Asian Shares Broadly Down, Tracking U.S. Weakness

26 October 2016 - 4:30PM

Dow Jones News

Shares in Asia were broadly lower early Wednesday, tracking

declines on Wall Street that followed disappointing earnings

reports and weak economic data, with Australia leading the region

downward.

Japan's Nikkei Stock Average reversed early losses to trade

flat, Korea's Kospi was 1.4% lower, New Zealand's NZX 50 dropped

1.5%, Hong Kong's Hang Seng Index was down 0.8% and the Shanghai

Composite Index was off 0.4%.

Australia's S&P/ASX 200 slid 1.8% to its lowest level in a

month, led by financial and commodity stocks, as economic data

boosted the local dollar. Australia's third-quarter consumer-price

index, released early Wednesday, was up 0.7% from the second

quarter and 1.3% from a year earlier, beating the expected 0.5% and

1.1%, respectively. The Australian currency gained 0.6% against the

dollar following the data release, weighing on exporters.

"I don't think it's going to surprise anyone, this number, but

certainly the idea is now that rate cuts are off the table," said

Chris Weston, chief market strategist at IG Markets.

Australia's financial stocks were down markedly, with

Commonwealth Bank of Australia falling 1.7%, National Australia

Bank off 1.5% and Westpac Banking and Australia and New Zealand

Banking Group both 1.3% lower. Those four account for roughly a

third of the benchmark index.

"There is concern about holding bank equity today and that may

be a reflection of the outlook for dividends for the banks," said

Mr. Weston.

Elsewhere, share markets were hit by weak earnings in the U.S.,

where Under Armour shares fell 13% after the athletic-apparel maker

tempered its growth expectations and Whirlpool dropped 11% after

the company said sales and profit fell more than expected. The

Nasdaq fell 0.5% on Tuesday, while the Dow Jones Industrial Average

was off 0.3%.

Overnight, Apple notched its third consecutive quarterly

earnings decline and a 9% drop in revenue from a year earlier; its

shares were down more than 2% in after-hours trading. Taiwanese

technology companies, many of which are key suppliers to Apple,

felt the pain. Wistron Corp. was down 1.3%, underperforming the

main Taiex index, which fell 0.2%, and chip giant TSMC was down

1%.

Additionally, consumer-confidence data out of the U.S. suggested

that households there remain cautious in a year of lagging growth

and looming presidential elections. The U.S. Conference Board said

Tuesday its index of consumer confidence dropped to 98.6 in October

from 103.5 in September. Economists surveyed by The Wall Street

Journal had expected 101.2.

Oil prices slipped lower, hurting energy stocks across the

region. Brent, the global crude-oil benchmark, was recently down

1.1% at $50.23 a barrel. In Australia, Santos was down 3.1%, Oil

Search fell 2.9% and Woodside Petroleum declined 2.1%. Among Hong

Kong-traded shares, Chinese offshore oil giant Cnooc and oil

refiner Sinopec both shed 2.2%. In Japan, oil explorer Inpex Cop.

was off 1.6%.

Looking ahead, traders are zeroing in on next month's U.S.

presidential election and coming global central bank meetings.

According to CME Group's FedWatch tool, the probability of a

Federal Reserve rate increase in December has risen to 78.5%, up

from 73.7% on Tuesday.

"I feel we're having the calm before the storm," said

Christoffer Moltke-Leth, director of global sales trading at Saxo

Capital Markets. "We have huge risk events coming up."

Saumya Vaishampayan, Ira Iosebashvili, Kosaku Narioka and Akane

Otani contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

October 26, 2016 01:15 ET (05:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

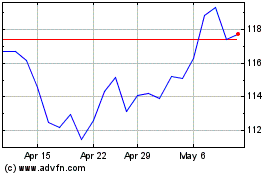

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Feb 2024 to Feb 2025