TIDMZIOC

RNS Number : 5571D

Zanaga Iron Ore Company Ltd

30 June 2021

30 June 2021

Zanaga Iron Ore Company Audited Results for the Year to 31

December 2020

2020 Highlights and post reporting period end events to June 2021

-- Zanaga Iron Ore Project (the "Project" or the "Zanaga

Project") 30Mtpa staged development project (12Mtpa Stage One

("Stage One"), plus 18Mtpa Stage Two expansion ("Stage Two"))

o Initiative completed to update the cost estimates associated

with Stage One, as outlined in the 2014 Feasibility Study (the "FS

Review")

o External independent technical expert engineering firms

engaged by Jumelles Limited ("Jumelles"), the joint venture company

between ZIOC and Glencore, to oversee and provide input into the FS

Review

o Successfully ascertained potential capital and operating costs

associated with the construction of Stage One in the current market

environment

o FS review indicates that capital and operating cost estimates

for Stage One remain approximately within the guidance levels

outlined in the 2014 Feasibility Study ("2014 FS")

o Floating Offshore Port Study completed in May 2020

-- Concept Study completed on the viability of a Floating

Dewatering, Storage, and Offloading port facility ("FDSO" or

"Floating Port")

-- Potential indicated for $184m reduction to capital costs of

Stage One of the Zanaga Project

-- No change expected to operating cost, significant NPV and IRR

improvement

-- Ore Reserve estimate re-statement

o The Zanaga Project's 2.1 billion tonne Ore Reserve estimate

has been re-stated by SRK and updated based on market pricing as of

31 December 2020

-- Early Production Project ("EPP Project" or "EPP")

o Multiple production scenarios remain under investigation

focusing on processing facilities and suitable logistics solutions

through the Republic of Congo ("RoC") and/or Republic of Gabon

("Gabon")")

o Studies completed in June 2020 to determine cross border

transport viabiity (mainly taxes and customs) between RoC and

Gabon

-- Work programme and budget for 2021 and 2021 Funding Agreement

agreed with Glencore Projects Pty Ltd ("Glencore"), a subsidiary of

Glencore plc

Corporate

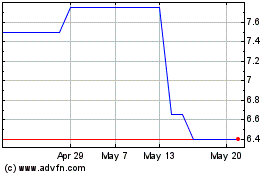

-- Equity subscription agreement concluded with Shard Merchant Capital Ltd ("SMC")

o Subscription agreement ("Subscription Agreement") with SMC

dated 25 June 2020

o SMC has subscribed for 21 million ordinary shares of no par

value in ZIOC (7 million in 2020 and 14 million in 2021),

equivalent to 6.8% of ZIOC's ordinary shares on a fully diluted

basis

o Transaction involves SMC using reasonable endeavours to place

the relevant Subscription Shares that it has subscribed for and to

pay to ZIOC 95% of the gross proceeds of any such sales

o Proceeds of GBP1,025,942.30 received to date, following

14,750,000 shares being placed by SMC, with a further 6,250,000

ordinary shares remaining to be placed

o Proceeds applied to general working capital, including the

provision of further contributions to the Zanaga Project's

operations

-- Cash balance of US$0.4m as at 31 December 2020 and a cash balance of US$0.7m as at 31 May 2021

-- Outbreak of COVID-19 has not had a material impact upon the

Group although the continuing prevalence of the pandemic constrains

a number of commercial activities. Further detail regarding the

Group's response to the outbreak can be found within the Business

Review.

Clifford Elphick, Non-Executive Chairman of ZIOC, commented:

"Despite significant challenges in 2020, the Zanaga Project has

managed to proceed through significant milestones.

The conclusion of a Concept Study into a Floating Port facility

for the Zanaga Project presented a potential solution to a

logistics challenge which now provides significant flexibility on

coastal route selection. In addition, the Concept Study indicates

that there is potential to achieve significantly improved economics

through the reduction of upfront capital costs relating to the

transportation of Zanaga iron ore product at the coast, leading to

an enhanced Internal Rate of Return.

It is also pleasing to have concluded an updated costing

exercise, using independent technical experts to evaluate the Stage

One development costs. This resulted in confirmation that the

Project's 2014 cost estimates remain reliable in today's market

environment.

Furthermore, an update exercise was undertaken to evaluate the

Ore Reserve for the Project. This has resulted in the

reconfirmation of the Ore Reserve - which remains one of the

largest ore reserves globally."

The Company will post its Annual Report and Accounts for the

year ended 31 December 2020 ("2020 Annual Report and Accounts") to

shareholders on approximately 9 July 2021.

The 2020 Annual Report and Accounts will be available on the

Company's website www.zanagairon.com today .

For further information, please contact:

Zanaga Iron Ore

Corporate Development and Andrew Trahar

Investor Relations Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser, Financial Scott Mathieson, Edward Thomas

Adviser and Corporate Broker +44 20 3100 2000

About us:

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM

ticker: ZIOC) is the owner of 50% less one share in the Zanaga Iron

Ore Project based in the Republic of Congo (Congo Brazzaville)

through its investment in its associate Jumelles Limited. The

Zanaga Iron Ore Project is one of the largest iron ore deposits in

Africa and has the potential to become a world-class iron ore

producer.

Chairman's Statement

Dear Shareholder,

In these exciting times for iron ore it is pleasing to see

substantial progress being made by the Zanaga Project Team

("Project Team"). The efforts of Jumelles, the joint venture

between the Company and Glencore, have provided new and exciting

opportunities for the Project which is particularly relevant at

such an interesting and positive time for iron ore.

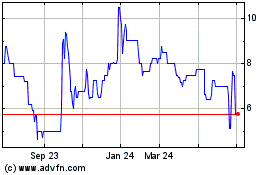

Iron Ore Market

China's strong demand for iron ore continues to surprise the

market, with sustained levels of high steel production and an

increasing desire for high quality iron ore products - similar to

those that would be produced by the Zanaga Project. Iron ore prices

have risen to record highs in the last few weeks and have

maintained these high levels as the supply side struggles to

respond, however there are reports in the media that the Chinese

authorities are making attempts to manage speculative trading in

iron ore contracts and mitigate extreme price movements such as we

have seen in recent months.

30Mtpa Staged Development Project

Three key activities have been completed by the Project Team in

relation to the Stage One of the 30Mtpa Project.

1) Floating Port Study

In May 2020 a Concept Study was completed to evaluate a Floating

Port facility for the Zanaga Project. This concept study

demonstrated the clear potential of a Floating Port facility to

significantly enhance the economics of the Zanaga Project through

the reduction of upfront capital costs and increase the Internal

Rate of Return. In addition, there is potential to achieve

significant ancillary technical benefits such as reduced

environmental impact, elimination of dredging, and significant

flexibility on coastal route selection. The Project's port solution

has been a challenge for the Project since the 2014 FS was

completed and we are pleased with the results of this evaluation

exercise.

2) FS review

The Project Team also concluded the FS review process which

involved an updated costing exercise, using independent technical

experts to evaluate the Stage One Project development costs. This

resulted in confirmation that the Project's 2014 FS cost estimates

remain reliable in today's market environment.

3) Ore Reserve Statement Update

The Project Team have completed a process to update the Ore

Reserve estimate. The Zanaga Project's 2.1 billion tonne Ore

Reserve estimate has been re-stated by SRK and updated based on

market pricing as of 31 December 2020.

