Relentless focus on a safe and sustainable

workplace

Strong liquidity and financial flexibility to

manage through continued market volatility

Double digit volume growth in North America in

Q4 FY20

James Hardie Industries plc (ASX:JHX) today provided an update

on actions the Company has proactively taken since the pandemic was

declared to ensure that its workplaces around the world are

protected and secured for its thousands of employees. With 19

manufacturing plants in the U.S., Europe and Asia Pacific, the

Company has instituted pandemic protocols in plants and workspaces

around the globe, including strict social distancing policies,

extensive disinfection processes, robust employee communications,

procurement of required PPE, and ongoing well-being and hygiene

support for our employees at work and at home.

“James Hardie employees have been incredibly dedicated and

resilient during this very challenging time,” said James Hardie

CEO, Dr. Jack Truong. “I want to express my gratitude to our team

members and their families for their tireless commitment to the

safety of themselves and one another. I am confident we will emerge

from this crisis a stronger company.”

Business Update

James Hardie also shared an update on its global business,

including additional detail on financial and operational

performance.

“Two years ago, we established a strategic and scalable

management system to drive sustainable and profitable growth. Now,

the management system also proved to be critical to our ability to

navigate through the global COVID-19 crisis,” said Dr. Truong. “By

operating in a safe, sustainable and thoughtful manner, we continue

to protect our employees, deliver value to our customers, minimize

disruption to our plants and preserve liquidity in anticipation of

a potentially prolonged period of market volatility.”

Refined FY20 Guidance

The Company narrowed its previous, guided range for FY20

Adjusted NOPAT from US$350 million – US$370 million to US$350

million – US$355 million, an increase from the prior year’s US$301

million. Refined guidance is driven by the following operating

results in Q4 FY20:

- Double digit volume growth in North America

- Strong revenue growth in Europe

- APAC results in line with expectations, driven by strong

Australian business performance

- Higher than anticipated integration and operational costs in

Europe

- Unplanned costs related to government-mandated closures of

manufacturing plants in Spain, New Zealand and the

Philippines.

Dr. Truong noted, “Since the COVID-19 crisis emerged, we have

maintained a relentless focus on providing our teams with a safe

and efficient workplace and a comprehensive management system with

clearly defined and connected processes. This resulted in a strong

finish to our fiscal year 2020 performance. Our strategic

initiatives in North America continued to take hold as we drove

significant growth in both our exteriors and interiors businesses

in Q4FY20 and continued to deliver manufacturing cost improvements

through our Hardie Manufacturing Operating System.”

Cash Management and Liquidity

To further strengthen the Company’s liquidity position and to

manage market volatility, the Company is taking the following

strategic measures:

- The immediate suspension of dividends until further notice, as

approved by the Board of Directors.

- Adjusted FY21 Capital Expenditures to be in a range of US$80 –

US$95 million, compared to a historic three-year, annual average of

approximately US$240 million.

- Will make its annual contributions to Asbestos Injuries

Compensation Fund (AICF) in quarterly installments, versus one lump

sum payment in July 2020, as allowed under the provisions of the

Amended and Restated Final Funding Agreement (AFFA).

- Implemented strategic cost-control measures globally. These

include a hiring freeze and a significant reduction of

non-essential and controllable expenses.

As of 30 April 2020, the Company’s liquidity position was US$578

million, an increase from US$510 million at 31 March 2020 and

US$464 million at 31 December 2019. Its leverage ratio improved

from 2.1x at 31 December 2019 to approximately 1.9x at 31 March

2020.

James Hardie CFO, Mr. Jason Miele, noted, “We remain

well-positioned with sufficient liquidity to manage through a

prolonged downturn, should that happen. Our strong sales

performance in the fourth quarter along with our quick and decisive

capital management and working capital actions helped increase our

liquidity position to US$578 million as of 30 April 2020. Our

relentless focus on these actions will help ensure strong liquidity

and financial flexibility as we navigate through this crisis.”

Improving and Securing Global

Operations

Consistent with the Company’s strategy to scale and modernize

its global operations, the following changes to the global

manufacturing footprint have been announced:

- To better harmonize supply and demand in the North American

market, the Company will close its Summerville, South Carolina, USA

manufacturing plant.

- Delayed commissioning of the Prattville, Alabama, USA

manufacturing plant until FY22.

