TIDMZIOC

RNS Number : 5417X

Zanaga Iron Ore Company Ltd

05 May 2021

5 May 2021

ZANAGA PROJECT DEVELOPMENT COST UPDATE AND ORE RESERVE

RE-STATEMENT

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM:

ZIOC) is pleased to provide an update to shareholders following

completion of the Zanaga Iron Ore Project ("Zanaga" or the

"Project") re-costing exercise and Ore Reserve update.

Highlights

-- Zanaga Iron Ore Project (the "Project" or the "Zanaga

Project") 30Mtpa staged development project (12Mtpa Stage One

("Stage One"), plus 18Mtpa Stage Two expansion ("Stage Two"))

o Initiative to update the cost estimates associated with the

12Mtpa Stage One Project, as outlined in the 2014 Feasibility

Study, has been completed (the "FS Review")

o External independent technical expert engineering firms

engaged by Jumelles Limited ("Jumelles"), the joint venture company

between ZIOC and Glencore to oversee and provide input into the FS

Review

o Objective is to ascertain the potential capital and operating

costs associated with the construction of the Zanaga Project's

12Mtpa Stage One Project in the current market environment

o FS review indicates capital and operating cost estimates for

the 12Mtpa Stage One development project remain approximately

within the guidance levels outlined in the 2014 Feasibility Study

("FS"), specifically:

-- Capital expenditure expected to range between -2.9% and +2.5%

of the 2014 Feasibility Study estimate, or to range between

US$2,154m and US$2,275m. The lower range being dependent on the

implementation of a number of potential savings opportunities

identified by the independent technical experts. (It needs to be

noted that the potential savings opportunities so identified

exclude and do not take account of any potential savings identified

by the Zanaga Project Team from the implementation of a floating

port solution, as announced in [XX June 2020])

-- 12Mtpa Stage One operating cost estimate estimated to be

approximately in line with the estimates provided in the 2014

FS

-- Ore Reserve estimate re-statement

o The Zanaga Project's 2.1 billion tonne Ore Reserve estimate

has been re-stated by SRK and updated based on market pricing as of

31 December 2020

Clifford Elphick, Non-Executive Chairman of ZIOC, commented:

" The Zanaga Project Team have worked with third party technical

experts to re-assess the potential capital and operating costs that

could be achieved in the current market for the 12Mpta Stage One

project, as outlined in the 2014 Feasibility Study. The review of

these figures indicates that the capital and operating costs

estimated in 2014 remain valid in today's market environment,

encouraging us to continue to pursue pathways available for

development of the 30Mtpa staged development project, especially

during the current high iron ore price environment. "

For further information, please contact:

Zanaga Iron Ore

Corporate Development and Andrew Trahar

Investor Relations Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser, Financial Scott Mathieson, Edward Thomas

Adviser and Corporate Broker +44 20 3100 2000

About us:

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM

ticker: ZIOC) is the owner of 50% less one share in the Zanaga Iron

Ore Project based in the Republic of Congo (Congo Brazzaville)

through its investment in its associate Jumelles Limited. The

Zanaga Iron Ore Project is one of the largest iron ore deposits in

Africa and has the potential to become a world-class iron ore

producer.

12Mtpa Stage One project cost review

The Zanaga Project Team has continually taken steps to monitor

evolving improvements into its strategy for assessing the options

available for the development of the Zanaga Project. The Project

Team has maintained its view that high quality products will

continue to achieve significant price premiums in the future and

has sought to lock in this additional revenue benefit into the

Project's development plan.