EPP Project

The Project Team continue to undertake a process to evaluate the

potential development of an EPP Project that would be quicker to

construct than the larger 30Mtpa staged development project and

would utilise existing road, rail and port infrastructure in

Republic of Congo and Republic of Gabon. The Project Team continue

to advance study work in an effort to improve their understanding

of the viability of the EPP Project. The Project Team continue to

evaluate the potential for the EPP Project to operate as a

standalone project, or as an initial pathway to production during

the construction period of the flagship 30Mtpa Staged Development

Project.

Cash Reserves and Project Funding

ZIOC is pleased with the current operating budget expectations

for the Project for 2021 and expects the Project Team to continue

to deliver on work programmes as planned.

Glencore and ZIOC have agreed a 2021 Project Work Programme and

Budget for the Project of up to US$1.3m plus US$0.1m of

discretionary spend. ZIOC has agreed to contribute towards this

work programme and budget an amount comprising US$0.6m plus 49.99%

of all discretionary items approved jointly with Glencore. Ignoring

any entitlement to savings, ZIOC's potential contribution to the

Project in 2021 under the 2021 Funding Agreement is as described

above.

The Company had cash reserves of US$0.7m as at 31 May 2021 and

continues to take a prudent approach to managing these funds. Based

on the current cost base at the Zanaga Project, the current low

corporate overheads of ZIOC, the agreed cash preservation plan

adopted by the Company (described on page 53 of the 2020 Annual

Report), the Company's existing cash reserves and (on the basis of

cautious assumptions made by the Company in its funding model) the

funds expected to be obtained from the funding facility established

by the Subscription Agreement (see below), the Company will be

adequately positioned to support its operations going forward in

the near future. As the final cash amounts to be received for the

current and final tranche of issued shares under the Subscription

Agreement, and the timing of this receipt, are dependent on SMC

successfully placing the shares prior to transferring funds to the

Company, the board of directors of ZIOC (the "Board") is of the

view that the going concern basis of accounting is appropriate.

However, the Board acknowledges that there is a material

uncertainty which could give rise to significant doubt over the

Company's ability to continue as a going concern and, therefore,

that the Company may be unable to realise its assets and discharge

its liabilities in the normal course of business. Nevertheless,

based on and taking into account the foregoing factors, the Board

is satisfied that the Company will have sufficient funds to meet

its own working capital requirements up to, and beyond, twelve

months from the approval of these accounts.

Subscription Agreement concluded with Shard Merchant Capital

Ltd

On 26 June 2020 ZIOC announced that the Company had entered into

a Subscription Agreement with SMC, a financial services

provider.

Under the Subscription Agreement the Company has issued and SMC

has subscribed for 21 million ordinary shares of no par value in

the Company ("Subscription Shares") in three tranches of 7 million

shares each (First tranche in 2020 and the subsequent tranches in

2021). Consequently, the share capital of ZIOC has been increased

by 6.8% on a fully diluted basis, based on the 286,034,367 ordinary

shares in the Company in issue prior to ZIOC entering into the

Subscription Agreement.

As a result of such transactions, as at 24th June 2021

14,750,000 ordinary shares in the Company have been placed and the

Company has received the aggregate net sum of GBP1,025,942.30.

As at 24th June 2021, 6,250,000 ordinary shares in the Company

still remain to be placed by SMC. Pursuant to the Subscription

Agreement, SMC has undertaken to use its reasonable endeavours to

place the relevant Subscription Shares that it has subscribed for

and to pay to ZIOC 95% of the gross proceeds of any such sales.

The Subscription Agreement provides a number of attractive

advantages to ZIOC, which are highlighted below:

-- Relatively low level of dilution to ZIOC shareholders

-- ZIOC has the ability to repurchase any unsold Subscription

Shares from SMC, subject to legal requirements - an important

element of flexibility for ZIOC. Any Subscription Shares

re-purchased will be cancelled, limiting dilution further

-- Low cost of capital - SMC will retain only 5% of the gross

proceeds of any sale of Subscription Shares

The proceeds received by the Company from SMC pursuant to the

Subscription Agreement have been and will be applied to general

working capital, including the provision of further contributions

to the Zanaga Project's operations.

ZIOC is pleased that a financing structure is in place which has

given and continues to give the Company access to funding through a

relatively low cost structure which minimises dilution to

shareholders.

Outlook

Despite the significant challenges faced in 2020, the Project

Team have progressed numerous workstreams which continue to add

value to the options available for the development of the Zanaga

Project.

Due to bouyant iron ore prices and continued strength in demand

from China, the need for investment into tier one iron ore assets

is compelling and the Zanaga Project provides such an opportunity.

We look forward to further advancing our desired objectives through

the remainder of 2021.

Clifford Elphick

Non-Executive Chairman

Business Review

The Zanaga Project remains uniquely positioned as an attractive

tier one asset with multiple potential development options from a

scale perspective. China's strong demand for iron ore, coupled with

a lack of investment in the development of new iron ore mines in

the last few years, has led to a surge in iron ore prices which

bodes well for the Project.

It is fortunate that the Project Team have dedicated significant

effort to securing updated development costs associated with the

flagship 30Mtpa project, while also evaluating a new floating port

solution with the potential to deliver significant benefits to the

Project through logistics optionality and capital expenditure

savings.

In addition, the EPP Project remains an area of significant

interest for the Project Team and work continues to explore the

potential to utilise existing logistics infrastructure to enable

initial production to take place.

30Mtpa Staged Development Project

The Project Team's ultimate objective remains to develop the

flagship 30Mtpa staged development mining project. As a reminder,

the Stage One project plans to produce 12Mtpa of premium quality

66% Fe content iron ore pellet feed product at bottom quartile

operating costs for more than 30 years on a standalone basis.

The Stage Two expansion of 18Mtpa is nominally scheduled to suit

the project mine development, construction timing and forecast cash

flow generation, and would increase the Project's total production

capacity to 30Mtpa. The product grade would increase to an even

higher premium quality 67.5% Fe content due to the addition of

18Mtpa of 68.5% Fe content iron ore pellet feed production, at an

even lower operating cost. The capital expenditure for the

additional 18Mtpa production, including contingency, could

potentially be financed from the cash flows from the Stage One

phase.

12Mtpa Stage One project cost review

The Zanaga Project Team has continually taken steps to monitor

evolving improvements into its strategy for assessing the options

available for the development of the Zanaga Project. The Project

Team has maintained its view that high quality products will

continue to achieve significant price premiums in the future and

has sought to lock in this additional revenue benefit into the

Project's development plan.

In light of the current positive market environment for high

grade iron ore products, the Jumelles shareholders considered it

sensible to obtain a "high level" indicative review of certain

costs of the Project (including costs generated by exchange rate

movements) by leading external technical consultancy firms without

any re-engineering of the Project. Jumelles commissioned a report,

led by Coffey Geotechnics Ltd (a Tetra Tech Company ("Tetra Tech"))

, to assess the potential capital and operating costs associated

with Stage One of the 30mtpa staged development project outlined in

the 2014 Feasibility Study ("2014 FS") . Since the 2014 FS was

produced, industry input costs dropped initially and have now

returned to approximately the same levels seen in 2014. The initial

review of the 2014 FS cost estimates indicates that capital and

operating costs associated with the Stage One 12Mtpa project are

broadly in line with the estimates provided in 2014.

The review indicates that as regards the costs of the 12 Mtpa

Stage One Project, the capital cost is estimated to be between 2.5%

above and 2.9% below the estimate provided in the 2014 FS.

Operating costs are expected to be approximately in line with the

estimate provided in 2014, with an estimated variance of + or -

2%.

