Pasinex Announces Filing of 2023 Annual Financial Results

01 June 2024 - 9:34AM

Pasinex Resources Limited (CSE: PSE) (FSE: PNX) (The

“

Company” or “

Pasinex”) announces

that, further to its news releases dated April 22, 2024, May 13,

2024, May 24, 2024, and May 28, 2024, the Company has filed its

annual financial statements, management's discussion and analysis,

and related certifications for the year ended December 31, 2023

(collectively, the “

Annual Filings”) on SEDAR+.

The Company expects that the Management Cease

Trade Order ("MCTO") issued by the British

Columbia Securities Commission ("BCSC") on April

30, 2024 will be revoked in the coming days. The MCTO prohibits all

trading in the capital of the Company, whether directly or

indirectly, by the Company’s CEO and CFO. This trading prohibition

will continue until the MCTO is revoked. The MCTO does not affect

the ability of other shareholders to trade in the securities of the

Company.

However, as announced on May 28, 2024, the

Company’s application for a second voluntary management cease trade

order in connection with the delay in filing its interim financial

statements and accompanying management's discussion and analysis

for the three months ended March 31, 2024 (the “Interim

Filings”), was rejected. The Company expects the BCSC to

issue a Cease Trade Order as a result of not filing the Interim

Filings by the May 30, 2024 filing deadline.

Annual Financial Results

Cautionary Note

The Company has not completed a current

technical report that includes a mineral resource estimate as

defined by the Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by CIM Council, and procedures for

classifying the reported Mineral Resources were undertaken within

the context of the Canadian Securities Administrators National

Instrument 43-101 (NI 43-101). The Company has no intention of

completing a NI 43-101 compliant technical report. The Joint

Venture has not followed accepted quality assurance and quality

control procedures with respect to its current drilling program and

has not used an independent third-party laboratory for its assay

analysis. The Joint Venture uses field handheld X-ray fluorescence

analysers (“XRF”) for zinc assays and grade control in exploration

and mining. In addition, assays are completed by an independent

third-party laboratory for all of the Joint Venture’s sales.

Highlights – Year Ended December 31,

2023

|

|

|

Years Ended December 31, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Financial: |

|

|

|

|

|

|

|

Equity gain from Horzum AS |

$ |

1,797,579 |

|

|

$ |

3,928,724 |

|

|

$ |

200,062 |

|

|

Assigned dividend |

$ |

626,476 |

|

|

$ |

1,095,289 |

|

|

$ |

- |

|

|

Consolidated net (loss) income |

$ |

(309,768 |

) |

|

$ |

2,043,173 |

|

|

$ |

(129,678 |

) |

|

Basic and diluted net (loss) income per share |

$ |

0.00 |

|

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

Net cash (used in) provided by operating activities |

$ |

(554,397 |

) |

|

$ |

1,838,461 |

|

|

$ |

480,034 |

|

|

Weighted average shares outstanding |

|

144,554,371 |

|

|

|

144,554,371 |

|

|

|

144,554,371 |

|

| |

|

|

|

|

|

|

| |

|

Years Ended December 31, |

|

| |

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Horzum AS operational data (100% basis): |

