TIDMUJO

RNS Number : 9389L

Union Jack Oil PLC

11 September 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

11 September 2023

UNION JACK OIL PLC

(AIM: UJO)

Unaudited Results for the Six Months Ended 30 June 2023

Union Jack Oil plc ("Union Jack" or the "Company"), a UK focused

onshore conventional oil and gas production, development and

exploration company, is pleased to announce its unaudited results

for the Half Year ended 30 June 2023.

FINANCIAL AND OPERATIONAL HIGHLIGHTS

-- For the six-month period ended 30 June 2023:

o Gross Profit of GBP1,608,973

o Net Profit of GBP572,263

o Revenue of GBP3,584,866

-- Cash balances, receivables and liquid investments stand in excess of GBP9,250,000 as at

8 September 2023

-- Robust Balance Sheet, cash generative and debt free

-- All current projects funded for at least the next 12 months

without recourse to Capital Markets

-- Wressle is amongst the most productive conventional producing

UK onshore oilfields with nearly 500,000 barrels of high-quality

oil having been produced from the Ashover Grit formation alone

-- Wells planned for Keddington, Wressle and West Newton

-- Ongoing evaluation of new projects offering short-term

cash-flow, rapid payback and accretive value

David Bramhill, Executive Chairman, commented: "I am very

pleased to be again, able to present to the shareholders of Union

Jack, a positive set of Half Yearly results, containing several

highlights of note, including a sustained profit, a strong cash

position and a robust Balance Sheet free of debt.

"These results reflect the determined effort by the Board of

Directors, advisers and technical consultants, all who share the

same objective to grow the Company with minimal dilution in the

future.

"Union Jack remains in a strong financial position with a

combination of consistent cash flows, principally from our flagship

asset at Wressle, plus significant future upside potential from our

balanced portfolio, giving Union Jack the confidence to support a

forward drilling and development programme on our key projects that

is being planned for the remainder of 2023 and beyond.

"Union Jack continues to be cash flow positive, covering all

current G&A, OPEX and contracted or planned CAPEX costs,

including any drilling activities for at least the next 12 months,

without recourse to the Capital Markets.

"The future of Union Jack remains bright."

For further information please contact the following:

Union Jack Oil plc info@unionjackoil.com

David Bramhill

SP Angel Corporate Finance

LLP +44 (0)20 3470 0470

Nominated Adviser and Broker

Matthew Johnson

Richard Hail

Kasia Brzozowska

Shore Capital

Joint Broker

Toby Gibbs

Iain Sexton +44 (0)20 7408 4090

In accordance with the AIM Rules - Note for Mining and Oil and

Gas Companies, the information contained within this announcement

has been reviewed and signed off by Graham Bull, Non-Executive

Director, who has over 47 years of international oil and gas

industry exploration experience. This announcement contains certain

forward-looking statements that are subject to the usual risk

factors and uncertainties associated with the oil and gas

exploration and production business. While the directors believe

the expectation reflected within this announcement to be reasonable

in light of the information available up to the time of approval of

this announcement, the actual outcome may be materially different

owing to factors either beyond the Company's control or otherwise

within the Company's control, for example, owing to a change of

plan or strategy. Accordingly, no reliance may be placed on the

forward-looking statements.

Evaluation of hydrocarbon volumes has been assessed in

accordance with 2018 Petroleum Resources Management System (PRMS)

prepared by the Oil and Gas Reserves Committee of the Society of

Petroleum Engineers (SPE) and reviewed and jointly sponsored by the

World Petroleum Council (WPC), the American Association of

Petroleum Geologists (AAPG), the Society of Petroleum Evaluation

Engineers (SPEE), the Society of Exploration Geophysicists (SEG),

the Society of Petrophysicists and Well Log Analysts (SPWLA) and

the European Association of Geoscientists & Engineers

(EAGE).

CHAIRMAN'S STATEMENT

I am pleased to present this Half Yearly Report for the six

months ended 30 June 2023 to the shareholders of the Company.