It is encouraging to see that the costs estimated for the

construction of the Zanaga Project remain in broad alignment with

the costs outlined in the 2014 FS, especially as iron ore prices

have risen substantially beyond the levels seen in 2014, ultimately

providing the potential for significant improvement in the economic

returns of the Project. It is important to recognise that these

numbers have not yet been re-estimated to a high level of

definition and are only estimates as to the potential costs of

bringing the project into production in the current market. In

order to better define these estimates the Project Team would

require further work to be conducted ahead of considering a full

re-estimate of the 2014 FS.

The Project Team will continue to engage in activity to

ascertain opportunities for optimisation and improvement of the

30Mtpa staged development project and will update the market as

these improvements develop.

1) Overview of the process

Tetra Tech completed the high level, top-down review and update

of the Zanaga Iron Ore Stage One Feasibility Study capital and

operating cost estimates as contained in the 2014 FS.

The scope of the 2014 FS and the associated estimates is the

development of the Zanaga iron ore deposit, complete with

infrastructure for transport and seaborne loading. This update

review looked at the capital and operating costs of the front-end

engineering design (FEED) and Stage One 12Mtpa portions of the

total project.

Since the March 2014 FS study, an increase in global and

regional economic volatility, structural changes to the mining

equipment supply chain, changes in the contracting market and

changes in commodity consumption patterns have impacted the basis

of the capital and operating cost estimates with varying

effects.

The updating process relied on a variety of information sources

to define trends expressed as factored cost drivers. In some cases,

direct re-pricing of major line items were indicated. The updated

estimate is expressed in US dollars (USD), but was significantly

influenced by the exchange rate movements of the past decade,

including impacts of the Central African Franc (XAF), Euro (EUR)

and South African Rand (ZAR) rates of exchange to the USD.

The updated estimate is thus qualified and strongly impacted by

global economic insights and relative cost movements rather than

being a re-priced estimate.

2) Capital Cost

Capital expenditure is expected to range between -2.9% and +2.5%

of the 2014 Feasibility Study estimate, or between US$2,154m and

US$2,275m.

The lower estimate includes adjustments to the cost estimates

for particular items which were viewed to be overstated in the 2014

FS, or possible to reduce based on optimised procurement and

contracting to find lower costs without compromising quality.

Furthermore, the piping estimate for the process plant had been

factorised and appears significantly overstated, for which a

further adjustment of 40% reduction was made. The other adjustments

were limited to 80% of the adjustment percentage that was made in a

review conducted in 2017, since the 2020 review already includes

some consideration of the current market conditions.

Once the opportunity adjustments are applied, the estimate is

that there would be a 2.9% reduction in the capital cost estimate

provided by the 2014 FS.

It should be noted that any potential savings identified by the

Project Team through the implementation of a floating port

solution, as announced in May 2020, have not been factored into the

lower estimate provided above.

3) Operating Cost

The outcome of Tetra Tech's analysis showed that overall

operating cost is likely to fall within the range of -2% to +2%

when compared to the March 2014 estimate as contained in the 2014

FS. As such, Jumelles regards the operating costs of the 12Mtpa

Stage One project to be approximately in line with the estimate

provided in the 2014 FS.

Floating Port Concept Study

Significant opportunities have been identified for potential

cooperation between infrastructure companies and EPC contractors to

enhance the economics and technical solutions available to the

Zanaga Project - particularly the 30Mtpa Staged Development

Project.

During H1 2020 a Concept Study was completed to evaluate a

Floating Port facility for the Zanaga Project, the results of which

were announced on 28 May 2020. The solution involves extending

Zanaga's slurry pipeline straight out into the ocean, with

significantly reduced land-based facilities. The pipeline would run

along the ocean floor to a fixed mooring point where the pipeline

would connect to the floating dewatering, storage, and offloading

vessel (FDSO). The slurry would be processed onboard by a

dewatering plant and the pellet feed concentrate would be stored

within the vessel. Offloading facilities would be built into the

vessel to allow the FDSO to load cape size vessels directly. By

utilising the FDSO Zanaga's materials handling steps would be

reduced to only three phases, providing significant efficiencies

and a more seamless operation.

The FDSO evaluation process has been led by Paterson & Cooke

(P&C), who are leading experts in slurry pipeline design and

engineering. P&C have completed a concept level report

involving a comparison of the three port solutions available for

the Zanaga Project, namely transhipping, deep water port, or the

new floating port (FDSO).

The results of the investigation have been very positive from a

technical and economic perspective. Potential has been indicated

for a $184m reduction to total capital costs of the 12Mtpa Stage

One Project, resulting in a reduction of total capital cost from

$2,219m to $2,035m. Operating costs are expected to be maintained

at approximately $6.5 per tonne due to previously high transhipping

costs being substituted by a lease cost to the EPC contractor

providing the solution. The net impact on economics shows the

potential for the Floating Port to produce a significant NPV and

IRR improvement. More detailed information is available in the

Company's announcement released on 28 May 2020.

This concept study demonstrated the clear potential of a

Floating Port facility to significantly enhance the economics of

the Zanaga Project through the reduction of upfront capital costs

and increase the Internal Rate of Return. In addition, there is

potential to achieve significant ancillary technical benefits such

as reduced environmental impact, elimination of dredging, and

significant flexibility on coastal route selection. The Project's

port solution has been a challenge for the Project since the 2014

FS and we are pleased with the results of this evaluation exercise;

however additional study work would be required in order to advance

this solution to feasibility study level.

Reserves & Resource Statement

SRK Consulting (UK) Limited ("SRK") was appointed to provide

consent to the re-statement of Ore Reserves for the Zanaga Project.

The restatement exercise confirmed that the Ore Reserves reported

in April 2021 are reported in accordance with the terms and

definitions of the JORC Code and are restated to be so with an

effective date of 31 December 2020.

In rendering its opinion as expressed herein, SRK concluded:

-- That the 2014 Ore Reserves are reported in accordance with

the terms and definitions of the "The Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves published by the Joint Ore Reserves Committee of the

Australasian Institute of Mining and Metallurgy, Australian

Institute of Geoscientists and Minerals Council of Australia, as

amended (the "JORC Code (2012)"): www.jorc.org) ";

-- That the 2014 Ore Reserves remain valid as of 31 December 2020

EPP Project

The Project Team continue to undertake a process to evaluate the

potential development of an EPP Project that would be quicker to

construct than the larger 30Mtpa staged development project and

would utilise existing road, rail and port infrastructure in

Republic of Congo and/or Gabon. The Project Team continue to

advance study work in an effort to improve their understanding of

the viability of the EPP Project. The Project Team continue to

evaluate the potential for the EPP Project to operate as a

standalone project, or as an initial pathway to production during

the construction period of the flagship 30Mtpa Staged Development

Project.

COVID-19 update

Following the outbreak of the coronavirus ("COVID-19"), the

Project Team have been implementing and expanding a range of

measures to protect the health and safety of employees and

subcontractors and contribute to efforts to prevent the spread of

COVID-19 in Republic of Congo and the local communities around the

Zanaga Project.

The Project Team have continued to meet regularly to ensure that

protective measures are being taken in accordance with the advice

and guidance provided by the RoC Government. Regular communication

has been maintained with our teams and the communities around the

Project site on all matters relating to the coronavirus with a

strong emphasis on the importance of hygiene and social

distancing.

The RoC guidelines involve comprehensive measures to combat the

virus including a full lock down restricting movement of the

population that ended on May 17th. However, a curfew remains in

place daily between 8pm to 5am until mid-July and then 11 pm to 5am

until end of September 2020, which remains in place, and a number

of measures have been enacted by the Government to protect the

health of the population. The Project Team have enacted all

required procedures in order to ensure compliance with these new

regulations.

