Pasinex Announces Third Quarter 2023 Financial Results

30 November 2023 - 11:30PM

Pasinex Resources Limited (CSE: PSE) (FSE: PNX) (The “Company” or

“Pasinex”) is pleased to provide financial results for third

quarter of 2023.

Cautionary Note

The Company has not completed a current

technical report that includes a mineral resource estimate as

defined by the Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by CIM Council, and procedures for

classifying the reported Mineral Resources were undertaken within

the context of the Canadian Securities Administrators National

Instrument 43-101 (NI 43-101). The Company has no intention of

completing a NI 43-101 compliant technical report. The Joint

Venture has not followed accepted quality assurance and quality

control procedures with respect to its current drilling program and

has not used an independent third-party laboratory for its assay

analysis. The Joint Venture uses field handheld X-ray fluorescence

analysers (“XRF”) for zinc assays and grade control in exploration

and mining. In addition, assays are completed by an independent

third-party laboratory for all of the Joint Venture’s sales.

Highlights – Third Quarter Ended September

30, 2023

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2022 |

|

|

|

Financial: |

|

|

|

|

|

|

|

|

|

|

|

Equity gain from Horzum AS |

$ |

529,122 |

|

$ |

|

- |

|

$ |

2,017,182 |

|

$ |

|

- |

|

|

|

|

Dividend income from Horzum AS |

$ |

- |

|

$ |

|

- |

|

$ |

626,476 |

|

$ |

|

4,072,320 |

|

|

|

|

Consolidated net income (loss) |

$ |

(270,729 |

) |

$ |

|

(637,956 |

) |

$ |

385,929 |

|

$ |

|

2,106,043 |

|

|

|

|

Basic and diluted net income (loss) per share |

$ |

0.00 |

|

$ |

|

0.00 |

|

$ |

0.00 |

|

$ |

|

0.02 |

|

|

|

|

Net cash (used in) provided by operating activities |

|

|

$ |

(358,087 |

) |

$ |

|

2,106,129 |

|

|

|

|

Weighted average shares outstanding |

|

144,554,371 |

|

|

|

144,554,371 |

|

|

144,554,371 |

|

|

|

144,554,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

2023 |

|

|

|

2022 |

|

|

|

Horzum AS operational data (100% basis): |

|

|

|

|

|

|

|

|

|

|

|

Zinc product mined (wet) tonnes |

|

1,748 |

|

|

|

3,001 |

|

|

6,513 |

|

|

|

10,805 |

|

|

|

|

Zinc product sold (wet) tonnes |

|

1,989 |

|

|

|

4,941 |

|

|

7,979 |

|

|

|

11,005 |

|

|

|

|

Zinc oxide product average grade sold |

|

NA |

|

|

|

NA |

|

|

NA |

|

|

|

38.0 |

% |

|

|

|

Zinc sulphide product average grade sold |

|

49.0 |

% |

|

|

50.0 |

% |

|

48.6 |

% |

|

|

51.0 |

% |

|

|

|

Zinc low-grade sulphide product average grade sold |

|

NA |

|

|

|

19.0 |

% |

|

NA |

|

|

|

19.0 |

% |

|

|

|

Gross margin (1) |

|

51 |

% |

|

|

64 |

% |

|

55 |

% |

|

|

73 |

% |

|

|

|

CAD cost per tonne mined (1) |

$ |

634 |

|

|

$ |

481 |

|

$ |

531 |

|

|

$ |

392 |

|

|

|

|

USD cash cost per pound of zinc mined (1) |

$ |

0.45 |

|

|

$ |

0.39 |

|

$ |

0.38 |

|

|

$ |

0.30 |

|

|

(1) See Non-GAAP Measures

- For the three and nine months ended

September 30, 2023, Pasinex recorded net loss of approximately $0.3

million and a net income of approximately $0.4 million,

respectively, compared with a net loss of approximately $0.6

million for the three months ended September 30, 2022, and a net

income of approximately $2.1 million for the nine months ended

September 30, 2022. The primary reason for the decrease in the net

income in 2023 versus 2022 was that dividend income was

considerably higher in 2022 than in 2023. Also, higher general and

administration costs and higher exploration costs contributed to

the decrease in 2023.

- The operating income in Horzum AS

decreased to $1.0 million and $4.0 million, in the three and nine

months ended September 30, 2023, respectively, from $1.9 million

and $7.9 million for the same periods in 2022. The decreases were

due to lower revenue as sales prices and the number of tonnes sold

declined in 2023 compared with 2022 and costs were higher due to

inflationary pressures. Gross margin (see non-GAAP measures) for

the three and nine months ended September 30, 2023, were 51% and

55%, respectively, compared with 64% and 73% for the same periods

in 2022.

- Horzum AS mined 1,748 tonnes and

6,513 tonnes of zinc product during the three and nine months ended

September 30, 2023, respectively, at the Pinargozu mine, compared

with 3,001 tonnes and 10,805 tonnes of zinc product for the same

periods in 2022. Mine production was negatively impacted by a

temporary halt in activity at the Pinargozu mine to ensure the

safety and well-being of the Joint Venture’s employees, after the

tragic earthquakes in Türkiye in the first quarter of 2023. Second

quarter production in 2023 was negatively impacted by the ingress

of rainwater that rendered some of the deeper areas below the

541-metre level inaccessible. Third quarter production was lower

primarily due to a lack of access to available ore.