OPERATIONAL AND FINANCIAL HIGHLIGHTS

-- Gross profit of GBP1,608,973 for the six-month period ended 30 June 2023

-- Net profit of GBP572,263 for the six-month period ended 30 June 2023

-- Revenue of GBP3,584,866 for the six-month period ended 30 June 2023

-- Cash balances, receivables and liquid investments stand in excess of GBP9,250,000 as at

8 September 2023

-- Robust Balance Sheet, cash generative and debt free

-- Wressle is amongst the most productive conventional producing

UK onshore oilfields with nearly 500,000 barrels of high-quality

oil having been produced from the Ashover Grit formation alone

-- Wells planned for Keddington, Wressle and West Newton

-- Ongoing evaluation of new projects offering short-term

cash-flow, rapid payback and accretive to value

FINANCIAL AND OPERATIONAL OVERVIEW

Union Jack has made good progress during 2023 which can be seen

in the Half Yearly results ended 30 June 2023 (the "Period"), with

a net profit posted of GBP572,263 (H1 2022: GBP2,034,086).

A Gross Profit of GBP1,608,973 (H1 2022: GBP2,833,629) was

posted for the Period.

Revenues for the Period were GBP3,584,866 (H1 2022:

GBP4,384,254).

The average oil price received for the Period was USD80 (H1

2022: USD104).

Foreign exchange movements had a negative effect on revenues

with the firming of the GBP versus the USD conversion rate.

Contributions from our flagship project Wressle, supplemented by

revenues from the Keddington oilfield, have enabled the Company to

sustain and support an extremely robust Balance Sheet, with cash,

near term receivables and investments currently standing in-excess

of GBP9,250,000 and to remain debt free. The majority of long-term

cash is held in a competitive, interest bearing account, without

risk to funds.

The Company is fully funded for all G&A, OPEX and planned

CAPEX costs, including any budgeted drilling activities for at

least the next 12 months without recourse to the Capital

Markets.

Since the commencement of the dividend and share buy-back

programme during September 2022 to date, the Company has returned

over GBP2,995,000 to shareholders. The dividend policy remains as

previously stated and the intention is to continue these payments,

based on the proportion of free cash available, subject to our

project obligations being fulfilled.

Union Jack's selective investment portfolio during the period

has generated significant returns, well over 100% of our original

investment from the sale of the Claymore Area Royalty Agreement in

May 2023 and a return of 194% on our investment in Egdon Resources

plc, as a result of the recent agreed take over by Petrichor

Partners LLP.

Operationally, good progress has been made at Wressle where the

Joint Venture partners have agreed a budget and drilling programme,

targeting the Penistone Flags formation for 2024. Pre-application

planning advice has been sought from North Lincolnshire Council for

review and a decision has been made on a sales route for the gas

produced. A planning application is in preparation along with the

associated supporting studies and reports.

Agreement has been reached between the partners to drill a

side-track well at the earliest opportunity at Keddington, for

which planning consent is already in place. A final well trajectory

has been decided upon and procurement of the rig, materials and

services is progressing. The well, if successful, will add

considerably to production.

West Newton, located in an area that provides excellent regional

infrastructure and substantial technically recoverable resources,

awaits the drilling of a 1,500 metre horizontal well, where

planning has been approved, whilst corporate activity regarding our

Joint Venture partners continues with third party discussions

regarding future drilling and possible development

partnerships.

Additional information on our leading projects at Wressle, West

Newton, Keddington and other licence interests can be found later

within this statement.

Union Jack remains committed to promoting and investing in the

conventional UK onshore oil sector. The opinion of the Board is

that several "rich pickings" remain which could be transformed into

substantive discoveries over the coming years. However, the rate of

progress can only be described as painfully slow due to the wider

UK regulatory process that neither the Company nor its Joint

Venture partners have the ability to influence. Onshore UK will

remain the prime driver for Union Jack and we are confident that

our flagship project Wressle, will continue to deliver as the

future development plans indicate.

Union Jack's very able technical team continue to screen and

investigate the impressive upside that we believe is contained

within our existing projects and we will continue to invest and

agree to capital expenditure budgets to advance them. However, over

the past year we have considered the potential UK political

environment and the possible impacts on Union Jack's business

development over the coming years.

