TIDMSTVG

RNS Number : 1296F

STV Group PLC

06 July 2023

STRICTLY PRIVATE & CONFIDENTIAL

STV Group plc

Press Release 0700 hours, 6 July 2023

Acquisition of Greenbird Media for initial cash consideration of

GBP21.4 million

Accelerates STV's strategy to grow its production business,

further diversifying its earnings from outside linear broadcasting

and driving long-term shareholder value

Acquisition highlights:

-- STV acquires 100% of major UK unscripted production network

Greenbird Media through existing bank facilities

-- Greenbird's portfolio - which includes majority stakes in

leading unscripted companies Crackit Productions and Tuesday's

Child and minority positions in 13 other producers - not only

brings immediate scale and earnings enhancement but also the

potential for future growth through consolidation of minorities

-- Significantly boosts STV Studios returning series from 12 to

almost 40, including international series

-- Transaction is margin accretive for STV Studios and

materially earnings enhancing for STV Group from day 1, as well as

offering scope for future revenue and cost synergies

-- Takes STV beyond its diversification target of 50% of

earnings from outside traditional linear broadcasting by end 2023,

with estimated out-turn of at least 60%, while keeping the group

well within its financial covenants.

STV Group plc ("Company" or "STV") today announces it has

acquired, through its wholly-owned subsidiary STV Studios Limited,

100% of the issued share capital of unscripted television

production network Greenbird Media Limited ("Greenbird") for a

total cash consideration of approximately GBP24 million, of which

GBP21.4 million was paid on completion.

As well as helping its network of investee production companies

to accelerate their growth plans, Greenbird is also a service

provider, offering a bespoke back-office solution to enable

creatives to focus on pipeline development and programme

production.

Strategic benefits:

Accelerates the growth of STV Studios by more than trebling the

number of returning series, strengthening STV's existing rights

catalogue and future creative pipeline

-- Founded by respected television executives Jamie Munro and

Stuart Mullin in 2012, Greenbird has built the largest

independently-owned network of high quality producers in the UK,

with an archive of 2,000+ hours of content, and will this year

produce over 350 hours of new programming across 25 returning

series.

-- Greenbird network companies are behind such hit shows such as

LEGO Masters (C4, Fox in the US), The Hit List (BBC One), Animal

Casualty 24/7 (C5), The Misadventures of Romesh Ranganathan (BBC

Two), Late Night Lycett (C4) and Mortimer & Whitehouse: Gone

Fishing (BBC Two).

-- Greenbird directly owns majority stakes in two of the UK's

leading unscripted production companies, Crackit Productions (75%)

and Tuesday's Child (51%), founded and run by award-winning

creative leaders Elaine Hackett (ex Endemol UK board member

overseeing Big Brother) and Karen Smith (ex MD of Shine TV and

co-creator of Strictly Come Dancing) respectively. Tuesday's Child

in turn owns a majority stake in Interstellar (51%). Greenbird also

holds minority positions in a further 12 production companies,

including Rumpus Media (40%), Glasgow-based Hello Halo (30%) and

Flicker Productions (40%), offering significant scope for future

consolidated growth.

Delivers scale benefits for STV Studios as one of the largest UK

production groups and further diversifies STV Group's earnings

-- The acquisition will make STV Studios one of the largest

production groups in the UK, is a major step towards our stated

objective of becoming the UK's No.1 nations & regions producer,

and accelerates the STV Group's overall diversification

strategy.

-- We now expect to comfortably exceed our diversification

target that at least 50% of STV's operating profit should come from

outside linear broadcasting by the end of FY23, transforming STV

into a more balanced, resilient media company offering both linear

and digital reach, and the creation and ownership of valuable IP in

the growing global content market.

Provides significant opportunities for further growth

-- The acquisition will materially enhance the future growth

prospects of STV Studios creatively, commercially, and

internationally.

-- STV Studios production labels will more than double from 9 to

24 forming an unrivalled network of senior creative leaders and a

significantly expanded forward pipeline of new programme ideas, a

number of which have already been greenlit for 2024. The enhanced

scale of the group will allow STV Studios to realise more value

from a combined programme catalogue of 5,000+ hours in the

distribution and secondary sales markets.

-- The enlarged STV Studios will also pursue an international

growth strategy to generate maximum value from its shows outside

the UK and build on the recent success of LEGO Masters (20

territories including UK and US) and Bridge of Lies (16 territories

including UK & Spain).

-- The group will have expanded bases in Glasgow and London, as

well as offices in Belfast, Cardiff, Manchester and Brighton,

strengthening our ability to take advantage of the continuing

strong growth of production in the nations and regions.

-- STV Studios is also one of the few multi-genre production

groups of scale in the UK with the capability to produce high

quality programming across scripted and unscripted, with our drama

companies delivering three high-profile new series in 2023: the

acclaimed Blue Lights for BBC One, series 2 of prison drama Screw

for C4, and Peter Capaldi/Cush Jumbo thriller Criminal Record for

Apple TV+.

