Brambles Calls Out Economic Uncertainty as 1st Half Profit Drops

17 February 2020 - 9:22AM

Dow Jones News

By Stuart Condie

SYDNEY--Logistics company Brambles Ltd. reported a 13% fall in

half-year profit against a backdrop of what its chief executive

called increasing political instability and macroeconomic

uncertainty.

Brambles reported a net profit of US$277.9 million for the six

months through December, down from US$$319.8 million a year

earlier, largely due to the absence of the year-ago period's

contribution from its offloaded reusable plastic containers

business.

Underlying profit, a measure of continuing operations that

strips out financing costs, tax and discontinued items, rose by 8%

to US$278.9 million, on a constant currency basis in the half-year

period.

Half-year revenue rose by an above-guidance 7% to US$2.40

billion after stripping out the impact of currency swings, in line

with management's expectation for sales growth of mid-single digits

through the cycle.

Brambles said Monday that global transport and lumber inflation

had moderated compared to a year ago. Combined with supply chain

efficiencies, that helped offset anticipated direct cost increases

in the U.S. and higher indirect costs across the group.

Labor and property related inflation and temporary

inefficiencies during the rollout of Brambles' automation program

drove an increase in plant costs in the U.S.

Brambles said Monday underlying profit growth across the

full-year was expected to be in line with sales revenue growth.

"Our operating environment in the first half was characterized

by increasing macroeconomic uncertainty and ongoing political

instability, particularly evident in major European markets," Chief

Executive Graham Chipchase said.

"Our first-half sales performance reflects the resilient nature

of our business."

Directors cut the interim dividend to 13.38 Australian cents

from 14.50 cents a year earlier.

Brambles shares have largely recovered from the 15% selloff that

followed its fiscal 2019 result and cautious outlook due to an

economic slowdown in major markets. Investors have seen the stock

as a defensive exposure to developed market and consumable

products, with limited exposure to Asia and the coronavirus.

That shortlived retreat represented a dip in a largely steady

share price improvement since a rare profit warning and hefty

writedowns in the 2017 fiscal year. Asset sales have steadied

Brambles' share price, although labor shortages in key markets and

import tariffs have bitten.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

February 16, 2020 17:07 ET (22:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

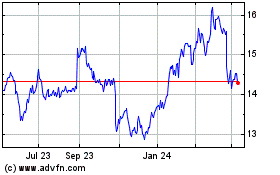

Brambles (ASX:BXB)

Historical Stock Chart

From Dec 2024 to Jan 2025

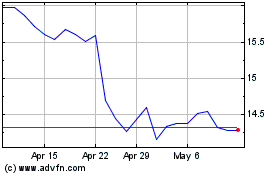

Brambles (ASX:BXB)

Historical Stock Chart

From Jan 2024 to Jan 2025