To mitigate future risk, the Board believes it is compelled

strategically to seek growth opportunities further afield in

politically safe regimes and with sympathetic views toward the oil

industry, without compromising the world's environmental objectives

and the aim of a Net Zero target by 2050.

Over the past six months we have appointed a team of specialists

who are able to provide a bespoke service in generating potential

value adding projects for review and consideration. We are seeking

projects that will be self-funding in the short term, without

placing undue strain on our strong Balance Sheet, allowing us to

remain focused on the onshore UK as our core area of investment. We

look forward to updating the market as this search progresses.

PEDL180 AND PEDL182 WRESSLE OILFIELD DEVELOPMENT (40%)

Wressle is located in Lincolnshire on the Western Margin of the

Humber Basin.

The Wressle-1 well discovery was defined on proprietary 3-D

seismic data. The structure is on trend with the producing Crosby

Warren oilfield and the Broughton B-1 oil discovery, both to the

immediate northwest, and the Brigg-1 discovery to the southeast.

All these wells contain oil in various different sandstone

reservoirs within the Upper Carboniferous succession.

Since the resumption of production during August 2021, following

the successful proppant-squeeze and coiled tubing operation,

Wressle-1 has produced nearly 500,000 barrels of oil from the

Ashover Grit formation.

Since late June 2023, limited amounts of water have been

observed with water cut averaging approximately 3.72% of total

field production. This figure has remained constant throughout July

and August 2023.

The Operator has planned for this event and a simple clean water

disposal plan is in place which is an inexpensive exercise for the

Joint Venture partners.

The start of modest water production is significantly later than

originally anticipated, providing further evidence that the

expected recoverable volumes from the Ashover Grit are likely to be

at the higher estimates detailed in the independent Competent

Person's Report ("CPR") prepared by ERCE during 2016. The 2016 CPR

forecast gross volumes from the Ashover Grit of 2P 0.54 MMstb and

3P 1.12 MMstb.

The planned maintenance shutdown scheduled for early 2024, where

artificial lift equipment capable of pumping in excess of 1,000

barrels of fluid per day was to be installed along with other site

upgrades, has been brought forward and the fitting of a downhole

jet pump is currently being completed, along with the siting of

other surface equipment. This exercise is a natural sequence in the

life-cycle of an oil well and offers a reliable method of ensuring

the continued operation and the optimisation of its future

production performance.

Environmental monitoring throughout the Wressle operation has

shown no measurable impact on surface or groundwater quality, no

related seismicity and that operational noise levels have been

contained within permitted ranges.

Evaluations are continuing in order to deliver a full Field

Development Plan that will maximise hydrocarbon recoveries from the

Ashover Grit, Wingfield Flags, Penistone Flags and other associated

prospects.

WEST NEWTON APPRAISAL PEDL183 (16.665%)

PEDL183 is located onshore UK, north of the River Humber,

encompassing the town of Beverley, East Yorkshire. The licence area

is within the western sector of the Southern Zechstein Basin.

Union Jack entered into a farm-in during 2018 with Rathlin

Energy (UK) Limited ("Rathlin") the Operator, and since that time

the West Newton A-2 ("WNA-2") and West Newton B -1Z ("WNB-1Z")

drilling programmes have yielded substantial hydrocarbon

discoveries within the Kirkham Abbey formation.

Throughout 2022, data collected during drilling operations and

well testing, which included core, oil and gas samples, wireline

log and well test records were analysed by independent laboratories

CoreLab, Applied Petroleum Technology ("APT") and RPS Group Limited

("RPS"). The results of these analyses, in conjunction with

internal evaluations, have been invaluable in informing the

upcoming programme of work and future drilling plans.

The laboratory reports confirm that the hydrocarbon-bearing

Kirkham Abbey reservoir is extremely sensitive to aqueous fluids

and that previous drilling of the West Newton wells with

water-based mud had created near well-bore damage through the

creation of very fine rock fragments, affecting the natural

porosity and permeability of the formation which had a detrimental

effect on its ability to flow. Further analyses have determined

that the use of dilute water-based acids during well testing would

have also affected the flow characteristics of the Kirkham Abbey

reservoir.

