European IPO Market Picks Up After Volatility Curbed 2022 Listings -- At a Glance

15 February 2023 - 12:12AM

Dow Jones News

By Christian Moess Laursen

Europe's initial-public-offering activity is picking up this

year after new listings slowed sharply in 2022 due to market

volatility. Proceeds raised by European IPOs plunged to 15.6

billion euros ($16.73 billion) in 2022 compared with EUR75 billion

in 2021, and more than half of last year's proceeds corresponded to

Porsche AG's listing, according to a PwC report published earlier

this year.

German web-hosting and cloud company Ionos Group SE and Italian

supplier of electric-motor components EuroGroup Laminations SpA

debuted on stock markets last week, and more companies have said an

IPO is in the cards. Here are some of the companies that are either

planning or considering an IPO in 2023:

--Thyssenkrupp AG said on Tuesday that it is closely watching

capital markets, as it readies to launch an IPO for Thyssenkrupp

Nucera, its water-electrolysis business, when market conditions are

right. The German industrial conglomerate owns a 66% stake, with

Italy's Industrie de Nora SpA holding the remaining 34%. The IPO

was originally planned for last June but was postponed due to a

difficult market environment.

--ABB Ltd. said this month that its E-Mobility unit had raised a

further 325 million Swiss francs ($353.5 million) in a private

placement ahead of its expected IPO. The Swiss technology group

last year postponed the IPO of the unit, which focuses on

engineering and making chargers and infrastructure for electric

vehicles, but ABB said it remains committed to listing once market

conditions are right. ABB E-Mobility has raised a total of around

CHF525 million.

--Renault SA in November last year said it planned to list its

EV and software business Ampere on the Euronext Paris stock market

in the second half of 2023 at the earliest. Renault will hold a

majority in Ampere, while its long-term ally Nissan Motor Co. will

take a stake of up to a 15%, the companies said earlier this

month.

--Spanish construction-materials company Grupo Cosentino is

considering an IPO but hasn't made a decision yet, a company

spokesman told Dow Jones Newswires. The company could be valued at

more than EUR3 billion in an IPO, Spanish business paper Expansion

reported last month.

--Lottomatica, an Italian gambling company backed by Apollo

Global Management Inc., said in late January that it is

contemplating a potential listing as it considers alternatives to

support future growth. A possible IPO could raise around EUR1

billion, Bloomberg reported last month.

--Other European IPOs were called off last year due to tough

market conditions, including those of Wintershall Dea AG, an

oil-and-gas company majority-owned by BASF SE, and Italian energy

company Eni SpA's retail and renewables business Plenitude. BASF

remains committed to selling its Wintershall shares through an IPO,

the company has told Dow Jones Newswires.

Saxo Bank said last month that an IPO could happen this year,

after the lender pulled out of a merger deal with a special purpose

acquisition company in December, Reuters reported. Saxo Bank

declined to comment on a potential IPO when contacted by Dow Jones

Newswires.

Write to Christian Moess Laursen at christian.moess@wsj.com

(END) Dow Jones Newswires

February 14, 2023 07:57 ET (12:57 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

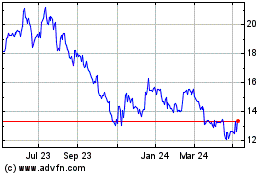

Industrie De Nora (BIT:DNR)

Historical Stock Chart

From Dec 2024 to Jan 2025

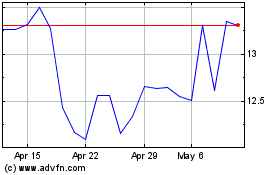

Industrie De Nora (BIT:DNR)

Historical Stock Chart

From Jan 2024 to Jan 2025