Further strengthens STV Group's management team

-- Following the acquisition, Greenbird founders Jamie Munro and

Stuart Mullin will join the board of STV Studios in the roles of

Chief Commercial Officer and Finance & Integration Director

respectively, working alongside Chief Operating Officer Paul

Sheehan under the leadership of Studios Managing Director David

Mortimer, with a brief to drive the expansion of STV Studios both

in the UK and internationally.

-- The founders and creative leaders of the key Greenbird

production companies will remain with their businesses under

long-term incentive arrangements, forming an unrivalled network of

creative leaders across STV Studios.

Key financials:

STV has acquired 100% of the issued share capital of Greenbird

from Keshet International (60% shareholder) and Greenbird's

founders, Jamie Munro, Stuart Mullin and Karen Smith (the

"Founders"), for a total cash consideration of approximately GBP24

million.

An initial cash payment of GBP21.4 million includes GBP11.5

million for the repayment of loan notes to Keshet at completion, a

cash adjustment of GBP0.3 million, and the balance payable to the

existing shareholders, equivalent to 86% of the equity, including

Keshet's entire equity interest. Deferred consideration in relation

to the balance of 14% of the equity, currently estimated to be

GBP1.6 million, is payable to the Founders based on agreed EBITDA

targets over the two years ending 31 December 2024. The remaining

consideration of c.GBP1 million relates to surplus cash balances

held by the majority companies (being Crackit, Tuesday's Child and

Interstellar) at completion, which will be paid to the existing

shareholders at the point in future when STV, through Greenbird,

owns 100% of their equity or when monies are dividended by them to

Greenbird.

Immediately earnings enhancing and further diversifies STV's

revenues and profits

-- The acquisition will be materially earnings enhancing, in

terms of STV Studios and STV Group's revenue, profit and margin, as

well as STV Group's EPS.

-- On a proforma basis and in line with Greenbird's 'percentage

of completion' revenue recognition policy, Greenbird generated

consolidated revenues of c.GBP32 million, consolidated operating

profit of c.GBP3.5 million and consolidated profit before tax of

c.GBP2.9 million in the year ended 31 December 2022 (excluding

share of associates). Greenbird's gross assets as at 31 December

2022 were GBP18.5 million. The total revenue generated by entities

in which Greenbird held an investment in 2022 was c.GBP64

million.

-- Under STV's ownership, Greenbird will report in accordance

with STV's episodic delivery revenue recognition policy. On that

basis, the proforma FY22 results would have been revenue of c.GBP28

million, operating profit of c.GBP3 million and profit before tax

of c.GBP2.5 million. Furthermore, Greenbird is forecast to deliver

revenue of GBP20-25 million and operating profit of GBP3-3.5

million in H2 2023, which will be consolidated into the STV Group

financial statements for FY23. As the corporate structure of

Greenbird includes entities who are not wholly owned, there will be

an allocation of profit, via reserves, to minority interests that

we expect to be c.GBP1 million in H2 2023.

-- We expect the enlarged STV Studios division to deliver

revenue of GBP70-75 million and adjusted operating profit of

GBP6-6.5 million in FY23, taking the STV Group well beyond its

diversification target of achieving 50% of operating profit, to at

least 60%, from outside traditional linear broadcasting by the end

of 2023.

-- STV expects to deliver significant revenue and cost synergies

across the enlarged STV Studios business of at least GBP750k p.a.

from 2024.

Significant headroom remains in bank facility and key financial

covenants

-- STV has funded the acquisition entirely from its existing

GBP60 million revolving credit facility. The Group has also

released GBP10 million from its accordion facility to provide

additional liquidity headroom although does not currently

anticipate using this incremental funding capacity.

-- The enlarged group's net debt on day 1 will be approximately

GBP32 million, which comprises net debt in the existing STV Group

of c.GBP38 million and cash balances in the Greenbird network of

c.GBP6 million, of which GBP2 million is available to the Group on

completion. Greenbird currently funds working capital through

existing cash reserves and without external bank facilities, and

this is expected to continue for the foreseeable future.

-- STV Group's key financial covenants are net debt to EBITDA

(maximum of 3 times) and interest cover (minimum of 4 times). In

accordance with STV's debt facility, the Group expects net debt to

EBITDA to be c.1 times and interest cover to be at least 10 times

at the end of FY23.

-- STV expects to continue to generate adequate cash resources

to fund future growth. Its dividend policy will remain

unchanged.

- excluding lease liabilities

Simon Pitts, STV CEO said: "Growing STV Studios into the UK's #1

nations and regions production company is one of our core strategic

objectives. This transformative acquisition represents a major step

towards that goal, adding significant scale and creative firepower

to the group and immediately accelerating STV's overall

diversification in terms of both revenue and profit. We're

delighted to be partnering with Greenbird and to welcome their

incredibly talented network of creative leaders to the STV family

as we jointly aim to grow our production base in the UK and

internationally."