These tests indicate that by drilling the Kirkham Abbey

reservoir with an oil-based drilling fluid, damage to the oil and

gas reservoir should be minimised.

The Operator, Rathlin, has made applications to the Environment

Agency ("EA") for use of oil-based drilling fluids within the

hydrocarbon bearing Permian section for both the West Newton A and

B sites.

Analyses by APT of numerous oil and gas samples recovered from

the West Newton wells during testing, along with evaluation of mud

gases measured during drilling utilising a proprietary software

package, indicates that the Kirkham Abbey reservoir is

predominantly gas (primarily methane 90% plus ethane 5%) with

associated light condensate.

RPS has modelled wells extending up to 1,500 metres horizontally

through the Kirkham Abbey reservoir. These wells have a much

greater likelihood of encountering significant sections of the

naturally fractured reservoir, enhancing its productive

capability.

In preparation for a decision on the potential development of

the West Newton discoveries, the Operator submitted revised

planning applications for the development of West Newton to the

ERYC. This was approved by the ERYC Planning Committee by a vote of

ten to one during March 2022.

A revised CPR was compiled by RPS during 2022, evaluating the

resources of PEDL183 as of 30 June 2022, ("Effective Date").

The results of the 2022 CPR were very encouraging,

highlighting:

-- Kirkham Abbey Best Case Gross Unrisked Contingent Technically

Recoverable Sales Gas is estimated to be 197.6 billion cubic feet

("bcf")

-- Geological Chance of Success of Kirkham Abbey horizontal well estimated to be 85.5%

-- Gross NPV10 risked value of Kirkham Abbey Contingent Gas

Resource as at Effective Date of USD396.1 million post tax

-- Substantial additional Prospective Resource figures for

Ellerby, Spring Hill and Withernsea prospects

In the preparation of the 2022 CPR, RPS adopted the Petroleum

Resource Management System ("PRMS") standard.

WEST NEWTON GROSS UNRISKED TECHNICALLY RECOVERABLE SALES

Category Gross Technically Recoverable

Gas Liquids

(bcf) (mbbl)

-------------- ----------------

1C 99.7 299.4

-------------- ----------------

2C 197.6 593.0

-------------- ----------------

3C 393.0 1,178.9

-------------- ----------------

Note: Net data for Union Jack can be calculated by applying its

16.665% economic interest to the above gross data.

WEST NEWTON GEOLOGICAL CHANCE OF SUCCESS

Asset Source Charge Migration Reservoir Trap Seal Geological

Rock COS

West Newton 1.00 1.00 1.00 0.90 0.95 1.00 0.855

------- ------- ---------- ---------- ----- ----- -----------

A future West Newton development will benefit from being located

in an area that provides access to substantial regional

infrastructure and could deliver significant volumes of onshore

low-carbon sales gas into the UK's energy market.

Domestically produced natural gas is, and will remain, a

much-needed part of the energy mix as the UK seeks to reduce its

reliance on imported products.

Union Jack looks forward to the drilling of a 1,500 metre

horizontal well at the earliest opportunity and unlocking the

significant potential of the Greater West Newton project.

PEDL253 BISCATHORPE (45%)

PEDL 253 is situated within the proven hydrocarbon fairway of

the South Humber Basin and is on-trend with the Keddington oilfield

and the Saltfleetby gasfield.

While drilling the Biscathorpe-2 well, there were hydrocarbon

shows, elevated gas readings and sample fluorescence observed over

the entire interval from the top of the Dinantian to the Total

Depth of the well, with 68 metres being interpreted as being

oil-bearing.

Independent consultants APT also conducted analyses, confirming

a hydrocarbon column of 33-34 API gravity oil, comparable with the

oil produced at the nearby Keddington oilfield.

Further evaluation of the results of the Biscathorpe-2 well,

together with the reprocessing of 264 square kilometres of 3D

seismic, indicate a material and potentially commercially viable

hydrocarbon resource remaining to be appraised.

