Germany Liquidates Over 90% Of Bitcoin Holdings, Retains Only $284 Million

12 July 2024 - 5:00PM

NEWSBTC

After a month-long period of increased selling pressure, the German

government has nearly exhausted its Bitcoin treasury, selling over

90% of its BTC seized in January in the country’s largest Bitcoin

seizure, worth over $2.1 billion. With less than $300 million

worth of BTC remaining, this signals the end of a significant

sell-off period, with expectations of further price appreciation

for the largest cryptocurrency on the market. 9.9% Of Seized BTC

Remains On-chain data from market intelligence firm Arkham reveals

the German government’s selling activity on Thursday, showing that

the German police wallet initially sold 2,375 BTC ($137.87 million)

to exchanges including Kraken, Bitstamp, and Coinbase.

Subsequently, an additional 3,250 BTC ($191.02 million) was sent to

exchanges for selling purposes and over-the-counter (OTC) deals,

according to the data. The German government recently

transferred 5,000 BTC ($286.44 million) to Flow Traders, Coinbase,

Kraken, Bitstamp, 139Po and bc1qu. They have now transferred 10,627

BTC ($615.33 million) to market makers and exchanges on Thursday

alone. Related Reading: Analyst Predicts Major Gains for These

Altcoins But Warn Against XRP and ADA With only 4,925 BTC

remaining, Arkham data shows that the German government currently

holds 9.9% of the original 50,000 BTC seized from Movie2k in

January, worth just over $284 million at the current BTC price of

$57,000. Movie2k, a movie streaming website, was found guilty

of money laundering and other illegal activities by the state of

Saxony in Germany. Our sister site Bitcoinist reported on

Wednesday that Dr. Lennart Ante, co-founder of the German-based

blockchain research lab, said the Saxon government is obligated to

sell the confiscated bitcoin as per standard procedure, even though

lawmakers such as Joana Cotar have urged the country’s legislative

chamber to keep the seized BTC. Nonetheless, Dr. Ante further

clarified that the general prosecutor’s office of Saxony is

responsible for liquidating the confiscated BTC assets as per

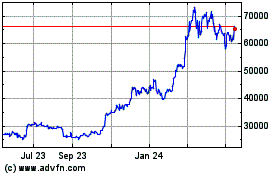

“standard procedure.” Bitcoin Price Analysis Currently trading

above $57,400, the good news is that the BTC price has

consolidated above this level for the past few days, signaling

a sense of stability in the market ahead of a potential renewed

bullish move higher to tackle key resistance levels. This starkly

contrasts last week’s price action, when Bitcoin saw violent price

swings in both directions as selling pressure from the German

government and uncertainty surrounding the payments from defunct

exchange Mt. Gox flooded the market. Related Reading: Binance

Bought A Whooping 41,000 BTC During The Dip: Did They Save The

Bitcoin Market? In the short term, the Bitcoin price will have to

face the $58,200 resistance wall, which has proven to be a hard nut

to crack for the largest cryptocurrency on the market for the past

6 days, being unable to surpass this level to test the $60,200

obstacle subsequently. Ultimately, it remains to be seen when

the German government will end its Bitcoin sell-off and deplete its

entire Bitcoin treasury and how BTC’s price will react as the daily

selling pressure experienced for the past month subsides.

Featured image from DALL-E, chart from TradingView.com

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

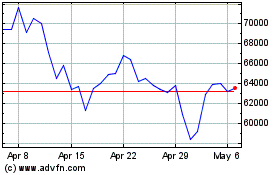

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024