South32 to Book $1.7 Billion Charges and Warns of Job Cuts

04 February 2016 - 10:54AM

Dow Jones News

By David Winning

SYDNEY--South32 Ltd. (S32.AU), the mining company spun out of

BHP Billiton Ltd. (BHP.AU) last year, said it would take an around

US$1.7 billion charge against its assets as the pain from slumping

prices of commodities including nickel and coal continues to

spread.

South32 said it's also seeking to slash costs at operations

including its Cerro Matoso nickel mine and smelter in northern

Colombia and its Australian coal, alumina and manganese operations

to protect profits. However, the company stopped short of

shuttering a troubled manganese operation in South Africa

permanently in response to the global commodity price rout.

Around 620 workers will be laid off at the South African arm of

Samancor Manganese, a joint venture between South32 and Anglo

American PLC (AAL.LN), the company said. Samancor Manganese is the

world's largest producer of manganese, largely used in the making

of steel and aluminum, and has operations in South Africa and

Australia.

South32 and Anglo agreed to halt mining at the Hotazel manganese

mines in South Africa in November in response to low commodity

prices, a move that removed around 700,000 metric tons of manganese

ore from global supply.

On Thursday, South32 said mining would restart at the South

African arm of Samancor Manganese but at a substantially lower

rate. Management said the Hotazel mines would operate at around

900,000 tons below peak output for the foreseeable future.

"When combined with the restructuring initiatives that are

currently being finalized at many operations across our portfolio,

we expect to further strengthen our financial position and increase

our cash generating capacity through the cycle," Graham Kerr,

South32's Chief Executive, said.

Shares in South32 have been falling since it listed last May in

one of the largest corporate breakups in mining history. The stock

closed at 95 Australian cents (US$0.68) on Wednesday, versus its

debut value of A$2.13 a share.

Last August, the miner said it aimed to cut annual costs by

US$350 million or more by mid-2018. It also projected it would

reduce its capital expenditure this fiscal year through June by 9%

to US$700 million.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

February 03, 2016 18:39 ET (23:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

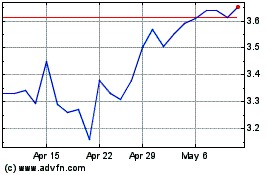

South32 (ASX:S32)

Historical Stock Chart

From Oct 2024 to Nov 2024

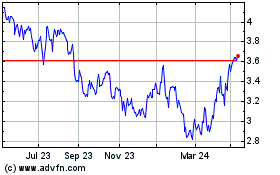

South32 (ASX:S32)

Historical Stock Chart

From Nov 2023 to Nov 2024