James Hardie Industries plc Announces Pricing of Offering of Senior Notes

28 September 2018 - 10:51AM

Business Wire

James Hardie Industries plc (ASX: JHX) (“James Hardie”)

announced today the pricing of an offering of €400 million

aggregate principal amount of senior notes due 2026 (the “2026

notes”) of its wholly-owned subsidiary, James Hardie International

Finance Designated Activity Company. The 2026 notes will bear

interest at a rate of 3.625% per annum. The net proceeds from the

offering will be used to repay certain of the outstanding

borrowings under James Hardie’s 364-day term loan facility, which

was used to fund the previously completed Fermacell acquisition,

and to pay related transaction fees and expenses.

The notes have not been registered under the Securities Act of

1933, as amended (the “Securities Act”), or the securities laws of

any other jurisdiction. As a result, they may not be offered or

sold in the United States or to any U.S. persons, except pursuant

to an applicable exemption from, or in a transaction not subject

to, the registration requirements of the Securities Act.

Accordingly, the notes are being offered only to “qualified

institutional buyers” in reliance on the exemption from

registration provided by Rule 144A under the Securities Act or,

outside the United States, to persons other than “U.S. persons” in

reliance on Regulation S under the Securities Act. You are hereby

notified that sellers of the notes may be relying on the exemption

from the provisions of Section 5 of the Securities Act provided by

Rule 144A.

This press release is neither an offer to sell nor a

solicitation of an offer to buy, nor shall there be any sale of,

the notes in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

Forward Looking Statements

This Media Release contains forward-looking statements. James

Hardie Industries plc (the “Company”) may from time to time make

forward-looking statements in its periodic reports filed with or

furnished to the Securities and Exchange Commission, on Forms 20-F

and 6-K, in its annual reports to shareholders, in offering

circulars, invitation memoranda and prospectuses, in media releases

and other written materials and in oral statements made by the

Company’s officers, directors or employees to analysts,

institutional investors, existing and potential lenders,

representatives of the media and others. Statements that are not

historical facts are forward-looking statements and such

forward-looking statements are statements made pursuant to the Safe

Harbor Provisions of the Private Securities Litigation Reform Act

of 1995.

Examples of forward-looking statements include:

- statements about the Company’s future

performance;

- projections of the Company’s results of

operations or financial condition;

- statements regarding the Company’s

plans, objectives or goals, including those relating to strategies,

initiatives, competition, acquisitions, dispositions and/or its

products;

- expectations concerning the costs

associated with the suspension or closure of operations at any of

the Company’s plants and future plans with respect to any such

plants;

- expectations concerning the costs

associated with the significant capital expenditure projects at any

of the Company’s plants and future plans with respect to any such

projects;

- expectations regarding the extension or

renewal of the Company’s credit facilities including changes to

terms, covenants or ratios;

- expectations concerning dividend

payments and share buy-backs;

- statements concerning the Company’s

corporate and tax domiciles and structures and potential changes to

them, including potential tax charges;

- statements regarding tax liabilities

and related audits, reviews and proceedings;

- statements regarding the possible

consequences and/or potential outcome of legal proceedings brought

against us and the potential liabilities, if any, associated with

such proceedings;

- expectations about the timing and

amount of contributions to AICF, a special purpose fund for the

compensation of proven Australian asbestos-related personal injury

and death claims;

- expectations concerning the adequacy of

the Company’s warranty provisions and estimates for future

warranty-related costs;

- statements regarding the Company’s

ability to manage legal and regulatory matters (including but not

limited to product liability, environmental, intellectual property

and competition law matters) and to resolve any such pending legal

and regulatory matters within current estimates and in anticipation

of certain third-party recoveries; and

- statements about economic conditions,

such as changes in the US economic or housing market conditions or

changes in the market conditions in the Asia Pacific region, the

levels of new home construction and home renovations, unemployment

levels, changes in consumer income, changes or stability in housing

values, the availability of mortgages and other financing, mortgage

and other interest rates, housing affordability and supply, the

levels of foreclosures and home resales, currency exchange rates,

and builder and consumer confidence.

Words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,”

“guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,”

“objective,” “outlook” and similar expressions are intended to

identify forward-looking statements but are not the exclusive means

of identifying such statements. Readers are cautioned not to place

undue reliance on these forward-looking statements and all such

forward-looking statements are qualified in their entirety by

reference to the following cautionary statements.

