Commonwealth Bank to Sell Stake in Wealth Management Arm to KKR

13 May 2020 - 9:44AM

Dow Jones News

By Alice Uribe

SYDNEY--Commonwealth Bank of Australia has agreed to sell a 55%

stake in its wealth management arm Colonial First State to global

investment firm KKR & Co. Inc. as it moves to simplify its

business.

The bank, Australia's biggest by market value, said the

transaction implies a total valuation for CFS of 3.3 billion

Australian dollars (US$2.1 billion). CBA expects to receive cash

proceeds of approximately A$1.7 billion from KKR.

On Wednesday, the bank reported an unaudited net profit of about

A$1.3 billion Australian in the three months through March. No

comparable figure was released, but it represents a drop of about

26% from the A$1.75 billion profit reported a year ago.

Cash earnings--the measure followed by analysts that strips out

items including hedging volatility and losses or gains on

acquisitions and asset sales--totalled A$1.3 billion.

The bank also lifted its provisions amid the ongoing Covid-19

pandemic, adding an additional loan loss provision of A$1.5

billion. Total provisions now stand at A$6.4 billion, representing

a coverage ratio of 1.65% to total credit risk weighted assets.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

May 12, 2020 19:29 ET (23:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

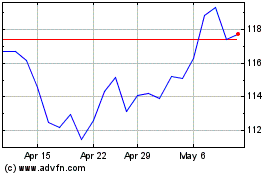

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Commonwealth Bank Of Aus... (ASX:CBA)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Commonwealth Bank Of Australia (Australian Stock Exchange): 0 recent articles

More Commonwealth Bank Of Australia News Articles