Subject to a favourable planning appeal decision a side-track

well is planned, targeting the Dinantian Carbonate where the

Operator has assessed, in accordance with the PRMS Standard, a

gross Mean Prospective Resource of 2.55 MMbbl. The overlying Basal

Westphalian Sandstone has the potential to add gross Mean

Prospective Resources of 3.95 MMbbl. Economic modelling

demonstrates that the Westphalian target is economically robust,

especially in the current oil price environment. Commercial

screening indicates break-even full cycle economics to be USD18.07

per barrel.

During November 2021, a planning application for a side-track

drilling operation, associated testing and long-term production was

refused by the Lincolnshire County Council Planning Committee,

despite being recommended for approval by the planning

officers.

The Joint Venture partners are awaiting a decision from the

Planning Inspectorate, where an appeal was heard in October

2022.

Union Jack's technical team believe that Biscathorpe remains one

of the largest unappraised conventional onshore discoveries within

the UK.

PEDL005(R) KEDDINGTON (55%)

The producing Keddington oilfield is located along the highly

prospective East Barkwith Ridge, an east-west structural high on

the southern margin of the Humber Basin.

A subsurface review conducted by the Operator has highlighted a

viable target to the east of the field, with up to 180,000 barrels

of incremental production.

Modelling indicates that infill drilling is forecast to improve

recovery from the Keddington field by between 113,000 to 183,000

barrels of oil. With planning permission already in place,

Keddington presents an excellent opportunity to increase oil

production relatively inexpensively.

The Keddington 3-D seismic has been re-processed and a well

trajectory agreed between the Joint Venture partners. The

procurement of the rig, materials and services is progressing and

the drilling of a side-track well is expected to take place at the

earliest opportunity.

PEDL241 NORTH KELSEY (50%)

North Kelsey is a conventional oil exploration prospect, on

trend with and analogous to the Wressle oilfield which lies

approximately 15 kilometres to the northwest. The prospect has been

mapped from 3-D seismic data and has the potential for oil in four

stacked Upper Carboniferous reservoir targets.

The Operator estimates that gross Prospective Resources range

from 4.66 to 8.47 MMbo.

During August 2022, the Operator submitted an appeal on behalf

of the Joint Venture, against the refusal of an extension of time

to the existing planning permission by Lincolnshire County Council

for the drilling and testing of a conventional exploration well at

the North Kelsey site.

Subsequent to this event, Union Jack was informed by the

Operator that it has withdrawn the planning appeal outlined

above.

A new application will be submitted at a later date following

consultation with the local community.

NET ZERO CARBON POLICY

The UK is committed by law to reach Net Zero carbon emissions by

2050. Union Jack pursues a strategy whereby it is not the Operator

of any of its projects. Therefore, the Company will only work with

Operators who have a firm commitment to safety, environmental and

social responsibility in all aspects of their operations.

Regardless of the fact that the Company has chosen not to be an

Operator, we are subject to the same scrutiny as any other

hydrocarbon producer.

We remain pro-active in the quest for Net Zero and Union Jack's

focus is to minimise emissions and the carbon footprint generated

by its hydrocarbon interests in the most efficient means possible,

whilst continuing to contribute positively to the growing demand

for energy and hydrocarbon products in the supply chain.

As the demand for energy increases as the global economy

recovers, hydrocarbons will continue to play an important role in

ensuring the energy security of the UK.

Union Jack's development interests are located close to areas

with a high demand for energy and as a consequence management

believes that locally produced hydrocarbons provide the benefit of

displacing, to some extent, imported hydrocarbons.

OUTLOOK

I am very pleased again to be able to present to the

shareholders of Union Jack a positive set of Half Yearly results,

containing several highlights of note, including a sustained

profit, a strong cash position and a robust Balance Sheet free of

debt, reflecting the determined effort and perseverance by the

Board of Directors, advisers and valued technical consultants with

an unwavering objective to grow the Company going forward with

minimal dilution in the future.

