NB Global Corporate Income Trust (“NBI”) Makes First Distribution

09 November 2018 - 8:55AM

Business Wire

Neuberger Berman, manager of the newly listed NB Global

Corporate Income Trust (“NBI”), is pleased to confirm that NBI has

declared its first monthly distribution to investors in line with

its investment objective.

Head of Asia Pacific for Neuberger Berman, Nick Hoar, noted that

the payment of its first monthly distribution puts NBI firmly on

track to achieving its Target Distribution1 of 5.25% per annum (net

of fees and expenses).

“NBI aims to deliver a consistent and stable income stream, paid

via monthly distributions, by investing in a diversified portfolio

of high yield bonds of global companies. We are delighted to

announce that NBI will be paying its first distribution within six

weeks of listing,” he said.

Mr. Hoar added that despite the volatility in global equity

markets since NBI’s listing, the global high yield market has

remained relatively stable.

“While equity markets have experienced a sharp sell-off, the

global high yield market has experienced solid returns over the

past few months, making it one of the few fixed income sectors

enjoying positive year-to-date returns,” he said.

“In our view, the credit quality of the global high yield market

remains stable, largely due to the robust performance of underlying

issuers, which continue to exhibit improving revenue and earnings

growth.”

As previously reported, NBI was fully invested within three days

of listing and now holds a diversified portfolio of high yield

bonds issued by large, liquid companies globally, including well

known global brand names such as Virgin Media and Avis.

NBI’s Target Distribution is paid monthly, with its next

distribution to be paid in early December.

About Neuberger Berman

Neuberger Berman, founded in 1939, is a private, independent,

employee-owned investment manager. The firm manages a range of

strategies—including equity, fixed income, quantitative and

multi-asset class, private equity and hedge funds—on behalf of

institutions, advisors and individual investors globally. With

offices in 20 countries, Neuberger Berman’s team is more than 2,000

professionals. For four consecutive years, the company has been

named first or second in Pensions & Investments Best Places to

Work in Money Management survey (among those with 1,000 employees

or more). Tenured, stable and long-term in focus, the firm fosters

an investment culture of fundamental research and independent

thinking. It manages A$441 billion2 in client assets as of

September 30, 2018. For more information, please visit our website

at www.nb.com.

1.

The Target Distribution is only a target and may not be

achieved. Actual distributions will be monitored against the Target

Distribution. The Target Distribution will be formally reviewed at

least annually (as at the end of each financial year) and any

reduction in Target Distribution will be notified by way of ASX

announcement as required. Investors should review the “Risk

Factors” set out in Section 8 of the PDS. Please refer to the PDS

for full details of the terms of the Offer, including Section 10

for the fees and costs that apply.

2.

Source: Neuberger Berman, as of September 30, 2018. Exchange rate 1

USD = 1.40315 AUD

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181108005262/en/

For further information please contact:WE BuchanArthur

Chan, 02 9237 2805neuberger@we-buchan.com

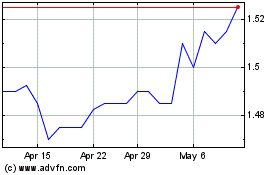

NB Monthly Income (ASX:NBI)

Historical Stock Chart

From Jan 2025 to Feb 2025

NB Monthly Income (ASX:NBI)

Historical Stock Chart

From Feb 2024 to Feb 2025