Westpac to Pay Record Fine for 23 Million Money-Laundering, Terror-Financing Breaches

24 September 2020 - 12:58PM

Dow Jones News

By Alice Uribe

SYDNEY-- Westpac Banking Corp. has agreed to pay the largest

fine in Australian corporate history to settle a civil lawsuit that

revealed more than 23 million breaches of the country's

money-laundering and terrorism-financing laws.

Westpac, Australia's second-largest bank, said it would pay a

$920 million penalty for breaches that included a failure to detect

transfers that may have been used to facilitate child exploitation

in Asia.

The bank also said it had failed to report more than 19.5

million international transfers and didn't keep records relating to

the origin of some of them.

The proposed agreement with the federal government's

financial-intelligence agency, which remains subject to court

approval, includes further admissions by the bank it contravened

the law another 76,000 times.

"We are committed to fixing the issues to ensure that these

mistakes do not happen again," said Westpac Chief Executive Peter

King. "We have also closed down relevant products and reported all

relevant historical transactions."

The penalty of 1.3 billion Australian dollars, equivalent to

$920 million, follows legal proceedings brought by the Australian

Transaction Reports and Analysis Centre, or Austrac, in November

last year. Westpac said the additional breaches that came to light

following that claim meant the settlement was larger than a A$900

million provision made by the lender in May. That provision has now

been increased by A$404 million.

Australia's banks once held a reputation for being among the

world's safest and most profitable for investors, but a series of

scandals in recent years has rocked the country's top financial

institutions. The country's biggest lender, Commonwealth Bank of

Australia, in 2018 settled a case involving more than 53,700

money-laundering contraventions for A$700 million plus legal

costs.

Austrac Chief Executive Nicole Rose said the settlement sends a

strong message to the banking industry that it would act to ensure

Australia's financial system remains strong to prevent it being

exploited by criminals. "Our role is to harden the financial system

against serious crime and terrorism financing and this penalty

reflects the serious and systemic nature of Westpac's

noncompliance," she said.

In court documents filed last year, Austrac alleged Westpac's

infractions between 2013 and 2019 were "the result of systemic

failures in its control environment, indifference by senior

management and inadequate oversight by the board."

That led to a failure to properly assess and monitor the risks

in moving money in and out of the country and to carry out

appropriate due diligence on customers--who were known for

child-exploitation risks--sending money to the Philippines and

elsewhere in Southeast Asia, Austrac said.

Austrac alleged Westpac failed to carry out due diligence on 12

of its customers to manage known child-exploitation risks. In one

case, when a customer who had served jail time for child

exploitation opened a number of Westpac accounts, only one was

promptly identified as indicative of child exploitation. The

customer continued to send frequent low-value payments to the

Philippines through accounts that weren't being monitored

appropriately, Austrac said.

Westpac, which has a market value of $41.8 billion, changed its

chief executive soon after the lawsuit was filed by Austrac and

brought forward the retirement of its chairman.

An internal investigation by Westpac identified three main

causes of the compliance failures. Some areas of money laundering

and counterterrorism financing risk weren't sufficiently understood

within the company, the bank said. It was unclear who was

accountable for managing compliance with the laws, while the bank

didn't have enough staff working in that area, Westpac said.

The internal investigation also concluded that directors could

have recognized earlier the systemic nature of some of the

financial-crime issues that Westpac was facing. A total of 38

employees took a hit to their pay, including bonuses being

withheld. Some staff have been disciplined, Westpac said in June

when publishing the review's conclusions.

"We have recruited about 200 financial-crime people to the

group, created a new Group Executive position directly responsible

for improving our financial-crime capability, and established a new

Board Legal, Regulatory and Compliance subcommittee," Mr. King said

Thursday.

Write to Alice Uribe at alice.uribe@wsj.com

(END) Dow Jones Newswires

September 23, 2020 22:43 ET (02:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

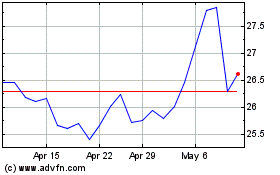

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Jan 2025 to Feb 2025

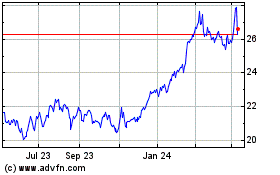

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Feb 2024 to Feb 2025