James Hardie Cuts Fiscal Year Guidance on Housing Market Weakness

08 November 2022 - 8:59AM

Dow Jones News

By Stuart Condie

SYDNEY--Australian building materials supplier James Hardie

Industries PLC cut its annual profit guidance on expectations that

macroeconomic conditions and challenging housing markets will hit

volumes.

James Hardie said it now anticipates adjusted net income for the

12 months through May of between $650 million and $710 million. It

had previously guided for net income of between $730 million and

$780 million.

Chief Executive Aaron Erter said the firm expects housing

markets to remain weak through the remainder of its 2023 fiscal

year and for volumes to soften in North America, Asia-Pacific and

Europe.

James Hardie reported a first-half net profit of $330.5 million

for the six months through September, up 22% on year. Revenue

jumped 14% on year to $2.00 billion.

The company did not declare a dividend but said it would instead

buy back shares worth up to $200 million through October 2023.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

November 07, 2022 16:44 ET (21:44 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

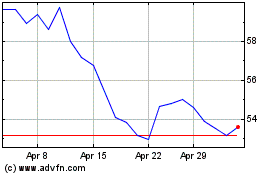

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Jan 2025 to Feb 2025

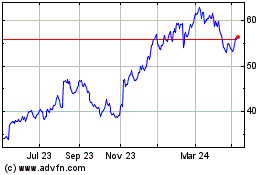

James Hardie Industries (ASX:JHX)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about James Hardie Industries plc (Australian Stock Exchange): 0 recent articles

More James Hardie Industries plc News Articles