In light of the current positive market environment for high

grade iron ore products, the Jumelles shareholders considered it

sensible to obtain a "high level" indicative review of certain

costs of the Project (including costs generated by exchange rate

movements) by leading external technical consultancy firms without

any re-engineering of the Project. Jumelles commissioned a report,

led by Coffey Geotechnics Ltd (a Tetra Tech Company ("Tetra Tech"))

, to assess the potential capital and operating costs associated

with Stage One of the 30mtpa staged development project outlined in

the 2014 Feasibility Study ("FS") . Since the 2014 FS was produced,

industry input costs dropped initially and have now returned to

approximately the same levels seen in 2014. The initial review of

the 2014 FS cost estimates indicates that capital and operating

costs associated with the Stage One 12Mtpa project are broadly in

line with the estimates provided in 2014.

The review indicates that as regards the costs of the 12 Mtpa

Stage One Project, the capital cost is estimated to be between 2.5%

above and 2.9% below the estimate provided in 2014. Operating costs

are expected to be approximately in line with the estimate provided

in 2014, with an estimated variance of + or - 2%.

It is encouraging to see that the costs estimated for the

construction of the Zanaga Project remain in broad alignment with

the costs outlined in the 2014 FS, especially as iron ore prices

have risen substantially beyond the levels seen in 2014, ultimately

providing the potential for significant improvement in the economic

returns of the Project. It is important to recognise that these

numbers have not yet been re-estimated to a high level of

definition and are only estimates as to the potential costs of

brining the project into production in the current market. In order

to better define these estimates the Project Team would require

further work to be conducted ahead of considering a full

re-estimate of the 2014 Feasibility Study.

The Project Team will continue to engage in activity to

ascertain opportunities for optimisation and improvement of the

30Mtpa staged development project and will update the market as

these improvements develop.

Overview of the process

Tetra Tech completed the high level, top-down review and update

of the Zanaga Iron Ore Stage One Feasibility Study capital and

operating cost estimates, dated March 2014.

The scope of the Feasibility Study and the associated estimates

is the development of the Zanaga iron ore deposit, complete with

infrastructure for transport to and seaborne loading. This update

review looked at the capital and operating costs of the front-end

engineering design (FEED) and Stage One 12Mtpa portions of the

total project.

Since the March 2014 study, an increase in global and regional

economic volatility, structural changes to the mining equipment

supply chain, changes in the contracting market and changes in

commodity consumption patterns has impacted the basis of the

capital and operating cost estimates with varying effects.

The update relied on wide reading and a variety of information

sources to define trends expressed as factored cost drivers. In

some cases, direct re-pricing of major line items were indicated.

The estimate is expressed in US dollars (USD), but was

significantly influenced by the exchange rate movements of the past

decade, including impacts of the Central African franc (XAF), euro

(EUR) and South African Rand (ZAR) rates of exchange to the

USD.

The updated estimate is thus qualified and strongly impacted by

global economic insights and relative cost movements rather than

being a re-priced estimate. In 2017 Tetra Tech completed a similar

cost estimate update. Instead of extrapolating that exercise to the

current date, it was considered more prudent to return to the base

estimate of 2014 as datum and avoid ambiguous composite

updates.

Capital Cost

Capital expenditure is expected to range between -2.9% and +2.5%

of the 2014 Feasibility Study estimate, or to range between

US$2,154m and US$2,275m.

The lower estimate includes adjustments to the cost estimates

for particular items which were viewed to be overstated in the 2014

FS, or possible to reduce based on optimised procurement and

contracting to find lower costs without compromising quality.

Furthermore, the piping estimate for the process plant had been

factorised and appears significantly overstated, for which a

further adjustment of 40% reduction was made. The other adjustments

were limited to 80% of the adjustment percentage that was made in a

review conducted in 2017, since the 2020 review already includes

some consideration of the current market conditions.

Once the opportunity adjustments are applied, the estimate is

that there would be a 2.9% reduction in the capital cost estimate

provided by the 2014 FS.

It should be noted that any potential savings identified by the

Project Team through the implementation of a floating port

solution, as announced in [XX June 2020], have not been factored

into the lower estimate provided above.

