Bitcoin SV Makes A Surprise Move With 10% Uptick – Details

15 August 2024 - 11:00AM

NEWSBTC

The market’s bullishness has now spread to altcoins with Bitcoin SV

capturing some of its momentum. According to CoinGecko, the token

is up over 10% since last week, becoming one of the top gainers

within this market environment. Related Reading: HODLing

Resurgence? 374,000 Bitcoin Transfer Ignites Crypto Recovery With

private equity enjoying gains as well, the bullishness has leaked

to the crypto market, turning the early August wipe into

well-deserved upticks. Bitcoin SV On Good Price Range For A

Breakout As of writing, the token sits right in the middle of the

$40-$46 price range which will be essential for the coming

breakout. For the bulls, maintaining the current momentum of the

token is vital in the long term. The market’s continuous

bullishness should be enough to prop up the bulls if exhaustion

takes over. However, the relative strength index (RSI) of the

token reveals that the bulls and the bears are in a tight lock,

indicating that BSV’s momentum has slightly gone down. But with the

general market in support of the bulls in the short term, the token

has a shot at taking $62 in the long term if the momentum is

consistent. But this also depends on the general outlook of

the market. As G7 economies experience slightly better economic

conditions, the market will continue to be positive on the coming

release of several economic indicators in the coming weeks. Market

Hunkers Down As CPI Data Release Nears As of writing, traders in

traditional finance are still split between a 25 and 50 base point

cut in the coming weeks. However, 51% of traders are still

expecting a 50 bps cut once the consumer price data is released.

The CPI is one of the most crucial economic indicators that

investors and traders are monitoring monthly. Last July, the CPI

data showed a slight dip in CPI, indicating a slight dip in the

purchasing power of the US dollar. With the release of the

CPI data nearing, the general market enters a lockdown phase,

gaining slight upticks in the short term to stabilize the price in

a manageable price range. The S&P 500 and the Dow Jones are

both up over a percent as the market gradually slows its

momentum. Related Reading: Helium (HNT) Surges 48% — Here’s

What’s Fueling The Rally If the CPI data shows that inflation is

dropping, the market’s assumption of a rate cut will eventually

come true. A drop in interest rate will not only be beneficial for

TradFi but also for the crypto market as the latter’s movement

hinges on the movement of private equity. However, another dip in

CPI might push the US Federal Reserve to maintain its interest

rates which is currently 5.5% after the 8th Federal Open Market

Committee last month. This scenario will see large outflows on both

stocks and crypto, hurting long-term and short-term gains.

Featured image from Host Merchant Services, chart from TradingView

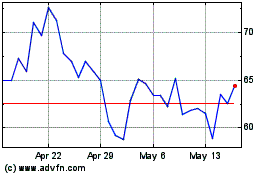

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

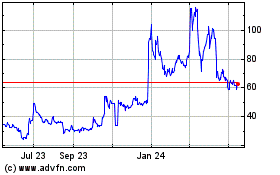

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024