David Mortimer, Managing Director of STV Studios said "Over the

last 4 years we have transformed STV Studios' creative and

commercial performance, so now feels like the right time to take

our next big step towards becoming one of the UK's most successful

production groups. I've known and worked with many of the team at

Greenbird and their associated companies previously and can't wait

to get on with the job of integrating these great production

companies into the STV Studios family. Jamie and Stuart have built

a brilliant business and they'll bring unrivalled commercial

expertise as part of our senior management team. Over the next few

years, we will be making some huge television shows for

broadcasters and streamers both here in the UK and around the

world, so this feels like an exciting new era for STV Studios."

Jamie Munro and Stuart Mullin, Greenbird founders, said: "This

is an exciting new chapter in Greenbird's history. We are hugely

proud of the Greenbird incubator model we have built. It has given

creatives space to flourish and deliver some of the most

innovative, entertaining and loved programmes in the UK. Their

creative power is unrivalled and has been recognised by viewers,

critics, awards panels and through the volume of international

sales that their shows have generated.

We're delighted to be working with Simon and David at STV. We

look forward to a future together helping a wider network of

creatives realise their ambitions."

There will be a presentation for analysts and investors today,

6(th) July 2023, at 12.30pm, via Zoom. Should you wish to attend

the presentation, please contact Angela Wilson,

angela.wilson@stv.tv or telephone 0141 300 3000.

Further information

The Greenbird network comprises the following production

investments:

Majority positions

Crackit Productions (75%)

Tuesday's Child (51%), which in turn owns 51% of

Interstellar

Large minority positions

Flicker Productions (40%)

Rumpus Media (40%)

Pi (40%)

Riverdog (37.5%)

Hello Halo (30%)

Kalel Films (25%)

Small minority positions

Top Hat (5%)

Goat Films (5%)

Owl Power (5%)

Little Dooley (5%)

Big Light (5%)

Rockerdale Studios (3.2%)

Enquiries:

STV Group plc Stephen Innes, Senior PR Executive 07500 757 049

Panmure Gordon Rupert Dearden / Sam Elder / Dominic Morley 020 7886 2678

(Joint Broker)

Shore Capital Mark Percy / Rachel Goldstein 020 7408 4090

(Joint Broker)

Camarco Geoffrey Pelham-Lane, Partner 07733 124 226

(Financial PR) Ben Woodford, Partner 07790 653 341

This announcement contains inside information for the purposes

of Regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310 (as amended). Upon the publication of this

announcement via a Regulatory Information Service, this inside

information is now considered to be in the public domain.

Under the FCA Listing Rules, the acquisition of Greenbird

constitutes a Class 2 transaction and, as such, this announcement

is made in accordance with STV's disclosure obligations pursuant to

Chapter 10 of the FCA Listing Rules. For the purposes of LR 10.4.1

R (Notification of Class 2 transactions), the gross assets of the

Greenbird network were GBP18.5 million at 31 December 2022 and

profits for the year then ended were GBP2.5 million.

Notes to Editors

STV Group plc

STV Group plc is Scotland's home of news, entertainment and

drama, providing audiences with top-quality programming on air,

online and on demand.

STV's broadcast channel reaches 3 million viewers each month,

with a packed schedule across the day. STV's fast-growing streaming

service, STV Player, offers viewers across the UK home-grown and

international drama box sets and a vast array of factual

entertainment series. Production company STV Studios - one of the

UK's leading content businesses - has an impressive track-record of

success across a wide range of broadcasters and streamers, with

productions including BAFTA-winning Elizabeth Is Missing for BBC

One and prison drama, Screw for Channel 4, quiz format Bridge of

Lies for BBC One and much-loved returning series Celebrity

Catchphrase (ITV and STV) and Antiques Road Trip (BBC One).

Greenbird

Greenbird is both an investment business and a services business

to help production companies achieve their full potential. Founded

in 2012, it invests equity capital to accelerate companies' growth

plans, and provides a bespoke back office solution to ease the

process of running a business as well as offering commercial

advice.

With more than 30 years' experience in television production,

Jamie Munro and Stuart Mullin provide producers with access to

innovative funding models, offer expertise in the commercial

exploitation of intellectual property and licensing deals; give

strategic and operational support and provide administration

services including business affairs, IT, legal, accounting and

HR.

Since 2012, Greenbird has helped 22 unscripted indies deliver

approximate 2,000 hours of programmes - an estimated GBP300m worth

of production activity.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUNARROUUBRRR

(END) Dow Jones Newswires

July 06, 2023 02:00 ET (06:00 GMT)

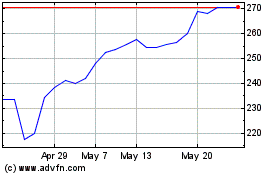

Stv (AQSE:STVG.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Stv (AQSE:STVG.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025