Bitcoin SV (BSV) Ushers In 2024 With A 110% Bang – Details

02 January 2024 - 7:31PM

NEWSBTC

The hard fork token from Bitcoin, known as Bitcoin SV, continues to

rise and has crossed $100 for the first time since February 2022.

The price spike, which is noteworthy for having increased by almost

110% in just one week, is mostly attributable to increased trading

activity and interest in the South Korean market. Upbit Spurs

Bitcoin SV Surge: Insights Upbit, the biggest cryptocurrency

exchange in South Korea, has been the center of this increased

interest in BSV. On New Year’s Day, Upbit registered a significant

$275 million in BSV trading activity. With a total trading volume

of $753.5 million, this trading frenzy has driven Bitcoin SV’s

market cap to $1.7 billion. Related Reading: LUNC Plunges 14% As

SEC Scores Knockdown Blow Vs. Terraform Labs The trend is not

exclusive to Upbit, as the trading volume of the token on OKX has

also significantly increased, surpassing $47.5 million. In the past

24 hours, BSV’s trading activity has surged by more than 300%. By

trading volume, Bithumb, a significant regional exchange, ranks

among the top three as well. Notably, throughout the past 24 hours,

Upbit and Bithumb have accounted for around 70% of BSV’s total

trading volume. As of this writing, Coingecko statistics indicates

that BSV was trading at $102.87, up 7.3% and 109.1% over the

previous day and week, respectively. BSV seven-day price action.

Source: Coingecko Positive indicators including a bullish Relative

Strength Index and a Moving Average Convergence Divergence,

together with a trading volume rise of more than 40%, back the

surge. The RSI is moving north while in the overbought area,

suggesting a bullish future trajectory for the price of BSV. While

the price of Bitcoin SV appears to be accelerating, the MACD is

likewise in the green zone, indicating purchasing pressure on the

cryptocurrency. The Bitcoin fork stands out as one of the top

cryptocurrency gainers, and although encountering resistance around

the $115 level, BSV’s performance follows a wider pattern of

erratic moves in the crypto market. BSV market cap currently at

$1.9 billion. Chart: TradingView.com Bitcoin SV’s Rise Amid

Regulatory Moves In an effort to transform Bitcoin SV into an

enterprise-level blockchain and peer-to-peer payment system,

proponents highlight the platform’s scalability, reliability, and

security. The recent surge in Bitcoin and the likelihood of the SEC

approving a spot ETF are driving interest in BSV. Related Reading:

Can BSV Hold Its New 2023 Peak? Analysts Watch As Trading Volume

Explodes Meanwhile, to counteract illicit behavior, South Korea

recently established a regulatory framework for cryptocurrencies.

In a significant move toward regulation, the nation mandated on

December 28 that public servants register their cryptocurrency

holdings. Controlled domains offer security, which may have drawn

investors to these developments. Although there remains resistance

in the vicinity of $115, BSV has outperformed the overall market

and is now a top gainer. Depending on how investors respond to its

distinct value proposition and how the larger crypto scene

develops, the market’s trend may continue or slow down. Watch BSV

closely as it forges ahead in the dynamic digital asset market.

Featured image from Shutterstock

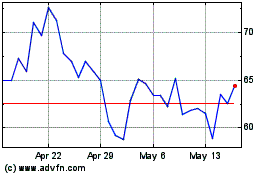

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

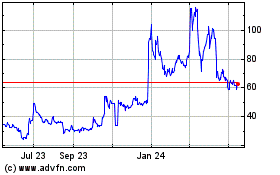

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024