Union Jack remains in a strong financial position with a

combination of consistent cash flows, principally from our flagship

asset at Wressle, plus significant future upside potential from our

balanced project portfolio.

Union Jack continues to be cash flow positive covering all

G&A, OPEX and contracted or planned CAPEX costs, including any

drilling activities for at least the next 12 months without

recourse to Capital Markets.

I would like to take this opportunity to thank our shareholders

for their continued support and I look forward to the remainder of

2023 and beyond, reporting on a number of fronts, in particular on

our potential new ventures.

The future of Union Jack remains bright.

David Bramhill

Executive Chairman

11 September 2023

Unaudited income Statement

FOR THE SIX MONTHSED 30 JUNE 2023

Year

Six Months Six Months ended

ended ended 31 December

30 June 30 June 2022

2023 Unaudited 2022 Unaudited Audited

Notes GBP GBP GBP

================================ ====== ================ ================ ================

Revenue 3,584,866 4,384,254 8,507,050

Cost of sales - operating (527,425) (514,824)

costs (1,297,439) (1,035,801) (1,143,967)

Cost of Sales - depreciation (151,029) - (2,125,425)

Cost of sales - Net Profit

Interest payment (137,179)

Gross profit 1,608,973 2,833,629 5,100,479

-------------------------------- ------ ---------------- ---------------- ----------------

Administrative expenses (925,077) (789,007) (1,665,174)

Impairment (30,201) - (475,556)

Total administrative

expenses (955,278) (789,007) (2,140,730)

-------------------------------- ------ ---------------- ---------------- ----------------

653,695

Operating profit 42,231 2,044,622 2,959,749

Finance income 70,000 52,222 86,586 42,444

Other income 42,023

-------------------------------- ------ ---------------- ---------------- ----------------

Profit before taxation 3 765,926 2,138,867 3,088,779

Taxation- (193,663) (104,781) 517,845

-------------------------------- ------ ---------------- ---------------- ----------------

Profit for the period

/ year 572,263 2,034,086 3,606,624

-------------------------------- ------ ---------------- ---------------- ----------------

Attributable to:

Equity shareholders of

the Company 572,263 2,034,086 3,606,624

-------------------------------- ------ ---------------- ---------------- ----------------

- -

Earnings per share

Basic (pence) 2 0.52 1.80 3.20

Diluted (pence) 2 0.51 1.78 3.16

-------------------------------- ------ ---------------- ---------------- ----------------

Unaudited Statement of Comprehensive Income

FOR THE SIX MONTHSED 30 JUNE 2023

Year

Six Months Six Months ended

ended ended 31 December

30 June 30 June 2022

2023 Unaudited 2022 Unaudited Audited

GBP GBP GBP

============================= ================ ================ =============

Profit for the period

/ year 572,263 2,034,086 3,606,624

Items which will not

be reclassified

subsequently to profit

Profit on investment

revaluation 267,727 371,230 170,500

------------------------------ ---------------- ---------------- -------------

Total comprehensive profit

for the period / year 839,990 2,405,316 3,777,124

------------------------------ ---------------- ---------------- -------------

Unaudited Balance Sheet

AS AT 30 JUNE 2023

As at

As at As at 31 December

30 June 30 June 2022

2023 Unaudited 2022 Unaudited Audited

Notes GBP GBP GBP

================================= ====== ================ ================ =============

Assets

Non-current assets

Exploration and evaluation

assets 8,866,419 9,134,006

Property, plant and equipment 9,312,335 6,779,563 5,666,212

Investments 4,688,927 662,748 552,043

937,783

Deferred tax asset 1,849,928 - 1,805,025

--------------------------------- ------ ---------------- ---------------- -------------

16,788,973 16,308,730 17,157,286

Current assets

Inventory 27,622 19,246 28,038

Trade and other receivables 2,674,289 2,124,110 2,020,913

Cash and cash equivalents 6,280,609 6,503,962 7,155,100

--------------------------------- ------ ---------------- ---------------- -------------

8,982,520 8,647,318 9,204,051

--------------------------------- ------ ---------------- ---------------- -------------