|

|

|

|

|

|

|

Zinc product mined (wet) tonnes |

|

8,061 |

|

|

|

13,766 |

|

|

|

10,608 |

|

|

Zinc product sold (wet) tonnes |

|

7,979 |

|

|

|

13,013 |

|

|

|

8,620 |

|

|

Lead product sold |

|

- |

|

|

|

54 |

|

|

- |

- |

|

|

Zinc oxide product - average grade sold |

|

NA |

|

|

|

37.8 |

% |

|

|

31.0 |

% |

|

Zinc sulphide product - average grade sold |

|

48.9 |

% |

|

|

50.1 |

% |

|

|

49.0 |

% |

|

Zinc sulphide product - low-grade - average grade sold |

|

NA |

|

|

|

18.8 |

% |

|

|

NA |

|

|

Lead product - average grade sold |

|

NA |

|

|

|

53.0 |

% |

|

|

NA |

|

|

Gross margin (1) |

|

42.5 |

% |

|

|

71.6 |

% |

|

|

49.9 |

% |

|

CAD cost per tonne mined (1) |

$ |

601 |

|

|

$ |

380 |

|

|

$ |

383 |

|

|

USD cash cost per pound of zinc product mined (1) |

$ |

0.44 |

|

|

$ |

0.28 |

|

|

$ |

0.36 |

|

| (1) See Non-GAAP Measures |

|

|

|

|

|

|

| |

|

|

|

|

|

|

- For the year ended December 31, 2023, Pasinex recorded a net

loss of approximately $0.3 million, compared with a net income of

approximately $2.04 million for 2022. The primary reason for the

decrease in the net income into a net loss was the decrease in the

equity gain in 2023 compared with 2022. In addition, the assigned

dividend was lower in 2023. The decrease in net income was

partially offset by lower exploration costs being incurred in

Nevada in 2023 compared with 2022.

- The operating income in Horzum AS decreased in 2023, compared

with 2022, as a result of the lower sales prices having been

realized, fewer tonnes being sold, and higher costs being incurred.

The results in 2022 were strong compared with prior years and the

results in 2023 were comparable to 2021 and higher than 2020. The

gross margin, (see non-GAAP measures), for the year ended December

31, 2023, decreased to 42% from 72% in 2022.

- Horzum AS declared a dividend to be paid to its shareholders of

which Pasinex Arama was entitled to TRY 32.1 million (approximately

$2.2 million using the exchange rate on the date the dividend was

declared and approved). Pasinex Arama had received all of this

amount by the end of 2023.

- Horzum AS had another zero-fatality year at the Pinargozu Mine

with a total of 151,200 fatality free hours having been worked at

the Pinargozu Mine in 2023. Horzum AS did report five serious

injuries and 28 lost-time injuries during the year.

- Horzum AS mined 8,061 tonnes of zinc product during 2023, at

the Pinargozu mine, compared with 13,766 tonnes of zinc product in

2022. Production at the Pinargozu Mine for 2023 fell short of the

amount forecast at the beginning of the year. Production was

negatively impacted, as Horzum AS effectively “lost” two months of

production early in the year as a result of seconding some of its

experienced miners and its mine rescue team to the earthquake

recovery effort that badly impacted the province of Adana and Hatay

in February and March of 2023.

- Sales volumes decreased for the year ended December 31, 2023,

when compared with 2022. Total tonnes sold decreased to 7,979 in

2023 compared with 13,067 tonnes in 2022, representing an

approximately 39% decrease. The decrease in tonnes sold was

primarily a function of having lower zinc product available to sell

during the year.

- Sales prices per tonne on a USD basis decreased by

approximately 30% for zinc sulphide product for the year ended

December 31, 2023, when compared to prices in 2022. There were no

sales of zinc oxide product, low-grade zinc sulphide product or

lead product in 2023. Total sales of all zinc product decreased to

$8.4 million in 2023 compared with approximately $17.9 million in

2022, which translates into a 53.4% decrease in total revenue in

2023 compared to 2022.

- The average grade of the zinc sulphide product sold was 48.9%

zinc per tonne for the year ended December 31, 2023, compared with

50.1% zinc per tonne in the same period in 2022. There were no

sales of zinc oxide product, low-grade zinc sulphide product and

lead product in 2023. In 2022, the average grade of sales of zinc

oxide product was 37.8% per tonne, low-grade zinc sulphide product

was 18.8% per tonne and lead product was 53.0% per tonne.

- The CAD cost per tonne mined (see non-GAAP measures) increased

substantially in 2023, to $601 per tonne mined, compared with $380

per tonne mined in 2022. The cost per tonne metric was much higher

in 2023 compared with 2022, in part due to far fewer tonnes being

mined. However, the main reason for the substantial increase was

the increase in the prices of supplies and services incurred in

2023, as a result of inflationary pressures experienced in

Türkiye.

- The USD cash cost per pound of zinc product mined (see non-GAAP

measures) increased to US$0.44 per pound in 2023 compared with

US$0.28 per pound in 2022 primarily because of the increases in the

costs of supplies and services incurred.

- The Joint Venture completed 10,782 metres of underground and

surface diamond drilling in 2023 (9,345 metres in 2022) and

completed 1,108 metres of exploration and development adit

development during 2023 (1,743 metres in 2022).