- Sales volumes were 1,989 tonnes and

7,979 tonnes of high-grade zinc sulphide product in the three and

nine months ended September 30, 2023, respectively, compared with

3,998 tonnes and 9,569 tonnes of high-grade zinc sulphide product

for the same periods in 2022. Sales in 2022 also included 493

tonnes of oxide product, 943 tonnes of low-grade zinc sulphide

product and 54 tonnes of lead product.

- Sales prices per tonne on a USD

basis decreased by 34.2% for zinc sulphide product for the nine

months ended September 30, 2023, when compared to prices in the

same period in 2022. The average USD sales price for the nine

months ended September 30, 2023, was US$780 per tonne for zinc

sulphide product versus US$1,185 per tonne for zinc sulphide

product in the same period in 2022. Sales prices were lower not

only because of lower worldwide zinc prices but also because the

average grade of product sold was lower in 2023 versus 2022.

- The average grade of the high-grade

zinc sulphide product sold was 48.6% zinc per tonne for the nine

months ended September 30, 2023, compared with 50.5% zinc per tonne

for the same period in 2022.

- The CAD cost per tonne mined (see

non-GAAP measures) increased to $634 per tonne and $531 per tonne

mined for the three and nine months ended September 30, 2023,

respectively, compared with $481 per tonne and $392 per tonne mined

in the same periods in 2022. The USD cash cost per pound of zinc

product mined (see non-GAAP measures) increased to US$0.45 per

pound and US$0.38 in the three and nine months ended September 30,

2023, from US$0.39 per pound and US$0.30 for the same periods in

2022.

Non-GAAP Measures

Please note that all dollar amounts in this news

release are expressed in Canadian dollars unless otherwise

indicated. Refer also to the 2022 Management’s Discussion and

Analysis (MD&A) and Audited Financial Statements found on

SEDAR.com for more information. This news release includes non-GAAP

measures, including gross margin, cost per tonne mined and US$ cash

cost per pound of zinc product mined. A reconciliation of these

non-GAAP measures to the GAAP financial statements is included in

the MD&A.

Qualified Person

Jonathan Challis, a Fellow of the Institute of

Materials, Minerals and Mining and a Chartered Engineer, is the

qualified person (“QP”) as defined by NI 43-101 for all information

in this news release other than the information relating to the

Gunman Project. He has inspected the original paid sales invoices

issued by the Joint Venture for the shipment of zinc sulphide

product specified in this news release and has approved the

scientific and technical disclosure herein. Mr. Challis is a

director of the Company and Chair of the Joint Venture.

About Pasinex

Pasinex Resources Limited is a Toronto-based

mining company that owns 50% of Horzum Maden Arama ve Isletme

Anonim Sirketi (“Horzum AS” or “Joint Venture”), through its 100%

owned subsidiary Pasinex Arama ve Madencilik Anonim Sirketi

(“Pasinex Arama”). Horzum AS holds 100% of the producing Pinargozu

high-grade zinc mine. Horzum AS sells directly to zinc smelters and

or refiners through commodity brokers from its mine site in

Türkiye. The Company also holds a 51% interest, with an option to

increase to an 80% interest of a high-grade zinc exploration

project, the Gunman Project, located in Nevada. Pasinex has a

strong technical management team with many years of mineral

exploration and mining project development experience. Pasinex

Resources Limited mission is to explore and extract high grade ore

to drive growth and wealth for all of its stakeholders including

shareholders, employees and the communities of our operations,

meeting all requirements in safety, health and the environment.

Visit our website at www.pasinex.com.

On Behalf of the Board of Directors

PASINEX RESOURCES LIMITED

|

“Andrew Gottwald” |

|

| Andrew Gottwald |

Evan White |

| Chief Financial Officer |

Manager of Corporate

Communications |

| Phone: +1 416.861.9659 |

Phone: +1 416.906.3498 |

|

Email: info@pasinex.com |

Email:

evan.white@pasinex.com |

The CSE does not accept responsibility for the

adequacy or accuracy of this news release. This news release

includes forward-looking statements that are subject to risks and

uncertainties. Forward-looking statements involve known and unknown

risks, uncertainties, and other factors that could cause the actual

results of the Company to be materially different from the

historical results or any future results expressed or implied by

such forward-looking statements. All statements within, other than

statements of historical fact, are to be considered

forward-looking. Although Pasinex believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not a guarantee of

future performance, and actual results or developments may differ

materially from those in forward-looking statements. Factors that

could cause actual results to differ materially from those in

forward-looking statements include market prices, continued

availability of capital and financing, exploration results, and

general economic, market or business conditions. There can be no

assurances that such statements will prove accurate and, therefore,

readers are advised to rely on their own evaluation of such

uncertainties. We do not assume any obligation to update any

forward-looking statements.

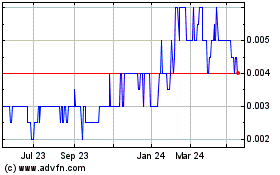

PNX Metals (ASX:PNX)

Historical Stock Chart

From Feb 2025 to Mar 2025

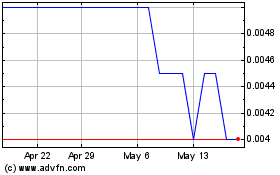

PNX Metals (ASX:PNX)

Historical Stock Chart

From Mar 2024 to Mar 2025