Total assets 25,771,493 24,956,048 26,361,337

--------------------------------- ------ ---------------- ---------------- -------------

Liabilities

Current liabilities

Trade and other payables 1,104,700 383,561 778,290

--------------------------------- ------ ---------------- ---------------- -------------

Non-current liabilities

Provisions 1,717,206 1,867,061 1,700,069

Deferred tax liability 638,219 - 877,747

--------------------------------- ------ ---------------- ---------------- -------------

Total liabilities 3,460,125 2,250,622 3,356,106

--------------------------------- ------ ---------------- ---------------- -------------

Net assets 22,311,368 22,705,426 23,005,231

--------------------------------- ------ ---------------- ---------------- -------------

Capital and reserves

attributable

to the Company's equity

shareholders

Share capital 7,514,576 7,507,076 7,514,576

Share premium - 21,528,077 -

Share-based payment reserve 712,634 733,350 712,634

Treasury reserve (1,748,079) - (214,227)

Accumulated profit /

(deficit) 4 15,832,237 (7,063,077) 14,992,248

--------------------------------- ------ ---------------- ---------------- -------------

Total equity 22,311,368 22,705,426 23,005,231

--------------------------------- ------ ---------------- ---------------- -------------

Unaudited Statement of Cash Flows

FOR THE SIX MONTHSED 30 JUNE 2023

Six months Six months Year

ended ended ended

30 June 2023 30 June 31 December

Unaudited 2022 Unaudited 2022

GBP GBP Audited

GBP

=============================== ============== ================ ===============

Cash outflow from operating

activities 2,178,691 1,006,040 5,811,734

------------------------------- -------------- ---------------- ---------------

Cash flow from investing

activities

Purchase of intangible

assets

Purchase of property, (304,596)

plant and equipment (366,224) (330,375) (712,935)

Disposal of assets 227,272 (197,599) (2,852,254)

Fixed term deposit (1,000,000) - -

Loan advanced - (1,000,000) (1,000,000)

Loan capital returned - - 1,000,000 (1,000,000)

Purchase of investments (118,013) - 2,000,000

Sale of investments - - (100,000)

Interest received 42,231 48,355 6,772 105,996

------------------------------- -------------- ---------------- ---------------

Net cash used in investing

activities (1,519,330) (479,619) (3,552,421)

------------------------------- -------------- ---------------- ---------------

Cash flow from financing

activities - - 33,000

Proceeds on issue of

new shares - - - (900,527)

Dividends paid (1,533,852) (214,227)

Treasury shares

------------------------------- -------------- ---------------- ---------------

Net cash generated from

financing activities (1,533,852) - (1,081,754)

------------------------------- -------------- ---------------- ---------------

Net (decrease) / increase

in

cash and cash equivalents (874,491) 526,421 1,177,559

------------------------------- -------------- ---------------- ---------------

Cash and cash equivalents

at beginning of period

/ year 7,155,100 5,977,541 5,977,541

------------------------------- -------------- ---------------- ---------------

Cash and cash equivalents

at end of period / year 6,280,609 6,503,962 7,155,100

------------------------------- -------------- ---------------- ---------------

Notes to the Unaudited Financial Information

FOR THE SIX MONTHSED 30 JUNE 2023

1 Accounting Policies

Basis of Preparation

These financial statements are for the six-month period ended 30

June 2023.

The information for the year ended 31 December 2022 does not

constitute statutory financial statements as defined in section 434

of the Companies Act 2006.

A copy of the statutory financial statements for that period has

been delivered to the Registrar of Companies. The Auditor's Report

was not qualified, did not include a reference to any matters to

which the Auditor drew attention by way of emphasis without

qualifying the report and did not contain statements under section

498(2) or (3) of the Companies Act 2006.

The interim financial statements for the six months ended 30

June 2023 are unaudited.

The interim financial information in this report has been

prepared in accordance with International Financial Reporting

Standards ("IFRS") applied in accordance with the provisions of the

Companies Act 2006.

The financial statements have been prepared under the historical

cost convention. The principal accounting policies have been

consistently applied to all periods presented.

