TIDMWTG

RNS Number : 0905U

Watchstone Group PLC

30 November 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014 ("MAR").

Watchstone Group plc

Claim filed against KPMG LLP

Watchstone Group plc (LON:WTG) ("Watchstone") announces that it

has served and filed a claim against KPMG LLP ("KPMG") in the High

Court.

The claim against KPMG is for GBP13.73m plus interest and arises

from KPMG's audit of Watchstone's (then Quindell's) financial

statements for the financial year ending 31 December 2013

("FY2013") ("Claim").

On 31 March 2014, Quindell announced its preliminary results for

FY2013, based upon the 2013 financial statements audited by KPMG

and signed off by the Quindell Board on 29 March 2014. KPMG

provided an unqualified audit report in respect of the FY2013

audit.

However, the FY2013 financial statements subsequently needed to

be very significantly restated, which they were, in the FY2014

financial statements published on 5 August 2015, which were also

audited by KPMG ("the Restated Accounts").

On the same day, the Financial Reporting Council ("the FRC")

announced that it had opened an investigation into KPMG and the

partner responsible for the FY2013 audit under the Accountancy

Scheme.

On 11 June 2018, the FRC announced that following its

investigation it had fined and reprimanded KPMG and the partner

responsible for handling the FY2013 audit, following their

admission of misconduct in relation to it. KPMG was reprimanded and

fined GBP4.5m (discounted for settlement to GBP3.15m). The admitted

misconduct is the subject of a document entitled "Particulars of

Fact and Admitted Misconduct" ("the PFAM").

The Claim is based primarily upon (although is not exclusively

limited to) the same heads of misconduct as were admitted by KPMG

and as are set out in the PFAM.

By its admitted misconduct under the Accountancy Scheme, and in

further respects as outlined in the Claim, Watchstone claims that

KPMG was negligent and/or breached its contractual and/or statutory

duties in the conduct of the 2013 audit.

As a result, Watchstone suffered loss in the sum of GBP13.73m

which it now claims in damages from KPMG.

The Particulars of Claim will be available on written

application to the Commercial Court, alternatively online at the HM

Courts & Tribunals e-filing Service: HMCTS e-filing service at

https://efile.cefile-app.com/login, subject to the payment of the

prescribed fee. The claim number is CL-2021-000673, High Court of

Justice, Queens Bench Division, Commercial Court.

Watchstone will make further announcements in due course, as

appropriate.

The release of this announcement has been authorised by Stefan

Borson, Group Chief Executive Officer and Company Secretary of the

Company.

For further information:

Watchstone Group plc Tel: +44 (0)7824

638 553

Stefan Borson, Group Chief Executive Officer

WH Ireland LLP, Financial Adviser and Broker Tel: +44 (0)20 7220

1666

Chris Hardie

IN THE HIGH COURT OF JUSTICE Claim No. CL-2021-000673

BUSINESS AND PROPERTY COURTS OF ENGLAND AND WALES

COMMERCIAL COURT (QBD)

BETWEEN:

WATCHSTONE GROUP PLC

Claimant

- and -

KPMG LLP

Defendant

SUMMARY OF PARTICULARS OF CLAIM

Background

1. Watchstone (formerly known as "Quindell") is an English

public company currently trading on the Aquis Stock Exchange. It

was formerly well known for providing personal injury litigation

and related services.

2. Quindell engaged KPMG, the well-known accountancy and

professional services firm, to audit its financial statements for

the financial year ending 31 December 2013 ("FY2013").

3. Following the publication of the FY2013 accounts, Quindell

and its leadership were the subject of significant criticism in the

market and press in relation to its accounting policies,

specifically those concerning revenue recognition. The Chairman and

Group Finance Director also came under significant scrutiny for

dealings with their shares, and resigned. With a view to restoring

public and market confidence, Quindell's new leadership retained

PwC to carry out an extensive review of the business, with a

particular focus on its accounting policies as well as cash

generation. Following such review and further work Quindell

announced that it would be making significant changes to its

accounting policies, particularly those concerning revenue

recognition. It also retained experienced accountant consultants to

assist its leadership to consider the accounting policies in light

of the PwC report, and to implement the restatements of the

accounts.

4. The PwC review concluded that certain accounting policies

were unduly aggressive and/or inappropriate and, as a result, the

FY2013 financial statements needed to be very significantly

restated, which they were, in the FY2014 financial statements

published on 5 August 2015, which were also audited by KPMG ("the

Restated Accounts").

5. Unsurprisingly in the circumstances, on 5 August 2015, the

date of the publication of the Restated Accounts, the FRC opened an

investigation into KPMG in relation to its audit of Watchstone's

financial statements for FY2013.

Misconduct admitted by KPMG in relation to the relevant

audit

6. On 11 June 2018, the FRC announced that following its

investigation it had fined and reprimanded KPMG and the partner

responsible for handling the audit, following their admission of

misconduct in relation to it. The admitted misconduct is the

subject of a document entitled "Particulars of Fact and Admitted

Misconduct" ("the PFAM").

7. This claim is based primarily upon (although is not

exclusively limited to - see below) the same heads of misconduct as

were admitted by KPMG and are set out in the PFAM.