The Zanaga Project's operations involve an office in Brazzaville

and the project site at Lefoutou where the Project Team have

adopted the following steps to comply with the guidelines provided

by the RoC and provide the best support to all the Zanaga Project's

staff. No incidents of COVID-19 have been recorded among any of the

Project's employees or subcontractors. A number of steps taken by

the Project Team are provided below:

-- Health and safety rules have been reinforced and adapted in

order to prevent the spread of COVID-19 including: social

distancing, washing hand training, distribution of soap,

communication and information provided to all employees,

subcontractors and communities living in the villages surrounding

the mining concession

-- The Zanaga Project's Brazzaville office and mine site were

closed from mid-April to September 2020 with only essential

services in place and the team worked remotely where possible. The

mine site facility has now reopened and the local team remain in

RoC to oversee the continuation of operations.

-- The Lefoutou Health Centre (constructed and supported by the

Zanaga Project since July 2015): MPD Congo, local operating

subsidiary for the Zanaga Project, continues to fund the operating

costs of the Lefoutou Health Centre.

-- Gifts of protection equipment: >16,000 protective masks

have been provided to all the employees and subcontractors, the

population surrounding the mining concession and different health

centres in the area of the Project : health centre in Lefoutou and

in Bambama hospital in Sibiti and Dolisie, 2 reference hospitals in

Pointe-Noire, and some clinics in Brazzaville

Unfortunately, Covid has resulted in constraints on movement

between countries, both of personnel and goods. While this has

impacted the ability to progress certain activities in-country the

overall impact has been minimal.

Next Steps

During H2 2021, the Project Team will continue to investigate

potential opportunities for smaller scale production utilising

existing infrastructure while continuing work on progressing the

30Mtpa project.

Financial Review

Results from operations

The financial statements contain the results for the Group's

eleventh full year of operations following its incorporation on 19

November 2009. The Group made a total comprehensive loss in the

year of US$1.8m (2019: total comprehensive loss US$1.9m). The total

comprehensive income for the year comprised:

2020 2019

US$000 US$000

------------------------------------------------------------------- ------- -------

General expenses (1,074) (1,264)

Net foreign exchange (loss)/gain (25) 19

Share of loss of associate (724) (644)

Interest income - 7

------------------------------------------------------------------- ------- -------

Loss before tax (1,823) (1,882)

Currency translation 8 (6)

Share of other comprehensive income of associate -foreign exchange 3 3

------------------------------------------------------------------- ------- -------

Total comprehensive income / (loss) (1,812) (1,885)

------------------------------------------------------------------- ------- -------

General expenses of US$1.1m (2019: US$1.3m) consists of US$ nil

professional fees (2019: US$0.8m), US$ nil Directors' fees (2019:

US$0.01m), LTIP US$0.7m (2019 US$0.2m) and US$0.4m (2019: US$0.29m)

of other general operating expenses.

The share of loss of associate reflected above relates to ZIOC's

investment in the Project, through Jumelles, which, generated a

loss of US$1.3m in the year to 31 December 2020 (2019: loss

US$1.3m). During the year Jumelles spent a net US$1.4m (2019

US$1.3m) on exploration, net of a currency translation gain of

US$0.17m (2019: loss US$0.05).

Financial Position

ZIOC's Net Asset Value ("NAV") of US$37.6m (2019: US$38.1m)

comprises of US$37.4m (2019: US$37.4m) investment in Jumelles,

US$0.4m (2019: US$0.8m) of cash balances and US$0.2m (2019:

US$0.1m) of other net current liabilities.

2020 2019

US$000 US$000

--------------------------------- ------ ------

Investment in Associate 37,354 37,492

Fixed Assets - -

Cash 352 755

Net current assets/(liabilities) (126) (127)

--------------------------------- ------ ------

Net assets 37,580 38,120

--------------------------------- ------ ------

Cost of investment

The Investment in Associate relates to the carrying value of the

investment in Jumelles which as at 31 December 2020 continued to

own 100% of the Project. During 2020, under the existing 2020

Funding Agreement between the Company and Glencore, the Company

contributed a further US$0.6m (2019: US$0.6m). Though a long term

project, in the light of currently forecast market conditions, the

carrying value of the exploration asset continues to be held in

Jumelles at US$80m (2019: US$80m). The Company accounts for 50%

less one share of Jumelles.

As at 31 December 2020, Jumelles had aggregated assets of

US$81.4m (2019: US$81.4m) and aggregated liabilities of US$0.8m

(2019: US$0.5m). Assets consisted of US$80m (2019: US$80m) of

capitalised exploration assets, US$1.1m (2019: US$1.1m) of other

fixed assets, US$0.3m cash (2019: US$0.3m) and US$nil other assets

(2019: US$nil). Net of a currency translation gain of US$0.17

(2019: loss US$0.05m) a net total of US$nil (2019: US$nil) of

exploration costs were capitalised during the year.

Subscription Agreement concluded with Shard Merchant Capital

Ltd

As outlined in the Chairman's Statement above, on 25 June 2020

ZIOC entered into a Subscription Agreement with SMC, a financial

services provider. Subsequent to the launch of the SMC transaction,

21 million shares in ZIOC have been issued to SMC. As at 24th June

2021 14,750,000 ordinary shares in the Company have been

subsequently placed by SMC and the Company has received the

aggregate net sum of GBP 1 ,025,942.30 .

As at 24th June 2021, 6,250,000 ordinary shares in the Company

still remain to be placed by SMC. Pursuant to the Subscription

Agreement, SMC has undertaken to use its reasonable endeavours to

place the relevant Subscription Shares that it has subscribed for

and to pay to ZIOC 95% of the gross proceeds of any such sales.

Cash flow

Cash balances decreased by US$0.4m during 2020 (2019: decrease

of US$1.2m), net of interest income US$nil (2019: US$0.01m) and a

foreign exchange gain of US$0.02m (2019: loss of US$0.02m) on bank

balances held in UK Sterling. Additional investment in Jumelles

required under the 2020 Funding Agreement (outline details in Note

1 to the financial statements) utilised US$0.6m (2019: US$0.6m) and

operating activities utilised US$0.4m (2019: US$0.7m). The Company

raised funds of US$0.6m from the Shard facility during the

year.

Fundraising activities

The fundraising activities carried out in 2020 (2019: nil) were

those relating to the SMC facility which are described earlier in

this announcement.

Reserves & Resource Statement

The Zanaga Project has defined a 6.9bn tonne Mineral Resource

and a 2.1bn tonne Ore Reserve, reported in accordance with the JORC

Code (2012), and defined from only 25km of the 47km strike length

of the orebody so far identified.

Ore Reserve Statement

The Ore Reserve estimate (announced by the Company on 5 May

2021) was prepared by independent consultants, SRK Consulting (UK)

Ltd ("SRK") and is based on the 30Mtpa Feasibility Study and the

6,900Mt Mineral Resource (announced by the Company on 8 May

2014).

As stipulated by the JORC Code, Proven and Probable Ore Reserves

are of sufficient quality to serve as the basis for a decision on

the development of the deposit. Based on the studies performed, the

mine plan as reported in the 2014 FS was reassessed in respect of

the updated sales revenue, operating expenditure and capital

expenditures and confirmed as at 31 December 2020 to be technically

feasible and economically viable.

