TIDMPREM

RNS Number : 1542A

Premier African Minerals Limited

18 January 2024

Premier African Minerals Limited / Ticker: PREM / Index: AIM /

Sector: Mining

For immediate release

18 January 2024

Premier African Minerals Limited

Zulu Lithium Update

The Board of Premier African Minerals Limited ("Premier" or the

"Company") is pleased to provide an update on Zulu Lithium and

Tantalum ("Zulu").

Resource Development

Mining operations at Zulu are currently focussed on a limited

area of the existing claims blocks and EPO. That area is our North

and South Pit. Premier plans to release a resource statement based

on this area and focussed on the tonnage of contained Spodumene in

Q1 of 2024.

Classification of the economic Mineral of Interest at Zulu in

the Mineral Resource

The new mineral resource estimate for Zulu will primarily

consider the tonnage of Spodumene contained within the area of

interest. With respect to Zulu, Li2O grade alone without an

understanding and estimation of the mineral assemblage in the

deposit, is a limited guide for mine planning and value assessment

purposes.

As background, Pegmatites as a source of Spodumene can be

classified into subtypes and contained Li2O associated with the

minerals of economic interest. In the case of Zulu, the main

mineral of economic interest is Spodumene and Zulu is classified as

Petalite-subtype, Spodumene Quartz Intergrowths ("SQI") dominant.

Extensive powder XRD ("X-Ray Diffraction Analysis"), careful visual

logging and supportive elemental analysis show that more than 85%

of the Li2O reported at Zulu is attributable to Spodumene and that

the only other lithium bearing mineral of any significance is

Lepidolite. At Zulu within the North and South Pit Premier is able

to estimate with reasonable confidence the Spodumene tonnage

contained in the deposit based on reported Li2O grade. Work

undertaken in both the Zulu laboratory and from independent

historic test work has indicated that the minimum economically

viable and recoverable percentage of Spodumene contained in Zulu

ore body, is 4%. When Spodumene is the only lithium bearing mineral

in an ore body, the minimum economically viable Li2O grade would be

0.37%.

SQI forms from the conversion of Petalite during the slow

cooling of the pegmatitic hydrothermal fluids. The Spodumene

contained in the SQI is made up of small crystals and is

recoverable after milling and floatation, the process followed at

Zulu. Typically, a SQI dominant deposit with an overall Li2O grade

of 0.8% with 90% of this grade attributable to Spodumene, will

contain significantly more Spodumene than a Petalite subtype

subordinate SQI deposit made up of dominantly Petalite with a

corresponding lower percentage of Spodumene, even though the Li2O

grade may be considerably higher. Recovery of the Spodumene from a

Petalite subtype subordinate SQI deposit is likely to require a

dense medium separation circuit and then may still need milling and

floatation.

It should be noted that the SQI dominant deposit at Zulu

contains a low Iron content, and this contributes to the

anticipated production of technical grade Spodumene

concentrates.

Plant upgrades and optimisation

Major concerns with the plant over the past year have been well

documented and Premier now can confirm that Stark International

Projects Limited has undertaken to upgrade the UV sorters to

include colour-based detection to complement the use of XRT. The

upgrade is expected to be installed and operational before startup.

A technical team from Germany is expected at Zulu from 23 January

2024 to optimise the sorters and in so doing facilitate the removal

of waste material that has previously led to contamination of

concentrates. At the same time, a new thickener is under

installation, and this is expected to complement the floatation

circuit by improving the density and flow of slurry to the float

plant.

Ball mill and material sizing

The new ball mill that has been custom built for Zulu is

expected to depart from South Africa in in the last week of January

2024 and will represent the last major item to be positioned and

connected for a restart of production that is still anticipated

late February 2024. By this time, an additional hydrosizer, mill

discharge screen, and associated tanks, sumps and pumps are

expected to have been installed.

Production costs, Spodumene pricing and sustaining Capital

Premier's internal budgets (which have not been independently

verified) predict an average production cost on a mine gate basis

of US$800 per ton of SC6. At present SC6 selling prices, and after

an allowance for freight charges of US$152 per ton, production at

this point in time of basic SC6 standard product is marginally

profitable. However, Zulu is expected to produce a low iron higher

grade Spodumene concentrate in the normal course from clean ore as

previously indicated by Anzaplan in original test work, and as

demonstrated in Premier's laboratory at site. This Spodumene

concentrate currently attracts a substantial price premium which is

expected to buffer the effects of the lower SC6 prices at

present.

The significant expansion in mining operations to facilitate

delivery of ore with less country waste and to compensate for any

residual issues with the sorters, together with the minor delay

with the mill delivery has further constrained Premier's cash

resources. It is likely that additional funding will be needed in

the near term. Premier's contractors and suppliers are assisting

and alternatives to equity-based funding are under investigation.

With a project as well advanced as Zulu with a fully developed

mine, and market in place, this remains the only significant

obstacle.

George Roach, CEO, commented " We have set out above a summary

of the status quo. The entire focus of our Company is on our Zulu

project and unless there are unforeseen circumstances that I have

overlooked, and provided our plant suppliers deliver as expected,

we remain on target to produce late in February 2024."

