James Hardie Industries Announces Debt Reduction

15 January 2021 - 8:21PM

Business Wire

Utilizes Strong Cash Position for Voluntary

Redemption of Senior Notes

James Hardie Industries plc (ASX: JHX; NYSE: JHX), the

world’s #1 producer and marketer of high-performance fiber cement

and fiber gypsum building solutions, today announced that it has

made a voluntary redemption of its 4.75% senior unsecured notes due

2025 with a payment of US$410 million in principal and call

premium. As a result of this redemption, the Company reduced its

long-term gross debt balance from approximately US$1.3 billion, as

of September 30, 2020, to approximately US$900 million, aligned

with the Company’s previously announced plans to reduce gross debt

by US$400 million by the end of fiscal year 2021. Following the

repayment, which was funded with cash on hand, the Company has

liquidity in excess of US$600 million, including cash plus

availability on its undrawn credit facility.

“This debt pay down represents another step forward in the

execution of our strategy since calendar 2019 to transform James

Hardie into a high-performing, world-class organization,” stated

James Hardie CFO, Jason Miele. “Today's announcement reflects the

continuation of exceptional cash generation from our consistent

improvement in LEAN manufacturing initiatives, profitable sales

growth, and supply chain integration with customers. Cash interest

expense savings are expected to approximate US$20 million on an

annualized basis. We are excited to begin calendar 2021 with a

flexible balance sheet and a solid liquidity position to further

invest in our strategic initiatives while continually improving

returns for shareholders.”

Forward-Looking Statements

This Media Release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of James Hardie to be materially

different from those expressed or implied in this release,

including, among others, the risks and uncertainties set forth in

Section 3 “Risk Factors” in James Hardie’s Annual Report on

Form 20-F for the year ended 31 March 2020; changes in general

economic, political, governmental and business conditions globally

and in the countries in which James Hardie does business; changes

in interest rates; changes in inflation rates; changes in exchange

rates; the level of construction generally; changes in cement

demand and prices; changes in raw material and energy prices;

changes in business strategy and various other factors. Should one

or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those described herein. James Hardie assumes no

obligation to update or correct the information contained in this

Media Release except as required by law.

This media release has been authorized by the James Hardie Board

of Directors.

James Hardie Industries plc is a limited liability company

incorporated in Ireland with its registered office at Europa House,

2nd Floor, Harcourt Centre, Harcourt Street, Dublin 2, D02 WR20,

Ireland

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210115005164/en/

Investor/Media/Analyst Enquiries: Anna Collins

Telephone: +61 2 8845 3356 Email:

media@jameshardie.com.au

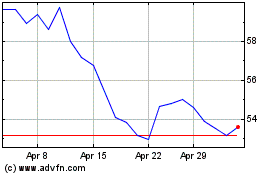

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2024 to Dec 2024

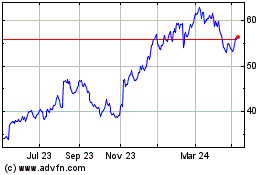

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Dec 2023 to Dec 2024