Operating Cost

The outcome of Tetra Tech's analysis showed that overall

operating cost is likely to fall within the range of -2% to +2%

when compared to the March 2014 estimate. As such, Jumelles regards

the operating costs of the 12Mtpa Stage One project to be

approximately in line with the estimate provided in the 2014

FS.

Reserves & Resource Statement

The Zanaga Project has defined a 6.9bn tonne Mineral Resource

and a 2.1bn tonne Ore Reserve, reported in accordance with the JORC

Code (2012), and defined from only 25km of the 47km strike length

of the orebody so far identified.

Introduction

SRK Consulting (UK) Limited ("SRK") was appointed to provide

consent to the re-statement of Ore Reserves for the Zanaga Project.

The restatement confirms that the Ore Reserves as reported herein

are reported in accordance with the terms and definitions of the

JORC Code (as defined below) and are restated to be so with an

effective date of 31 December 2020.

In rendering its opinion as expressed herein, SRK concluded:

-- That the 2014 Ore Reserves are reported in accordance with

the terms and definitions of the "The Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves published by the Joint Ore Reserves Committee of the

Australasian Institute of Mining and Metallurgy, Australian

Institute of Geoscientists and Minerals Council of Australia, as

amended (the "JORC Code (2012)"): www.jorc.org) ";

-- That the 2014 Ore Reserves remain valid as of 31 December 2020

Ore Reserve Statement

This Ore Reserve estimate was prepared by independent

consultants, SRK Consulting (UK) Ltd ("SRK") and is based on the

30Mtpa (product) Feasibility Study (announced by the Company on 8

May 2014, hereinafter the "2014 FS".

As stipulated by the JORC Code, Proven and Probable Ore Reserves

are of sufficient quality to serve as the basis for a decision on

the development of the deposit. Based on the studies performed, the

mine plan as reported in the 2014 FS was reassessed in respect of

the updated sales revenue, operating expenditure and capital

expenditures and confirmed as at 31 December 2020 to be technically

feasible and economically viable.

2020 Ore Reserves for the Zanaga Iron Ore Project

Ore Reserve Category Tonnes (Mt(Dry) Fe (%) SiO(2) (%) Al(2) O(3) P (%)

) (%)

---------------------- --------------- ------ ---------- ---------- -----

Proved 774 37.3 35.1 4.7 0.04

---------------------- --------------- ------ ---------- ---------- -----

Probable 1,296 31.8 44.7 2.3 0.05

---------------------- --------------- ------ ---------- ---------- -----

Total 2,070 33.9 41.1 3.2 0.05

---------------------- --------------- ------ ---------- ---------- -----

Notes:

Long term price assumptions are based on a CFR IODEX 65%Fe

forecast of US$90tdry (USc138/dmtu) with adjustments for quality,

deleterious elements, moisture and freight.

Discount Rate 10% applied on an ungeared 100% equity basis

Mining dilution ranging between 5% and 6%

Mining losses ranging between 1% and 5%

Note: The full Ore Reserve Statement is available on the

Company's website (www.zanagairon.com)

Mineral Resource

Classification Tonnes (Mt) Fe (%) SiO(2) Al(2) O(3) P (%) Mn (%) LOI (%)

(%) (%)

---------------- ------------ ------- ------- ----------- ------ ------- --------

Measured 2,330 33.7 43.1 3.4 0.05 0.11 1.46

Indicated 2,460 30.4 46.8 3.2 0.05 0.11 0.75

Inferred 2,100 31 46 3 0.1 0.1 0.9

---------------- ------------ ------- ------- ----------- ------ ------- --------

Total 6,900 32 45 3 0.05 0.11 1.05

---------------- ------------ ------- ------- ----------- ------ ------- --------

Reported at a 0% Fe cut-off grade within an optimised Whittle

shell representing a metal price of 130 USc/dmtu. Mineral Resources

are inclusive of Reserves. A revised Mineral Resource, prepared in

accordance with the Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves (the JORC Code, 2012

Edition) was announced on 8 May 2014 and is available on the

Company's website (www.zanagairon.com).