Significant Accounting Policies

The accounting policies and methods of computation followed in

the interim financial statements are consistent with those as

published in the Company's Annual Report and Financial Statements

for the year ended

31 December 2022.

The Annual Report and Financial Statements are available from

the Company Secretary at the Company's registered office, 6

Charlotte Street, Bath BA1 2NE or on the Company's website

www.unionjackoil.com.

Going Concern

The directors have, at the time of approving the interim

financial statements, a reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future and continue to adopt the going concern basis of

accounting.

2 Profit per Share Attributable to the Equity Shareholders of the Company

Basic profit per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

In the periods prior to 30 June 2022, the share options in issue

were excluded as their inclusion would have been anti-dilutive.

Where the calculated average share price was lower than the

exercise price of share options in issue, these potential ordinary

shares have not been included for the purposes of calculating the

diluted profit per share.

Basic profit per share Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

pence pence pence

======================== ============ ============ =============

Profit per share from 0.52 1.80 3.20

continuing operations

- Basic 0.51 1.78 3.16

- Diluted

------------------------ ------------ ------------ -------------

The profit and weighted average number of ordinary shares used

in the calculation of basic earnings per share are as follows:

---------------------------------------------------------------------------------

Six months Year

Six months ended ended

ended 30 June 31 December

30 June 2022 2022

2023 GBP GBP

GBP

================================= ============== ============== ==============

Profit used in the calculation

of total

basic and diluted earnings

per share 572,263 2,034,086 3,606,624

--------------------------------- -------------- -------------- --------------

Six months Year

Number of Shares ended Six months ended

30 June ended 31 December

2023 30 June 2022

2022

================================= ============== ============== ==============

Weighted average number

of ordinary

shares for the purposes

of basic and

diluted earnings per share

- Basic 110,000,979 112,715,896 112,706,307

- Diluted 111,350,979 114,215,896 114,132,334

--------------------------------- -------------- -------------- --------------

Treasury Shares

As at 30 June 2023, the Company held 6,300,000 of its ordinary

shares in treasury. These shares are not included in the earnings

per share calculation. There are no current plans to cancel these

shares.

3 Taxation

Consistent with the year-end treatment, current and deferred tax

assets and liabilities have been calculated at tax rates which were

expected to apply to their respective period of realisation at the

period end. The Energy Profits Levy for the year 2023 has been

increased to 35% and the CAPEX relief decreased to 129%. OPEX

relief remains at 100%.

4 Share Capital

At 30 June 2023, there were 112,865,896 ordinary shares of a

nominal value of 5 pence in issue.

At 30 June 2023, there were 831,680,400 deferred shares of 0.225

pence nominal value in issue.

5 Events after the Balance Sheet Date

On 28 July 2023, a dividend of 0.3 pence per ordinary share of

Union Jack was paid to shareholders. Treasury Shares held by the

Company did not qualify for this dividend.

6 Related Party Transactions

Charnia Resources (UK), an unincorporated entity owned by Graham

Bull, non-executive director, received from the Company the sum of

GBP60,187 during the period under review in respect of consulting

fees. GBP12,011 was outstanding at the end of the period.

Jayne Bramhill, spouse of David Bramhill, received from the

Company the sum of GBP6,000 during the period under review in

respect of IT maintenance and administration costs.

On 19 June 2023, Joseph O'Farrell, Executive Director purchased

a total of 133,400 ordinary shares of 5 pence each in Union Jack,

at a weighted average price of 31.25 pence each.

7 Copies of the Half Yearly Report

A copy of the Half Yearly Report is now available on the

Company's website www.unionjackoil.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GZGMLZGDGFZZ

(END) Dow Jones Newswires

September 11, 2023 02:00 ET (06:00 GMT)

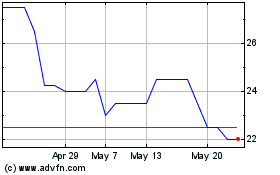

Union Jack Oil (AQSE:UJO.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Union Jack Oil (AQSE:UJO.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025