J.P. Morgan Sees Alumina Rally Running Out of Steam -- Market Talk

01 August 2014 - 10:05AM

Dow Jones News

2335 GMT [Dow Jones] Alumina Ltd.'s (AWC.AU) valuation is

looking a little stretched after a circa-45% lift in shares

year-to-date, says J.P. Morgan analyst Lyndon Fagan, who cuts the

stock's rating to underweight from neutral. "While we recognize a

lack of identifiable catalysts to drive a share price derating, we

believe an underweight recommendation is now justified based on

stretched valuation metrics versus mining sector peers such as Rio

Tinto PLC (RIO)," he says. AWC is also facing shrinking margins,

with spot alumina prices down and the Australian dollar stronger,

he says. Fagan has a price target of A$1.50 on the stock. AWC last

traded at A$1.605 a share. (rhiannon.hoyle@wsj.com; Twitter:

@RhiannonHoyle)

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

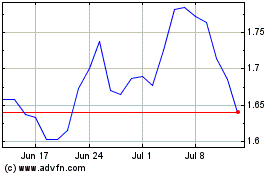

Alumina (ASX:AWC)

Historical Stock Chart

From Dec 2024 to Jan 2025

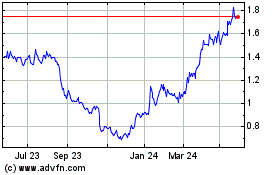

Alumina (ASX:AWC)

Historical Stock Chart

From Jan 2024 to Jan 2025