 1,600

________ ________

(1,618) 464

Adjustments for:

Impairment of asset classified as

held for sale 400 0

Reclassification of foreign exchange

gain 0 (1,600)

Non cash items: Share Option expense 72 19

________ ________

(1,146) (1,117)

Movement in Working Capital

Movement in receivables (35) 320

Movement in liabilities (24) (358)

________ ________

Net Cash used in operations (1,206) (1,155)

Investing activities

Expenditure on intangible assets (14) (10)

Proceeds from disposal of associate 0 6,000

________ ________

Net cash (used in)/generated from

investing activities (14) 5,990

Net (decrease)/increase in cash

and cash equivalents (1,219) 4,835

Cash and cash equivalents at the

beginning of the year 4,965 130

______ ______

Cash and cash equivalents at the

end of the year 3,746 4,965

______ ______

Consolidated Statement of Changes in Equity

for the year ended 31 December 2021

Share

based

Share Share Payment Other Retained

Capital Premium Reserve Reserves Losses Total

EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s

Balance at 1 January

2020 13,485 29,932 837 1,636 (37,265) 8,625

Loss for the year - - - - (1,136) (1,136)

Reclassification of foreign

currency gain on disposal

of foreign operation - - - (1,600) 1,600 0

______ ______ ______ ______ ______ ______

Total comprehensive income

for the year 0 0 0 (1,600) 464 (1,136)

Release relating to expired

share options - - (572) - 572 0

Employee share-based compensation - - 18 - - 18

Cancellation of shares (8,760) - - - 8,760 0

______ ______ ______ ______ ______ ______

Balance at 31 December

2020 4,725 29,932 283 36 (27,469) 7,507

Loss for the year - - - - (1,618) (1,618)

______ ______ ______ ______ ______ ______

Total comprehensive income

for the year 0 0 0 0 (1,618) (1,618)

Release relating to expired

share options - - (74) - 74 0

Employee share-based compensation - - 72 - - 72

______ ______ ______ ______ ______ ______

Balance at 31 December

2021 4,725 29,932 281 36 (29,013) 5,961

______ ______ ______ ______ ______ ______

1. The basic loss per share and the diluted loss per share have

been calculated on a loss after taxation of EUR1,618,026 (2020:

profit of EUR464,000) and a weighted average number of Ordinary

Shares in issue for the year of 472,507,482 (2020: 472,507,482) for

the basic loss per share and 472,507,482 (2020: 472,507,482) for

the diluted loss per share.

2. The financial information prepared using accounting policies

consistent with International Financial Reporting Standards

("IFRS") as adopted by the European Union included in this

preliminary statement does not constitute the statutory financial

statements for the purposes of Chapter 4 of part 6 of the Companies

Act 2014. Full statutory statements for the year ended 31 December

2021 prepared in accordance with IFRS, upon which the auditors have

given an unqualified report, have not yet been filed with the

Registrar of Companies. Full financial statements for the year

ended 31 December 2020 prepared in accordance with IFRS and

containing an unqualified report, have been filed with the

Registrar of Companies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR URUARUWUNUUR

(END) Dow Jones Newswires

June 21, 2022 02:00 ET (06:00 GMT)

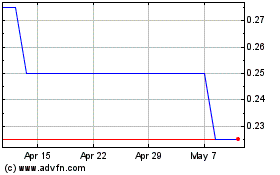

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Apr 2024 to May 2024

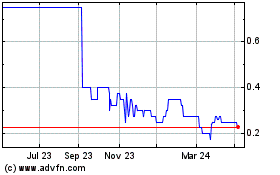

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From May 2023 to May 2024