Ore Reserve Category Tonnes (Mt(Dry) Fe (%) SiO(2) (%) Al(2) O(3) P (%)

) (%)

---------------------- --------------- ------ ---------- ---------- -----

Proved 774 37.3 35.1 4.7 0.04

---------------------- --------------- ------ ---------- ---------- -----

Probable 1, 296 31.8 44.7 2.3 0.05

---------------------- --------------- ------ ---------- ---------- -----

Total 2,070 33.9 41.1 3.2 0.05

---------------------- --------------- ------ ---------- ---------- -----

Notes:

Long term price assumptions are based on a CFR IODEX 65%Fe

forecast of US$90tdry (USc138/dmtu) with adjustments for quality,

deleterious elements, moisture and freight.

Discount Rate 10% applied on an ungeared 100% equity basis

Mining dilution ranging between 5% and 6%

Mining losses ranging between 1% and 5%

Note: The full Ore Reserve Statement is available on the

Company's website (www.zanagairon.com)

Mineral Resource

Classification Tonnes Fe (%) SiO(2) Al(2) O(3) P (%) Mn (%) LOI

(Mt) (%) (%) (%)

---------------- ------- ------- ------- ----------- ------ ------- -----

Measured 2,330 33.7 43.1 3.4 0.05 0.11 1.46

Indicated 2,460 30.4 46.8 3.2 0.05 0.11 0.75

Inferred 2,100 31 46 3 0.1 0.1 0.9

---------------- ------- ------- ------- ----------- ------ ------- -----

Total 6,900 32 45 3 0.05 0.11 1.05

---------------- ------- ------- ------- ----------- ------ ------- -----

Reported at a 0% Fe cut-off grade within an optimised Whittle

shell representing a metal price of 130 USc/dmtu. Mineral Resources

are inclusive of Reserves. A revised Mineral Resource, prepared in

accordance with the Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves (the JORC Code, 2012

Edition) was announced on 8 May 2014 and is available on the

Company's website (www.zanagairon.com).

Note: The figures shown are rounded; they may not sum to the

subtotals shown due to the rounding used.

The Mineral Resource was estimated as a block model within

constraining wireframes based upon logged geological boundaries.

Tonnages and grades have been rounded to reflect appropriate

confidence levels and for this reason may not sum to totals

stated.

Geological Summary

The Zanaga iron ore deposit is located within a North-South

oriented (metamorphic) Precambrian greenstone belt in the eastern

part of the Chaillu Massif in South Western Congo. From airborne

geophysical survey work, and morphologically, the mineralised trend

constitutes a complex elongation in the North-South direction, of

about 47 km length and 0.5 to 3 km width.

The ferruginous beds are part of a metamorphosed,

volcano-sedimentary Itabirite/banded iron formation ("BIF") and are

inter-bedded with amphibolites and mafic schists. It exhibits

faulted and sheared contacts with the crystalline basement. As a

result of prolonged tropical weathering the BIF has developed a

distinctive supergene iron enrichment profile.

At surface there is sometimes present a high grade ore (+60%

Fe), classified as canga, of apparently limited thickness (<5m)

capping a discontinuous, soft, high grade, iron supergene zone of

structure-less hematite/goethite of limited thickness (<7m). The

base of the high-grade supergene iron zone grades quickly at depth

into a relatively thick, leached, well-weathered to moderately

weathered friable hematite Itabirite with an average thickness of

approximately 25 metres and grading 45-55% Fe.

The base of the friable Itabirite zone appears to correlate with

the moderately weathered/weakly weathered BIF boundary, and fresh

BIF comprises bands of chert and magnetite/grunerite layers.

Competent Persons

The statement in this announcement relating to Ore Reserves is

based on information compiled by Dr Iestyn Humphreys, FIMM, AIME,

PhD who is a Corporate Consultant, and Practice Leader with SRK. He

has sufficient experience relevant to the style of mineralisation

and type of deposit under consideration and to the activity he is

undertaking to qualify as a Competent Person as defined in the JORC

Code (2012). The Competent Person, Dr Iestyn Humphreys, confirms

that the Ore Reserve Estimate is accurately reproduced in this

announcement and has given his consent to the inclusion in the

report of the matters based on his information in the form and

context within which it appears.

The information in this announcement that relates to Mineral

Resources is based on information compiled by Malcolm Titley, BSc

MAusIMM MAIG, of CSA Global (UK) Ltd. Malcolm Titley takes overall

responsibility for the report as Competent Person. He is a Member

of the Australasian Institute of Mining and Metallurgy ("AUSIMM")

and has sufficient experience, which is relevant to the style of

mineralisation and type of deposit under consideration, and to the

activity he is undertaking, to qualify as a Competent Person in

terms of the JORC Code. The Competent Person, Mr Malcolm Titley,

has reviewed this Mineral Resource statement and given his

permission for the publication of this information in the form and

context within which it appears .

Definition of JORC Code

The Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves (2012) as published by the Joint

Ore Reserves Committee of the Australasian Institute of Mining and

Metallurgy, Australian Institute of Geoscientists and Minerals

Council of Australia.

Principal Risks & Uncertainties

The principal business of ZIOC currently comprises managing

ZIOC's interest in the Zanaga Project, including the Jumelles

group, and monitoring the development of the Project and engaging

in discussions with potential investors. The principal risks facing

ZIOC are set out below. Risk assessment and evaluation is an

essential part of the Group's planning and an important aspect of

the Group's internal control system. Overall these potential risks

have remained broadly constant over the past year with the

exception of the implications of COVID-19 on the long term outlook

for the iron ore market.

Risks relating to the agreement with Glencore and development of

the Zanaga Project

The Zanaga Project is majority controlled at both a shareholder

and director level by Glencore. The ability of the Company to

control the Zanaga Project and its operations and activities,

including the future development of the Project (including any

variant such as an EPP development) and the future funding

requirements of Jumelles, is therefore limited.

The future development of the mine and related infrastructure

(including any variant such as an EPP development) will be

determined by the Jumelles board. There can be no certainty that

the Jumelles board will approve the construction of the mine and

related infrastructure or any variant thereof such as an EPP

development, including the taking of preparatory steps associated

with the construction of the mine and related infrastructure, such

as front end engineering and design, or the undertaking of work

needed to assess the viability of an EPP development or any

component part of an EPP development.

Risks relating to future funding of the Zanaga Project

Under the Joint Venture Agreement between the Company, Glencore

and Jumelles of 3 December 2009, as amended (the "JVA"), there is

no obligation on the Company or Glencore to provide further funding

to Jumelles. The Company and Glencore have reached agreement on a

work programme and funding of the Zanaga Project for 2021. As such

agreement relates to 2021, there is a risk that after 31 December

2021 Jumelles may be subjected to funding constraints and this

could have an adverse impact upon the Project. Moreover,

discretionary amounts are contained in the 2021 work programme and

budget; these require the joint approval of ZIOC and Glencore. It

is possible that as regards certain items, joint approval would not

be forthcoming.

Risks relating to iron ore prices, markets and products

The ability to raise finance for the Project is largely

dependent on movements in the price of iron ore. Iron ore prices

have historically been volatile and are primarily affected by the

demand for and price of steel and the level of supply of iron ore.

Such prices are also affected by numerous other factors beyond the

Company's and the Jumelles group's control, including the relative

exchange rate of the U.S. dollar with other major currencies,

global and regional demand, political and economic conditions,

production levels and costs and transportation costs in major iron

ore producing regions.

