Rogue Baron Plc Audited Annual Accounts to 31 December 2021

01 July 2022 - 2:38AM

UK Regulatory

TIDMSHNJ

For Immediate Release

30 June 2022

ROGUE BARON PLC

("Rogue Baron", "Rogue", "The Group" or "The Company")

Audited Annual Accounts to 31 December 2021

Rogue Baron PLC (AQSE: SHNJ), a leading company in the premium spirit sector is

pleased to announce its audited results for the year ended 31 December 2021.

The Company's annual report and accounts will be dispatched to shareholders

shortly and will be available on the website at https://roguebaron.com/.

Rogue Baron PLC

DIRECTOR'S STATEMENT & STRATEGIC REPORT

For the year ended 31 December 2021

Rogue Baron plc listed on the AQSE Growth Market of the Aquis Stock Exchange on

12 March 2021 and has made substantial progress towards the goals it set out

for 2021. In spite of significant global challenges continuing from the Covid

pandemic, the Company has continued to grow and persevere.

Shortly after listing on the AQSE Growth Market one of the Company's key goals

was to enable cross trading on a United States recognised stock exchange. Rogue

successfully completed this on the OTCQB, under the ticker symbol SHNJF in June

2021.

Since listing, Rogue has placed Shinju into seven new U.S. markets; Texas,

Georgia, Nevada, Illinois, Colorado, Kansas, and Ohio. With the addition of

these markets Shinju's availability now covers over 60% of the United States.

In addition, Shinju is now available for sale in the United States on many of

the largest direct to consumer online platforms,

including ReserveBar and Drizly.

ReserveBar alone delivers to 35 states.

Rogue's strategy in marketing Shinju is to focus more on an organic approach

while letting the quality of the product create the traction and employ a

salesforce for direct contact with our customers. This approach is proving

successful as requests from new markets and accounts continue to drive the

product forward. Liquor.com awarded Shinju as one of the '10 best Japanese

Whiskies to drink in 2020' and we were pleased that it was again awarded as

'one of the best' in 2021.

Shinju has recently won double gold at Sante International Spirits competition,

where it was one of only two brands to receive a perfect score of 100, a silver

Medal from The Fifty Best, and gold Medal at the John Barleycorn Awards.

In 2019 the Company sold 1,000 cases of Shinju. In 2020, despite the Covid

shutdowns, the Company doubled the cases sold to 2,000. In 2021 the company

sold 3,500 cases. This number would have been more other than for the ongoing

issues in Asia to USA trade caused by covid lockdowns at Chinese ports which

has had a massive impact on both cost and availability of shipping containers.

Hopefully this backlog should start to unwind to a great extent if not fully by

the end of 2022.

In 2022 the Company plans to make a big marketing push to increase the velocity

and turnover in its current markets, while also expanding into new markets. New

distribution deals have already been announced in the UK and Spain.

As part of its UK launch of Shinju, Rogue spent the four months redesigning and

upgrading the label design on the bottle. Based on the current Japanese Whisky

landscape, the Company believes the new label will set it apart from the

competition and be one of the best-looking labels on the market.

Included in the UK launch was one of the most exciting pieces for the Company,

the introduction of Shinju's first aged extension. Very few of the newer

Japanese whiskies have multiple expressions, especially aged expressions. Aged

Japanese whisky has been in very limited capacity, with many brands having to

pull their aged expressions due to the lack of supply. Rogue feels it is a

perfect time to launch its 8-year old whiskey as aged expressions are in high

demand from customers. The 8-year should open many new accounts for the

Company. Part of the sales strategy the Company will employ is requiring

accounts that want the 8-year to also carry the original. This will continue to

increase the sales of the original Shinju expression as well. The 8-year will

carry a premium which will increase the revenues and margins for the Company.

2021 was a difficult time for the bar/restaurant industry as the initial end of

lockdown proved to be a false dawn in Washington DC as far as hospitality was

concerned with covid restrictions reintroduced. Many bars and restaurants

suffered accordingly. Rogue's Washington DC location, Bin 1301, was no

different. One consequence of lockdowns which was the dramatic effect it would

have on labour markets in the USA (and in many western countries). The ability

to hire labour in the industry became extremely hard even at premium pay

rates. This led to the decision to close our first DC location. The burden on

managing two locations in the post covid environment gave rise to the decision

to close Bin 1301. As much as there is commercial logic to the bar model in

conjunction with spirit brands, the major focus of the Company has been and

will continue to be Shinju whisky for the foreseeable future.