Qualified Person

Bruce Cumming, geologist with Premier, has reviewed and approved

this release to the extent that reference is made to the geology of

the Zulu pegmatites. Mr. Cumming is a SACNASP and GSSA registered

geoscientist with 48 years' experience in exploration and project

management, in multicommodity projects throughout Africa.

Market Abuse Regulations

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

The person who arranged the release of this announcement on

behalf of the Company was George Roach.

A copy of this announcement is available at the Company's

website, www.premierafricanminerals.com

Enquiries:

Premier African Minerals Tel: +27 (0) 100

George Roach Limited 201 281

Michael Cornish / Beaumont Cornish Limited Tel: +44 (0) 20

Roland Cornish (Nominated Adviser) 7628 3396

--------------------------- -----------------

Tel: +44 (0) 20

Douglas Crippen CMC Markets UK Plc 3003 8632

--------------------------- -----------------

Toby Gibbs/Rachel Shore Capital Stockbrokers Tel: +44 (0) 20

Goldstein Limited 7408 4090

--------------------------- -----------------

Nominated Adviser Statement

Beaumont Cornish Limited ("Beaumont Cornish"), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting as nominated adviser to the Company in

connection with this announcement and will not regard any other

person as its client and will not be responsible to anyone else for

providing the protections afforded to the clients of Beaumont

Cornish or for providing advice in relation to such proposals.

Beaumont Cornish has not authorised the contents of, or any part

of, this document and no liability whatsoever is accepted by

Beaumont Cornish for the accuracy of any information or opinions

contained in this document or for the omission of any information.

Beaumont Cornish as nominated adviser to the Company owes certain

responsibilities to the London Stock Exchange which are not owed to

the Company, the Directors, Shareholders, or any other person.

Forward Looking Statements

Certain statements in this announcement are or may be deemed to

be forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding the

Company's future growth results of operations performance future

capital and other expenditures (including the amount. Nature and

sources of funding thereof) competitive advantages business

prospects and opportunities. Such forward looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions competition environmental and other regulatory changes

actions by governmental authorities the availability of capital

markets reliance on key personnel uninsured and underinsured losses

and other factors many of which are beyond the control of the

Company. Although any forward-looking statements contained in this

announcement are based upon what the Directors believe to be

reasonable assumptions. The Company cannot assure investors that

actual results will be

consistent with such forward looking statements.

Notes to Editors:

Premier African Minerals Limited (AIM: PREM) is a

multi-commodity mining and natural resource development company

focused on Southern Africa with its RHA Tungsten and Zulu Lithium

projects in Zimbabwe.

The Company has a diverse portfolio of projects, which include

tungsten, rare earth elements, lithium and tantalum in Zimbabwe and

lithium and gold in Mozambique, encompassing brownfield projects

with near-term production potential to grass-roots exploration. The

Company has accepted a share offer by Vortex Limited ("Vortex") for

the exchange of Premier's entire 4.8% interest in Circum Minerals

Limited ("Circum"), the owners of the Danakil Potash Project in

Ethiopia, for a 13.1% interest in the enlarged share capital of

Vortex. Vortex has an interest of 36.7% in Circum.

Glossary of Technical Terms:

--------------------------------------------------------------------------

"Lepidolite" A pink to lavender coloured lithium bearing

mineral (KLi 2 Al(Si 4 O 10 )(F,OH) 2 ).

----------------------------------------------------

"Li (2) O" Lithium Oxide (Lithia) - an inorganic lithium

compound used to assess lithium minerals.

----------------------------------------------------

"Petalite" A white coloured lithium bearing mineral (LiAl(Si

4 O 10 )).

----------------------------------------------------

"pegmatite" is an exceptionally coarse-grained igneous rock,

with interlocking crystals, usually found as

irregular dikes, lenses, or veins, esp. at the

margins of granitic intrusions.

----------------------------------------------------

"SC6" Is a high-purity Spodumene concentrate with

approximately 6 percent Li (2) O content being

produced as a raw material for the subsequent

production of lithium-ion batteries for electric

vehicles.

----------------------------------------------------

"Spodumene" A white to pink coloured lithium bearing mineral

(LiAlSi 2 O 6 ) containing up to 8.03% Li (2)

O.

----------------------------------------------------

"X-Ray Diffraction" X-ray diffraction (XRD) is a widely used technique

to assess the mineral assemblage, crystallinity

and structure of rocks, cores etc.

----------------------------------------------------

"XRT" X-ray sorting technique where specific mineral

bearing rock can be separated from specific

mineral-poor rock and other impurities. This

upgrades in metal terms the material feed to

the plant and lowers the tonnage of rock requiring

processing which results in substantially improved

economics for mineral processing operations.

----------------------------------------------------

Ends

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAPFPFLSLEEA

(END) Dow Jones Newswires

January 18, 2024 04:00 ET (09:00 GMT)

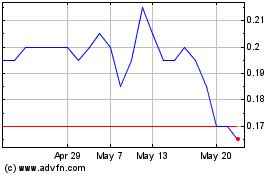

Premier African Minerals (AQSE:PREM.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Premier African Minerals (AQSE:PREM.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025