While it appears to be the case that there has been some degree

of stabilisation of iron ore prices in the global market for iron

ore, the duration of such stabilisation remains uncertain. The

level of iron ore prices in the global market for iron ore

continues to be subject to uncertainty, particularly in light of

the impact of the COVID 19 pandemic. Although the 2014 FS

identifies the product from the Project and the potential demand

for such product within a range of iron ore prices, there are no

assurances that the demand for the Project's product will be

sufficient in quantity or in price to ensure the economic viability

of the Project or to enable finance for the development of the

Project to be raised. Furthermore, the range of iron ore prices in

the 2014 FS will need to be reviewed so as to reflect changed

market conditions and changed expectations relating to the supply

and demand for iron ore.

Risks relating to an EPP

For some considerable period, an initiative has been and is

being carried out to investigate the possibility of a low-cost

small scale start-up, using existing infrastructure, focussing on a

standard 62% Fe benchmark iron ore product or a high grade 65% Fe

pellet feed iron ore product that would involve simple 'processing'

applications. In conjunction with this, the possibility of a

low-cost small scale start-up involving the production of a pellet

feed concentrate and conventional pelletisation continues to be

investigated. This initiative also involves the assessment of

methods of providing the necessary power requirements as well as

logistical support to enable the product to be transported to an

available exit port. There will also be the need to put in place

the appropriate contractual and permitting arrangements. There is a

risk that such kind of start-up is found not to be viable or is not

proceeded with for other reasons or is delayed.

Risks relating to financing the Zanaga Project

Any decision of the Jumelles board to proceed with construction

of the mine and related infrastructure (or any variant such as a

low capital cost, small scale start-up EPP Project) is itself

dependent upon the ability of Jumelles to raise the necessary debt

and equity to finance such construction and the initial operation

of the mine (or any variant such as a low-cost small scale

start-up). Jumelles may be unable to obtain debt and/or equity

financing in the amounts required, in a timely manner, on

favourable terms or at all and should this occur, it is highly

likely to pose challenges to the proposed development of the Zanaga

Project and the proposed timeline for its development. Moreover,

the global credit environment may pose additional challenges to the

ability of Jumelles to secure debt finance or to secure debt

finance on acceptable terms, including as to rates of interest.

Risks relating to financing of the Company

The Company will not generate any material income until an

operating stage of the Project has been constructed and mining and

export of the iron ore has successfully commenced at commercial

volumes. In the meantime the Company will continue to expend its

cash reserves. Should the Company seek to raise additional finance,

it may be unable to obtain debt and/or equity financing in the

amounts required, in a timely manner, on favourable terms or at

all.

If construction of the mine and related infrastructure proceeds

(including any preparatory steps associated with the construction

of the mine and related infrastructure) or any small scale start-up

proceeds, and ZIOC elects to fund its pro rata equity share of

construction capital expenditure, there is no certainty as to its

ability to raise the required finance or the terms on which such

finance may be available.

If ZIOC raises additional funds (including for the purpose of

funding the construction of the Project or any part of the Project,

including any small-scale start-up) through further issuances of

securities, the holders of ordinary shares could suffer significant

dilution, and any new securities that ZIOC issues could have

rights, preferences and privileges superior to those of the holders

of the ordinary shares.

If the Company fails to generate or obtain sufficient financial

resources to develop and operate its business, this could

materially and adversely affect the Company's business, results of

operations, financial condition and prospects.

Risk relating to Ore Reserves estimation

Ore Reserves estimates include diluting materials and allowances

for losses, which may occur when the material is mined. Appropriate

assessments and studies have been carried out and include

consideration of and modification by realistically assumed mining,

metallurgical, economic, marketing, legal, environmental, social

and governmental factors. These assessments demonstrate at the time

of reporting that extraction could reasonably be justified. Ore

Reserve estimates are by their nature imprecise and depend, to a

certain extent, upon statistical inferences and assumptions which

may ultimately prove unreliable. Estimated mineral reserves or

mineral resources may also have to be recalculated based on changes

in iron ore or other commodity prices, further exploration or

assessment or development activity and/or actual production

experience.

Host country related risks

The operations of the Zanaga Project are located mainly in the

RoC. These operations will be exposed to various levels of

political, regulatory, economic, taxation, environmental and other

risks and uncertainties. As in many other countries, these

(varying) risks and uncertainties can include, but are not limited

to: political, military or civil unrest; fluctuations in global

economic and market conditions impacting on the economy; terrorism;

hostage taking; extreme fluctuations in currency exchange rates;

high rates of inflation; labour unrest; nationalisation; changes in

taxation; illegal mining; restrictions on foreign exchange and

repatriation. In addition, the RoC is an emerging market and, as a

result, is generally subject to greater risks than in the case of

more developed markets.

HIV/AIDS, malaria and other diseases are prevalent in the RoC

and, accordingly, the workforce of the ZIOC group and of the

Jumelles group will be exposed to the health risks associated with

the country. The operating and financial results of such entities

could be materially adversely affected by the loss of productivity

and increased costs arising from any effect of HIV/AIDS, malaria

and other diseases on such workforce and the population at

large.

Weather conditions in the RoC can fluctuate severely.

Rainstorms, flooding and other adverse weather conditions are

common and can severely disrupt transport in the region where the

Jumelles group operates and other logistics on which the Jumelles

group is dependent.

The host country related risks described above could be relevant

both as regards day-to-day operations and the raising of debt and

equity finance for the Project. The occurrence of such risks could

have a material adverse effect on the business, prospects,

financial condition and results of operations of the Company and/or

the Jumelles group.

Risks relating to the Project's licences and the regulatory

regime

The Project's Mining Licence was granted in August 2014 and a

Mining Convention has been entered into. With effect from 20 May

2016, the Zanaga Mining Convention has been promulgated as a law of

the RoC, following ratification by the Parliament of the RoC and

publication in the Official Gazette.

The holder of a mining licence is required to incorporate a

Congolese company to be the operating entity and the Congolese

Government is entitled to a free participatory interest in projects

which are at the production phase. This participation cannot be

less than 10%. Under the terms of the Mining Convention, there is a

contingent statutory 10% free participatory interest in favour of

the Government of the RoC as regards the mine operating company and

a contingent option for the Government of the RoC to buy an

additional 5% stake at market price.

The granting of required approvals, permits and consents may be

withheld for lengthy periods, not given at all, or granted subject

to conditions which the Jumelles group may not be able to meet or

which may be costly to meet. As a result, the Jumelles group may

incur additional costs, losses or lose revenue and its business,

result of operations, financial condition and/or growth prospects

may be materially adversely affected. Failure to obtain, renew,

enforce or comply with one or more required approvals, permits and

consents could have a material adverse effect on the business,

prospects, financial condition and results of operations of the

Company and/or the Jumelles group. Mitigation of such risks is in

part dependent upon the terms of the Mining Convention and

compliance with its terms.

Transportation and other infrastructure

The successful development of the Project (including any

low-cost small scale start-up) depends on the existence of adequate

infrastructure and the terms on which the Project can own, use or

access such infrastructure. The region in which the Project is

located is sparsely populated and difficult to access. Central to

the Zanaga Project becoming a commercial mining operation is access

to a transportation system through which it can transport future

iron ore product to a port for onward export by sea. In order to

achieve this it will be necessary to access a port at

Pointe-Indienne, which is still to be constructed, or some other

exit port in the case of a low-cost small scale start-up.

The nature and timing of construction of the proposed new port

are still under discussion with the government of the RoC and other

interested parties. In relation to the pipeline and Project

facilities at the proposed new port and (to the extent needed)

other infrastructure, the necessary permits, authorisations and

access, usage or ownership rights have not yet been obtained.