Admitted and other heads of breach

8. In summary the findings of the FRC, which now constitute

Watchstone's allegations of breach of contract/breach of duty of

care, were:

(1) The audit work in relation to recognition of revenue for

legal services did not comply with ISAs 200 and 500. KPMG failed to

obtain sufficient appropriate audit evidence to provide reasonable

reassurance that the use of the WIP model approach adopted by

Quindell enabled it to reliably to measure unbilled revenue, and

KPMG failed to exercise appropriate professional scepticism in

carrying out the audit. Accordingly, an unqualified audit opinion

should not have been given.

(2) The audit work in relation to Quindell's software business

did not comply with ISAs 200, 220 and 500, in that KPMG failed to

exercise sufficient scepticism and/or properly to obtain sufficient

appropriate audit evidence in relation to the question of whether

certain transactions concerning software were linked or arm's

length transactions at fair values. Watchstone makes a further

allegation concerning KPMG's failure to notice that an

inappropriate policy was applied to the part of its software

business relating to 'software as a service' or 'SaaS'.

9. Although those items alone had a significant effect on the

accounts and would be sufficient on their own to make out the

claims and losses relied upon by Watchstone, following scrutiny of

the FY2013 financial statements and related documents by it and its

expert, Watchstone also relies on further heads of breach, which

can be summarised as follows:

(1) KPMG's overall approach to the audit was errant in several

respects, not least in the failure to exercise professional

scepticism.

(2) As regards Quindell's medical and rehabilitation services

business, KPMG failed to recognise or point out to Quindell's board

that its accounting policies were inappropriate. Such policies had

to be changed in the Restated Accounts, resulting in significant

reductions in profit and revenue.

(3) KPMG failed properly to evaluate or point out to Quindell's

board, the inappropriate accounting treatment of a number of

transactions connected with the acquisition of businesses by the

Quindell Group, in three categories, namely (i) share-based

payments, (ii) share transactions, and (iii) equity swaps.

(4) KPMG failed to exercise professional scepticism, and/or to

obtain sufficient appropriate audit evidence in relation to whether

sales to companies that were subsequently acquired by Quindell were

genuine commercial transactions, and therefore whether and, if so,

how revenue from such sales should recognised.

Causation and loss

10. Watchstone says that it has suffered losses as a result of the breaches alleged as follows:

(1) Dividend (GBP6.18m) :

(a) Quindell had resolved in advance of the publication of the

FY2013 Accounts to pay a dividend to its shareholders conditional

upon its financial position as set out in those Accounts. Following

sign off by KPMG and release of its FY2013 financial statements, it

declared and subsequently paid a dividend on 2 May 2014, in the sum

of GBP6.18m.

(b) In reliance upon the audited FY2013 financial statements

Quindell believed that it had sufficient distributable reserves

under s.830 of the Companies Act 2006 to pay the dividend, and that

it was appropriate and prudent to do so. In fact, there was a

deficit of distributable reserves of GBP19.7m and the company was

heavily loss-making. Quindell therefore (i) could not legally,

and/or (ii) would not in fact, had it known the true position, have

paid the dividend.

(2) Excess KPMG audit fees (GBP2.089m) :

(a) KPMG applied a heightened internal risk profile to

Watchstone as a client, resulting in higher fees being payable for

its audit in the years following the restatement of the FY2013

financial statements. Such increased fees were the direct result of

the publication of the errant accounts, the need publicly to

restate them, and the FRC's investigation into KPMG.

(b) The fees charged by KPMG included work done on re-auditing

the FY2013 financial statements which, again, would not have been

necessary had the FY2013 financial statements been properly audited

in the first place.

(c) Watchstone's estimate of the amount attributable to the

enhanced risk profile and re-audit costs is GBP2.089m.

(3) PwC fees (GBP5.032m): In light of the reputational damage

caused by the public criticism of Quindell's accounting policies in

the FY2013 financial statements, Quindell instructed PwC to carry

out a review of its business, cash position and accounting

policies. Watchstone paid PwC a little over GBP5m for its

services.

(4) Consultants' fees : (GBP0.433m): Watchstone recruited, in

order to help it to deal with the fallout from the publication of

the FY2013 financial statements and the need to restate them,

experienced accounting consultants, which would not have been

necessary had the accounts originally been produced in the form in

which they appeared in the Restated Accounts. Accordingly,

Watchstone claims for the costs of three accounting professionals

each for a time limited, specific period of work.

11. The total sum that Watchstone claims is therefore

GBP13,734,922, plus interest.

MARK TEMPLEMAN Q.C.

WATSON PRINGLE

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXEAKFEDEAFFFA

(END) Dow Jones Newswires

November 30, 2021 11:29 ET (16:29 GMT)

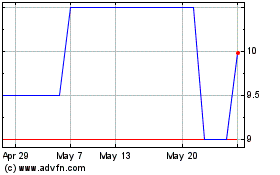

Watchstone (AQSE:WTG)

Historical Stock Chart

From Nov 2024 to Dec 2024

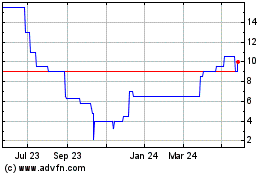

Watchstone (AQSE:WTG)

Historical Stock Chart

From Dec 2023 to Dec 2024