2nd UPDATE: ProLogis Leads Battle To Buy ProLogis European

15 April 2011 - 2:11AM

Dow Jones News

U.S. industrial real-estate giant ProLogis (PLD) said Thursday

it plans to make an offer for ProLogis European Properties

(PEPR.AE) that values the Euronext-listed warehouses developer at

about EUR1.2 billion ($1.73 billion), with analysts saying the bid

will likely triumph over interest from a rival group.

The Denver-based company said it will launch a takeover offer

for ProLogis European worth EUR6.10 per share, after it raised its

stake in the biggest owner of warehouses in Europe to about 38% by

buying around 11 million ordinary shares from Third Avenue

Management LLC.

The offer represents a 22% premium over the closing share price

April 12 when Australian property investor Goodman Group (GMG.AU)

and Dutch pension-fund asset manager APG Algemene Pensioen Groep NV

had a joint takeover bid for ProLogis European rejected.

ProLogis Chief Executive Walter Rakowich told Dow Jones

Newswires that its offer was "a compelling proposition" that would

"provide liquidity to all shareholders that want it."

ProLogis said its offer is at an attractive price and eliminates

instability and uncertainty created by the rival group's indicative

offer for its own stake, which previously stood at 33.1%. Goodman

and APG were prepared to offer ProLogis EUR6 per share, which

valued ProLogis European at about EUR1.1 billion.

Rakowich added the company was making "a concrete offer with no

material contingencies" and said its rival bidders had presented a

non-definitive and highly conditional proposal. APG told Dow Jones

Newswires that it would make a statement after studying the

ProLogis offer.

The bid from ProLogis was likely to be successful according to

Martijn ter Laak, a real estate analyst at Rabobank. He said the

offer created an exit opportunity for APG, which it probably would

consider fair value, and means a counterbid in conjunction with

Goodman was very unlikely.

Despite the consortium still having room to increase its offer,

analysts at ABN Amro agreed that there was little likelihood of a

raised bid as the conditions of ProLogis handing over its stake and

management contract would probably remain. ABN Amro raised its

ProLogis European price target to EUR6.10, the level of the new

bid, and maintained its reduce rating.

Goodman's status as a competitor in Europe also means it

wouldn't make strategic sense for ProLogis to sell its management

stake in ProLogis European, ter Laak said. Rabobank increased its

ProLogis Europe price target to EUR6.10 and reiterated its hold

rating.

Investors and analysts have complained about a weak

corporate-governance structure at ProLogis European that puts small

shareholders at a significant disadvantage. Investors with less

than a 20% holding have no powers to call general meetings or make

proposals to the board. ProLogis can't be replaced as manager

before 2016 and the company has reaffirmed that it plans to retain

both its ownership in and management deal with ProLogis

European.

Michael Winer, portfolio manager at Third Avenue Management,

told Dow Jones Newswires that the deal it struck with ProLogis at

EUR6.10 a share was "right in line with our valuation," given that

it sees an uncertain industrial property market on the

continent.

"It was interesting to see APG's proposal was the catalyst for

ProLogis to make their move," Winer added. "They created a buzz and

forced ProLogis to act before they wanted to."

ProLogis European had a portfolio with a market value of EUR2.8

billion at the turn of the year. It consisted of 232 buildings

across 11 countries, covered 4.9 million square meters, and had an

occupancy level of 94.5%. At 1530 GMT, its shares traded up 8.7% at

EUR6.25.

The deal activity around the company comes as ProLogis and U.S.

rival AMB Property Corp. (AMB) enter the final stages of their

effort to close a $14 billion merger that would form a global

real-estate powerhouse with gross assets of $46 billion. At 1530

GMT, ProLogis shares traded up 0.7% at $15.69.

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

(Patrick Buis in Amsterdam contributed to this article.)

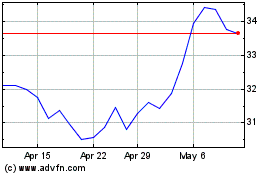

Goodman (ASX:GMG)

Historical Stock Chart

From Apr 2024 to May 2024

Goodman (ASX:GMG)

Historical Stock Chart

From May 2023 to May 2024