Shipbuilders Fincantieri and Damen in the Running to Buy STX France

09 September 2016 - 11:10PM

Dow Jones News

Italian shipbuilding giant Fincantieri SpA and Dutch counterpart

Damen Shipyards Group are in the running to buy STX France, which

has been put on the block by Korean debt-ridden parent STX Offshore

& Shipbuilding Co., a person with direct knowledge of the

matter said Friday.

"It's down to Fincantieri and Damen," the person said. "If there

is a deal, it could be announced as early as this month."

STX France, which specializes in building cruise ships, is the

only profitable unit of STX, with a full order book for the next

seven years.

STX, which filed for receivership in May, is Korea's

fourth-largest shipyard and a unit of conglomerate STX Corp. STX is

active in shipping, construction and energy around the world.

The sale of the French yard is a key part of a restructuring

plan by STX, which also includes cutting by 35% its 2,090 staff in

Korea by the end of September. The company's creditors will decide

in October whether to accept the plan. If it is rejected, the

company will be liquidated.

"STX France is a good asset, but there is still no certainty

that an agreement with the bidders will be reached," the person

involved in the sale process said.

Fincantieri declined to comment and Damen didn't immediately

return requests for comment.

Korean shipyards, including the world's three largest—Hyundai

Heavy Industries Co., Daewoo Shipbuilding & Marine Engineering

Co. and Samsung Heavy Industries Co.—are restructuring led by

creditor banks that have struggled to rehabilitate the embattled

shipbuilders through the sale of noncore assets.

Profits at Korean shipbuilders began sliding when the 2008

global economic crisis damped orders from shipping companies, and

lower-cost Chinese rivals made market inroads.

A glut of ships in the water and not enough cargo to fill them

over the past three years has led to record-low freight rates,

prompting owners to further cut or push back new ship orders.

The Korean yards ventured into offshore oil rigs starting around

2010 to avoid direct competition with shipbuilding rivals in China,

where inexpensive labor could churn out low-profit vessels at

cheaper rates.

But a sharp decline in crude prices has prompted international

oil companies to reduce their capital expenditure, resulting in

fewer offshore and other projects for shipbuilders.

STX Offshore creditors have injected billions of dollars to bail

it out, but it still ran a 314 billion won ($265 million) operating

loss last year, following a 1.5 trillion won loss in 2014. The

company owes financial institutions nearly 6 trillion won.

Write to Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

September 09, 2016 08:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

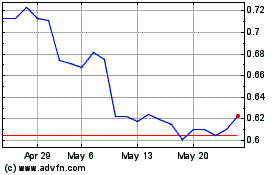

Fincantieri (BIT:FCT)

Historical Stock Chart

From Nov 2024 to Dec 2024

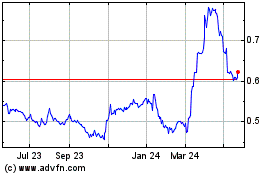

Fincantieri (BIT:FCT)

Historical Stock Chart

From Dec 2023 to Dec 2024