- The move to a regional model for the manufacture and supply of

fiber cement products for the New Zealand market. The Company will

begin by entering into consultations with affected employees and

their union. Ultimately, the Company intends to cease all

manufacturing of products in New Zealand under this model and shift

manufacturing from Penrose, New Zealand to its two plants in

Australia: Rosehill and Carole Park. The Company would also expand

the outsourcing of freight and logistics management, in New

Zealand, to a third-party logistics provider. The sales, marketing,

customer service and technical support teams would continue to be

based locally in New Zealand to ensure that the Company is able to

partner with customers and provide them with the service and

support to which they are accustomed.

- Closure of James Hardie Systems, the permanent formwork

business based out of Cooroy, Australia, and the associated

manufacturing plant in the middle of calendar year 2020.

- The temporary closure of the Siglingen, Germany manufacturing

plant to better match supply to demand in the short term in

Europe.

In addition to the above noted operational actions, the Company

reviewed its organizational structure and resourcing levels

globally and made strategic adjustments to ensure it is well

positioned to continue serving customers in this fast-changing

market environment. As a result of realigning the global resources

and closing the Summerville, Penrose and Cooroy plants as noted

above, the Company expects to reduce its global workforce by

approximately 375 employees.

“These decisions are always extremely difficult. Our leadership

team took this action with considerable thoughtfulness, with the

strategic objective of preserving and enhancing the global

organization’s competitiveness over the long term,” said Dr.

Truong.

Expected Impairment Charges

The actions regarding the Summerville, Penrose and Cooroy

manufacturing plants will result in impairment expenses in the

Company’s Q4 FY20 financial results. In addition to the impairments

of these three manufacturing plants, the Company identified some

non-core assets which have also been impaired as of 31 March 2020.

The Company expects the total amount of non-cash impairment

expenses to be approximately US$90 million in Q4 FY20, which is

subject to the finalization of our annual independent audit of our

financial statements. These non-cash impairment expenses will be

excluded from Adjusted EBIT and Adjusted NOPAT in the FY20

financial results.

Full Year Fiscal Year 2020 and Q4 Fiscal

Year 2020 Results Briefing

Management will conduct its Q4 FY20 results briefing on Tuesday

19 May 2020, 09:00 Sydney, Australia time. A teleconference and

webcast will be available for analysts, investors and media,

details will be announced shortly via the ASX.

Dr. Truong concluded, “Our strong fourth quarter finish

completes a very positive year and demonstrates our ability to

perform well in both growing and highly volatile markets. It also

demonstrates that our commitment to the safety and well-being of

our employees, accompanied by the appropriate discipline and

adherence to execution of the strategic plan we set two years ago,

is the right path forward. I am confident that we will emerge from

this crisis even stronger as a company with a relentless focus on

taking market share and commercializing high-impact innovations to

deliver continued growth above market with consistently strong

returns.”

This media release has been authorized by the James Hardie Board

of Directors.

James Hardie Industries plc is a limited liability company

incorporated in Ireland with its registered office at Europa House

2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20,

Ireland.

Forward Looking Statements

This Media Release contains forward-looking statements. James

Hardie Industries plc (the “Company”) may from time to time make

forward-looking statements in its periodic reports filed with or

furnished to the Securities and Exchange Commission, on Forms 20-F

and 6-K, in its annual reports to shareholders, in offering

circulars, invitation memoranda and prospectuses, in media releases

and other written materials and in oral statements made by the

Company’s officers, directors or employees to analysts,

institutional investors, existing and potential lenders,

representatives of the media and others. Statements that are not

historical facts are forward-looking statements and such

forward-looking statements are statements made pursuant to the Safe

Harbor Provisions of the Private Securities Litigation Reform Act

of 1995.

Examples of forward-looking statements include:

- statements about the Company’s future performance;

- projections of the Company’s results of operations or financial

condition;

- statements regarding the Company’s plans, objectives or goals,

including those relating to strategies, initiatives, competition,

acquisitions, dispositions and/or its products;

- expectations concerning the costs associated with the

suspension or closure of operations at any of the Company’s plants

and future plans with respect to any such plants;

- expectations concerning the costs associated with the

significant capital expenditure projects at any of the Company’s

plants and future plans with respect to any such projects;

- expectations regarding the extension or renewal of the

Company’s credit facilities including changes to terms, covenants

or ratios;

- expectations concerning dividend payments and share

buy-backs;

- statements concerning the Company’s corporate and tax domiciles

and structures and potential changes to them, including potential

tax charges;

- uncertainty from the expected discontinuance of LIBOR and

transition to any other interest rate benchmark;

- statements regarding the effect and consequences of the novel

coronavirus ("COVID-19") public health crisis;

- statements regarding tax liabilities and related audits,

reviews and proceedings;

- statements regarding the possible consequences and/or potential

outcome of legal proceedings brought against us and the potential

liabilities, if any, associated with such proceedings;