Results for the year

The loss before tax attributable to shareholders for the year amounted to

$1,336,000 (2020: $385,000) which includes transaction costs relating to the

IPO and extraordinary costs of $358,000 (2020: $216,000) and payments made in

shares of $440,000 (2020: $Nil).

Net assets have increased from $2,997,000 to $4,794,000 reflecting the placing

proceeds and the conversion of debt in the year.

Auditor Opinion

Given a qualified opinion in the audit report, quarterly management statements

will be released in each quarter until an audit report is published without

qualification.

Key performance indicators

Due to the size of the Group, the Group currently monitors progress with

particular reference to the following key performance indicators:

Revenue

Revenue from the sales of Shinju has increased from $15,000 to $299,000

reflecting both the increase in sales of Shinju and the fact that the prior

year included only six months of trading. Revenue from Bin 301 is shown as a

discontinued business.

Loss before taxation

The loss before taxation increased from $385,000 to $1,336,000 reflecting the

full year's trading as well as the one off costs of listing and also a

significant non cash loss on the conversion of loan notes.

The Directors of the Company accept responsibility for the contents of this

announcement.

Hamish Harris

Chairman

30 June 2022

Rogue Baron PLC

For further information, please contact:

The Company

Ryan

Dolder

rdolder@roguebaron.com

AQSE Corporate Adviser:

Peterhouse Capital Limited

Guy Miller

+44 (0) 20 7469 0936

AQSE Corporate Broker:

Peterhouse Capital Limited

Lucy Williams

+44 (0) 20 7469 0936

GROUP STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2021

Year ended Year ended

2021 2020

$'000 $'000

Revenue 299 15

Cost of sales (236) (10)

Gross Profit 63 5

IPO and costs (358) (216)

Payments made in shares (440) -

Other administrative expenses (590) (69)

Total administrative expenses (1,388) (285)

Share of loss in associate company (72) -

Loss from continuing operations (1,397) (280)

Finance cost (15) (50)

Loss before and after taxation from (1,412) (330)

continuing operations

Profit/(loss) on discontinued 76 (55)

operations

Exchange difference on translating (37) (140)

foreign operations

Total comprehensive loss for the (1,373) (525)

year, attributable to owners of the

company

Profit/(loss) attributable to

Non-controlling shareholders 36 (24)

Equity holders of the parent (1,372) (361)

(1,336) (385)

Total comprehensive loss attributable

to

Non-controlling shareholders 36 (24)

Equity holders of the parent (1,409) (501)

(1,373) (525)

Total earnings per ordinary share

Basic and diluted loss per share (1.78) (1.80)

(cents) from continuing operations

Basic and diluted loss per share 0.10 (0.30)

(cents) from discontinued operations

GROUP statement of FINANCIAL POSITION

At 31 December 2021

31 December 2021 31 December 2020

ASSETS $'000 $'000

Non-current assets

Intangible assets 3,826

3,826

Investment in associates

64 -

3,826

3,890

Current assets

Inventory 717 614

Cash and cash equivalents 246 131

Trade and other receivables 325 159

Total current assets 904

1,288

Total assets 5,178 4,730

LIABILITIES

Current liabilities

Trade and other payables 39 240

Loans payable 156 892

Net liabilities of discontinued 189 160

operations

Total current liabilities and total 384 1,292

liabilities

Liabilities falling due over one year

Loans - 441

- 441

Total liabilities 384 1,733

EQUITY

Share capital 119 46

Share premium 6,627 3,529

Exchange reserve (177) (140)

Retained deficit (1,734) (361)

Equity attributable to the equity 4,835 3,074

holders of the Company

Non-controlling interest (41) (77)

Total equity 4,794 2,997

Total equity and liabilities 5,178 4,730

END

(END) Dow Jones Newswires

June 30, 2022 12:38 ET (16:38 GMT)

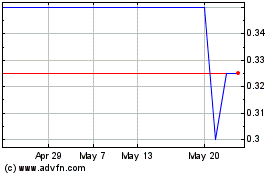

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Nov 2024 to Dec 2024

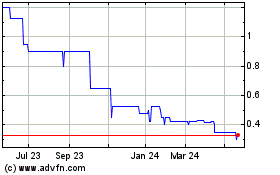

Rogue Baron (AQSE:SHNJ)

Historical Stock Chart

From Dec 2023 to Dec 2024