Australian Telecom Companies in US$11 Billion Merger

30 August 2018 - 9:29AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Australian telecommunications company TPG

Telecom Ltd. (TPM.AU) has struck a deal to combine with rival

Vodafone Hutchison Australia in an effort to build a bigger

challenger to the country's two big incumbent operators.

The tie-up will create a company with an enterprise value of

about 15 billion Australian dollars (US$10.97 billion), bringing

together TPG's more than 1.9 million fixed-line residential

subscribers and Vodafone Hutchison's roughly 6 million

mobile-service subscribers.

Each of Australia's telecom operators has struggled in recent

years with intense competition that has been heightened as the

federal government rolls out its nationwide broadband network,

which sells capacity to the operators that in turn sell broadband

services to consumers. TPG, which had plans to roll out a

competitively priced mobile telecom network to challenge the

country's three incumbents, last week admitted to exploratory

discussions with Vodafone Hutchison regarding a potential deal.

The Australian market is characterized by the presence of

Telstra Corp. (TLS.AU) and Singapore Telecommunications Ltd.-owned

(Z74.SG) Optus, said Inaki Berroeta, chief executive of Vodafone

Hutchison.

"Together, TPG and VHA will provide stronger competition in the

market and greater choice for Australian consumers and enterprises

across fixed broadband and mobile," Mr. Berroeta said.

Billed as a merger of equals, the combined company will be 50.1%

owned by Vodafone Hutchison, a 50-50 venture between the U.K.'s

Vodafone Group PLC (VOD.LN) and an Australian company controlled by

Hong Kong's CK Hutchison Holdings Ltd. The remainder will be held

by TPG's shareholders.

The new company will still be known as TPG Telecom and listed on

the Australian Securities Exchange. TPG and Vodafone Hutchison said

they anticipate substantial cost savings through their tie up as

well as revenue synergies from cross-selling products across their

respective corporate and consumer customer bases.

David Teoh, currently chief executive and chairman of TPG, will

be chairman of the combined company and Mr. Berroeta will be the

managing director and CEO.

"The characteristics that have made TPG what it is today...will

be magnified through this combination," Mr. Teoh said. "Together we

will become a more effective industry challenger that strives to

create competitively-priced consumer products."

The National Broadband Network has become the core of TPG's main

fixed-line business, and it has spent about A$1.26 billion to buy

unallocated mobile bandwidth used in current fourth-generation

networks that it had aimed to use for a rival fourth network in

Australia. Since it was founded in 1986 as Total Peripherals Group,

TPG has expanded rapidly and picked up a number of rivals,

including broadband provider iiNet in 2015. It now offers a range

of services to retail and business customers.

In parallel with the merger plans, the two companies said they

would jointly bid capacity in the upcoming government auction of

the 3.6 Gigahertz spectrum that will be used for so-called 5G

networks.

TPG also said it would spin off to its shareholders its mobile

business in Singapore, and the new merged company would later seek

to agree commercial services agreements with the unit.

The company said they expect the deal to be complete next

year.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 29, 2018 19:14 ET (23:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

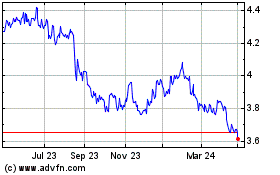

Telstra (ASX:TLS)

Historical Stock Chart

From Dec 2024 to Jan 2025

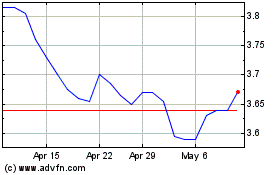

Telstra (ASX:TLS)

Historical Stock Chart

From Jan 2024 to Jan 2025