- Subsequent to December 31, 2023, Pasinex Canada received

approximately $380,000 from shareholders of the Company, which have

been added to existing shareholder loan agreements. In addition,

Pasinex Arama transferred US$60,000 (approximately $82,000 using

the exchange rates on the dates of the transfers) to Pasinex

Canada.

Non-GAAP Measures

Please note that all dollar amounts in this news

release are expressed in Canadian dollars unless otherwise

indicated. Refer also to the 2022 Management’s Discussion and

Analysis (MD&A) and Audited Financial Statements found on

SEDAR.com for more information. This news release includes non-GAAP

measures, including gross margin, cost per tonne mined and US$ cash

cost per pound of zinc product mined. A reconciliation of these

non-GAAP measures to the GAAP financial statements is included in

the MD&A.

Qualified Person

Jonathan Challis, a Fellow of the Institute of

Materials, Minerals and Mining and a Chartered Engineer, is the

qualified person (“QP”) as defined by NI 43-101 for all information

in this news release other than the information relating to the

Gunman Project. He has inspected the original paid sales invoices

issued by the Joint Venture for the shipment of zinc sulphide

product specified in this news release and has approved the

scientific and technical disclosure herein. Mr. Challis is a

director of the Company and Chair of the Joint Venture.

About Pasinex

Pasinex Resources Limited is a Toronto-based

mining company that owns 50% of Horzum Maden Arama ve Isletme

Anonim Sirketi (“Horzum AS” or “Joint

Venture”), through its 100% owned subsidiary Pasinex Arama

ve Madencilik Anonim Sirketi (“Pasinex Arama”).

Horzum AS holds 100% of the producing Pinargozu high-grade zinc

mine. Horzum AS sells directly to zinc smelters and or refiners

through commodity brokers from its mine site in Türkiye. The

Company also holds a 51% interest, with an option to increase to an

80% interest of a high-grade zinc exploration project, the Gunman

Project, located in Nevada. Pasinex has a strong technical

management team with many years of mineral exploration and mining

project development experience. Pasinex Resources Limited mission

is to explore and extract high grade ore to drive growth and wealth

for all of its stakeholders including shareholders, employees and

the communities of our operations, meeting all requirements in

safety, health and the environment.

Visit our website at www.pasinex.com.

On Behalf of the Board of Directors

PASINEX RESOURCES LIMITED

| “Andrew Gottwald” |

|

|

| Andrew Gottwald |

|

Evan White |

| Chief Financial Officer |

|

Manager of Corporate Communications |

| Phone: +1 416.861.9659 |

|

Phone: +1 416.906.3498 |

| Email: info@pasinex.com |

|

Email: evan.white@pasinex.com |

| |

|

|

The CSE does not accept responsibility for the adequacy or

accuracy of this news release. This news release includes

forward-looking statements that are subject to risks and

uncertainties. Forward-looking statements involve known and unknown

risks, uncertainties, and other factors that could cause the actual

results of the Company to be materially different from the

historical results or any future results expressed or implied by

such forward-looking statements. All statements within, other than

statements of historical fact, are to be considered

forward-looking. Although Pasinex believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not a guarantee of

future performance, and actual results or developments may differ

materially from those in forward-looking statements. Factors that

could cause actual results to differ materially from those in

forward-looking statements include market prices, continued

availability of capital and financing, exploration results, and

general economic, market or business conditions. There can be no

assurances that such statements will prove accurate and, therefore,

readers are advised to rely on their own evaluation of such

uncertainties. We do not assume any obligation to update any

forward-looking statements.

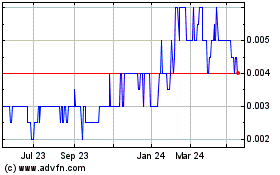

PNX Metals (ASX:PNX)

Historical Stock Chart

From Feb 2025 to Mar 2025

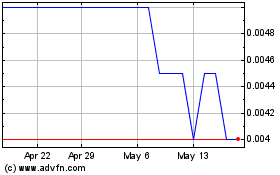

PNX Metals (ASX:PNX)

Historical Stock Chart

From Mar 2024 to Mar 2025