Forward-looking statements are based on the Company’s current

expectations, estimates and assumptions and because forward-looking

statements address future results, events and conditions, they, by

their very nature, involve inherent risks and uncertainties, many

of which are unforeseeable and beyond the Company’s control. Such

known and unknown risks, uncertainties and other factors may cause

actual results, performance or other achievements to differ

materially from the anticipated results, performance or

achievements expressed, projected or implied by these

forward-looking statements. These factors, some of which are

discussed under “Risk Factors” in Section 3 of the Form 20-F

filed with the Securities and Exchange Commission on 22 May

2018, include, but are not limited to: dependence on residential

and commercial construction markets; competition and product

pricing in the markets in which the Company operates; unforeseen

delays and/or cost overruns in planned capital expenditures in

future periods; regulatory action and continued regulatory

scrutiny; risks of conducting business internationally; currency

exchange risks; the consequences of product failures or defects,

including risks associated with warranty claims; exposure to

environmental, asbestos, putative consumer class action or other

legal proceedings; general economic and market conditions;

compliance with and changes in environmental and health and safety

laws; the supply and cost of raw materials; dependence on customer

preference and the concentration of the Company’s customer base on

large format retail customers, distributors and dealers; reliance

on a small number of customers; risks associated with the fact that

the company’s ability to sell its products in certain markets is

influenced by building codes and ordinances; a customer’s inability

to pay; reliance on third-party distribution channels; compliance

with and changes in laws and regulations; possible increases in

competition and the potential that competitors could copy the

Company’s products; unauthorized disclosure of sensitive or

confidential information or other cyber security incidents; the

effect of adverse changes in climate or weather patterns; inherent

limitations on internal controls; acquisition or sale of businesses

and business segments; the integration of Fermacell into the

Company’s business; lack of disclosure in connection with

historical financial information for Fermacell and related pro

forma financial statements; estimates of Fermacell’s adjusted

EBITDA for the twelve months ended 31 March 2018; changes in the

Company’s key management personnel; use of accounting estimates;

and all other risks identified in the Company’s reports filed with

Australian, Irish and US securities regulatory agencies and

exchanges (as appropriate). The Company cautions you that the

foregoing list of factors is not exhaustive and that other risks

and uncertainties may cause actual results to differ materially

from those referenced in the Company’s forward-looking statements.

Forward-looking statements speak only as of the date they are made

and are statements of the Company’s current expectations concerning

future results, events and conditions. The Company assumes no

obligation to update any forward-looking statements or information

except as required by law.

MiFID II professionals/ECPs-only/ No PRIIPs KID – Manufacturer

target market (MiFID II product governance) is eligible

counterparties and professional clients only (all distribution

channels). No PRIIPs key information document (KID) has been

prepared as not available to retail in the European Economic

Area.

Promotion of the notes in the United Kingdom is restricted by

the Financial Services and Markets Act 2000 (the “FSMA”), and

accordingly, the notes are not being promoted to the general public

in the United Kingdom. In the United Kingdom, this announcement is

for distribution only to, and is only directed at, persons who (i)

have professional experience in matters relating to investments

falling within Article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005, as amended (the

“Financial Promotion Order”), (ii) are persons falling within

Article 49(2)(a) to (d) (high net worth companies, unincorporated

associations, etc.) of the Financial Promotion Order, or (iii) are

persons to whom an invitation or inducement to engage in investment

activity within the meaning of section 21 of the FSMA in connection

with the issue or sale of any securities may otherwise lawfully be

communicated or caused to be communicated (all such persons

together being referred to as “relevant persons”). This

announcement is directed only at relevant persons in the United

Kingdom and must not be acted on or relied on in the United Kingdom

by anyone who is not a relevant person.

Neither the content of the Company’s website nor any website

accessible by hyperlinks on the Company’s website is incorporated

in, or forms part of, this announcement. The distribution of this

announcement into certain jurisdictions may be restricted by law.

Persons into whose possession this announcement comes should inform

themselves about and observe any such restrictions. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

This announcement contains inside information by the Issuer

under Regulation (EU) 596/2014 (16 April 2014).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180927006004/en/

James Hardie Industries plcJason Miele, +61 2 8845 3352Vice

President, Investor and Media Relationsmedia@jameshardie.com.au

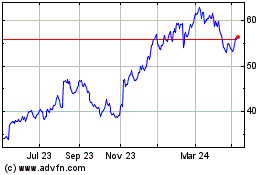

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Feb 2025 to Mar 2025

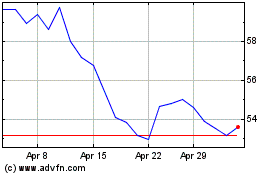

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Mar 2024 to Mar 2025