112,000 ETH Moved To Crypto Exchanges In The Past Day — Impact On Ethereum Price?

15 September 2024 - 5:00AM

NEWSBTC

The Ethereum price has been one of the major talking points in the

crypto space lately, having been under significant bearish pressure

in recent weeks. However, the second-largest cryptocurrency seems

to be on a recovery path following its first positive weekly

performance in more than a month. Recent on-chain data shows that

significant amounts of ETH tokens have made their way to

centralized exchanges in the past day. The question now is — could

this hamper the recent progress shown by the Ethereum price? Here’s

How Rising Exchange Inflow Affects Ethereum Price Prominent crypto

pundit Ali Martinez took to the X platform to reveal that Ethereum

investors have been moving their assets to centralized exchanges in

the past 24 hours. This on-chain observation is based on the

CryptoQuant exchange reserve metric, which monitors the total

amount of a particular cryptocurrency on all exchanges. Related

Reading: Is Bitcoin Heading For A Bear Market? Analysts Weigh In On

The Price Struggles Typically, the value of this metric increases

when investors make more deposits than withdrawals of a token

(Ether, in this case) into a centralized exchange. On the flip

side, when the exchange reserve metric falls, it implies that the

holders are moving their assets out of crypto exchanges. When

investors move their assets from self-custodial wallets to

centralized exchanges, it is often because they intend to use the

platforms’ services, which include selling. As a result, an

increase in the exchange reserve metric is often associated with

increasing selling pressure. According to data from

CryptoQuant, more than 112,000 ETH (worth around $257.6 million)

were transferred to cryptocurrency exchanges in the last 24 hours.

The movement of these significant Ether amounts could trigger

downward pressure on the Ethereum price. Considering its delicate

position at the moment, bearish circumstances, such as rising

exchange inflows, could hinder the Ethereum price’s newly found

momentum. Nonetheless, it is worth noting there has not been such

an effect on ETH’s price in the past day. On the contrary, the

altcoin is up by more than 3% while looking to breach the $2,500

level. Are Investors Fleeing The Market? The latest on-chain data

shows that investors might be flooding out of the Bitcoin and

Ethereum markets. According to Ali Martinez, over $2.6 billion has

flowed out of the two largest cryptocurrencies in the last seven

days. Related Reading: Cardano (ADA) Whales Securing Gains After

10% Upswing: What’s Next? This revelation is based on Glassnode’s

aggregate market realized value net position change metric. And it

somewhat supports the earlier notion that investors might be

offloading their Ether tokens. Moreover, this outflow of capital

could spell more trouble for the crypto market, specifically the

Bitcoin and Ethereum prices. Featured image created with Dall-E,

chart from TradingView

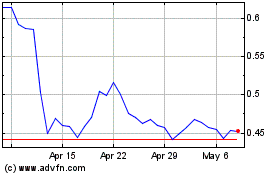

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024