UPDATE: James Hardie Posts Fiscal Year Loss; Calls Bottom Of US Housing Downturn

27 May 2010 - 12:23PM

Dow Jones News

James Hardie Industries Se (JHX.AU) posted a full-year net loss

Thursday as asbestos liabilities ballooned but said the U.S.

housing market looks like it has finally bottomed out.

James Hardie, the largest maker of housing siding in the U.S.,

said its loss for the 12 months to March 31 was US$84.9 million,

compared to a net profit of US$136.3 million in the previous

year.

The result was marred by a US$224.2 million rise in the

company's asbestos liabilities, arising from compensation payments

to workers and customers suffering diseases caught from

discontinued products.

On a positive note, quarterly sales volumes in U.S. business

increased for the first time in four years compared to the previous

corresponding period.

"I think we've probably reached the bottom of the housing

downturn in the U.S. obviously it's a very low level," Chief

Executive Louis Gries told investors on a conference call. "It

looks like we've hit it now."

Net sales for the U.S. and Europe increased 4% in the final

quarter to US$196.8 million, while over the full year the figure

was down 11% at US$828.1 million.

But Gries said the rate and extent of the U.S. recovery remained

uncertain and also warned costs for freight, energy, pulp and other

raw materials were on the rise.

"This full year result is much better than we thought we would

do in this type of market," he said.

Gries said James Hardie's Asia Pacific business, which includes

Australia and New Zealand, enjoyed a "great" fourth quarter, with

net sales up 49% to US$78.1 million. Over the year, sales in the

division rose 9% to US$296.5 million.

The company's operating profit, which excludes asbestos

liabilities and corporate costs, rose to US$133.0 million, compared

with a revised US$100.5 million in the prior year.

The operating profit was above market expectations of U$127.7

million, according to a poll of four analysts conducted by Dow

Jones Newswires. It was toward the top end of company guidance of

US$111 million-US$135 million.

Gries said the Australian-listed company hoped to move its

corporate domicile from The Netherlands to Ireland in the near

future.

The company didn't pay a dividend, in line with its policy of

conserving capital amid market and industry uncertainty implemented

in November 2008.

It said full year sales fell to US$1.12 billion, from US$1.20

billion.

Gries didn't give earnings guidance for the current fiscal

year.

At 0150 GMT, James Hardie shares were down 14 Australian cents,

or 2%, at A$7.01, while the benchmark S&P/ASX 200 index was up

1.7 points at 4308.9.

-By Neil Sands, Dow Jones Newswires; 61-3-9292-2095;

neil.sands@dowjones.com

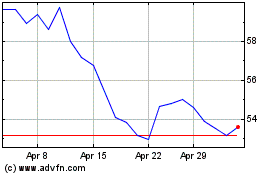

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Nov 2024 to Dec 2024

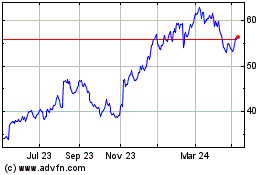

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2023 to Dec 2024