Enel Signs EUR12 Billion Revolving Credit Facility

27 December 2022 - 7:09PM

Dow Jones News

By Christian Moess Laursen

Enel SpA said late Friday that it has signed a 12 billion euros

($12.76 billion) revolving credit facility with a group of banks to

fund the collateral requirements for its energy-market trading

activities.

The Italian utility said the credit facility--guaranteed by the

Italian export credit agency SACE SpA for up to 70% of its nominal

amount--has a term of about 18 months.

"The revolving credit facility is part of a structured course of

action to protect Italy's energy system, aimed at providing sector

operators with an additional tool for managing the risks associated

with the very large size reached by the contracts stipulated to

cover industrial positions (so-called margining) due to the

continuing volatility of the energy markets as a result of the

crisis," it said.

The company said the deal is in line with the European

Commission's temporary crisis framework for state aid to support

the economy during the Russia-Ukraine war.

The credit facility doesn't have any effect on its net financial

debt, Enel said. The company had around EUR24.7 billion in

liquidity at the end of September, it said.

Write to Christian Moess Laursen at christian.moess@wsj.com

(END) Dow Jones Newswires

December 27, 2022 02:54 ET (07:54 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

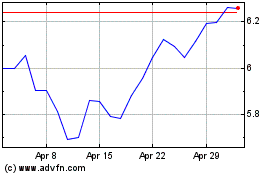

Enel (BIT:ENEL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Enel (BIT:ENEL)

Historical Stock Chart

From Dec 2023 to Dec 2024