- expectations about the timing and amount of contributions to

Asbestos Injuries Compensation Fund (AICF), a special purpose fund

for the compensation of proven Australian asbestos-related personal

injury and death claims;

- expectations concerning the adequacy of the Company’s warranty

provisions and estimates for future warranty-related costs;

- statements regarding the Company’s ability to manage legal and

regulatory matters (including but not limited to product liability,

environmental, intellectual property and competition law matters)

and to resolve any such pending legal and regulatory matters within

current estimates and in anticipation of certain third-party

recoveries; and

- statements about economic conditions, such as changes in the US

economic or housing recovery or changes in the market conditions in

the Asia Pacific region, the levels of new home construction and

home renovations, unemployment levels, changes in consumer income,

changes or stability in housing values, the availability of

mortgages and other financing, mortgage and other interest rates,

housing affordability and supply, the levels of foreclosures and

home resales, currency exchange rates, and builder and consumer

confidence.

Words such as “believe,” “anticipate,” “plan,” “expect,”

“intend,” “target,” “estimate,” “project,” “predict,” “forecast,”

“guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,”

“objective,” “outlook” and similar expressions are intended to

identify forward-looking statements but are not the exclusive means

of identifying such statements. Readers are cautioned not to place

undue reliance on these forward-looking statements and all such

forward-looking statements are qualified in their entirety by

reference to the following cautionary statements.

Forward-looking statements are based on the Company’s current

expectations, estimates and assumptions and because forward-looking

statements address future results, events and conditions, they, by

their very nature, involve inherent risks and uncertainties, many

of which are unforeseeable and beyond the Company’s control. Such

known and unknown risks, uncertainties and other factors may cause

actual results, performance or other achievements to differ

materially from the anticipated results, performance or

achievements expressed, projected or implied by these

forward-looking statements. These factors, some of which are

discussed under “Risk Factors” in Section 3 of the Form 20-F filed

with the Securities and Exchange Commission on 21 May 2019 and

subsequently amended on 8 August 2019, include, but are not limited

to: all matters relating to or arising out of the prior manufacture

of products that contained asbestos by current and former Company

subsidiaries; required contributions to AICF, any shortfall in AICF

and the effect of currency exchange rate movements on the amount

recorded in the Company’s financial statements as an asbestos

liability; the continuation or termination of the governmental loan

facility to AICF; compliance with and changes in tax laws and

treatments; competition and product pricing in the markets in which

the Company operates; the consequences of product failures or

defects; exposure to environmental, asbestos, putative consumer

class action or other legal proceedings; general economic and

market conditions; the supply and cost of raw materials; possible

increases in competition and the potential that competitors could

copy the Company’s products; reliance on a small number of

customers; a customer’s inability to pay; compliance with and

changes in environmental and health and safety laws; risks of

conducting business internationally; compliance with and changes in

laws and regulations; currency exchange risks; dependence on

customer preference and the concentration of the Company’s customer

base on large format retail customers, distributors and dealers;

dependence on residential and commercial construction markets; the

effect of adverse changes in climate or weather patterns; possible

inability to renew credit facilities on terms favorable to the

Company, or at all; acquisition or sale of businesses and business

segments; changes in the Company’s key management personnel;

inherent limitations on internal controls; use of accounting

estimates; the integration of Fermacell into our business; risk and

uncertainties arising out of the COVID-19 public health crisis,

including the likely significant negative impact of COVID-19 on our

business, sales, results of operations and financial condition and

all other risks identified in the Company’s reports filed with

Australian, Irish and US securities regulatory agencies and

exchanges (as appropriate). The Company cautions you that the

foregoing list of factors is not exhaustive and that other risks

and uncertainties may cause actual results to differ materially

from those referenced in the Company’s forward-looking statements.

Forward-looking statements speak only as of the date they are made

and are statements of the Company’s current expectations concerning

future results, events and conditions. The Company assumes no

obligation to update any forward-looking statements or information

except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200504005776/en/

Investor, Analyst and Media Enquiries: Katie Spring and Josh

Hochberg +1 312 447 1925 and +1 917 848 7194

katie.spring@edelman.com josh.hochberg@edelman.com

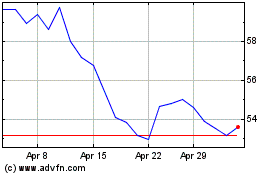

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Nov 2024 to Dec 2024

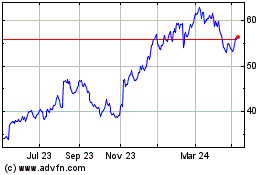

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2023 to Dec 2024