Note: The figures shown are rounded; they may not sum to the

subtotals shown due to the rounding used.

The Mineral Resource was estimated as a block model within

constraining wireframes based upon logged geological boundaries.

Tonnages and grades have been rounded to reflect appropriate

confidence levels and for this reason may not sum to totals

stated.

Geological Summary

The Zanaga iron ore deposit is located within a North-South

oriented (metamorphic) Precambrian greenstone belt in the eastern

part of the Chaillu Massif in South Western Congo. From airborne

geophysical survey work, and morphologically, the mineralised trend

constitutes a complex elongation in the North-South direction, of

about 47 km length and 0.5 to 3 km width.

The ferruginous beds are part of a metamorphosed,

volcano-sedimentary Itabirite/banded iron formation ("BIF") and are

inter-bedded with amphibolites and mafic schists. It exhibits

faulted and sheared contacts with the crystalline basement. As a

result of prolonged tropical weathering the BIF has developed a

distinctive supergene iron enrichment profile.

At surface there is sometimes present a high grade ore (+60%

Fe), classified as canga, of apparently limited thickness (<5m)

capping a discontinuous, soft, high grade, iron supergene zone of

structure-less hematite/goethite of limited thickness (<7m). The

base of the high-grade supergene iron zone grades quickly at depth

into a relatively thick, leached, well-weathered to moderately

weathered friable hematite Itabirite with an average thickness of

approximately 25 metres and grading 45-55% Fe.

The base of the friable Itabirite zone appears to correlate with

the moderately weathered/weakly weathered BIF boundary, and fresh

BIF comprises bands of chert and magnetite/grunerite layers.

Competent Persons

The statement in this announcement relating to Ore Reserves is

based on information compiled by Dr Iestyn Humphreys, FIMM, AIME,

PhD who is a Corporate Consultant, and Practice Leader with SRK. He

has sufficient experience relevant to the style of mineralisation

and type of deposit under consideration and to the activity he is

undertaking to qualify as a Competent Person as defined in the JORC

Code (2012). The Competent Person, Dr Iestyn Humphreys, confirms

that the Ore Reserve Estimate is accurately reproduced in this

announcement and has given his consent to the inclusion in the

report of the matters based on his information in the form and

context within which it appears.

The information in the report that relates to Mineral Resources

is based on information compiled by Malcolm Titley, BSc MAusIMM

MAIG, of CSA Global (UK) Ltd. Malcolm Titley takes overall

responsibility for the report as Competent Person. He is a Member

of the Australasian Institute of Mining and Metallurgy ("AUSIMM")

and has sufficient experience, which is relevant to the style of

mineralisation and type of deposit under consideration, and to the

activity he is undertaking, to qualify as a Competent Person in

terms of the JORC Code. The Competent Person, Mr Malcolm Titley,

has reviewed this Mineral Resource statement and given his

permission for the publication of this information in the form and

context within which it appears.

Definition of JORC Code

The Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves (2012) as published by the Joint

Ore Reserves Committee of the Australasian Institute of Mining and

Metallurgy, Australian Institute of Geoscientists and Minerals

Council of Australia.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAESLEDDFEAA

(END) Dow Jones Newswires

May 05, 2021 02:00 ET (06:00 GMT)

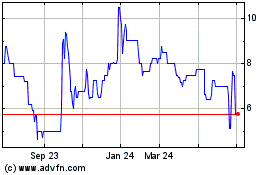

Zanaga Iron Ore (AQSE:ZIOC.GB)

Historical Stock Chart

From Mar 2025 to Apr 2025

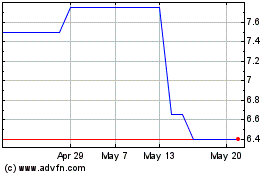

Zanaga Iron Ore (AQSE:ZIOC.GB)

Historical Stock Chart

From Apr 2024 to Apr 2025