Wesfarmers Quarterly Sales Rise At Coles Grocery Business

27 April 2017 - 10:10AM

Dow Jones News

By Mike Cherney

SYDNEY--Australian conglomerate Wesfarmers Ltd. (WES.AU) said

food and liquor sales at its important Coles supermarket chain rose

1.2% in the third quarter, reflecting increased investment as the

company seeks to fend off challenges from a crowded field of

competitors.

Total food and liquor sales were 7.6 billion Australian dollars

(US$5.68 billion) in the third quarter of its financial year

against A$7.52 billion a year earlier, and were up , and were up

1.9% year-to-date at A$24.63 billion against A$24.18 billion

previously.

Comparable same-store food and liquor sales, however, increased

just 0.3% while comparable food sales increased 0.4%, a slowdown

from earlier in the year.

Total convenience-store sales in the Coles division fell 3% in

the third quarter to A$1.4 billion, including fuel. Comparable

convenience store sales, excluding fuel, fell 0.8% in the

quarter.

Food and liquor price deflation was 0.5% during the quarter and

0.8% for the financial year to date. Wesfarmers said the business

has seen 24 consecutive quarters of price deflation.

The Australian grocery industry has seen competition increase in

recent years as Coles and traditional rival Woolworths Ltd.

(WOW.AU) fend off new rivals such as discount retailer Aldi.

Amazon.com Inc.'s (AMZN) recent announcement that it would expand

its retail offering in Australia could also add to the pressure if

the e-commerce giant rolls out its AmazonFresh grocery service.

Overall, Wesfarmers said its third-quarter retail sales were

"generally pleasing" giving the later timing of Easter holidays

this year.

Wesfarmers said sales at its home-improvement chain Bunnings

rose 7.7% to A$2.8 billion in Australia and New Zealand. In the

U.K. and Ireland, where Wesfarmers recently acquired the Homebase

chain, Bunnings said sales were A$400 million.

Third-quarter sales at its Kmart stores rose 2.5% to A$1.1

billion, though sales dropped 18% at discount retailer Target to

A$555 million. Officeworks sales rose 9% to A$558 million in the

quarter.

Wesfarmers also said coal production at its Curragh mine was

1.5% lower than the previous quarter. It warned that production and

sales volumes for the fourth quarter would be impacted by Cyclone

Debbie, which slammed the east coast of Australia last month, and

that exported coking coal volumes for the 2017 financial year would

be at the lower end of a previously guided range of 8 million-8.5

million metric tons.

Wesfarmers said its share of coal production at the Bengalla

mine was 15.3% below the previous quarter.

Write to Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

April 26, 2017 19:55 ET (23:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

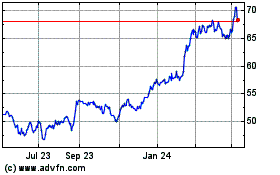

Wesfarmers (ASX:WES)

Historical Stock Chart

From Dec 2024 to Jan 2025

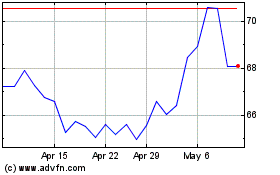

Wesfarmers (ASX:WES)

Historical Stock Chart

From Jan 2024 to Jan 2025