CSL Makes US$11.7 Billion Offer for Switzerland's Vifor Pharma

14 December 2021 - 5:24PM

Dow Jones News

By Stuart Condie

SYDNEY--Australian biopharmaceutical company CSL Ltd. said it

had made an all-cash offer for Vifor Pharma Ltd. that values the

Swiss pharmaceutical developer's equity at US$11.7 billion.

CSL on Tuesday said it would partially fund the acquisition with

a fully underwritten 6.3 billion Australian dollars (US$4.49

billion) share placement and a share purchase plan of up to A$750

million. It will also tap US$6.0 billion in existing cash and a

combination of new and existing debt.

CSL said it had made a public tender offer of US$179.25 a share.

The offer had been unanimously recommended by Vifor's directors, it

said.

Vaccine and blood-products maker CSL, the second-largest

ASX-listed company by market capitalization, has requested that its

shares be placed in a trading halt until Thursday for the capital

raising.

CSL said Vifor's portfolio focused on renal disease and iron

deficiency would complement its existing therapeutic focus areas,

while the Australian company's global reach, R&D capabilities

and resources would augment the delivery of Vifor Pharma

products.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

December 14, 2021 01:09 ET (06:09 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

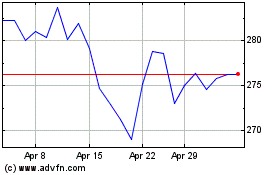

CSL (ASX:CSL)

Historical Stock Chart

From Dec 2024 to Jan 2025

CSL (ASX:CSL)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about CSL Limited (Australian Stock Exchange): 0 recent articles

More CSL Limited News Articles