Wells Fargo Enters Agreement with Computershare to Sell Wells Fargo Corporate Trust Services

24 March 2021 - 9:49AM

Business Wire

Wells Fargo & Company (NYSE: WFC) today announced it has

entered into a definitive agreement to sell its Corporate Trust

Services (CTS) business to Computershare. The transaction is

expected to close in the second half of 2021, subject to customary

closing conditions. Under the terms of the agreement, the purchase

price is $750 million.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210323006085/en/

(Photo: Wells Fargo)

Wells Fargo’s CTS business provides a wide variety of trust and

agency services in connection with debt securities issued by public

and private corporations, government entities, and the banking and

securities industries. It is annually ranked among the top service

providers in most league tables by deal count and dollars

serviced.

“This transaction is consistent with Wells Fargo’s strategy of

focusing on businesses that are core to our consumer and corporate

clients,” said David Marks, head of Wells Fargo Commercial Capital.

“Additionally, we believe that Computershare’s similar approach to

service and their emphasis on innovative product development will

be valuable to our clients and Corporate Trust Services colleagues

in the future,” he added.

With decades of experience and 2,300 clients across North

America in a variety of industries, Computershare brings a

long-term commitment to the business, along with a market-leading

client services approach. It is also the largest Title Custodian

service provider in the Canadian Mortgage-Backed Securities

industry. Computershare’s Frank Madonna will lead the integration,

as approximately 2,000 CTS employees across the U.S. are expected

to transfer to the company as part of the acquisition.

“We’re excited to welcome these new employees to the

Computershare family. We know they are interested in the same

things we’re passionate about: providing excellent customer

service, supporting diversity and inclusion efforts, and giving

back to local communities,” said Madonna. “We’re confident that as

our businesses come together following the closing, our client

proposition will be second to none in North America,” he added.

Wells Fargo Securities LLC served as exclusive financial

advisor, and Sullivan & Cromwell LLP served as legal counsel to

Wells Fargo.

About Wells Fargo

Wells Fargo & Company is a leading financial services

company that has approximately $1.9 trillion in assets and proudly

serves one in three U.S. households and more than 10% of all middle

market companies in the U.S. We provide a diversified set of

banking, investment, and mortgage products and services, as well as

consumer and commercial finance, through our four reportable

operating segments: Consumer Banking and Lending, Commercial

Banking, Corporate and Investment Banking, and Wealth and

Investment Management. Wells Fargo ranked No. 30 on Fortune’s 2020

rankings of America’s largest corporations. In the communities we

serve, the company focuses its social impact on building a

sustainable, inclusive future for all by supporting housing

affordability, small business growth, financial health, and a

low-carbon economy. News, insights, and perspectives from Wells

Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com |

Twitter: @WellsFargo.

About Computershare Limited

Computershare (ASX: CPU) is a global market leader in transfer

agency and share registration, employee equity plans, mortgage

servicing, proxy solicitation, and stakeholder communications. We

also specialize in corporate trust, bankruptcy, class action, and

utility administration, and a range of other diversified financial

and governance services.

Founded in 1978, Computershare is renowned for its expertise in

high integrity data management, high volume transaction processing

and reconciliations, payments, and stakeholder engagement. Many of

the world's leading organizations use us to streamline and maximize

the value of relationships with their investors, employees,

creditors, and customers. Computershare is represented in all major

financial markets and has over 12,000 employees worldwide.

Cautionary statement about forward-looking statements

This news release contains forward-looking statements about our

future financial performance and business. Because forward-looking

statements are based on our current expectations and assumptions

regarding the future, they are subject to inherent risks and

uncertainties. Do not unduly rely on forward-looking statements as

actual results could differ materially from expectations.

Forward-looking statements speak only as of the date made, and we

do not undertake to update them to reflect changes or events that

occur after that date. For information about factors that could

cause actual results to differ materially from our expectations,

refer to our reports filed with the Securities and Exchange

Commission, including the “Forward-Looking Statements” discussion

in Wells Fargo’s most recent Quarterly Report on Form 10-Q as well

as to Wells Fargo’s other reports filed with the Securities and

Exchange Commission, including the discussion under “Risk Factors”

in our Annual Report on Form 10-K for the year ended Dec. 31, 2020,

available on its website at www.sec.gov.

WF-CF

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210323006085/en/

Media Trisha Schultz, 424-268-6202

Trisha.Schultz@wellsfargo.com

(or)

Investor Relations John Campbell 415-396-0523

john.m.campbell@wellsfargo.com

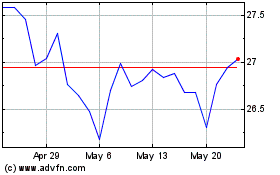

Computershare (ASX:CPU)

Historical Stock Chart

From Dec 2024 to Dec 2024

Computershare (ASX:CPU)

Historical Stock Chart

From Dec 2023 to Dec 2024