ProLogis In Takeover Offer For ProLogis European

14 April 2011 - 7:32PM

Dow Jones News

U.S. industrial real-estate giant ProLogis (PLD) said Thursday

it plans to make an offer for ProLogis European Properties

(PEPR.AE) which values the Euronext-listed warehouses developer at

around EUR1.2 billion, trumping a rival group's bid.

The Denver-based company said it will launch a takeover offer

for ProLogis European worth EUR6.10 per share, after it raised its

stake in the biggest owner of warehouses in Europe to around 38% by

buying around 11 million ordinary shares from a major institutional

investor.

The offer represents a 22% premium over the closing share price

April 12 and comes after Australian property investor Goodman Group

(GMG.AU) and Dutch pension-fund asset manager APG Algemene Pensioen

Groep NV had a joint takeover bid for ProLogis European rejected

Tuesday.

ProLogis said its offer is at an attractive price and eliminates

instability and uncertainty created by the rival group's indicative

offer for its own stake. Goodman and APG were prepared to offer

ProLogis EUR6 per share, which valued ProLogis European at about

EUR1.1 billion.

Investors and analysts have complained about a weak

corporate-governance structure at ProLogis European that puts small

unit holders at a significant disadvantage. Investors with less

than a 20% holding have no powers to call general meetings or make

proposals to the board. ProLogis reaffirmed that it plans to retain

its ownership in and management deal with ProLogis European.

The deal activity around ProLogis European comes as ProLogis and

U.S. rival AMB Property Corp. enter the final stages of their

effort to close a $14 billion merger that would form a global

real-estate powerhouse.

At 0827 GMT, shares in ProLogis European traded up 7.1% at

EUR6.16.

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

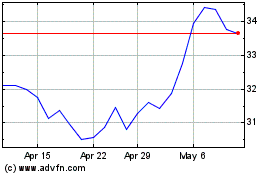

Goodman (ASX:GMG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Goodman (ASX:GMG)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Goodman Group (Australian Stock Exchange): 0 recent articles

More Goodman News Articles