By Sarah Kent, Eric Sylvers and Inti Landauro

LONDON--Some of the world's largest oil companies reported

sharply lower earnings on Thursday as they gave up on some ventures

that no longer make sense in a world of crude prices around $50 a

barrel.

Royal Dutch Shell PLC posted a $6.1 billion loss in the third

quarter after its decision to walk away from exploring the Arctic

for oil and exploiting Canada's oil sands resulted in $7.9 billion

in charges. Petro China Co., the biggest oil-and-gas producer by

volume in China, said its third-quarter net profit fell by more

than 80%.

Total SA, the French oil giant, said its net profit fell 69%

compared with last year's third quarter, partly the result of a

$650 million write-down in its Canada oil-sands ventures. Italy's

Eni SpA experienced a loss of EUR952 million in the third quarter

and decided to sell 12.5% of its troubled oil-field services

company Saipem SpA.

And in the U.S., ConocoPhillips reported a loss of $1.1 billion

and announced new plans to trim spending.

This unpleasant picture is presented after a third quarter in

which Brent crude, the international benchmark for oil prices,

traded at about $50 a barrel on average, the lowest sustained

levels since the financial crisis. The companies said they were

straining to change how they do business as prices are depressed by

new supplies of U.S., Russian and Middle Eastern oil outstripping

global demand.

"The reality of the day is that we don't know when and how this

will balance out. We don't even know if it really stabilizes,"

Shell Chief Executive Ben van Beurden said on a call with reporters

Thursday. "If you have a high degree of uncertainty over the oil

price, you have to have projects that are very resilient."

Shell's about-face is among the industry's starkest. The

U.K.-Dutch giant had gained a reputation as being optimistic about

the future direction of oil prices, moving aggressively to buy BG

Group PLC for $70 billion in an acquisition seen as bullish.

Now, Shell says it is looking at $55 a barrel as the break-even

oil price for new projects and took billions of dollars in

impairment charges in the third quarter after lowering its

long-term oil and gas price outlook.

The company has moved to focus on what Mr. van Beurden sees as

its two core strengths: challenging deep water projects and

liquefied natural gas. The chief executive proved he was willing to

abandon two major developments--the Alaskan Arctic and its Canadian

oil-sands project called Carmon Creek--that he didn't see as core,

even though the company had spent billions on them.

The cost of those decisions was steep, though. And even

stripping out its impairments and write-offs, Shell reported an

adjusted profit of $1.8 billion, down 70% compared with a year

earlier and missing analysts' expectations.

Low oil prices were most apparent in Shell's upstream business,

which focuses on finding and producing oil and gas. The segment

reported a net loss of $8.6 billion in the third quarter compared

with a $3.9 billion profit a year earlier. Reduced costs and a 3%

increase in production volumes weren't enough to offset the impact

of weaker prices, the company's sizable write downs and a higher

tax bill.

The extent of the oil prices' effect on the industry will come

into sharper focus on Friday when American giants like ExxonMobil

Corp. and Chevron Corp. reveal their third-quarter earnings. Their

profits have fallen in the past year, though neither has posted a

net loss like Shell and other European companies this year.

Eni's sale of a Saipem stake to an Italian state-run investment

fund will bring in some needed cash--about EUR5.4 million euros--as

the company confronts low-oil prices. Eni has said that it will use

the proceeds for its exploration and production business and to

shore up its balance sheet.

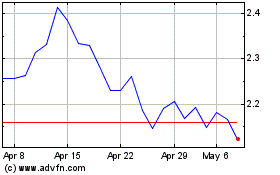

Eni Chief Executive Claudio Descalzi has indicated that the 31%

stake his company still owns in Saipem could be lowered further

though he is in no rush to do so in light of the company's

depressed stock. The shares have lost half their value in the past

two years as Saipem issued multiple profit warnings and cycled

through three CEOs.

Total was able to soften the blow of low oil prices by raising

output to an average of 2.34 million barrels of oil equivalent a

day, up from 2.12 million barrels a day in the same period a year

ago. Its adjusted net profit--a closely watched figure that strips

out one-time charges such as write-downs--fell just 22% to $2.76

million, beating expectations.

Some analysts said that they weren't worried about the

third-quarter earnings. With the exception of Eni, the companies

appear committed to paying hefty dividends, and many of the losses

are "one offs," said Oswald Clint, an energy analyst at Sanford C.

Bernstein Research.

"In the nine months year to date, many are delivering cash flows

above expectations and balance sheets in the same state of health

as this time last year, and therefore the dividend payment

potential remains intact," he added.

Brian Spegele contributed to this article.

Write to Sarah Kent at sarah.kent@wsj.com, Eric Sylvers at

eric.sylvers@wsj.com and Inti Landauro at inti.landauro@wsj.com

Access Investor Kit for "BG Group Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB0008762899

Access Investor Kit for "Royal Dutch Shell PLC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB00B03MLX29

Access Investor Kit for "Royal Dutch Shell PLC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB00B03MM408

Access Investor Kit for "BG Group Plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US0554342032

Access Investor Kit for "EXXON MOBIL CORP"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US30231G1022

Access Investor Kit for "Royal Dutch Shell PLC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US7802591070

Access Investor Kit for "Royal Dutch Shell PLC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US7802592060

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 09:37 ET (13:37 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

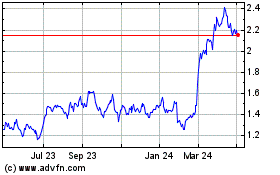

Saipem (BIT:SPM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Saipem (BIT:SPM)

Historical Stock Chart

From Feb 2024 to Feb 2025