Failure to construct the proposed pipeline and/or facilities at

the proposed new port and/or other needed infrastructure or a

failure to obtain access to and use of the proposed new port and/or

other needed infrastructure or a failure to do this in an

economically viable manner or in the required timescale could have

a material adverse effect on the Project.

In the case of a low-cost small scale start-up, failure to put

in place the necessary logistical requirements (including trucking,

rail transportation and port facilities) and/or other needed

infrastructure or a failure to obtain access to and use of the

proposed logistical requirements or a failure to do this in an

economically viable manner or in the required timescale could have

a material adverse effect on the Project.

The availability of reliable and continuous delivery of

sufficient quantity of power to the Project at an affordable price

will also be a significant factor on the costs at which iron ore

can be produced and transported to any proposed exit port and will

impact on the economic viability of the Project.

Reliable and adequate infrastructure (including an outlet port,

roads, bridges, power sources and water supplies) are important

determinants which affect capital and operating costs and the

ability of the Jumelles group to develop the Project, including any

low-cost small scale start-up. Failure or delay in putting in place

or accessing infrastructure needed for the development of the

Zanaga Project could have a material adverse effect on the

business, prospects, financial condition and results of operations

of the Company and/or the Jumelles group.

Risks associated with access to land

Pursuant to the laws of the RoC, mineral deposits are the

property of the government with the ability to purchase surface

rights. Generally speaking, the RoC has not had a history of native

land claims being made against the state's title to land. There is

no guarantee, however, that such claims will not occur in the

future and, if made, such claims could have a deleterious effect on

the progress of development of the Project and future

production.

The Mining Convention envisages that the RoC will carry out a

process to expropriate the land required by the Zanaga Project and

place such land at the disposal of the holder of the Mining Licence

in order to build the mine and the infrastructure, including the

pipeline, required for the realisation of the Zanaga Project. This

means that the rights of the Jumelles company which holds the

Mining Licence to the relevant land will be subject to negotiation

between the Congolese government and such company. Alternatively,

if the land is not declared DUP (i.e. is expropriated by the State

under its sovereign powers) then the Jumelles group will have to

reach agreement with the local land owners which may be a more time

consuming and costly process.

Risks relating to timing

Any delays in (i) obtaining rights over and access to land and

infrastructure; (ii) obtaining the necessary permits and

authorisations; (iii) the construction or commissioning of the

mine, the pipeline or facilities at or offshore an exit port or

power transmission lines or other infrastructure; or (iv)

negotiating the terms of access to the exit port and supply of

power and other infrastructure (including an offshore loading

facility); or (v) raising finance to fund the development of the

mine and associated infrastructure, could prevent altogether or

impede the development of the Zanaga Project, including the ability

of the Zanaga Project to export its future iron ore products

whether on the anticipated timelines or at projected volumes and

costs or otherwise. Such delays or a failure to complete the

proposed infrastructure or the terms of access to infrastructure or

to do this in an economically viable manner, could have a material

adverse effect on the business, results of operations, financial

condition and prospects of the Company and/or the Jumelles

group.

Environmental risks

The operations and activities of the Zanaga Project are subject

to potential risks and liabilities associated with the pollution of

the environment and the disposal of waste products that may occur

as a result of its mineral exploration, development and production,

including damage to preservation areas, over-exploitation and

accidental spills and leakages. Such potential liabilities include

not only the obligation to remediate environmental damage and

indemnify affected third parties, but also the imposition of court

judgments, administrative penalties and criminal sanctions against

the relevant entity and its employees and executive officers.

Awareness of the need to comply with and enforcement of

environmental laws and regulations continues to increase.

Notwithstanding precautions taken by entities involved in the

development of the Project, breaches of applicable environmental

laws and regulations (whether inadvertent or not) or environmental

pollution could materially and adversely affect the financial

condition, business, prospects and results of operations of the

Company and/or the Jumelles group.

Health and safety risks

The Jumelles group is required to comply with a range of health

and safety laws and regulations in connection with its business

activities (including laws and regulations relating to the COVID-19

pandemic) and will be required to comply with further laws and

regulations if and when construction of the Project commences and

the mine goes into operation. A violation of health and safety laws

relating to the Jumelles group and/or the Project's operations, or

a failure to comply with the instructions of the relevant health

and safety authorities, could lead to, amongst other things, a

temporary shutdown of all or a portion of the business activity of

the Jumelles group and/or the Project's operations or the

imposition of costly compliance measures. Where health and safety

authorities and/or the RoC government require the business activity

of the Jumelles group and/or the Project to shut down or reduce all

or a portion of its activities of operations or to implement costly

compliance measures, whether pursuant to applicable health and

safety laws and regulations, or the more stringent enforcement of

such laws and regulations, such measures could have a material

adverse effect on the financial condition, business, prospects,

reputation and results of operations of the Company and/or the

Jumelles group.

COVID-19

The duration of COVID-19 pandemic and its potential or actual

impact upon global markets, countries, populations and businesses

is still uncertain. As a result of the measures taken by the

government and other authorities in the RoC, the business and other

activities of governmental agencies and authorities, of business

enterprises and of individuals has been affected. The impact that

this situation could have upon the business activities of the

Jumelles group and its personnel as well as the risks, is being

monitored. While the Jumelles group would seek to manage such

situation and to minimise the risks, there is the possibility that

the Project and the business activities of the Jumelles group could

be adversely affected by the COVID-19 pandemic and its impact upon

global markets and upon countries. Such adverse effect could

include there being constraints on the movement of people and goods

across borders and within countries. Additionally, these factors

could adversely affect and place constraints on ZIOC and its own

business activities. As noted within note [17] of the financial

statements, the outbreak thus far has had no material impact upon

the business operation or financial situation of the Company.

Risks relating to third party claims

Due to the nature of the operations to be undertaken in respect

of the development of the Zanaga Project, there is a risk that

substantial damage to property or injury to persons could be

sustained during such development. Any such damage or injury could

have a material adverse effect on the financial condition,

business, prospects, reputation and results of operations of the

Company and/or the Jumelles group.

Risks relating to outsourcing

The 2014 FS envisages that certain aspects of the Zanaga Project

will be carried out by third parties pursuant to contracts to be

negotiated with such third parties. Any low-cost small scale

start-up is also likely to involve the undertaking of various key

elements of the Project by third parties. There is a risk that

agreement might not be reached with such third parties or that the

terms of any such agreement are more stringent than currently

anticipated; this could adversely impact upon the Project and/or

the proposed timescale for carrying out the Project.

Fluctuation in exchange rates

The Jumelles group's functional and reporting currency is the

U.S. dollar, and most of its in country costs are and will be

denominated in CFA francs and Euros. Consequently, the Jumelles

group must translate the CFA franc and Euro denominated assets and

liabilities into U.S. dollars. To do so, non-U.S. dollar

denominated monetary assets and liabilities are translated into

U.S. dollars using the closing exchange rate at the reporting

period end date. Consequently, increases or decreases in the value

of the U.S. dollar versus the Euro (and consequently the CFA franc)

and other foreign currencies may affect the Jumelles group's

financial results, including its assets and liabilities in the

Jumelles group's balance sheets. These factors will affect the

financial results of the Company. In addition, ZIOC holds the

majority of its funds in Pounds Sterling, and incurs the majority

of its corporate costs in Pounds Sterling, but its contributions to

funding the Jumelles group in 2020 and 2021 are calculated in U.S.

dollars. Consequently, any fluctuation in exchange rates between

Pounds Sterling versus the U.S. dollar or the Euro, could also

adversely affect the financial results of the Company.

