Westpac Banking Corporation (NYSE:WBK), (ASX:WBC):

MEDIA RELEASE

1 NOVEMBER 2021

[All $ numbers are in Australian dollars/cents]

Financial

results snapshot1

KEY POINTS

- Statutory net profit $5,458m, up 138%

- Cash earnings $5,352, up 105%

- Cash EPS 146 cents, up 102%

- NIM 2.04%, down 4bps

- ROE 7.6%, up 372bps

- CET1 capital ratio 12.32%, up 119bps

- Fully franked final dividend 60 cents per share

- Excl. notable items2, cash earnings $6,953m, up 33%

- Excl. notable items2, ROE 9.8%, up 212bps

- Total return to shareholders $5.7bn – $3.5bn off-market

buy-back, $2.2bn dividends

- 2021 impairment benefit of $590m

- Australian mortgage lending up 3% ($14.7bn)

- Australian business lending up 4% in 2H21

- Total customer deposits up 4% ($24.9bn)

- Credit quality sound – stressed exposures to total committed

exposures 1.36%, down 55bps. Australian 90+ day mortgage

delinquencies 1.07%, down 55bps. Impaired exposures down 23% in the

year

1 Full Year 2021 compared to Full Year

2020. Reported on a cash earnings basis unless otherwise stated.

For a reconciliation of cash earnings to reported results, refer to

Section 5, Note 8 of Westpac Group 2021 Full Year Financial

Results. For an explanation of cash earnings, refer to Section

1.3.

2 References to notable items in this

release include (after tax) provisions and costs related to the

AUSTRAC proceedings; provisions for estimated customer refunds and

repayments, associated costs and litigation; the write-down of

assets; and the impact of asset sales and revaluations. Refer to

Westpac Group 2021 Full Year Financial Results for detail.

THE RESULT

Westpac Group CEO, Peter King, said: “2021 has been another

challenging year, with a focus on continuing to support customers

and employees through the pandemic, while implementing our Fix,

Simplify and Perform strategic priorities.

“Cash earnings rose, the balance sheet remains strong, and I am

pleased with the progress we are making to transform Westpac into a

simpler, stronger bank. Credit quality has remained remarkably good

with stressed exposures continuing to decline off last year’s peak,

while mortgage 90+ day delinquencies were also significantly

lower.

“A turnaround in impairment charges and lower notable items were

the main drivers of our improved earnings, while we also restored

growth in mortgages and have begun to see better momentum in our

institutional and business portfolios. While notable items were

lower, they remain elevated as we continue to work on fixing our

issues and simplifying our business,” he said.

“We grew our Australian mortgage portfolio 3 per cent or $14.7

billion over the year, a significantly better performance than

2020. Owner occupied lending increased 9 per cent. Consistent with

increased liquidity in the market, total customer deposits were up

4 per cent, or $24.9 billion.

“Margins were down in a competitive, low-rate environment, and

as we foreshadowed, costs were much higher in FY21. This was mainly

due to an increase in our workforce to improve risk management and

support higher business volumes, including COVID related

assistance, as well as returning more than 1,000 jobs back to

Australia,” Mr King said.

“Our underlying results are not where we want them to be, and we

recognise we have more to do to become the high-performing company

we aspire to be.

“However, we are making progress in changing how the bank is

run, including improving our culture and risk management systems,

streamlining decision-making processes through lines of business,

and streamlining our processes through digitisation,” he said.

FIX. SIMPLIFY. PERFORM.

Mr King said this year Westpac made significant progress on

becoming a simpler, stronger bank.

Fix

“We are one year into our Customer Outcomes and Risk Excellence

(CORE) Program, which comprises more than 300 activities to

strengthen risk governance, accountability and culture across the

organisation,” Mr King said.

“In addition, we have strengthened our financial crime practices

with a rebuild of our processes and systems.

“We are also progressing customer remediation with 2021 seeing

us substantially complete the two largest legacy advice

programs.”

In 2021 Westpac paid or offered more than $1 billion to

approximately 1 million customers as part of customer

remediation.

Simplify

Mr King said Westpac was well progressed in simplifying its

portfolio.

“We have completed the sale of four businesses and announced a

further three asset sales, with these due for completion in

2022.

“We have also made progress on consolidating our international

footprint, closing our offices in Mumbai and Jakarta, and we expect

three more international offices to close by the end of 2022,” he

said.

“We continued our focus on digital this year, launching a new

Westpac mobile banking app to iPhone customers, with 1.7 million

users.

“In mortgages, we have further digitised processes and

introduced more than 70 policy and process improvements, which

contributed to faster approval times. Our digital mortgage

origination platform peaked at 810 applications per week, and we

have started rolling out this platform to mortgage brokers,” Mr

King said.

“We also implemented more than 100 policy and process

improvements in business lending and increased automated credit

decisioning, leading to faster decisions for customers.”

Perform

“Our improved growth in mortgages was concentrated in owner

occupied lending which was up 9 per cent. We saw a significant

change in mix with fixed rate lending making up 52 per cent of new

lending and now comprising 38 per cent of the portfolio.

“In addition, we regained momentum in business lending, with our

Australian business loan book growing four per cent in the Second

Half,” he said.

