Prologis European Says Prologis Takeover Bid Too Low

03 May 2011 - 6:13PM

Dow Jones News

ProLogis European Properties (PEPR.AE) Tuesday dismissed a

takeover bid from U.S. industrial real-estate giant ProLogis (PLD)

that values the Euronext-listed warehouses developer at EUR1.2

billion ($1.73 billion), saying the offer is inadequate.

"Based on our strategy, business plans and the quality of our

portfolio, we believe that the offer does not reflect the full

value potential of PEPR," Chief Executive Peter Cassells said in a

statement.

The biggest owner of warehouses in Europe said it had considered

an opinion from Deutsche Bank AG (DB) which judged the offer as

inadequate from a financial perspective.

However, it added the bid could still represent a 'liquidity

event' for investors who believe their shareholding doesn't meet

their investment objectives and who fear the stock's liquidity

could be hampered by an increased shareholding from ProLogis.

ProLogis launched a mandatory takeover offer worth EUR6.10 per

unit April 22 after it raised its stake in PEPR to about 38%. The

Denver-based company said Tuesday it had since received for tender,

or purchased in the open market, 8,818 ordinary units that would

bring its stake to 39%.

ProLogis' offer represents a 22% premium over the closing share

price April 12 when Australian property investor Goodman Group

(GMG.AU) and Dutch pension-fund asset manager APG Algemene Pensioen

Groep NV had a joint takeover bid for ProLogis European rejected.

Goodman and APG were prepared to offer ProLogis EUR6 per unit for

its stake, which valued ProLogis European at about EUR1.1

billion.

ProLogis European had a portfolio with a market value of EUR2.8

billion at the turn of the year. It consisted of 232 buildings

across 11 countries, covered 4.9 million square meters, and had an

occupancy level of 94.5%. At 0730 GMT, its shares traded down 0.3%

at EUR6.13.

Investors and analysts have complained about a weak

corporate-governance structure at ProLogis European that puts small

unitholders at a significant disadvantage. Investors with less than

a 20% holding have no powers to call general meetings or make

proposals to the board. ProLogis can't be replaced as manager

before 2016 and the company has reaffirmed that it plans to retain

both its ownership in and management deal with ProLogis

European.

The deal activity around the company comes as ProLogis and U.S.

rival AMB Property Corp. (AMB) enter the final stages of their

effort to close a $14 billion merger that would form a global

real-estate powerhouse with gross assets of $46 billion. The deal

is expected to be finalized June 3. ProLogis shares closed Monday

at $16.29, valuing the company at just over $9.2 billion.

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

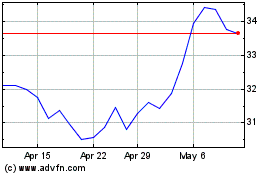

Goodman (ASX:GMG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Goodman (ASX:GMG)

Historical Stock Chart

From Mar 2024 to Mar 2025