Cash resources

The Company has limited cash resources. Although the Company has

taken steps to conserve and replenish its cash resources, there is

a risk that a shortage of such cash resources will adversely affect

the Company. Such shortage could result in further expenditure cuts

being introduced by the Company, both in its internal and its

external operations. Volatile and uncertain economic global

conditions in means that there can be no certainty as to when the

Zanaga resource is likely to be developed. The challenging economic

conditions as well as difficulties of monetising this resource

given its location impact upon the ability of the Jumelles group to

raise new finance for the Project as well as on the Company's

ability to raise new finance for itself. The Company's existing

cash resources may continue to come under increasing pressure

unless a more predictable investment, travel and trading climate

materialises in the foreseeable future which benefits the Project

and the Company can take steps which result in an improvement of

its financial position.

Financial Statements

Consolidated statement of comprehensive Income

for year ended 31 December 2020

2020 2019

Note US$000 US$000

--------------------------------------------------------------------------------- ---- ------- -------

Administrative expenses (1,099) (1,245)

Share of loss of associate 6b (724) (644)

--------------------------------------------------------------------------------- ---- ------- -------

Operating loss (1,823) (1,889)

Interest income - 7

Loss before tax (1,823) (1,882)

Taxation 5 -

--------------------------------------------------------------------------------- ---- ------- -------

Loss for the year (1,823) (1,882)

--------------------------------------------------------------------------------- ---- ------- -------

Items that will not be reclassified subsequently to profit or loss:

Share of other comprehensive income of associate - foreign exchange translation 8 3

Items that may be reclassified subsequently to profit or loss:

Foreign exchange translation - foreign operations 6b 3 (6)

--------------------------------------------------------------------------------- ---- ------- -------

Other comprehensive income/(loss) 11 (3)

--------------------------------------------------------------------------------- ---- ------- -------

Total comprehensive loss (1.812) (1,885)

--------------------------------------------------------------------------------- ---- ------- -------

(Loss) per share

Basic (Cents) 12 (0.6) (0.7)

Diluted (Cents) 12 (0.6) (0.7)

Loss and total comprehensive loss for the year is attributable

to the equity holders of the Parent Company.

The notes form an integral part of the financial statements.

Consolidated statement of financial position

for year ended 31 December 2020

2020 2019

Note US$000 US$000

------------------------------------------------------------ ---- --------- ---------

Non-current assets

Property, plant and equipment 6a - -

Investment in Associate 6b 37,354 37,492

------------------------------------------------------------ ---- --------- ---------

37,354 37,492

------------------------------------------------------------ ---- --------- ---------

Current assets

Other receivables 7 58 48

Cash and cash equivalents 8 352 755

------------------------------------------------------------ ---- --------- ---------

410 803

------------------------------------------------------------ ---- --------- ---------

Total Assets 37,764 38,295

------------------------------------------------------------ ---- --------- ---------

Current liabilities

Trade and other payables 9 (184) (175)

------------------------------------------------------------ ---- --------- ---------

Net assets 37,580 38,120

------------------------------------------------------------ ---- --------- ---------

Equity attributable to equity holders of the Parent Company

Share capital 10 268,864 267,592

Accumulated deficit (234,617) (232,794)

Foreign currency translation reserve 3,333 3,322

------------------------------------------------------------ ---- --------- ---------

Total equity 37,580 38,120

------------------------------------------------------------ ---- --------- ---------

The notes form an integral part of the financial statements.

These financial statements were approved by the Board of

Directors on 29 June 2021 and were signed on its behalf by:

Mr Clifford Elphick

Director

Consolidated statement of changes in equity

for year ended 31 December 2020

Foreign

currency

Share Accumulated translation Total

capital deficit reserve Equity

US$000 US$000 US$000 US$000

--------------------------------------- ------- ----------- ----------- -------

Balance at 1 January 2019 267,012 (230,912) 3,319 39,419

Consideration for share-based payments 580 - - 580

Loss for the year - (1,882) - (1,882)

Other comprehensive income - - 3 3

--------------------------------------- ------- ----------- ----------- -------

Total comprehensive loss - (1,882) 3 (1,879)

--------------------------------------- ------- ----------- ----------- -------

Balance at 31 December 2019 267,592 (232,794) 3,322 38,120

--------------------------------------- ------- ----------- ----------- -------

Balance at 1 January 2020 267,592 (232,794) 3,322 38,120

Issued Capital 565 - - 565

Consideration for share-based payments 707 - - 707

Loss for the year - (1,823) - (1,823)

Other comprehensive income / (loss) - - 11 11

--------------------------------------- ------- ----------- ----------- -------

Total comprehensive loss - (1,823) 113 (1,812)

--------------------------------------- ------- ----------- ----------- -------

Balance at 31 December 2020 268,864 (234,617) 3,333 37,580

--------------------------------------- ------- ----------- ----------- -------

Consolidated cash flow statement

for year ended 31 December 2020

2020 2019

Note US$000 US$000

------------------------------------------------ ------ ------- -------

Cash flows used in operating activities

Loss for the year (1,823) (1,882)

Adjustments for:

Interest receivable - (7)

Decrease/(Increase) in other receivables (11) 41

Increase in trade and other payables 9 100

Share based payments 707 580

Net exchange loss 25 19

Share of Loss in associate 724 644

Net cash used in operating activities (369) (505)

------------------------------------------------ ------ ------- -------

Cash flows generated by financing activities -

Proceeds from share issuance 564 -

------------------------------------------------ ------ ------- -------

Net cash flow generated by financing activities 564 -

------------------------------------------------ ------ ------- -------

Cash flows used in investing activities

Interest received - 7

Investment in Associate (578) (689)

------------------------------------------------ ------ ------- -------

Net cash used in investing activities (578)) (682)

------------------------------------------------ ------ ------- -------

Net decrease in cash and cash equivalents (383) (1,187)

Cash and cash equivalents at beginning of year 755 1,955

Effect of exchange rate difference (20) (13)

------------------------------------------------ ------ ------- -------

Cash and cash equivalents at end of year 8 352 755

------------------------------------------------ ------ ------- -------

The notes form an integral part of the financial statements.

Notes to the financial statements

1 Business information and going concern basis of

preparation

Background

Zanaga Iron Ore Company Ltd (the "Company"), was incorporated on

19 November 2009 under the name of Jumelles Holdings Limited. The

Company changed its name on 1 October 2010. The Company is

incorporated in the British Virgin Islands ("BVI") and the address

of its registered office, is situated at 2nd Floor, Coastal

Building, Wickham's Cay II, Road Town, P.O. Box 2221, Tortola,

British Virgin Islands. On 18 November 2010, the Company's share

capital was admitted to trading on the AIM Market ("AIM") of the

London Stock Exchange ("Admission"). The Company's principal place

of business as an investment holding vehicle is situated in

Guernsey, Channel Islands.

At 31 December 2010 the Company held 100% of the share capital

of Jumelles Limited subject to the then Call Option.

On 14 March 2011 the Company incorporated and acquired the

entire share capital of Zanaga UK Services Limited for US$2, a

company registered in England and Wales which provides investor

management and administrative services.

In 2007, Jumelles became the special purpose holding company for

the interests of its then ultimate 50/50 founding shareholders,

Garbet Limited ("Garbet") and Guava Minerals Limited ("Guava"), in

MPD Congo which, owns and operates 100% of the Zanaga Project in

the RoC (subject to a minimum 10% free carried interest in MPD

Congo in favour of the Government of the RoC).

In December 2009 Garbet and Guava contributed their then

respective 50/50 joint shareholding in Jumelles to the Company.

Guava is majority owned by African Resource Holdings Limited