Treasury Chief Urges Action on Puerto Rico

21 January 2016 - 10:20AM

Dow Jones News

SAN JUAN, Puerto Rico—Treasury Secretary Jacob Lew issued his

most forceful call to date for Congress to pass legislation

allowing Puerto Rico to restructure its debts and avoid looming

defaults during his first visit to the island territory

Wednesday.

His trip had twin audiences. It was in part a listening tour

with islanders frustrated by Washington's apparent apathy. To make

recent bond payments, the territory has withheld hundreds of

millions of dollars in tax refunds and payments to suppliers.

Assets in its depleted pension system have been sold to pay

bills.

But Mr. Lew also visited the island as part of a bid to focus

attention for Congress, which had been slow to confront the

island's debt crisis until December, when new Speaker Paul Ryan

(R., Wis.) committed to producing a plan in the House by the end of

March.

Puerto Ricans are U.S. citizens, meaning they are free to move

to the U.S. mainland. Many have been doing so as the island's

economy sputters, fueling a vicious circle in which the territory's

government collects less in taxes from the residents who

remain.

"The people of Puerto Rico are sacrificing, but unless that

sacrifice is shared by creditors in an orderly restructuring, there

is no path out of insolvency and back to growth," Mr. Lew told

reporters here after meeting with Puerto Rico's governor, Alejandro

Garcí a Padilla. He also met with local lawmakers, business

executives and labor leaders.

Puerto Rico missed around $37 million in payments on debts this

month after diverting money to pay some investors at the expense of

others.

The next three months are critical for the legislative effort

because of the March 31 deadline set by Mr. Ryan and because

passing legislation during that window would give Puerto Rico a

chance to begin restructuring before the next payments come due, in

May and July. Mr. Lew also defended the administration's support

for an independent fiscal oversight board that remains unpopular on

the island by saying that any such oversight should respect Puerto

Rico's self-governance.

Wednesday's visit "makes Secretary Lew a better advocate for

Puerto Rico" in Washington, said Pedro Pierluisi, the island's

nonvoting representative in Congress. "It is very important for him

to come to the ground level and validate what he's telling Congress

to do."

The Obama administration has also called on Congress to fix

funding discrepancies in the island's Medicaid program and provide

Puerto Rico with access to the earned-income tax credit, a tax

break designed to boost workforce participation among the poor.

Republicans have withheld their support of any

debt-restructuring mechanism and instead say a powerful fiscal

oversight board is needed.

Puerto Rico's economic advisers last week said they now expect

tax revenue to come in below previous estimates as the island's

economy continues to struggle with high unemployment and a

declining population. The Census Bureau said last month that Puerto

Rico's population loss accelerated in the year ended June. The

population fell by 1.7%, primarily as residents migrated to the

U.S. mainland.

If residents of Puerto Rico don't have access to the same public

benefits, health coverage or economic opportunities as other

Americans, "do not then complain if they hop onto a plane and move

to Florida or New York," Mr. Pierluisi said.

Mr. Lew said an action by Congress would provide the most

immediate and comprehensive solution to fix Puerto Rico's fiscal

problems. He repeated the Treasury's long-standing position that it

won't provide loans or other bailouts.

"There is no federal bailout here. Restructuring is an

alternative to a bailout," he said. "This is not a case of 'waiting

will help.' All waiting does is makes a process more complicated,

messier and more costly."

The trip offered Mr. Lew an up-close look at the fallout from

the debt crisis. Small-business owners who are vendors for the

government haven't been paid, and residents are concerned about

health-care cutbacks that have prompted hospitals to close

floors.

The island has in recent years sought to boost its struggling

economy with a tourist sector catering to wealthy Americans, such

as the Condado waterfront district featuring gleaming hotels beside

Gucci and Salvatore Ferragamo shops. Mr. Lew spoke to the media

from a hotel complex that had been a troubled development until it

was rescued by a New York hedge-fund manager two years ago.

Write to Nick Timiraos at nick.timiraos@wsj.com

(END) Dow Jones Newswires

January 20, 2016 18:05 ET (23:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

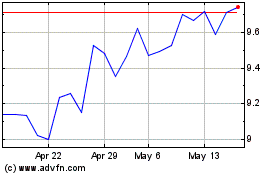

Salvatore Ferragamo (BIT:SFER)

Historical Stock Chart

From Oct 2024 to Nov 2024

Salvatore Ferragamo (BIT:SFER)

Historical Stock Chart

From Nov 2023 to Nov 2024