2nd UPDATE: LVMH Takes Controlling Stake In Italy's Bulgari

07 March 2011 - 8:56PM

Dow Jones News

LVMH Moet Hennessy Louis Vuitton (MC.FR) Monday agreed to take a

controlling stake in Italy's Bulgari SpA (BUL.MI) in a deal valuing

the company at around EUR3.68 billion, adding to the French firm's

watch and jewelry brands and underscoring the strength in the

luxury sector.

It's the latest acquisitive move by LVMH, which has already

swallowed up a string of competitors such as Gucci, Fendi and Donna

Karan, and last year disclosed it held a 17% stake in rival Hermes

International SCA (RMS.FR) which it has since upped to 20%.

LVMH will issue 16.5 million new shares in exchange for the

152.5 million Bulgari shares currently held by the Bulgari family,

which owns 50.43% of the firm, Bulgari said in a statement. The

French firm will also submit a public offer at EUR12.25 a share for

the stock held by minority shareholders, valuing the entire deal at

around EUR3.68 billion, according to Dow Jones Newswires

calculations.

LVMH offered a 61% premium to Bulgari's Friday closing price of

EUR7.59 and the shares of the Italian firm rose 60% in early trade

Monday. The deal is "in the high range for luxury-sector multiples,

which should help the whole sector," said a Milan-based analyst.

Shares in Italian peer Tod's SpA (TOD.MI) were up 4% at EUR76.25,

while in London Burberry Group PLC was the second highest riser on

the FTSE 100 index, up 4.2% at 1206 pence. LVMH shares were down 1%

at EUR110.2.

Bulgari said Paolo and Nicola Bulgari will remain chairman and

vice chairman of the Bulgari board of directors as part of the

deal. The Bulgari family will be entitled to appoint two

representatives to the LVMH board of directors and Francesco

Trapani, Bulgari's chief executive, will join the executive

committee of LVMH.

Trapani, who is also a member of the Bulgari family, will head

up an enlarged LVMH's jewelry and watches business, which already

includes Zenith and Hublot as well as TAG Heuer. The division saw

the strongest revenue growth of LVMH's main business groups last

year, posting a 29% rise in revenue to EUR985 million, but it is by

far the smallest division accounting for less than 5% of LVMH's

total revenue.

"We found in Bernard Arnault and the group he has built all the

elements that are required to guarantee the long term future of

Bulgari," Paolo and Nicola Bulgari said in a statement. They added

the corporate culture at both firms is "completely identical," a

point also stressed by LVMH Chief Executive Bernard Arnault.

The transaction comes as the luxury goods market is rebounding

sharply from a deep trough during the recession. Bulgari reported a

21% jump in quarterly revenue in January, helped by strong sales in

Japan, pushing its annual sales well over EUR1 billion.

Watch sales account for about a fifth of Bulgari's revenue while

jewelry accounts for nearly half. Trapani aims to push more

aggressively into China this year.

The agreement with the Bulgaris contrasts with LVMH Chief

Executive Bernard Arnault's standoff with Hermes International SCA

(RMS.FR). LVMH shocked the family-owned luxury brand last year when

it disclosed it controlled 17% of the smaller company, a stake LVMH

boosted in December to about 20%.

Arnault recently described the Hermes investment as peaceful but

not passive, while Hermes' Chief Executive Patrick Thomas said last

week that LVMH's stake is not "desired" nor "desirable". In

response to LVMH's move, the Hermes family members plan to regroup

a majority of the company into a family-controlled holding company

to lock up the firm from any takeover intent.

-By Inti Landauro, Dow Jones Newswires; +33 1 4017 1740;

inti.landauro@dowjones.com

(Guy Castonguay in Milan and Elizabeth Holmes contributed to

this story.)

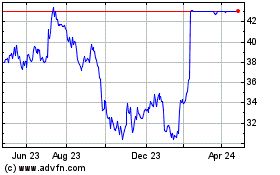

Tod`s (BIT:TOD)

Historical Stock Chart

From Dec 2024 to Jan 2025

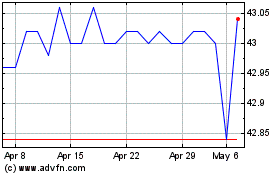

Tod`s (BIT:TOD)

Historical Stock Chart

From Jan 2024 to Jan 2025