“We announced our cost reset program this year – targeting an $8

billion cost base by FY24 – and this is underway, led initially by

divestments and simplification of our operations.

“We expect our costs to begin reducing in the year ahead from

our simplification and the completion of key programs in our Fix

priority,” Mr King said.

DIVIDENDS

The Board has determined a final, fully franked dividend of 60

cents per share to be paid on 21 December 2021.

Total dividends for 2021 were 118 cents per share representing a

62 per cent payout of cash earnings excluding notable items.

DIVISIONAL PERFORMANCE

Division

FY21 cash earnings

($m)

% change FY21-FY20

% change 2H21-1H21

Commentary (FY21-FY20)

Consumer

$3,081

12

(6)

Cash earnings were 12% higher than FY20,

mainly from an impairment benefit of $125m compared to a charge of

$1,015m in FY20. Mortgages increased $19.1bn or 5% over the year.

Margins decreased 3bps driven by competitive pricing to attract and

retain customers, portfolio mix effects as customers shifted to

lower fixed rate lending, and a decline in personal lending.

Operating expenses rose off the back of higher risk management and

processing costs.

Business

$1,789

144

(6)

Cash earnings were 144% higher mainly due

to an impairment benefit of $484m compared to an impairment charge

of $1,371m in FY20, along with a $268m turnaround in notable items.

Excluding notable items, net interest income was down $416m from an

11bp decrease in margins and a 5% decrease in lending. While

lending was down, momentum improved through the year. Deposits were

up 4%, or $6.8bn, over the year. Operating expenses rose as

resources increased as part of our Fix priority.

Westpac Institutional

Bank

($670)

Large

Large

Cash earnings were a loss of $670m for

FY21 compared to a profit of $332m in FY20. Notable items were

$991m (net of tax) and related to the write-down of assets, mostly

intangible assets, (including goodwill, capitalised software and

other assets) following an annual impairment test. Excluding this,

cash earnings were $321m, $11m lower than FY20. Net interest margin

declined 9bps to 1.26% with lower interest rates reducing deposit

spreads and earnings on capital. Impairment charges were lower as

asset quality improved. Compared to the first half, net loans

increased 7%, or $4.6bn, mainly from growth in the Retail and

Industrials sectors.

Westpac New Zealand

(NZ$)

$1,013

56

(26)

Cash earnings of $1,013m increased $364m

or 56% compared to FY20, primarily driven by a $404m turnaround in

impairment charges. Net interest income benefitted from a 3bp

increase in margins and lending growth of 5% driven by $5.7bn of

mortgage growth. Deposits increased 7%, or $4.9bn, fully funding

loan growth and lifting the deposit to loan ratio to 82%.

Specialist Businesses

$193

Large

(56)

Cash earnings for FY21 were $193m compared

to a loss of $506m for FY20, mainly due to lower notable items

($382m net of tax) and an impairment benefit of $66m compared to an

impairment charge of $255m in FY20.

OUTLOOK

Mr King said that despite a challenging 2021, he was confident

the Australian economy will rebound over the next 12 months.

“The recent lockdowns in NSW, Victoria and the ACT have been

difficult for many businesses, and while uncertainty in the outlook

remains, I am confident most industries will begin to recover as

Australia’s two biggest states re-open.

“Consumer spending will likely increase significantly as states

re-open and pent-up demand is released, particularly supported by

consumer optimism and sizeable savings.

“We expect the Australian economy to expand by 7.4 per cent in

2022, with credit growth expanding 6.8 per cent. Demand for housing

is likely to remain elevated but home price increases should

moderate to 8 per cent next year,” he said.

Mr King said while there was more work to do, Westpac continued

to make progress on its Fix, Simplify and Perform strategic

priorities.

“Next year we expect to reduce our cost base as we head towards

our $8 billion cost target from completion of programs under our

Fix priority and realise the benefits from divestments.

“We have made considerable progress in improving our mortgage

and business banking performance, driven by streamlining of lending

processes to create a better customer experience. This sets us up

to maintain momentum in the year ahead.

“For our business, loan growth is expected to be sound as the

economy rebounds, although net interest margins will remain under

pressure from low interest rates and competition.

“We are also committed to resolving a number of outstanding

regulatory issues where our actions were not good enough.

“We are making progress in strengthening risk management,

growing our core franchise, and simplifying the bank, which

provides a strong platform to deliver a better service to

customers, as well as returns for shareholders,” Mr King said.

A video interview with Mr King, and Chief Financial Officer,

Michael Rowland, is available on the Westpac Wire website –

www.westpacwire.com.au

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211101005366/en/

David Lording Head of Media Relations M. +61 419

683 411

Andrew Bowden Head of Investor Relations T. +612

8253 4008 M. +61 438 284 863

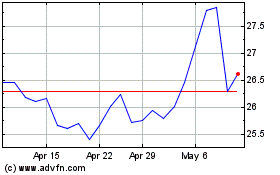

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Jan 2025 to Feb 2025

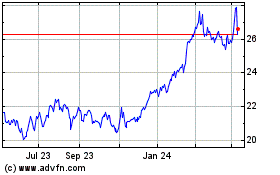

Westpac Banking (ASX:WBC)

Historical Stock Chart

From Feb 2024 to Feb 2025