BLUR Is Down 30%, And Whales Are To Blame–Here’s Why

08 December 2023 - 1:00PM

NEWSBTC

Blur, a decentralized non-fungible token (NFT) marketplace, and

OpenSea competitor is under pressure, tumbling by over 30% from its

November peaks. While BLUR retreats, on-chain data reveals that

BLUR whales have been moving their tokens to leading crypto

exchanges, possibly to liquidate. Whales On A Possible Selling

Spree According to Lookonchain data on December 7,

several whales have been offloading large amounts of BLUR. To

illustrate, 16.85 million BLUR, worth roughly $8.43 million, were

deposited to exchanges in the past 24 hours. Notably, one

whale deposited 2.54 million BLUR, worth $1.26 million, received

from the airdrop to Binance. At the same time, Mandala Capital

transferred 2.76 million BLUR, worth $1.4 million, to OKX.

The deluge continued as another whale, only marked by the

associated “0x68b5” address, withdrew 3.31 million BLUR worth $1.79

million from Binance between November 25 and 29 before moving them

to the same exchange on December 1. The token had fallen, meaning

the whale was down by roughly $65,000. Related Reading: Can Bitcoin

Spot ETFs Attract Enough Capital? Experts On What Will Lead To ATH

It is unclear whether the same addresses are sold for USDT or other

tokens. However, what’s known is that any whale transfers to a

centralized exchange is associated with liquidation. Accordingly,

sentiment is impacted when whales move coins in large batches to

exchanges, and retailers could interpret their transfers as

incoming selling pressure. BLUR Is Up 220% From October Lows Thus

far, looking at price action, buyers have the lead from a top-down

preview. The coin is already up 220% from October lows. Most

importantly, buyers have the upper hand, looking at the candlestick

arrangement in the daily chart. Even though the token is down

30% from November peaks, the failure of bears to force the coin

below the 20-day moving average (MA) in the daily chart suggests

that the uptrend is still valid. Losses below $0.46, or the base of

the current bull flag, might trigger a sell-off. Conversely, any

upswing above $0.58 and even $0.69–or November highs, could drive

more demand, lifting BLUR to $0.84 or higher in the coming

sessions. Related Reading: Binance CEO Disputes JPMorgan Chief’s

Critique Of Crypto Whether the uptrend will resume also remains to

be seen. What’s clear, though, is that the broader community is

closely monitoring the NFT scene and Blur, the marketplace. The

recent upswing was due to the activation of Season 2 Airdrop, which

ended on November 20. Ahead of this, the token was already up 150%,

only to extend gains briefly before cooling off in the first week

of December. Feature image from Canva, chart from TradingView

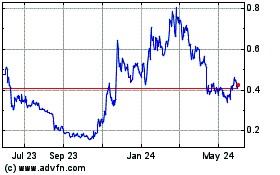

Blur (COIN:BLURUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Blur (COIN:BLURUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024