BHP Billiton Shares Fall to Near-Decade Low

13 November 2015 - 4:10PM

Dow Jones News

MELBOURNE, Australia—Shares of resources giant BHP Billiton Ltd.

fell close to a decade low on Friday as a drop in commodity prices

overnight compounded investor worries about the fallout from a

dam-burst at its jointly-owned Brazilian iron-ore mine operation

last week which killed nine people.

BHP's Sydney-listed shares slipped to levels last seen in late

2005, when China's burgeoning demand for minerals was starting to

raise prices of both commodities and miners' shares.

BHP's shares have slumped 13% since millions of tons of mining

waste burst from a dam at the Samarco operation on Nov. 5, adding

to a recent investor antipathy toward mining stocks as metals

prices have fallen. Mining stocks broadly were hit hard in London

trading on Thursday as crude-oil prices dropped to their lowest

levels since August and prices for copper and other metals fell.

BHP, which produces oil and gas as well as mining copper, iron ore

and other metals, saw its London-listed shares fall 5% on

Thursday.

The company on Friday said mine tailings—a mix of water and

iron-ore waste—now extended 440 kilometers (273 miles) downstream

through remote mountain valleys from the mine site in Brazil's

Minas Gerais state. Local authorities have advised that 637 people

have been evacuated and 11 communities affected. Nineteen people

remain missing.

A day earlier, Brazilian President Dilma Rousseff said the

mine's operator, Samarco Mineraç ã o SA, and owners BHP and local

mining company Vale SA broke federal environmental and other laws.

A statement from BHP on Friday didn't reference Ms. Rousseff's

remarks, but said it and Vale had pledged to establish an emergency

fund for affected communities and rebuilding work.

BHP Chief Executive Andrew Mackenzie flew to the Brazilian mine

this week, where part of a three-tiered dam failed, even as the

death toll continued to rise. Operations at the site have been

halted and Samarco's operating license in the country has been

suspended. Employees are on paid leave and BHP, Vale and Samarco

representatives are meeting with insurers in Brazil, BHP said

Friday.

"Let me be very clear, we are 100% committed to do everything we

can do to support Samarco and make this right," Mr. Mackenzie said

during a media conference while in Brazil.

In early trading Friday, BHP's shares slipped below 20

Australian dollars (US$14.27) a share but recovered modestly after

BHP released an update on the mining accident. If the stock closes

at current levels, it would be its lowest end-of-day level since

early 2005, according to FactSet.

In addition, BHP on Thursday said it had lodged an application

with the Supreme Court in Australia's eastern Queensland disputing

the state government's claim for A$186 million in unpaid royalties

and A$102 million in interest based on an assessment of the

company's calculations for the value of its coal and the use of its

Singapore marketing office between July 2005 and December 2012. BHP

said its coal venture had paid about A$2.4 billion in royalties to

the state during that time.

BHP's shares were recently 1.8% lower at A$20.24 in Sydney.

Other mining stocks were lower, with Rio Tinto Ltd. down 2.1% and

Fortescue Metals Group Ltd. down 3.6%.

Write to Robb M. Stewart at robb.stewart@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 12, 2015 23:55 ET (04:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

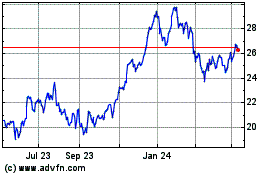

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024